Telecoms in the US are in a tricky spot. All the major names are now offering unlimited mobile data plans at pretty reasonable prices. The switch from limited to unlimited has had a negative revenue effect for AT&T (NYSE:T) and Verizon (NYSE:VZ). This intense competition is largely brought about by T-Mobile US (NASDAQ:TMUS), which, as a public, independent company, was a relative newcomer. T-Mobile US saw that consumers were transitioning to want unlimited data on their mobile phones, and for a fixed, reasonable monthly price.

The competitive landscape in Europe has nothing quite like this. While there is intense competition in Spain and Italy on the prepaid end, "unlimited" data plans in Continental Europe are pretty scarce. This is a good thing for telecom carriers, and it makes Europe an interesting place to invest if you want telecom exposure.

In past years, I was more negative on European telecoms, seeing a lot of gloom and doom ahead. To be sure, I"m still not all that optimistic on Europe, but Brexit and the rise of right-wing parties in "northern" Europe has been encouraging. Both of these events signify that the richer countries of Europe - Britain, Germany, Austria and others - will likely work to save themselves if the debt situation gets considerably worse for the eurozone. The rightward shift in Europe also ensures that there will not be another repeat of unlimited refugee movement as we saw in 2015.

For all these reasons, I am willing to take another, cautious, look at European telecoms. In previous articles, I"ve looked favorably upon BT Plc (NYSE:BT) due to its focus on Britain. Although I am less optimistic about the long-term prospects of continental Europe, I think Vodafone (NASDAQ:VOD) requires a second look as well. About 2/3rds of its revenue comes from Europe and the UK, with the remainder coming from "developing" countries such as India, Turkey, Egypt and others. Vodafone has become an interesting way to get exposure to some hard-to-reach developing countries, as well as consumers" increasing appetite for mobile data.

Momentum restored

Courtesy of Vodafone Investor Relations

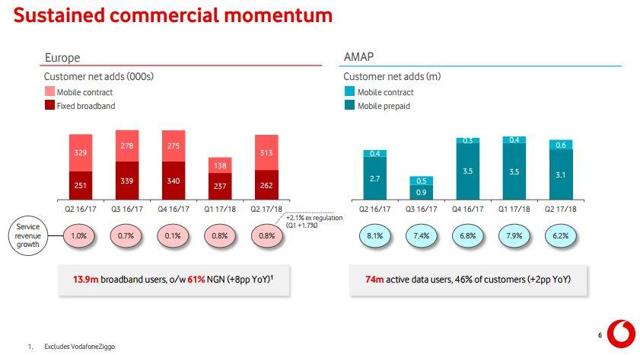

As you can see above, Vodafone has had some decent postpaid net adds. Over the last few quarters, it posted mobile postpaid net adds somewhere in the high 200 thousands or low 300 thousands. Notice that the company also achieved positive service revenue growth in Europe for at least the past five quarters. That"s also a good thing.

Developing markets, referred to here as "AMAP," shows far more impressive growth, but as you can see above, those markets are dominated by prepaid mobile, which has higher turnover and typically lower margins. Both categories, Europe and "AMAP," are very important to the business overall.

Courtesy of Vodafone Investor Relations

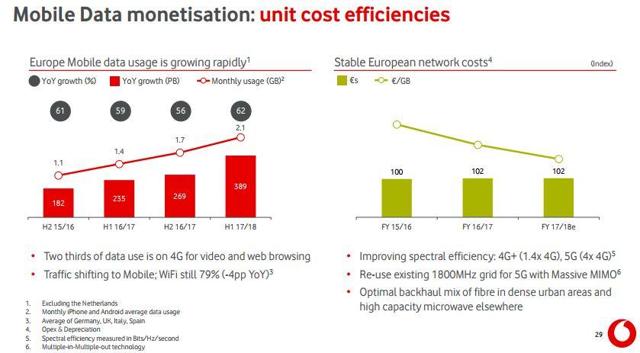

So long as Vodafone and other telecoms can hold the line on data tariffs, I expect margins to expand. We can see here that network costs per gigabyte in Europe have been dropping steadily, with data usage growing "rapidly."

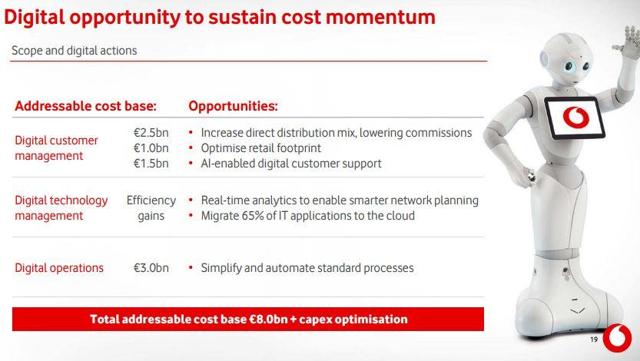

In addition to this, Vodafone has an exciting initiative to spread automation throughout the company and save a lot on the bottom line. Before going to itemized detail, Vodafone will be going from "mostly human and a bit digital" to "mostly digital with a really, really good" human element, in the words of CEO Vittorio Colao. Millennial consumers are much more willing to interact with artificial intelligence and automate things than previous generations were, and so Vodafone rightly expects to lower costs while improving customer satisfaction via automation. Have a look.

Courtesy of Vodafone Investor Relations

Altogether Vodafone expects a total addressable cost base of approximately US$9.6 billion, presumably annualized. We can see where, if the company gets this right, the bottom line is going to increase greatly, all other things considered.

Worth looking at on a dip

Courtesy of Google Finance

When looking at Europe, I continue to prefer BT Plc despite that company"s difficulties in Italy and its troubled public sector enterprise business. Overall, I am much more optimistic about the British economy than that of continental Europe as a whole. However, Vodafone has some strengths as well, including exposure to some hard-to-reach growth markets such as Turkey and India.

Considering that BT currently yields about 5.55%, I"d like to see Vodafone yielding a bit more than it does right now. I"m still not particularly optimistic on some of Vodafone"s largest markets: Germany, Spain and Italy. Still, there is some growth ahead, as you can see from growing demand for mobile data and increased savings from automation. All in all, I think VOD stock is worth picking up on any pullback from here.

If you"re interested in Vodafone, feel free to "Follow" me here on Seeking Alpha. I"ve been following this company for awhile, and will continue writing update articles when doing so is both material and relevant.

In addition, I have a Marketplace service which allows me to write more comprehensive articles on dividend investing which would not otherwise fit the mold of a "free" article. I encourage you to take a risk-free look at that as well.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment