Apple"s (AAPL) long awaited fiscal 1Q18 is now just around the corner.

The company will report the results of the quarter on February 1st, after the closing bell. The Street is anticipating revenues of $86.75 billion, a YOY increase of about 11% that would nearly match last quarter"s top line growth rate. EPS estimates of $3.81 would represent Apple"s largest earnings number on record, although it is unclear to me if any of the estimated $38 billion in tax payments from cash repatriation would impact the bottom line already this quarter (Apple reports earnings results in GAAP terms only).

Credit: Digital Trends

Phones, phones, phones

As I have argued recently, "performance of the iPhone X may help to set the course for the rest of the year in terms of financial results expectations and stock sentiment." This being the first full quarter following the model"s introduction in early November 2017, I believe all eyes will be on smartphone sales this week. If the iPhone X sputters, as a few sell-side analysts have been predicting, the stock could face headwinds in the near term.

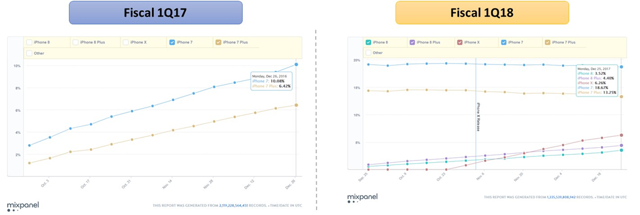

The graphs below might help to support these short-term concerns. Activation of new smartphone models introduced in calendar years 2016 (iPhone 7 and 7 Plus) and 2017 (iPhone 8, 8 Plus and X) accounted for roughly 16% and 14% of all iPhones activated by the end of each respective holiday quarter.

But because the iPhone X was not released until November 2017, the adoption of newly-introduced devices, including models 8 and 8 Plus, happened much more slowly this past year. Most iPhone sales, at least in the first half of fiscal 1Q18, seem to have come from older models - understanding that activation does not equal sales, yet the data seems very telling to me.

Source: DM Martins Research, using data from Mixpanel

Exiting the quarter, the iPhone X appears to be performing well in terms of activation, surpassing the iPhone 8 and 8 Plus in popularity. So if softness in smartphone sales is confirmed in fiscal 1Q18, I find it more likely to be reflective of product launch timing than indicative of a weak super cycle.

But it"s not all about phones

Although the iPhone super-cycle is a key pillar of many Apple bulls" investment theses, the story does not end there. I see Apple well positioned to benefit from increasing consumer sentiment (see graph below) and discretionary spending activity across its product and service portfolio.

Source: CCI historical data from OECD

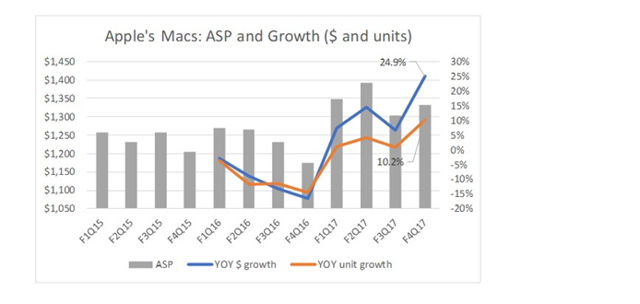

Back in November, I discussed how "Apple has been one of the few winners coming out of the undergoing (laptop and desktop) consolidation." Last quarter, Mac revenue growth shot up to about 25% YOY. Fiscal 1Q17 saw an improvement (see graph below), suggesting fiscal 1Q18 will face slightly stronger comps this time. Still, I anticipate both units sold and ASP to come in on the healthy side this quarter, particularly as Apple expands its product offering across multiple price points from the low-end Mac Mini ($499) to the recently-released iMac Pro ($5,000).

Source: DM Martins Research, using data from company reports

Elsewhere, I have no reason to believe that Apple"s Services segment will see a dip in its growth pace. The company continues to be well on track to double the division"s revenues between 2016 and 2020. Helping to support this mission is what appears to be a recovering Chinese market, which finally showed signs of having a pulse last quarter. As the installed base in the country returns to growth, the lagging effect on Services revenues is likely to follow.

Possible short-term risks, bullishness intact

All factors taken into account, I continue to believe AAPL will perform very well in the long term. The company is riding the tailwinds of an increasingly robust global economy, and a pickup in consumer discretionary purchases is likely to benefit the tech company. It does not hurt that (1) cash repatriation should further support the stock through increased investments, a potential bump in dividend payments and share repurchases, and (2) the stock still seems de-risked enough to me, trading at a forward P/E of only 14.9x and PEG of 1.7x (see graph below).

AAPL PE Ratio (Forward) data by YCharts

For now, I remain an AAPL holder, and find it unlikely that I will dispose of my shares any time soon. If short-term weakness related to iPhones in fact materializes, I believe a potential hit that the stock might take would be an opportunity for investors to accumulate shares on the dip.

Note from the author: If you have enjoyed this article and would like to receive real-time alerts on future ones, please follow D.M. Martins Research. To do so, scroll up to the top of this screen and click on the orange "Follow" button next to the header, making sure that the "Get email alerts" box remains checked. Thanks for reading.

Disclosure: I am/we are long AAPL.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment