General Electric (NYSE:GE) disappointed investors yet again with an earnings call that left investors with more questions than answers. It"s no secret to anyone following GE that I was bullish on the stock up until the GE Capital"s $22B bombshell that caught many investors by surprise.

The earnings call and NEW revelation of an SEC investigation into GE Capital was the game changer and second piece of information that turned this bull into a bear.

Deciphering a messy earnings call

Understanding GE"s earnings reports has always been a challenge for traders and investors alike. Everyone is trying to make the best decisions on where a company is headed and if they should buy, sell or hold based on the new quarterly data.

I will do my best to translate what I believe was a disastrous report, and why investors should avoid GE for now.

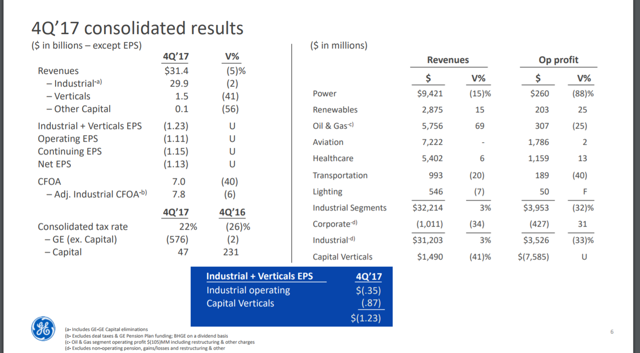

Energy division a wipe-out with Revenues down 15% and earnings down 88%

GE powers 30% of the world but that didn"t help revenues which were down 15% at $9.41 billion. The bigger issue is profit of $260M down 88%; these are simply terrible numbers and not likely to get better in the next several quarters.

Here is a clip from the earnings transcript:

With that, let me turn to the quarter. Clearly, 2017 was a challenging year for us and fourth quarter had a lot of moving pieces. We had significant charges in the quarter for insurance, tax reform, and planned portfolio moves. These charges totaled $1.49 of EPS. Excluding those charges, adjusted EPS was $1.05, at the low end of the EPS guide we gave you for the year.

Issues in the quarter were mostly localized to Power. The power market continues to be challenging. Power earnings were down 88% in the quarter, driven by the market, certain execution misses, and other charges.

This is an important franchise going through a difficult period. The team is working with amazing dedication and resilience and they have the support of the entire GE Company behind them. I"ve asked Russell to give you an update on the quarter and take you through our action plan on the business in a few minutes.

Translation: Our energy division is a mess, we don"t have a good handle on it and are behind the eight ball. We actually lost a fortune but due to accounting laws we are showing a profit of $1.05. Things are really tough and competition is eating our lunch.

Expect shrinking margins in the future as the Global power business is changing to a bid auction for new contracts. Very simply put, energy is going to be a drag on earnings all year.

Beware of forward-looking statements

To the novice investor: At the beginning of every conference call or investor update, the company issues a comment about forward-looking statements. Basically, it tells the investor that everything we are saying could change on a dime and you should not rely on what we are telling you because if we are wrong you might lose all your money. That is its protection when things don"t work out the way it planned.

You can apply this to the Alstom deal just a couple of years ago.

Here is a headline from the street.com from December 4, 2016.

Why GE"s $10 Billion Alstom Purchase Is its Best Deal in a Century

Retired CFO Jeff Bornstein said never in GE"s 123-year history of deal-making has it bought a business that fit quite as well as Alstom"s power division.

Here is a quote from Jim Cramer about the acquisition.

"This acquisition is a brilliant one because the world is going to switch to cleaner power plants, and now GE has a hammerlock on the business," said The Street"s Jim Cramer. Investors can view that article in full by clicking here.

I"m not trying to beat up on Jim Cramer, I just feel the need to share with less skilled investors the pitfalls of believing everything management tells you. I have lost far too much money over the years listening to lies from corrupt CEOs.

Investors should demand clawbacks

Immelt deserves the Wall of Shame along with Bornstein, the retired CFO with a big retirement package. How are these guys getting a pass from media and shareholders? Seems to me like it is time for a revolt and a march on headquarters demanding action; i.e., I am mad as hell and I"m not going to take it anymore.

Margins under pressure going forward

The clip below highlights what I now believe will be a squeezing of margins. If you look to renewable energy on the lower right corner of the earnings clip you can see that it is telling you about significant pricing pressure.

Translation: profits margins going down.

Aviation OK but NOT outperforming

Aviation revenues were flat at $7.222B; that"s not setting the world on fire as far as Wall Street is concerned. I expected more growth and am disappointed as I do not see this as out-performance.

Healthcare performing well

Healthcare added $5.4B in revenues, up 6%, and orders are up double-digits. That is pretty good performance but I don"t see it as good enough to make any difference to GE"s bottom line over the next couple of quarters.

Negative cash flow for 1st quarter a sell sign.

No investor wants to see or hear about negative cash flow from an industry giant.

Jamie Miller from earnings transcript:

We are planning for a negative free cash flow quarter in first quarter. We remain focused on our operating rigor and execution on cash, with compensation heavily tied to cash performance. And we are evaluating incremental restructuring at Power. We will update you on this as decisions are made.

Translation: We are in trouble, more write-downs coming.

SEC investigation is a headline risk

Surprise surprise surprise! I feel like I am watching an old episode of Gomer Pile. For those of you youngsters out there, I encourage you to Google it.

Jamie Miller got the honor of mentioning the SEC investigation.

Transcript:

I also want to note that we have been notified by the SEC that they are investigating the process leading to the insurance reserve increase and the fourth-quarter charge as well as GE"s revenue recognition and controls for long-term service agreements. We are cooperating fully with the investigation, which is in very early stages.

Translation: The government will be in our business for the foreseeable future. This may or may not open up a big can of worms that cause investors to flee the stock.

Important note: The SEC news came about 20 minutes into the conference call while GE was rallying up to $17.80 pre-market. That was a gift I took advantage of by selling most of my unhedged position. I hope you investors did as well. I wrote an instablog to try and warn investors as I feel for all of those that may have been trashed by this stock performance.

Is there any good news?

Yes, but the market is not going to focus on that until some big names and analysts decide the stock has bottomed. I personally cannot see that happening anytime in next 6 to 9 months.

Aviation is performing but needs to kick it up a notch. Healthcare is growing orders but needs double-digit revenue and profit growth to turn this aircraft carrier around.

Management is telling investors that the first quarter will likely be another miss and negative cash flow. That makes this a no-touch stock for the novice investor.

Is Flannery the man for the job?

The jury is still out on that one, he was heavily involved in the Alstom deal. I would rather see someone new come in such as retired Ford CEO, Alan Mulally. I think he could do the job that is needed to whip things into shape. One thing I want to see is Flannery out making deals with leaders of Government around the globe.

Flannery needs to reach out to President Trump for some new major contracts

The best thing Flannery could do right now is go to Trump with hat in hand and ask him what he could do to help GE with some large contracts. GE shareholders need some confidence and seeing a CEO reaching out on a personal level to leaders around the world in regards to power generation would likely land GE some contracts that it desperately needs.

Being the CEO of a major conglomerate requires salesmanship. I for one want to see major action from the CEO, not more excuses. GE needs a big contract win and it needs it now.

I really like the idea of Alan Mulally taking over the helm and have no doubt he could do a great job. I have serious doubts about whether a 30-year GE man can turn things around that he had a part in screwing up.

Where is the insider buying?

If GE breaks $15, there better be some major insider buying or this stock will continue to sell off. The last buy was from the CEO of Loews for 3 million shares that were bought with company money. I have yet to see any significant buys which is not surprising after hearing the string of recent news.

When insider buying does occur I will be the first one to let you know.

Where does GE trade from here?

Once again that is the billion-dollar question. I still feel the same as I did for my downside targets on my last article, General Electric Nearing Capitulation: Buy Sell Or Hold. I gave a detailed outline of where I believe the stock would bottom and interested investors can view that article in full by clicking here.

I realize many of you are trapped in this nightmare and just want to get out without losing your life savings. Once again I am not trying to cause anyone to panic out of their shares at the bottom. I gave myself a stomach ache writing this piece as I still hold a significant position in my portfolio with 6500 shares.

If you have a very long-term horizon (2-4 years) and a tolerance for risk, you may want to do nothing. There is a small possibility that the stock is close to the bottom, however, I doubt it.

As an investor you have the right to change your mind when new information comes to light. I have changed my mind and while I am long the stock I feel ambivalent about owning it. I will be looking for opportunities to exit the position.

Here is a monthly chart of GE over 10 years.

I am using the same chart from my last article as the points of support and resistance are the same. With 4th quarter earnings released and the SEC investigation in the early stages, I see first downside target matching November 2011 low of $14.68. Should that level fail then $14.02 was the October 2011 bottom.

Traders will likely stage an interim rally from that level that takes the stock back to $16.50 or even $17.50. The second scenario could be a big market sell-off and SEC problems that take the stock to multiyear lows around $13.

Stocks hardly ever go down in a straight line but this is about as close to it as you will get. One may want to sell into any rallies or use the opportunity to sell covered calls or buy puts.

Would it be a buy at $13?

Maybe, if there is evidence of a solid sustainable turnaround and the clouds of uncertainty are raised. Right now uncertainty is everywhere, there are far better stocks to buy that are going up, stocks with great earnings growth.

Better to put your money into financials like Bank of America (NYSE:BAC) or Citigroup (NYSE:C). They are both growing earnings and raising dividends. Rising interest rates will do wonders for their bottom lines. Apple (NSDQ:AAPL) is a cash-generating monster with a continuing revenue stream and great margins.

Conclusion

There are far better places to put your money right now than trying to game the bottom of GE. Management has a lot of work to do to restore investor confidence and it"s not going to happen in the next 90 days.

As the great Warren Buffett says, you don"t have to make it back on your loser.

The SEC investigation will be a cloud and a negative headline risk for the foreseeable future. GE Capital is in trouble and in my view not worth a penny at the moment.

I will be trading around the position and trying to get out without losing what is left of my shirt. The only saving grace for this trader was selling pre-market over $17.50 and rolling short-term covered calls on the rips for quick 70% to 90% profits. The $2500 dividend I got yesterday was not worth the price of admission.

I encourage investors to do your own research and make your own decisions. We are all responsible for our actions and our trades. I cannot stress how important it is to always have an exit strategy before making any trades.

Disclosure: I am/we are long GE.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long the stock and hedged.

No comments:

Post a Comment