The trade dispute between Boeing (BA) and Bombardier (OTCQX:BDRAF) has been eyeballed by investors, aerospace journalists and analysts for some months now. The Department of Commerce of the US advised a tariff to be applied on any C Series aircraft or partly assembled aircraft destined for the US market.

Boeing claimed that the program received illegal launch aid and was dumped on the US market. So, Boeing did not have one problem with the C Series, but two and that is very important to be aware of.

The DoC based on its findings advised a tariff of 300% on C Series aircraft imported for the US market. Today, the ITC having the final word on the matter for now unanimously rejected Boeing’s claim. The decision comes as a surprise to many, including aerospace analysts, not because market assessment and expertise support in any way that Boeing did suffer or would suffer damages but because the Boeing sphere of influence reaches far and there is a current political climate in the US that favors American companies any day over foreign counterparts.

In this article, I want to touch on some key points that I think have played a major role in the ITC’s decision to deny Boeing’s claim.

Investment or illegal aid

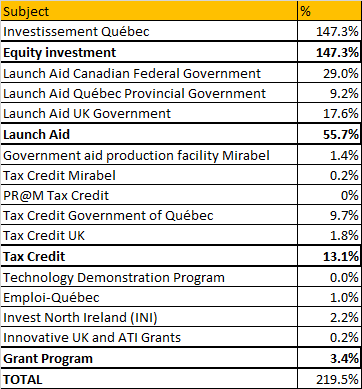

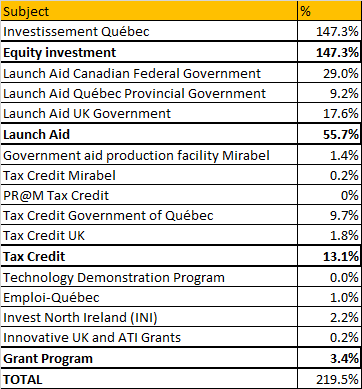

Part one of the problem was the determination whether any aid that the C Series program did receive was investment or illegal launch aid.

In October 2015, the Quebec government invested $1B for a 49.5% ownership of the limited partnership of the Bombardier C Series. I think there is not much doubt about this being an illegal form of state aid. Tax breaks are often already subject of debate and can possibly be considered illegal, let alone such a government involvement to drop a life to a program to save it.

Given the importance of Bombardier and the C Series to the aerospace industry in Canada, I think that government involvement was to be expected and we might have seen Boeing doing exactly the same if they ever would get themselves in a situation similar to Bombardier’s. The fact, however, is that the Quebec government has not even tried to conceal this state aid and Boeing is in a position to complain about that.

The DoC determined that the C Series program was uncreditworthy and unequityworthy at the time the ‘investment’ was made. Given that in the commercial space, Bombardier would be unable to secure commercially sourced loans it was determined that most of the help it did get was indeed illegal.

I think nobody will disagree with me when I say that there has been state aid, a lot of it and probably most of it was indeed illegal.

Dumping

Source: airwaysmag.com

Probably the most important part of the story is the dumping part. In case no dumping activity is found, any recommended tariff would unlikely to be held up.

Dumping, in reference to international trade, is the export by a country or company of a product at a price that is lower in the foreign market than the price charged in the domestic market or does not cover the costs of production. As dumping usually involves substantial export volumes of the product, it often has the effect of endangering the financial viability of manufacturers or producers of the product in the importing nation.

From the definition of dumping above, 2 things become clear. The sales price should be known and the damage to the domestic industry should be mapped. Although Delta Air Lines might have provided the sales price of the aircraft it bought from Bombardier, the Canadian jet maker for obvious reasons would not share any prices and supplier contracts making it very hard to dodge the DoC’s 300% tariff to level the playing field.

Pricing and sales campaigns

Source: Youtube

One of the big question marks was the pricing of the aircraft that Bombardier sold to Delta Air Lines (DAL). Boeing did supply the DoC with a figure of $19.6 million, while Bombardier and Delta Air Lines denied the figure. Since Bombardier did not supply any figure, the DoC was forced to apply the tariffs and was forced to apply the tariffs based on the figure that Boeing used, whether this figure was anywhere close to the actual prices or not.

Creating a level playing field sounds nice, but with tax breaks, investments and commercial market prices it is hard to determine what actually makes a level playing field.

The Boeing 737-700, which Boeing claims to be the main victim of the C Series alleged illegal subsidies and subsequent dumping has a list price of $85.8 million and its market value is expected to be slightly less than $36 million, which is a 60% discount. The tariff applied on the C Series would put its sales price on nearly $78.4 million. This would put the price including tariffs in line with the list price of the Bombardier CS100. Knowing that discounts of 50% or slightly higher are common in the industry, the tariff could hardly be called ‘leveling’ the playing field when using a bottom-up approach instead of a top-down approach.

What the DoC also totally ignored, probably because it has primarily assessed the subsidies, is that the price that Delta got the aircraft for is a contract price tailored to the needs of the airline in terms of range and with the airline being a key customer it has also received additional discounts. So, the pricing that Delta received does not necessarily reflect dumping and it does not reflect pricing that other airlines could expect going forward. Also for Airbus (OTCPK:EADSF) and Boeing giving discounts to key customers and early adopters is common practice and you could question how much this has to do with dumping of aircraft.

The above is amplified even more considering that Boeing has not entered the Boeing 737-700 or Boeing 737 MAX 7 going head to head with the Bombardier C Series to win an order from Delta.

In another sales campaign to sell aircraft to United Airlines (UAL), Boeing ended up on top but the airline likely has been given steep discounts with a sales price of $22 million for the Boeing 737-700. Likely that is a price tag that Embraer (ERJ) and Bombardier at that time could not meet and given that United Airlines ended up converting that order, I think it is fair to assume that Boeing dropped the pricing just to keep Bombardier out given that the Boeing 737-700 is a 128-seat aircraft and what United was looking for was a 100-seat aircraft. So, Boeing responded to a request for an aircraft with a capacity of roughly 100 seats with an aircraft that was far too big and United ultimately converted that entire order. Bombardier does have a 108-seat aircraft, Boeing doesn’t… but just wanted to keep Bombardier out with rock bottom pricing.

The important observation is that Boeing is complaining about an instance where it didn’t offer anything to Delta Air Lines. In that case you can rightfully ask how you can be harmed if you don’t offer anything, because in that case you didn’t have anything to win or lose in the first place. In the other case, the sales campaign with United Airlines, Boeing dented the pricing of the Boeing 737-700 and MAX 7 itself by offering an aircraft unfit for what United Airlines asked for.

You really cannot blame Bombardier for Boeing deciding not to put effort to win an order from Delta Air Lines and you cannot blame Bombardier for entering Boeing entering the Boeing 737-700 in the sales campaign with United Airlines with a product that was so unsuitable to fulfill the role it was required for efficiently that it had to throw the pricing of the smaller Boeing 737-700 and Boeing 737 MAX 7 off a cliff. That would be the same as holding Bombardier accountable for the decisions the sales team of Boeing is making.

Competitive analysis

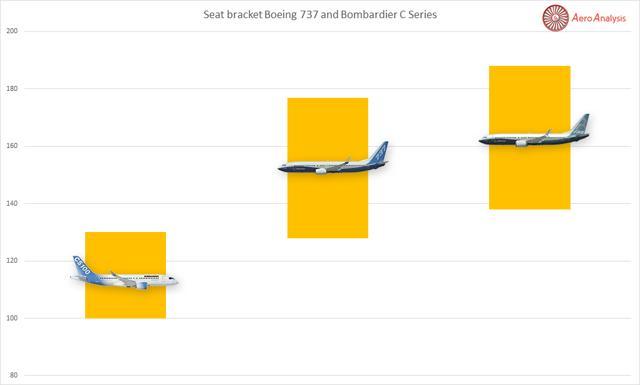

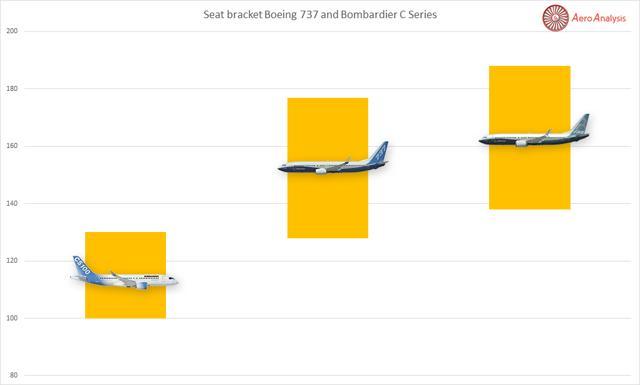

Boeing asked for anti-dumping duty and countervailing duty for aircraft imports from Canada with a 100-150 seating capacity regardless of airline-specific configuration and a minimum range of 2,900 nautical miles and covered by an FAA type certificate as such. I think that much of Bombardier’s stronger point started here. In order to understand why, you either have to know the capabilities of the products that Boeing and Bombardier offer or just look at the figure below, where we can have a look at the C Series, Boeing 737 NG and Boeing 737 MAX families.

Figure 1: Seat brackets Bombardier C Series and Boeing 737 NG and MAX (Source: AeroAnalysis)

One important observation that needs to be made is that there is very little overlap between the Boeing 737 families and the Bombardier C Series aircraft. In fact, there is no overlap between the 737 MAX and C Series aircraft at all.

Boeing has asked the Department of Commerce to consider the 100-150 seat aircraft with a minimum range of 2,900 nautical miles and that is something I could not disagree more on. The C Series as we know it today is a 100-130 seat aircraft family with 2 members. By taking the minimum range of 2,900 nautical miles, coinciding with the Boeing 737-800 range, and stretching that bracket all the way up to 150 seats, Boeing tried to create the impression that the C Series as we know it today is an immediate threat to Boeing"s core business where there is significant overlap.

The figure quite clearly shows that this is not the case and there is little to no overlap. The only overlap that there could be is between the Boeing 737-700 and the Bombardier CS300. With the introduction of the Boeing 737 MAX, Boeing has stretched the Boeing 737 MAX 7 to accommodate more passengers. Important to note here is that Boeing claimed that this has been done on customer demand, which somewhat takes away any thoughts that this decision is driven by a potential fierce competition on the lower part of the seat bracket.

The CS100 is a 108-seat aircraft, a one-to-one replacement for the Boeing 737-600 which Boeing abandoned years ago. The CS300 as a 130-seat aircraft slightly exceeds the Boeing 737-700 in terms of capacity, but with the aircraft being near the end of production life, Boeing has shifted away from the 130-spot and made the Boeing 737 MAX 7 a 138-seat aircraft. This means that the C Series family can hardly be labeled as a product competing with the lower side of the Boeing 737 aircraft family, which makes it hard to support any statement of dumping leading to damages to Boeing.

Boeing said the pricing pressure on the Boeing 737-700, a result of the United deal, would leak through to the Boeing 737 MAX 7. I think Bombardier is not to blame for Boeing’s decision to offer an aircraft that doesn’t fit the airline’s RFP leading to significantly pricing pressure on the Boeing 737-700 and subsequently the Boeing 737 MAX 7. That is something Boeing inflicted on itself.

Also if we look at efficiency, it is unlikely that the Boeing 737-700 or Boeing 737 MAX 7 can be as efficient as the clean sheet design. The Boeing 737 finds the majority of its customers in the 160+ seat segment and Boeing is also focused on optimizing for that market and has stepped away from 100-130 seat segment as the ‘stumpy’ designs aren’t nearly as efficient and appealing as the stretched variants. The sales figures also show this. Bombardier simply had the aircraft optimized for the 100-130 seat segment.

A spicy detail is that Embraer, a company that Boeing wants to team up with, announced the range of the Embraer 190-E2 to be 2,900 which triggered Bombardier to ask the ITC to re-open the record for Bombardier to provide additional information and make the Embraer E2 family an integral part of the dispute.

Domestic market

Source: United Technologies

One thing that is important to understand is that you cannot equate the aerospace industry in the US to Boeing and more importantly a sale to Canadian Bombardier doesn’t mean a lost sale for Boeing. Boeing is important to the aerospace industry, that cannot be denied but I do not think that if it would have managed to virtually eliminate the C Series aircraft from the US market, it would have seen orders for its Boeing product materialize.

Bombardier supported 22,700 jobs in the US adding $2.4B to the US economy and this would increase even more after the C Series joint venture between Bombardier and Airbus announced an assembly line would be set up in Mobile, US, Alabama. If there is any company that might lose due to the C Series, it would be Embraer along with the jobs it supports in the US but the company has been left out of the scope of investigation.

My view in a few snippets

I did not expect that the ITC would deny Boeing’s claim, not because I think Boeing had a valid point but because the political system in the US now more than ever would favor a US company over any other company.

In due time we will know what moved the ITC to deny Boeing’s claims, but I do not expect them to go into detail. In my view, Boeing behaved like the big kid in class bullying the smallest kid and that somewhat backfired. It has tried something which had little to no merit if you are aware of the competitive field, the efficiency of designs and include some other factors such as pricing in two aircraft deals in which Bombardier was involved.

I have collected some important or striking snippets from my previous work and my comments to the hundreds of comments I received when addressing the Boeing-Bombardier below:

Snippet 1:

The battle between Boeing and Bombardier is a complex one, it’s is a multi-dimensional space that includes product, market, contracts, launch aid, dumping and a legislative dimension.

Snippet 2:

Boeing has filed a complaint claiming that the C Series could be disruptive to its position on the 100-150 seat market. In reality, there is little overlap in the markets and one could say Boeing’s claim has little to no merit. I view the C Series as a product superior to the Boeing 737 [in its space] and the only way for Boeing to tackle that is by filing a complaint.

Snippet 3:

All in all, I think that Boeing’s competitive position is not being threatened by the CS100 or CS300, but the bigger threat would be a CS500 and by barring or at least trying to bar the C Series, Boeing is protecting its single aisle moat with the means that it has available. At this point, there is no immediate threat to Boeing but the C Series program uses suppliers in the US and if the C Series program crumbles those jobs could be affected.

Snippet 4:

Boeing says it loves the competition, if that is the case it should just point out that CS500 has the potential to destroy its single aisle margins because they do not have an up-to-date product and see how strong their case is... because that is what really is happening and what really bothers Boeing.

The future

Source: Reuters

Will we wake up in a different world after the ITC ruling? No. First of all, the ruling can be appealed by Boeing although I don’t expect another outcome there. Secondly, what Boeing tried was making it as difficult as possible for the C Series program to survive, preferably eliminating a competitor. They know it is a sound engineering product and after the most risky phases of the aircraft’s development were over, Boeing probably looked to acquire the technology and potentially even the program at no costs. What they probably also were after is preventing a third competitor from entering the highly profitable single aisle market and with Bombardier partnering with Airbus the fate of the program rests with Airbus. They can either choose to acquire the program or be forced to acquire the program, but I think it is unlikely that the CS500 will be launched to compete with the core products of Airbus or Boeing.

The market, as expected, awarded Bombardier with a 15% surge in share prices, but it doesn’t mean that Boeing came crashing down, it ended the day flat and I think that more or less reflects what the markets really thinks about the C Series that Boeing made such a deal about.

If the ITC would have ruled in Boeing’s favor, Bombardier would have seen the door to the US market being closed and that would dent the sales potential of the aircraft family, but any such thing does not hold for Boeing. The difference in scale of both companies makes it that a win for one company does not result in a loss of equal size for the opposing party.

What is the price that Boeing paid?

The more interesting question is what is the price Boeing will pay or has paid. With Boeing losing now, it might be worth more than ever to team up with Embraer. A buy out scenario seems unlikely at this point, but Boeing will have to do more to please Embraer and that might be somewhat disappointing given that Embraer counterpart of the C Series is older by design. Airbus might be stuck with the C Series aircraft in the future, while at this stage Boeing is unlikely to have big advantages when it comes up with some sort of partnership with Embraer. A full buy out would increase the premium for Embraer at this stage, but it is something that is opposed by the Brazilian Air Force and President.

Boeing lost a $5B jet deal with the Canadian government and it seems to be excluded for consideration for future defense contracts, but we will have to see for how long that will hold. I cannot imagine that the Canadian government would choose exclude any possible manufacturer for a prolonged time. It would not be in the best interest of the Canadian tax payer or Canada’s Air Force.

You could go as far as connecting the Delta Air Lines order for 100 A321neo aircraft valued $5B-$5.5B to the dispute between Boeing and Bombardier. This would bring the total price that Boeing ‘paid’ to $10B.

Was it worth it? Maybe, maybe not… the aerospace industry is complex, but I do think that ultimately Boeing has prevented a third competitor from rising in the single aisle space it shares with Airbus at a $10B price and pushed the C Series along with its technology to Airbus. Airbus will decide what will happen to the program and how it will fit in with the timeline of a A320neo successor.

The C Series now provides Airbus with a complimentary product and a head start for an Airbus A320neo replacement instead of adding another competitor for Boeing and Airbus.

Boeing will likely put effort into normalizing relations with parties such as the Canadian government and Delta Air Lines to limit the price that is being paid for this dispute.

Boeing investors have hardly noticed a thing from the dispute. Since the petition was filed by Boeing, its shares gained over 90%, Bombardier share prices were slightly more damped but are now trading 60% higher and Airbus shares are trading roughly 50% higher. So, the investor didn’t pay the price for this dispute. As an investor, I really can’t complain and as an analyst I do think the ITC ruling is fair.

Thank you for reading this article. If you enjoyed reading this article, don’t forget to hit the Follow text at the top of this page (below the article title) to receive updates for my upcoming articles. You are most welcome and encouraged to leave a comment and discuss your views with me and other readers in the comment section. If you have any suggestions, feel free to drop me a message.The AeroAnalysis premium service offers free trials.

Disclosure: I am/we are long BA, DAL.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor"s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.