Source: AZ quotes

First, let me be very clear that this is my personal portfolio tailored to my specific financial situation, risk profile, time horizon, and personality traits. I am not recommending anyone mirror this portfolio, which is merely designed to show my unique, rule-based, methodical approach to value-focused, long-term, dividend growth investing.

My situation is unique, as, though only 31, I"m already retired (medical retirement from the Army), thus making this portfolio an income-focused retirement portfolio (though in a taxable account). I"m also working full time (self-employed) and thus have an external source of income to continually add to this portfolio. I do not plan to actually tap the portfolio"s income stream for 20-25 years, when I plan to move my family (and help support my parents) to the promised land of my people: Sarasota, Florida.

What this portfolio can be used for is investing ideas; however, this portfolio includes high-, low-, as well as medium-risk stocks, so it"s up to each individual to do their own individual research and decide which, if any, of my holdings are right for you.

For a detailed explanation of my methodology, please read my introductory article to the EDDGE 3.0 portfolio.

What Happened This Week

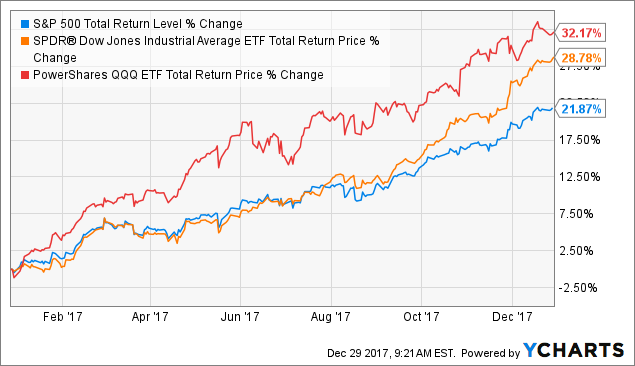

It"s been one heck of a year for Wall Street. All three major indexes soaring on strong optimism about tax reform and accelerating economic growth.

^SPXTR data by YCharts

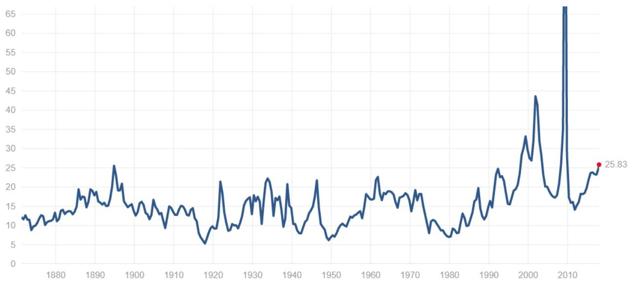

Of course, many are now worried that the market is in a bubble, and that"s understandable. After all, based on the S&P 500"s trailing 12-month earnings, stocks are trading at some of their loftiest valuations in history.

S&P 500 Trailing 12 Month PE

Source: Multpl.com

And looking at the popular (though far less useful than most people think) Shiller CAPE, things look even scarier.

S&P 10 Year Cyclically Adjusted PE Ratio (CAPE)

Source: Multpl.com

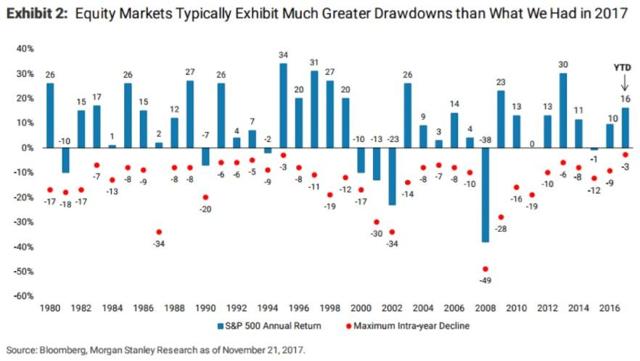

Even more amazing? This year"s strong rally has occurred with record low volatility. In fact, the biggest drawdown for the S&P this year was an astonishingly low 3%! You have to go back to 1994 to find a year with better returns with volatility this low.

This kind of freakishly high risk-adjusted total returns is likely why there is a bubble in people calling market bubbles. And since it"s natural to crave certainty in a deeply uncertain world, analysts and various "experts" are quick to offer predictions about the next year. But there"s a major problem with this: they are basically guesses plucked from thin air.

100% Guaranteed That The Market Will Rise In 2018... Or Fall... Or Stay Flat

Whether it"s economists predicting interest rates, or analysts predicting where the market will go next year, the track record is so bad as to make all predictions essentially useless.

For example, since Bloomberg began tabulating analyst consensus guesses for the next year"s market performance (in 2000), Wall Street"s very well paid best and brightest have predicted the market would rise every single year. This means that they completely missed the four negative years we"ve had in the last 17 years (when factoring in dividends).

This is due to two main factors. First, the stock market generally rises over time. In fact, on an annual basis, the S&P 500 rises about 80% of the time. And that trend has been especially strong recently. For example, in the past 31 years, the market"s total return has only been negative five times: in 1990, 2000, 2001, 2002, and 2008.

In other words, with the market rising 84% of the time in the past three decades, the safest bet for any analyst is to predict the market will go up next year.

This is likely why Mike Wilson, the chief US equity strategist at Morgan Stanley (MS), who offered the most bullish 2017 prediction in late 2016, is now predicting "just" a 2.6% rise (to 2,750) in the S&P 500 in 2018.

That"s despite predictions that: interest rates, increased volatility, and poorer than expected credit and economic data, will all roil the markets next year.

Even John Hussman, the famous permabear who is predicting a 65% market crash, is hedging his bets and saying that the market could continue rising for the foreseeable future.

In other words, every analyst making any kind of short- to medium-term prediction is basically pulling numbers out of thin air while making sure to cover their buts in case they are wrong.

This is why I don"t bother ever predicting what the market, or any given stock, will do over the next year.

"...in the short run, the market is like a voting machine - tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine - assessing the substance of a company." - Benjamin Graham

As Ben Graham, the father of modern value investing (and Buffett"s professor at Columbia University), explains, short-term prices are totally unpredictable. They are governed by "animal spirits" as millions of investors experience often inexplicable, and volatile, swings in emotions.

Source: Slideplayer

However, the fact is that this precise return of volatility and negative returns that everyone is worried about doesn"t matter. In fact, if you play your cards right, you can turn it to your advantage and use it to achieve the kind of financial independence that most people only dream of.

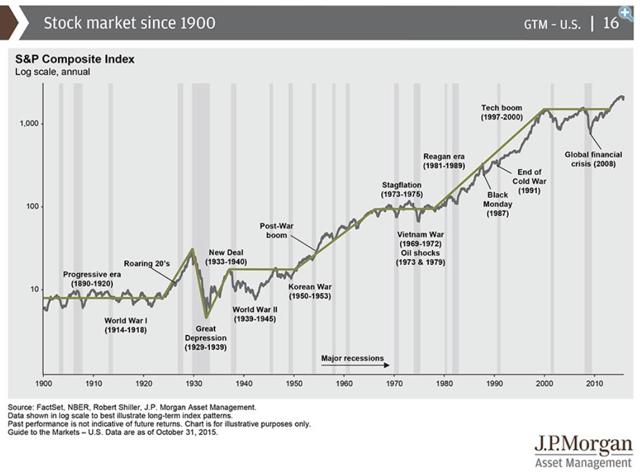

Markets Always Climb A Wall Of Worry

Source: A Few Dollars More

The US stock market, and the global economy that ultimately drives it, is incredibly complex. There are always some collection of threats and risks that could cause stocks to drop in the short term. This has always been the case, and will continue as long as there is a stock market.

This can lead to large crashes, and long bear markets, in which stocks stagnate or decline for years on end. However, this is where true opportunities lie. In fact, market crashes are where the biggest fortunes are made.

Source: Kapitalust

After all, Warren Buffett has made his fortune by being a value focused contrarian. Which is why I too have adopted this strategy for my own portfolio.

Of course, "being greedy when others are fearful" and being a buy and hold investor is easier said than done. That"s because, while great fortunes are made over decades, we live in a short-term world. One in where the media is constantly bombarding us with speculative, but plausible sounding reasons to churn our portfolios.

This is why the average investor does so terribly when actively managing his/her investments. In fact, between 1996 and 2015, JPMorgan (JPM) found that retail investors underperformed every single asset class, and even inflation.

This also explains the rise of passive investing, aka index funds. Warren Buffett, Mark Cuban, John Bogle (founder of Vanguard), and numerous other successful investors have called a low cost market ETF the best default option for almost everyone.

In other words, what all the historical market data (the examples of the top investors in history) shows, is that time in the market is what matters. That"s opposed to timing the market, in hopes of avoiding the big crashes.

This is why I personally love Steven Bavaria"s "income factory" theory of investing. Basically, Mr. Bavaria thinks of his high-yield retirement portfolio like a cash flow based business.

Each holding is a money minting machine that sits in his income factory. The market prices of those holdings, and the portfolio in general, are the market"s current valuation of his factory.

However, rather than concern himself with the short-term swings of the factory"s value, he only cares about growing the income over time. After all, dividends are what pay the bills, and as long as they rise over time, the factory"s valuation is irrelevant.

In fact, if prices crash, this high-yield investing strategy works even better. That"s because the income it generates can then be invested into even more income producing machines, and lock in a higher yield on each one.

Eventually, a diversified collection of quality income producing assets will naturally appreciate in value, and you will get your capital gains. This is born out by market studies that show that over the long term, the total return of a dividend portfolio follows the formula: yield + long-term dividend growth.

This makes intuitive sense, because current dividends require strong and consistent cash flow from which to pay them. Meanwhile, dividend growth is a good proxy for cash flow growth, since over the long term, payouts must track with earnings and cash flow per share increases. And since a stock"s ultimate value is based on its per share cash flow, rising dividends generally mean rising share prices over time.

All of which means that you don"t need to choose between high income and total returns. Because if you build a quality portfolio that, say yields 5%, and has long-term dividend growth of 5%, then over time, you"ll get about 10% total returns. That"s compared to the market"s historical 9.1% total return since 1871.

Basically, this is why I love dividend investing, because it is literally the easiest and highest probability way for regular people to build an exponentially growing stream of passive income. Not only does this allow you to retire early, and live life on your terms, but it also is the most likely way to beat the market over time. It"s also the best option for potentially become rich enough to do anything you want (such as become a philanthropist which is my ultimate end game).

Basically, by turning your portfolio into a cash flow based business, you can counteract all the dangerous, short-term speculative emotions that cause so many investors to do poorly over time.

Dip Buy List

This list represents quality blue chip dividend stocks that are worth owning, but whose yields are just a tad (15% or less) under my target yield. However, a combination of company specific dip plus a dividend increase could cause them to reach my target yield which would mean that I would snatch them up (get in while the getting"s good).

- Bank Of Nova Scotia (BNS) - low risk, 4% target yield, current yield 3.9%

- NextEra Energy (NEE)- low risk, target yield 3.0%, current yield 2.5%

- NextEra Energy Partners (NEP):- low risk, target yield 4.0%, current yield 3.8%

- Altria (MO) - low risk, target yield 4.0%, current yield 3.6%

- Pfizer (PFE) - low risk, target yield 4.0%, current yield 3.7%

- Crown Castle (CCI): - low risk, target yield 4.0%, current yield 3.8%

- Genuine Parts Company (GPC): - low risk (dividend king), 3% target yield, current yield 2.8%

Correction Buy List (in order of priority)

The correction list is the top five quality dividend stocks I want to own, that are between 15% and 20% away from their target yields. This means that it would likely require a broader correction before I can buy them.

- Main Street Capital (MAIN) low risk, target 8% yield, current yield 7.1%

- STAG Industrial (STAG) medium risk (unproven in recession), target 6% yield, current yield 5.2%

- AbbVie (ABBV) - low risk (fast growing dividend aristocrat), target 3.5% yield, current yield 2.9%

- Texas Instruments (TXN) - low risk, 3% target yield, current yield 2.4%

- Royal Bank of Canada (RY) - low risk, 4% target yield, current yield 3.5%

Because corrections usually only last one to three months, I have decided that I will only maintain a list of five correction buy list stocks. Any more would be pointless since I likely won"t have time to buy them before the downturn ends.

Everything that doesn"t make the correction list is thus shifted to the bear market/crash list.

Bear Market/Crash Buy List

Stocks whose yields are all 20+% away from my target yields.

Bear markets (20% to 39.9% declines from all-time highs) and crashes (40+% decline from all time high) usually only occur during recessions and last from one to three years. Thus, they offer longer and stronger chances to load up on Grade A blue chips and dividend aristocrats/kings that are currently at frothy valuations.

My goal during a bull market is to buy stocks yielding only 4% or higher. This might sound counterintuitive, but it"s actually not. That"s because there is always something of quality on sale in some beaten down industry, such as retail REITs, or pipeline MLPs. Only during a market crash will I allow myself to go as low (but no lower) than 3% yield.

That will allow me to pick up some truly high-quality and legendary dividend growth stocks - those in other sectors that are now closed to me due to high market valuations and low yields.

My current crash list, in order of priority, and target yield, is:

- Boeing (BA) - low risk, 3% target yield, current yield 2.3%

- Johnson & Johnson (JNJ) - low risk, 3% target yield, current yield 2.4%

- 3M (MMM) - low risk, 3% target yield, current yield 2.0%

- Home Depot (HD) -low risk, 3% target yield, current yield 1.9%

- Microsoft (MSFT) - low risk, 3% target yield, current yield 2.0%

- Amgen (AMGN) -low risk, 4% target yield, current yield 3.0%

- Apple (AAPL) - low risk, 3% target yield, current yield 1.5%

- Toronto Dominion Bank (TD) - low risk, target yield 4.0%, current yield 3.2%

- Digital Realty Trust (DLR): -low risk, 4% target yield, current yield 3.3%

- Target (TGT) - low risk, target 5% yield, current yield 3.8%

This week I was doing extensive research on some top pharma stocks, and it reminded me that Amgen is one of the few stocks in this complex but defensive industry that I want to own.

Meanwhile, the decision to forgo ETFs entirely due to the variable nature of their payouts means that the PowerShares S&P 500 High Dividend Low Volatility Portfolio ETF (SPHD) has been removed from my crash list.

However, I also realized that I need to ultimately diversify the high-yield REIT portion of my portfolio. This is why I"ll be gradually adding faster growing REITs to my crash list. For this week, I"ve added Digital Realty Trust to the crash list and Crown Castle to the dip buy list.

I"ve also added Genuine Parts Company to the dip list, as it"s one of my favorite fast growing dividend kings (with 10+% total return potential).

Finally, a reader pointed out that I had the current yield on Royal Bank of Canada incorrectly listed as 2.4%, when in fact it"s 3.5%. That means that it"s only about 15% away from my target yield and thus deserves a spot on my correction list. This was made possible by this week"s purchase of, and thus removal from my correction list, of STORE Capital.

Buys And Sells Of The Week

Sold $6,200 of iShares Global REIT ETF (REET)

Bought $1,000 Algonquin Power & Utilities (AQN)

Bought $6,000 of STORE Capital (STOR)

This past week, iShares Global REIT ETF announced its next dividends, and they were way down from Q4 of 2016. While this is normal for an ETF, due to the very large and diversified nature of the portfolio (275 stocks), I"ve decided that ETFs just don"t work for me.

After all, my most sacred rule is that I"m looking for safe, and steadily growing dividends, which means that the variable nature of ETFs, and CEFs, makes them unsuitable for my needs.

The biggest reason I had owned REET was the 1/3 exposure to global blue chips. However, since Interactive Brokers allows me to trade on dozens of foreign exchanges, I can pick and choose the best names. This allows me to avoid paying an expense ratio, while better targeting foreign dividend stocks that best meet my needs.

The capital from the REET sale also presented me an opportunity to buy one of my all time favorite, fast growing SWAN REITs; STORE Capital. Arguably STORE Capital is the highest-quality, (and one of the fastest growing) triple net lease REITs.

And as Brad Thomas just pointed out, it"s currently trading at a fair price and likely to generate strong market beating total returns. So under the Buffett Principle of "better to buy a wonderful company at a fair price, than a fair company at a wonderful price", I decided to swap my REET (fair investment) for a wonderful company at a reasonable price (STOR).

Meanwhile, the Algonquin purchase I had planned was larger than expected. That was thanks to a very nice surprise Christmas gift (of cash) that allowed me to buy double what I had initially anticipated.

The Tentative Plan Going Forward

In the past week, I came across another awesome Canadian utility with impressive yield, matched by industry leading dividend growth. This would be Emera (OTCPK:EMRAF), which currently yields 4.8% and plans to raise its dividend by 8% annually through 2020.

I love Emera"s huge regulated (and thus highly defensive and predictable) business and diversified asset base (US, Canada, and the Caribbean). The only iffy thing about them is the rather high debt levels they took on to acquire TECO (Tampa Electric Company). However, Moody"s has looked at their current leverage and judged them still worthy of a Baa3 rating (equivalent to S&P BBB-) which is investment grade.

Management plans to deleverage over time, while still aggressively investing in growth. So due to the highly diversified, and low risk business model, I consider it a worthy addition to the utility portion of my portfolio.

This means that in the coming weeks, I will finish trimming 75% of Uniti Group (UNIT) and New Residential Investment Corp. (NRZ) and put the capital to work:

- Paying down $2,000 more of margin debt (with another $2,000 to be paid off through net dividends through February).

- Finish off my position in Crius Energy Trust (OTC:CRIUF) - about $5,100.

- Buy a full position in Brookfield Real Estate Services (OTCPK:BREUF) - about $9,200.

- Buy a full position in NorthWest Healthcare Properties REIT (OTC:NWHUF) - about $8,000.

- Finish off my AQN position ($4,000).

- Buy an 80% position in Canadian Imperial Bank of Commerce (CM) with the remaining $4,100.

This tentative two-week plan serves several purposes. First, it completes the right sizing of all my positions by dividend risk. It also continues to "crash proof" my portfolio through deleveraging. Finally, it adds some much needed diversification via:

- my first hospital REIT;

- my first bank;

- more utilities to act as the third pillar of my portfolio (along with REITs and pipeline MLPs); and

- more Canadian companies, the best I can do in terms of international diversification given my need for non-variable dividends

Beyond these next 2 weeks, the plan is to finish off my CM position (which will take 2 weeks). Then get started on Telus (TU), the AT&T of Canada, but with much faster dividend growth.

As for Emera? Well, that is going to be tricky. This is because Interactive Brokers requires that I buy foreign stocks in round lots of 100. With Emera current trading at $37.49, that means I need to buy it $3,750 at a time.

That means that I would either have to buy it on margin and then pay it back, or wait until the first week of February or March (I receive the majority of my pay at the end of the month).

Since my goal is to crash proof my portfolio (thus paying down $36,000 in margin debt in a few months), I"ll have to wait to add Emera. I"ll also likely have to buy it over 2 months. This means that acquiring CM, TU, and EMRAF will basically eat up the first third of 2018.

However, remember that this is a "tentative plan" because my dip list takes priority in case any of those blue chips hits my target yields. Whether or not I"m able to build out a full position is uncertain, so in the future I may end up with several stocks with partial positions. These I"ll add to opportunistically until each position is full.

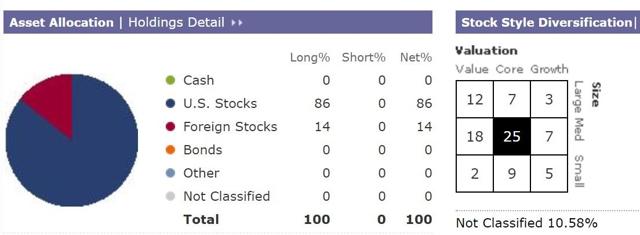

The Portfolio Today

Source: Morningstar

Dividend Risk Ratings

- Ultra low risk: (Limited to ETFs with proven histories of steadily growing dividends over time); max portfolio size 15% (core holding).

- Low risk: High dividend safety and predictable growth for 5+ years, max portfolio size 10% (core holding).

- Medium risk: Dividend safe and potentially growing for next two to three years, max portfolio size 5%.

- High risk: Dividend safe and predictable for one year, max portfolio size 2.5%.

High-Risk Stocks

- Uniti Group

- New Residential Investment Corp.

Medium-Risk Stocks

- Pattern Energy Group (PEGI): Will be upgraded when payout ratio declines under 85%.

- Iron Mountain (IRM): Will be upgraded when dividend is maintained/grown during next recession.

- Macquarie Infrastructure Corp. (MIC)

- Crius Energy Trust: Due to cyclical nature of part of its cash flow.

- CONE Midstream Partners (CNNX): Due to its small size.

- Omega Healthcare Investors: Due to ongoing downturn in SNF industry.

Low-Risk Stocks

- Enterprise Products Partners (EPD)

- MPLX (MPLX)

- AT&T (T)

- Tanger Factory Outlet Centers (SKT)

- EQT Midstream Partners (EQM)

- Brookfield Property Partners (BPY)

- TransAlta Renewables (OTC:TRSWF)

- Simon Property Group (SPG)

- Enbridge (ENB)

- Realty Income (O)

- EQT GP Holdings (EQGP)

- Brookfield Infrastructure Partners (BIP)

- Dominion Energy (D)

- STORE Capital

The diversification continues to proceed steadily. I wasn"t able to trim UNIT or NRZ this week, as my sell plan involves capturing the full January dividends to help pay down $2,000 in margin debt.

My portfolio began with five stocks, all medium to high risk, in two sectors. Right now I"m up to 23 stocks, mostly low to medium risk, in four sectors. By January 8th, I estimate I"ll be up to 26 stocks in five sectors. The goal for the end of 2018 is 30-35 stocks in six sectors. The Morningstar holding graphic is capable of showing my top 34 holdings.

Dividend Sources

- Uniti Group: 18.7%

- New Residential Investment Corp: 14.2%

- Omega Healthcare Investors: 6.9%

- Macquarie Infrastructure Corp: 5.8%

- Pattern Energy Group: 5.3%

- CONE Midstream Partners: 4.7%

- TransAlta Renewables: 4.4%

- Enterprise Products Partners: 4.3%

- MPLX: 4.3%

- Iron Mountain: 3.4%

- Everything Else: 34.9%

This week I"ve gone to a new format for dividend income mix. The previous pie chart was from the version of Simply Safe Dividends wasn"t capable of tracking Canadian stocks, of which I own many. Thus, I"ve gone to a manual income mix breakdown, generated from the newest version of the software that includes my foreign holdings.

The portfolio remains dominated by my top two positions, which will be corrected within the next two weeks. After that, about three stocks will still represent over 5% of my annual income (OHI, MIC, and PEGI). The goal is to get that under 5% (and much lower over time). This ensures strong portfolio income diversification and security. I estimate that it will take me until Q2 2018 before my additional savings and acquisitions dilute these three medium risk stocks to their target levels.

The portfolio has become far more diversified by stock style, especially compared to the early days when it was pretty much 100% small cap value. In fact, today almost none of it is small cap value but far more spread out over market cap and style.

Over time, I plan to use Trapping Value, the Canadian high-yield guru, as a source for lots of Canadian high-yield investments. Combined with some quality Canadian banks, I will have plenty of exposure to non-US holdings, whose representation in my portfolio is down from 15% to 14% this week. This is due to the sale of REET, which had one third exposure to international blue chip REITs.

In the coming months, the additions of CRIUF, BREUF, NWHUF, AQN, CM, TU, and likely BNS will raise that my Canadian exposure substantially. As for non-Canadian international stocks? I"m always on the lookout for international dividend stocks, but I likely won"t be finding too many that meet my steady dividend growth needs. That"s because foreign companies (like British Telecom (BT) or Vodafone (NASDAQ:VOD)) generally pay less frequent and variable dividends.

And since I"m no longer owning any ETFs, it"s unlikely that my portfolio will journey out beyond North America. That being said, my portfolio does have exposure to foreign cash flow. That"s because many of the blue chips I"ll be adding are themselves multi-nationals. For example, my 3% Asia exposure is due to BPY"s global portfolio of properties.

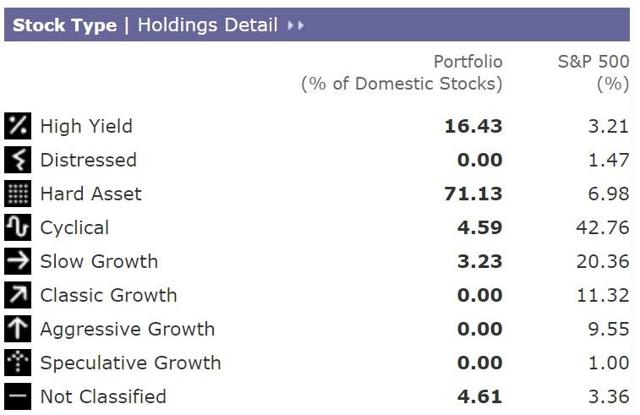

Source: Morningstar

While the market is dominated by cyclical companies, my need for steady and growing dividends requires more consistent cash flow. Thus, the large presence of hard assets (REITs and pipelines), high-yield (telecoms), and slow growth (utilities).

Source: Morningstar

Remember that Morningstar classifies some MLPs as energy and some as industrial. In reality, my portfolio is currently about:

- 44% REITs

- 33% Pipeline MLPs

- 18% Utilities

- 5% telecom

In the coming weeks, my utility positions will grow substantially. In addition, REITs, being one of the best sources of low risk, high-yield dividend growth, will likely always remain the largest sector in my portfolio. Pipeline MLPs are the other cornerstone of my portfolio. Utilities, while great, are generally too slow growing for me to add more than the few names I have currently planned. I may be able to find more later, but utilities will likely peak soon.

Source: Morningstar

With no more ETFs, my expense ratio is now zero. More importantly, thanks to my equity now surpassing $100K, I will no longer be at risk of Interactive Broker"s monthly maintenance fees.

This is $10/month minus any commissions. Once I"m done de-risking the portfolio, my average monthly commissions will likely fall to $2 or so, which means that my larger portfolio will avoid about $8/month in fees.

Rising interest rates are a major concern of course, with the Fed planning on at least three more hikes in 2018. Goldman Sachs (GS) expects the actual number to be four, with the first coming in March. My margin rate is the Fed Funds rate + 1.5%, so each hike raises my annual interest cost by $166.41 at present.

Currently, I anticipate that by the end of 2018, my margin debt will decline to about $50,000 which would have a single rate hike sensitivity of $125 per year. By the end of 2019 (assuming no correction by then), margin should be down to $35,000 or less. This would create rate sensitivity of $87.5 per rate hike.

During the next recession, the Fed is likely to take rates back to zero which would lower my margin rate to 1.625%. However, my actual future margin rates will depend on how much I borrow. Margin amounts over $100,000 have an interest rate of Fed Fund rate + 1.0%, so as the portfolio grows in the coming years, I"ll get substantial price breaks. However, the plan is to only add margin during corrections/bear markets. During bull markets, I"ll be deleveraging, both with capital gains as well as allowing net dividends to pay down margin debt.

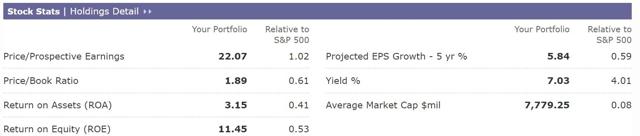

Source: Morningstar

I no longer believe my lower risk approach (avoiding most BDCs, mREITs, refiner and tanker MLPs) will allow me to hit a 7% total portfolio yield. However, I"m confident that 6% is doable, so that"s my new long-term goal.

The current profitability metrics for the portfolio are lower than the market average owing to the highly capital intensive nature of REITs, MLPs, and utilities. As I diversify in the future into higher margin and return on capital industries (pharma and tech especially), these figures will improve. As will the overall growth rate of the portfolio.

Of course, given the high-yield focus I have, there are limits to how high the earnings, cash flow and dividend growth can realistically climb.

Source: Simply Safe Dividends

Note that the longer-term growth figures are incorrect. They don"t take into account that some of my holdings (such as NRZ, UNIT, and MPLX) didn"t exist five or 10 years ago, and thus they make the dividend growth appear much faster than it really is. However, the organic dividend growth of the past year is factual and represents the most recent annual payout hikes provided by my holdings.

The 1-year organic growth rate is down to 9.4% from 10.6% last week. However, this is still a fantastic annual payout growth rate and up substantially from the 4.2% that this portfolio started with.

Of course, going forward, that will likely fall off as I continue to diversify my portfolio. That"s partially because the version of Simply Safe Dividend Portfolio tracking software I"m using isn"t able to track Canadian stocks. A different version is, but it only offers five-year average growth figures. The problem with that is that it doesn"t account for new stocks that went public during that time. However, in the future, I may include those figures as well, because once the portfolio is diversified with more mature blue chips, those figures will become more accurate and thus representative of actual historical (and future) results.

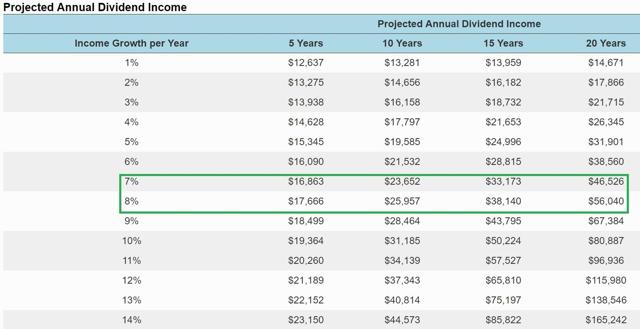

Source: Simply Safe Dividends

Keep in mind that this projection table only indicates how much the current holdings would be paying if I didn"t add any cash to the portfolio or didn"t reinvest the dividends. In other words, it"s a highly static, non-compounding figure - one, however, that still shows the awesome cash-minting power of the business empire I"m building here.

Also note that the above estimate assumes I maintain the current portfolio, with no changes. In reality, I"m still in the process of de-risking the portfolio with planned trimmings of my UNIT and NRZ holdings in early January. Owing to the relatively slow dividend growth rates of those companies (relative to the blue chips I"ll be adding in the future), the dividend growth rate should hold up rather well, or even increase slightly in the future.

Thanks to my high savings rate, I estimate that within 10 years, my portfolio should be generating about $130,000 in net inflation adjusted dividends.

That"s because, despite a very broadly diversified portfolio, I estimate the long-term portfolio dividend growth rate will be around 7%. So assuming I can maintain an annual savings rate of about $72K (once all my divorce debt is paid off), my 6% yielding portfolio should, within a decade, have an inflation adjusted value of about $2.2 million.

In perspective, the S&P 500"s 20-year median annual dividend growth rate has been 6.1%. So the goal is triple the market"s yield, with 1% faster dividend growth. That should result in approximately 13% unlevered total returns compared to an S&P 500 ETF"s historical (since 1871) total net return of 9.0%.

Portfolio Stats

- Holdings: 23

- Portfolio Size: $178,101

- Equity: $100,160

- Leverage Ratio (portfolio/equity): 1.78 (compared to max of 2.25 in week 5)

- Debt/Equity: 0.66 (compared to a max of 1.25 in week 5)

- Distance to Margin Call (portfolio wide drop): 36.9% (compared to a minimum of 20% in week 5)

- Margin Cost: 2.91%

- Margin Debt: $66,572 (compared to max of $98,000 in week 5)

- Remaining Buying Power: $206,592

- Dividends/Interest: 6.63

- Yield: 7.2%

- Yield On Cost: 7.5%

- Net Yield On Equity: 10.9%

- Total Return Since Inception (through Dec. 28th, 2017): 2.87%

- Total Annualized Unlevered Return Since Inception: 1.82%

- Unrealized Capital Gains (Current Holdings): $7,124(+4.6%)

- Cumulative Dividends Received (including accrued dividends):$5,235

- Annual Dividends: $12,837

- Annual Interest: $1,937

- Annual Net Dividends: $10,900

- Monthly Average Net Dividends: $908

- Daily Average Net Dividends (my business empire never sleeps): $29.86

Source: Simply Safe Dividends

- Portfolio Beta (volatility relative to S&P 500): 0.70

- Projected Long-Term Dividend Growth: 7% to 8%

- Projected Unlevered Total Return: 14.5% to 15.5%

- Projected Net Levered Total Return: 23.5% to 25.3%

Worst-Performing Positions

- Macquarie Infrastructure Corp: -8.0% (cost basis $69.85)

- Omega Healthcare Investors: -1.5% (cost basis $28.04)

- Crius Energy Trust: -0.6% (cost basis $7.19)

- STORE Capital: -0.2% (cost basis $26.04)

- Iron Mountain: 0.2% (cost basis $37.64)

- Dominion Energy: 0.2% (cost basis $80.85)

- Pattern Energy Group: 0.5% (cost basis $21.39)

- Algonquin Power & Utilities: 1.0% (cost basis $11.08)

- Brookfield Property Partners: 1.4% (cost basis $21.73)

- MPLX: 2.2% (cost basis $34.60)

The strong rally in high-yield value stocks has helped to turn my previous losers into winners, with only four of my 23 positions being in the red.

Best-Performing Positions

- Tanger Factory Outlet Centers: 16.9% (cost basis $22.76)

- AT&T: 15.8% (cost basis $33.71)

- Simon Property Group: 10.4% (cost basis $155.79)

- New Residential Investment Corp: 8.8% (cost basis $16.44)

- Brookfield Infrastructure Partners: 8.0% (cost basis $41.75)

- Enterprise Products Partners: 7.7% (cost basis $24.49)

- EQT GP Holdings: 6.1% (cost basis $25.46)

- EQT Midstream Partners: 5.9% (cost basis) $68.77

- Enbridge Inc: 4.5% (cost basis $37.53)

- Uniti Group: 3.7% (cost basis $17.21)

It was a great week for high-yield value stocks. Last week"s post tax reform freakout ended and REITs, MLPs, and high-yield blue chips all rose sharply. Tanger was the biggest winner, popping 6% in the past week.

Undervalued Dividend Stocks On My Radar (And Buy List)

While I may be tapped out of additional buying power, that doesn"t mean I"m not always on the hunt for quality, undervalued dividend growth stocks.

So, here are the ones I recommend you check out. They are all near 52-week lows, and I would buy them (if I had the capital) at this time because I am confident they can generate long-term 10+% (unlevered) total returns.

Note: Buy indicates I believe a stock is a good investment right now, while Strong Buy means I consider the company to be a Grade A industry leader (and a safer company) trading at particularly excellent levels.

I also include the dividend risk ratings for each stock:

- Ultra-low risk: (Limited to ETFs with proven histories of steadily growing dividends over time), max portfolio size 15% (core holding)

- Low risk: High dividend safety and predictable growth for 5+ years, max portfolio size 10% (core holding)

- Medium risk: Dividend safe and potentially growing for next two to three years, max portfolio size 5%

- High risk: Dividend safe and predictable for one year, max portfolio size 2.5%

The stocks are in order of highest to lowest yield:

- Crius Energy Trust: 8.8% yielding, monthly paying Canadian utility with very low payout ratio (53% after its latest acquisition), and a rock solid balance sheet. Medium risk, (due to somewhat volatile cash flow), buy.

- Starwood Property Trust (STWD) - 8.8% yield, Grade A commercial mREIT. High risk, buy.

- Brookfield Real Estate Services (OTCPK:BREUF): 8.2% yield, paid monthly, Canada"s top real estate service provider, managed by one of the top asset managers on earth, Brookfield Asset Management (BAM). Highly undervalued due to imminent demise of premium fees, but even with that payout ratio will be about 75%, meaning a safe, and likely growing dividend. Medium risk(housing market will cool eventually), buy.

- Pattern Energy Group: 7.7% yield, one of America"s top yieldCos (renewable utilities). Solid plan in place to double wind capacity by 2020 which should boost dividend growth from 2% a year to 10% to 11% (post 2020). Medium risk (payout ratio guidance 96% for 2017), buy.

- TransAlta Renewables: 7.0% yield, paid monthly. An excellent Canadian yieldCo with strong balance sheet, low payout ratio, and excellent growth prospects (5% to 6% long-term distribution growth). Low risk, Strong Buy.

- EPR Properties (EPR): 6.1% yield: Badly misunderstood REIT specializing in entertainment properties. Dividend protected by 81% AFFO payout ratio, strong balance sheet, and 6-7% long-term growth. 5-6% long-term dividend growth likely for 11-12% total return. Medium risk, buy.

- Brookfield Property Partners: 5.5% yield, this real estate LP is run by Brookfield Asset Management, the world"s top name in hard assets. Concerns over potentially overpaying for GGP have caused it to fall to 52-week lows. However, with 5% to 8% long-term dividend growth (guidance), today is a great time to take a contrarian approach and pick up this low risk, Grade A Strong Buy.

- American Campus Communities (ACC): 4.1% yield, safe dividend, strong long-term growth prospects of 6-7%. Buy, medium risk

Bottom Line: Don"t Lose Sight Of What Really Matters

2017 was a wild year, in a good way. What will 2018 bring? I have no idea, but I"m reasonably confident that the economy will continue accelerating, as will corporate profits. This means that dividends will keep rising, and income portfolios will likely keep generating exponentially more income for patient, long-term investors.

Which means that there is absolutely no reason to concern yourself with what arbitrary figures the market hits or doesn"t hit in 2018. Just focus on the fundamentals, specifically of building a diversified, high-quality portfolio of dividend stocks that meet your long-term goals.

Best of all? Since there is always some good dividend stock on sale, you can continue to build your portfolio, no matter how crazy overvalued the broader market gets. And when the inevitable correction and or bear market hits? Well, that"s when things really get exciting for value dividend investors. While the media may freak out and Wall Street might be running red with the blood of speculators" shattered dreams, smart long-term income investors will be sitting pretty in our crash proof bunker portfolios.

Not only will we be counting our generous, safe, and exponentially growing dividends, but we"ll also be able to snap up the best quality dividend growth stocks at fire sale prices.

A very happy New Year to all my readers and followers. May peace, joy and health bless you and yours in 2018, no matter what the market does.

Disclosure: I am/we are long UNIT, NRZ, PEGI, EPD, CNNX, MIC, TRSWF, SKT, MPLX, T, OHI, EQM, BPY, SPG, IRM, ENB, O, STOR, BIP, EQGP, D, CRIUF, AQN.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor"s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment