Source: imgflip

I"m currently building an epic high-yield retirement portfolio, and thus always on the hunt for high-yielding, low- to medium-risk blue chips to add at favorable prices.

This includes finding top names in a variety of defensive (recession-proof) industries, including leading drug makers such as Pfizer (PFE). Thanks to its recent 6.3% dividend hike, Pfizer"s forward yield has brought it right to the cusp of making the cut and being added to my portfolio.

Let"s take a look at why Pfizer is one of the few drug makers that I consider worth owning. But as importantly, learn precisely what large-scale risks it faces that make it potentially worth waiting for a slightly better price before taking the plunge yourself.

A Ho Hum 2017

| Metric | YoY Change (except payout ratio) |

| Revenue | -0.9% |

| Net Income | 40.3% |

| Adjusted Net Income | 3.8% |

| Free Cash Flow | -4.8% |

| Shares Outstanding | -1.9% |

| Adjusted EPS | 5.7% |

| FCF/Share | -2.9% |

| Dividend | 6.7% |

| FCF Payout Ratio | 70.2% |

Source: Earnings Release

Pfizer didn"t exactly have a terrible year in the first nine months of the year. After all, it saw some of its blockbuster drugs post massive sales gains including:

- Lyrica (nerve pain): $4.5 billion annualized sales +9% YOY

- Ibrance (breast cancer): $3.2 billion annualized sales + 61% YOY

- Eliquis (blood thinner): $2.4 billion annualized sales + 48% YOY

- Xeljanz (rheumatoid arthritis): $1.25 billion annualized sales + 44% YOY

However, these gains were offset by large declines in the company"s essential health division, which includes its legacy drugs that have lost patent protection. In fact, the essential health division experienced a 12% decline in sales compared to just 8% growth in the company"s patented drug innovative health division.

To make matters worse Pfizer"s comps were hurt by the sale of Hospira Infusion systems in February of 2017, as well as a major supply chain issue with Hospira"s sterile injectables that saw sales of this new business fall 12%.

And unlike in 2015 and 2016, when Pfizer made $28.2 billion in acquisitions, there were no such major deals to offset the declines the company faced this year.

Unfortunately that"s not likely to change soon, because Pfizer is still at the tail end of a rather large patent expiration cliff. For example, between 2011 and 2020, the patent protections on Celebrex, Lipitor, Lyrica, and Viagra all expired or will expire, costing the company an estimated $30 billion a year in annual sales.

Pfizer expects that ongoing patent expirations will result in annual sales declines of:

- $2 billion through 2020

- $1 billion in 2021

- Less than $500 million between 2022 and 2025

So how is it that I can remain bullish on Pfizer and recommend owning the stock? Because the fact is that the drug industry is cyclical, thanks to precisely these kinds of periodic patent expirations and the resulting decline in revenues and cash flow.

However, the company has a solid plan for a return to growth in the coming years.

But There Are Reasons For Optimism

First, you need to understand that Pfizer is a wide moat company, courtesy of the extremely high, long, and expensive regulatory burden all drug makers face.

Pfizer"s massive scale (63 operating facilities supporting drug sales in over 125 countries) means it has a big competitive advantage in production and distribution.

The company also has a world-class sales force, especially in fast growing emerging markets such as Brazil, Russia, India, China, and Turkey. Its sales efforts are further enhanced by a larger-than-average spending on post-clinical, follow-up safety studies that help its sales associates convince doctors all over the world to switch patients to its drugs.

Meanwhile, the costs savings it can squeeze out, even on patent expired medications, mean that Pfizer enjoys better-than-average profitability and returns on capital.

Pfizer Trailing 12-Month Profitability

| Company | Operating Margin | Net Margin | FCF Margin | Return On Assets | Return On Equity | Return On Invested Capital |

| Pfizer | 26.8% | 18.7% | 25.3% | 5.6% | 15.8% | 13.2% |

| Industry Average | 21.0% | 16.6% | NA | 6.7% | 17.6% | 7.3% |

Sources: Morningstar, GuruFocus, CSImarketing

Note especially the company"s very strong returns on invested capital (a proxy for quality of management and its capital allocation skills), and its very fat free cash flow margin.

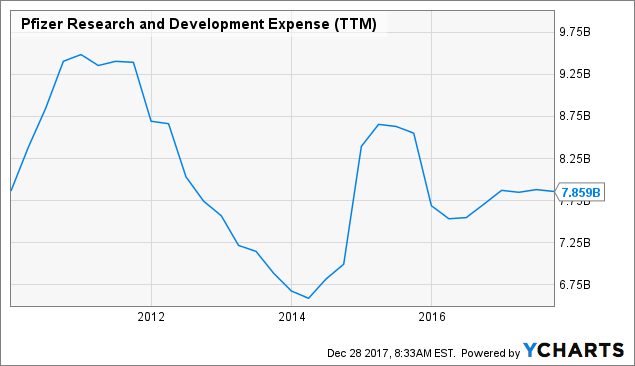

Remember free cash flow is what"s left over after running the company, and investing in its future growth, including over $7.5 billion annually in R&D. In other words, a quarter of Pfizer"s sales are converted into FCF, which is what ultimately funds the dividends and buybacks.

Speaking of which, Pfizer"s recent 6.3% dividend hike for 2018, and its $10 billion expansion of its buyback authorization (on top of the $6.4 billion remaining under its old one), means that shareholders are going to be richly rewarded for their patience.

The new buyback authorization alone means that Pfizer can (over the coming years) repurchase 7.6% of its shares. This more than offsets the new higher dividend cost.

But, of course, the real reason for owning Pfizer isn"t just for buybacks and dividends, but rather management"s long-term growth plans.

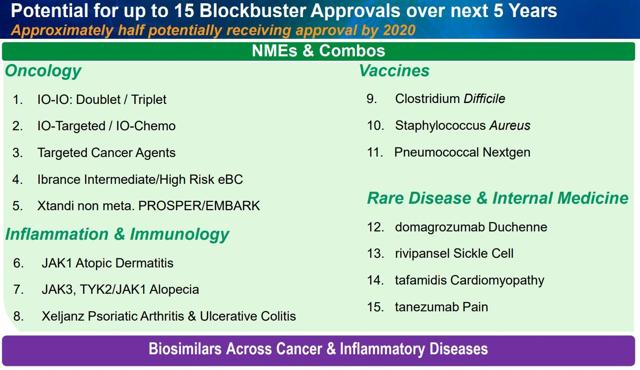

Source: Pfizer Investor Presentation

That includes high probability events like winning approval for additional indications for drugs already on the market like Xtandi and Ibrance. In fact, thanks to additional indication approvals analysts expect Ibrance"s 2018 sales to rise by $1 billion in 2018.

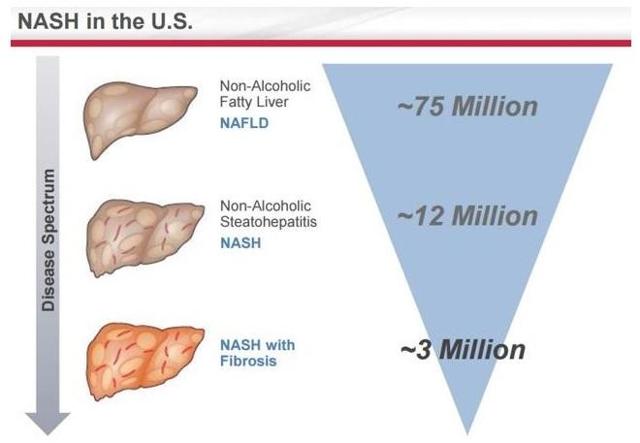

Pfizer is also working on breakthrough treatments in things like oncology (very high margin), vaccines (low competition), and nonalcoholic steatohepatitis, or NASH.

Source: Pfizer Investor Presentation

NASH in particular is a huge growth opportunity. This is because of two main factors. First, fatty liver disease is a fast growing problem caused by the worsening global obesity epidemic.

Source: Gilead Sciences Investor Presentation

Second, there are currently no treatments for NASH, meaning it"s a virgin market. One that"s estimated to be worth $40 billion a year in potential drug sales.

Of course, Pfizer is far from alone in targeting any of these fast growing and lucrative markets. However, its 96 drug pipeline is one of the largest in the industry. Which means that it has a better-than-average chance to win approvals on major potential blockbusters and return to slow but steady top- and bottom-line growth.

In fact, thanks to new drug launches, growth in existing patented drugs, and ongoing bolt-on acquisitions, analysts expect Pfizer"s sales to grow about 2% a year through 2020. That may seem slow, but remember that this includes the worst of Pfizer"s patent expiration cliff. Beyond 2022, Pfizer"s sales growth should return to about 4% to 5%.

And even through 2020, ongoing cost cutting and buybacks should allow Pfizer"s earnings and free cash flow to grow at about 6% to 8%, supporting continued strong dividend growth.

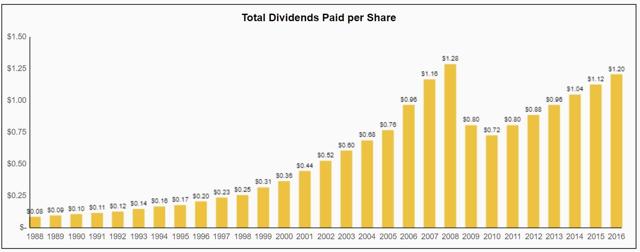

Dividend Profile Shows Safe Yield And Steady Income Growth

| Company | Forward Yield | TTM FCF Payout Ratio | Projected 10 Year Dividend Growth | Projected Potential Total Return |

| Pfizer | 3.8% | 57.1% | 4.7% to 6.3% | 8.5% to 10.1% |

| S&P 500 | 1.8% | 50% | 6.1% | 7.9% |

Sources: GuruFocus, Morningstar, FastGraphs, Multpl.com, CSImarketing

At the end of the day, Pfizer investors care about three things: the yield, dividend safety, and the company"s long-term payout growth prospects.

The good news is that Pfizer"s strong free cash flow means that in the past year the FCF payout ratio has been a low 57.1%. Even accounting for the new higher dividend, Pfizer"s payout ratio would have come in at just 61%, indicating low dividend risk.

Of course, there"s more to a safe dividend than just a low payout ratio. You also need to make sure the company isn"t over leveraged. That"s because too much debt can reduce a company"s financial flexibility and ability to grow, potentially meaning unsafe and or slow growing payouts.

| Company | Debt/EBITDA | EBITDA/Interest | Debt/Capital | Current Ratio | S&P Credit Rating |

| Pfizer | 2.2 | 15.85 | 32% | 1.34 | AA |

| Industry Average | 2.2 | 13.36 | 35% | 1.47 | NA |

Sources: Morningstar, CSImarketing, FastGraphs

Fortunately, Pfizer"s debt levels are about average for its industry. However, thanks to its strong, and recession-resistant cash flows (and high interest coverage ratio), it enjoys a very strong investment grade credit rating.

| Interest/EBITDA | Interest/EBIT | Average Interest Rate | Effective Interest Rate |

| 6.3% | 6.9% | 2.9% | 2.3% |

Sources: Morningstar, Simply Safe Dividend, Tax Bill

This allows Pfizer to borrow at very low cost. In addition, even under the new tax law, which caps interest deduction to 30% of EBITDA through 2022 (and 30% of EBIT after that), Pfizer"s low debt levels mean that it can still fully deduct 100% of its interest expense. That means that under the new tax code, Pfizer"s effective average interest rate is just 2.3%.

Or to put another way, Pfizer has access to ample cheap capital to fund its growth while still providing one of the industry"s most generous, safe, and steadily growing dividends.

Speaking of dividend growth, I expect Pfizer"s long-term increases to amount to about 5% to 6% a year. Assuming the current 2 cent per quarter annual increase were to continue (a highly conservative estimate in my view), this would be a 4.7% dividend growth rate over the next decade.

However, Pfizer is likely to grow the dividend slightly faster than that, at around its long-term FCF/share growth rate, which analysts estimate at 6.4% over the next 10 years.

That would mean that Pfizer is capable of not just delivering stronger total returns than the overvalued S&P 500 over the next 10 years, but also likely to exceed the market"s total return since 1871 (9.1%).

The bottom line is that I view Pfizer as a great low-risk, high-yield dividend growth stock, and one I hope to own one day. However, as I"ll now explain, that doesn"t necessarily mean I plan to buy at current prices.

Valuation: Almost Worth Buying

Despite a rather lackluster year for its top and bottom line, Pfizer"s stock has done pretty well, though it has failed to keep up with the overall market. However, the upside to that is that Pfizer is arguably highly undervalued right now, at least by some metrics.

| Company | Forward PE | Historical PE | Yield | Historical Yield |

| Pfizer | 13.2 | 17.6 | 3.8% | 2.9% |

| Industry Median | 25.4 | NA | 1.6% | NA |

| S&P 500 | 18.8 | 14.7 | 1.8% | 4.3% |

Sources: GuruFocus, Multpl.com, Yieldchart

For example, while Pfizer has never enjoyed a very high PE multiple, the current forward PE ratio is especially low. That"s especially true compared to the industry median or the S&P 500"s rather frothy levels.

More importantly, the current yield of 3.8% is more than double both the market"s payout and the average drug maker"s. In fact, Pfizer"s forward PE is now among the highest it"s been in years.

Source: YCharts

However, while this means that Pfizer is still potentially worth buying, based on backwards looking valuation metrics, I think it"s important to consider the future as well. After all, the future is where all dividends and profits are generated.

This is why I like to use a long-term (20-year), smoothed-out discounted free cash flow model to estimate a company"s fair value.

| TTM FCF/Share | 10 Year Projected FCF/Share Growth | FCF/Share Growth Years 11-20 | Fair Value Value Estimate | Growth Baked Into Current Share Price | Discount To Fair Value |

| $2.18 | 5.4% (conservative case) | 4% | $30.35 | 8.0% | -20% |

| 6.4% (likely case, analyst consensus) | 4% | $32.48 | -12% | ||

| 7.4% (bullish case) | 4% | $34.77 | -4% |

Sources: Morningstar, FastGraphs, GuruFocus

I use a 9.0% discount rate. This is because since 1871 a low-cost S&P 500 ETF (had it existed) would have generated net total returns (after expense ratio) of about 9.0%. And since a low-cost S&P 500 ETF is the best default investment option, I consider this the opportunity cost of money.

Now of course modeling any company"s growth over 20 years isn"t an exact science. This is especially true for industries like big pharma, where revenue growth is highly cyclical based on when and if certain drugs get approved compared to when patents expire.

Which is why I use a variety of growth scenarios to estimate the fair value of Pfizer based on the net present value of its future free cash flow. Unfortunately, under even the most optimistic (but realistic) growth outlook, I concluded that shares are overvalued. This is because the market is currently pricing in about 8% FCF/share growth over the next decade.

While that"s not an absurd assumption, it"s highly optimistic. Which is why I recommend waiting for a small pullback, to about $34 (a 4% yield) before buying Pfizer.

Don"t get me wrong, you won"t likely lose your shirt if you buy now. However, since investing isn"t done in a vacuum, I feel it"s important to avoid paying too much for any company, even a low-risk blue chip like Pfizer. After all, there are plenty of quality, high-yield stocks trading at discounts right now.

Lots Of Risks To Keep In Mind

Anyone considering investing in any big drug maker needs to understand some key risk factors inherent to this industry.

For one thing, the same strong regulatory challenges that come with bringing a new drug to market, as well as patent protections that result in such high FCF margins, also serve as double edged swords.

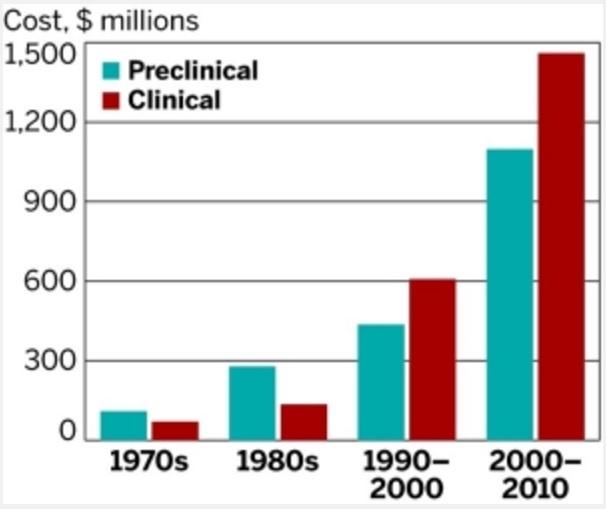

That"s because running the FDA"s stringent gauntlet of human trials generally takes 12 to 13 years to complete, and has seen rapidly rising costs over the decades. In fact, total (preclinical, clinical, and post approval safety studies) can end up costing $2.5 billion per drug.

Sources: Tufts Center For The Study Of Drug Development, Scientific American

And keep in mind that any drug can fail at any stage (just one in 5,000 potential drugs gets approved), meaning that this industry is littered with failed potential blockbusters.

The high risks associated with drug development is why the pharma industry is one in which large-scale M&A is necessary to grow. That"s especially true given that patent expirations mean that all drug makers are essentially on a kind of hamster wheel. Specifically this means having to run very fast, and spend a lot on R&D (about 15% of revenue in Pfizer"s case), just to bring new drugs to market to offset lost sales as patents expire and generic competition comes in.

Source: Simply Safe Dividends

Every large acquisition comes with large amounts of execution risk, both in terms of overpaying as well as failing to achieve expected synergistic cost savings.

For example, in 2009, Pfizer was facing a giant patent cliff, so it purchased Wyeth for $68 billion. While the deal brought numerous blockbusters with it, (such as Prevnar 13, Pfizer"s top selling product today), the high cost and stock dilution meant that Pfizer was forced to cut its dividend severely.

The good news is that this deal was made under former CEO Jeffrey Kindler, and current CEO Ian Read (who took over in 2010 and has over 30 years experience in the industry) has been far more dividend friendly. That being said, Read is far from perfect, and has shown a penchant for being willing to drastically cut R&D spending, which is the lifeblood of the industry.

In addition, Read has also shown a willingness to make potentially risky and massive deals, including:

Now it"s quite possible that these deals would have eventually proven to be accretive to FCF/share and helped grow the dividend. After all, Pfizer"s decision to spin off its animal health business into Zoetis (NYSE:ZTS) does appear to have created shareholder value. But it"s also possible that Pfizer got lucky that the deals fell apart and it was forced to make much smaller (and historically more successful) acquisitions in order to grow.

And now Pfizer is apparently considering selling its consumer brands for a reported $14 billion to $15 billion. While that"s a lot of money, I"m actually opposed to that deal for two mains reasons.

First, consumer healthcare is on track to generate $3.4 billion for Pfizer in 2017 sales or about 7% of the company"s total. Pfizer is expecting patent expirations to result in $2 billion in annual sales declines (about 4% of revenue) through 2020. The good news is that those patent expiration losses will drop to less than $500 million a year (about 1% of revenue) between 2022 and 2025. However, in the meantime if Pfizer sells its non-patented, and strong consumer brands (highly stable and recurring cash flow), then it"s potentially looking at a short-term 11% revenue hit.

This means that selling the consumer division could be big risk to the company"s potential dividend growth prospects. That"s because Pfizer would have to use the money very wisely, to offset the lost FCF, which is far from guaranteed. The cash could be used for something like the 2016 $16 billion acquisition of Hospira, which was very well done (and brought with it a strong portfolio of biosimilars).

Or it could end up being to fund something like Pfizer"s questionable 2016 $14 billion acquisition of Medivation. That acquisition brought with it two potential blockbusters, prostate cancer drug Xtandi, and breast cancer drug development candidate Talazoparib.

However, while both cancer drugs could prove to be big winners, the high cost Pfizer paid means that it could be a long time before this deal would prove worthwhile. That"s because Medivation owned just 40% of the rights to Xtandi. So even if the drug becomes a $4.7 billion a year blockbuster by 2022 as analysts project, Pfizer"s take of that would be just $1.8 billion.

The bottom line is that even if Pfizer gets top dollar for its consumer business, there is no guarantee that it will be able to invest that cash accretively to offset, much less grow, its lost FCF from that sale.

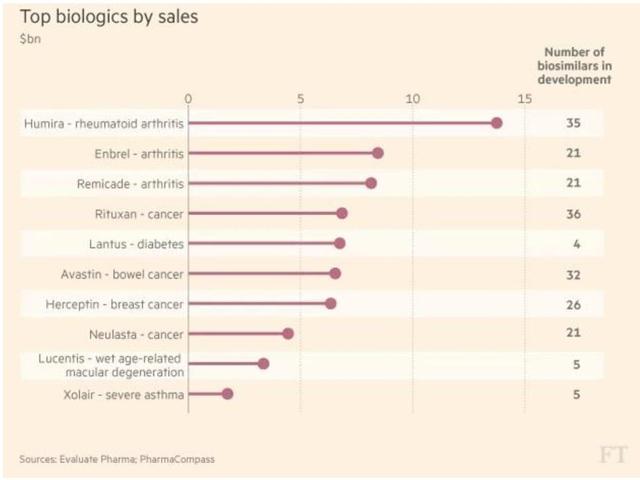

Meanwhile, Pfizer"s big reasons for buying into Hospira, biosimilars, are also facing their own challenges. The biological nature of these drugs means that they are hard to replicate and even after patent expiration they still require the same expensive regulatory approval as new drugs. This is compared to inorganic (chemical) based drugs whose formula can just be copied and result in massive low cost generic competition flooding the market.

The problem is that everyone and their mother is going after biosimilars, including no less than 21 rivals to Pfizer"s Enbrel (about $2.4 billion a year in sales). In fact, Pfizer has already seen increased competition hurt Enbrel sales, which are down 17% in 2017.

And we can"t forget that all drug makers also face plenty of other risks, including litigation (if drugs end up harming consumers), as well ever present political risks. For example, currently Medicare/Medicaid can"t negotiate bulk drug purchases. But if that law is changed (very low-hanging, cost-saving fruit), then all drug maker margins could suffer.

And even if the government doesn"t clamp down on costs, the private sector will do its best to. This is precisely why CVS Health (NYSE:CVS) is trying to buy Aetna (NYSE:AET), so that it can achieve the kinds of scale and buying power to negotiate the lowest possible drug costs.

The bottom line is that the pharmaceutical industry, while a free cash flow (and dividend) minting machine, is also fraught with complexity, uncertainty, and speculative risks.

This means that it"s not for everyone, but only those comfortable with the "black box" nature of such companies. This is why I avoid investing in anything but the best dividend blue chips in the industry and why my pharma buy list is limited to:

- Amgen (NASDAQ:AMGN) target yield: 4%, current yield 3.0%

- Pfizer (NYSE:PFE) target yield: 4%, current yield 3.8%

- Johnson & Johnson (NYSE:JNJ) target yield: 3%, current yield 2.4%

- AbbVie (NYSE:ABBV) target yield: 3.5%, current yield 2.9%

Bottom Line: Though Not The Best Name In The Industry Pfizer Is Potentially An Excellent Choice At The Right Price

The drug industry is notoriously complex, speculative, and fraught with numerous regulatory, litigative, and competitive risks. This means that few high-yield drug makers make good, low-risk, long-term dividend growth investments.

Despite its numerous challenges, I"m impressed with Pfizer"s strong profitability, better-than-average growth prospects, and highly generous but very safe payout profile.

This means that at the right price, I"m more than happy to recommend this blue-chip drug maker. In fact, if Pfizer hits my target 4% yield I"ll be adding it to my own high-yield retirement portfolio.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment