Nutanix (NASDAQ: NTNX), the leading provider of hyperconverged datacenter infrastructure, has kicked off its fiscal 2018 with a bang. Its Q1 earnings release smashed analyst expectations across all measures: revenue, billings, margins, and cash flow. The company"s record-setting $275.6 million in revenue this quarter also puts Nutanix at a $1.1 billion run rate, making it a huge player in the datacenter space relative to a few years back, when the company posted only a couple hundred million in sales.

Perhaps most importantly of all, it has cemented its strategy of pivoting to become a software-centric company. Though in its earlier years Nutanix was known primarily as a vendor of integrated hardware-software appliances, with the bulk of revenues deriving from hardware appliance sales (the same is still true today), the company has recently announced its intention to shift toward standalone software sales, with hardware only as an incidental revenue stream.

Investor excitement over Nutanix"s software shift has driven the stock into a phenomenal recovery in recent months, sending shares up to the mid-$30s from $15, levels not seen until immediately after the IPO in late 2016. For the majority of its life as a public company, Nutanix carried lower multiples of revenue due to its concentration in hardware - but as the company shifts to software-only billings, its gross margins can expand dramatically. Also think of how much more the company can scale as it looks to become the dominant OS for hyperconverged datacenters. Just as Microsoft"s (NASDAQ: MSFT) Windows gained prominence in the "90s as a standalone OS compatible with multiple hardware form factors, so too can Nutanix achieve its next leg of growth by selling software that"s completely decoupled from hardware. Customers can still opt to buy the integrated appliances from Nutanix, but if they have a preferred hardware brand of choice, they can still buy Nutanix software - widely recognized as the "best-of-breed" in hyperconverged infrastructures.

As I wrote in a prior article, I was hoping for the company"s Q1 to boost the stock to $40, a price target that now represents a 4.85x EV/FY18 revenues multiple based on estimated FY18 revenue of $1.2 billion. As Nutanix transitions more toward software sales in FY18, this multiple has plenty of room for expansion, and given that the stock"s post-Q1 price reaction didn"t show the uplift I was looking for, I"m holding on for additional upside - especially with Nutanix"s fundamentals showing so well this quarter.

$40 is a minimum for the stock. As analysts digest this quarter"s results, Wall Street will be adjusting its price targets much higher.

NTNX data by YCharts

Phenomenal growth in Q1, accompanied by vast margin improvement

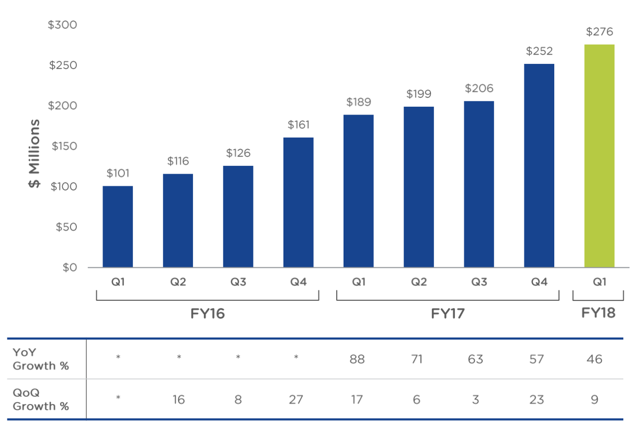

Nutanix posted record-setting revenues of $275.6 million this year, up 46% y/y. This was an $8.7 million beat over analyst consensus of $266.9 million, or +41% y/y. The chart below, taken from its Q1 earnings materials, shows the linearity in Nutanix"s growth since 2016. Note that the company had an accounting change to comply with software revenue recognition standards in ASC 606, and all figures are presented post change:

Figure 1. Nutanix revenue growth trajectory

Source: Nutanix Q1 earnings materials

Nutanix"s strong revenue growth was also supported by strong billings in the quarter. Total billings were $315 million in the quarter (+32% y/y), driving the company"s total deferred revenues to $409 million (+48% y/y). Effectively, the company is building its backlog as fast as (or faster than) it"s recognizing revenue, giving it a solid revenue base to draw from in future quarters and providing support to future earnings.

Other business metrics reported in the quarter trended strongly as well. Here are a couple of the highlights:

- 7,813 total customers, +760 in the quarter and +75% y/y.

- 49 deals in excess of $1 million, up +36% y/y, indicating strong traction for the company in the critical high-end enterprise market.

- 75% of bookings came from repeat customers, indicating that even though Nutanix isn"t a subscription software company, customers behave as if their business is recurring and keep purchasing additional Nutanix nodes.

For a company like Nutanix, the hard part is becoming "mainstream." Especially in the datacenter infrastructure space, where IT buyers are extremely inert and apt to keep buying from the vendors they already know, it"s a hard market to be a startup. With Nutanix"s run rate reaching well over $1 billion, however, the company is now hardly a startup - it has truly become as mainstream in backend infrastructure as VMware (NYSE: VMW) and Cisco (NASDAQ: CSCO). Hyperconverged infrastructures (NYSE:HCI) are now top of mind for enterprise CIOs, boasting reductions in total cost of ownership (as HCI requires less specialized human IT administration) as well as strong performance - and within HCI, the undisputed leader is Nutanix. VMware and HPE SimpliVity (NYSE: HPE) have competing offerings, but they are still a few years behind Nutanix"s traction in the market. And once Nutanix"s level of brand recognition and market acceptance has been achieved, its path to growth is more of an eventuality, a downhill ride.

As the company continues to scale, it"s also making vast improvements in the cost structure and slimming its losses. Nutanix once concerned Wall Street for its high (even for a Silicon Valley startup) net losses; now, the company"s loss margins have slimmed, and it"s even posting positive operating cash flow. The company posted an operating loss of $59.2 million in Q1 (representing a -21% operating margin), a huge improvement over a loss of $114.5 million in the prior-year quarter (a -61% margin).

The company"s pro forma EPS of -$0.16 is 10c above analyst consensus of -$0.26, as margins came in better than expected. Increased sales leverage, in particular, contributed a lot toward Nutanix"s slimmer losses - it increased sales spending only 13% y/y and achieved 46% y/y revenue growth in return, indicating the trend previously mentioned. As Nutanix becomes mainstream, more business will come knocking at its door without the company having to exert itself too much in field sales.

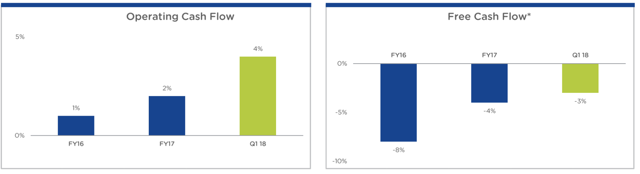

It also generated $10.2 million of operating cash flow in the quarter (a 4% margin), a 2.5x increase over just $4.2 million in 1Q17. Given the rapid advances in margins, coupled with strong top line growth, Nutanix is just on the cusp of expanding its cash flow, and in the longer run can probably achieve cash flow margins in the double digits. See the company"s cash flow margin trends in the chart below:

Figure 2. Nutanix cash flow margins

Implications of the software switch

Ever since it went public (in September 2016, at $16/share), Nutanix has been received with a bit of confusion by investors: is it a hardware company or a software company? It sells datacenter appliances, after all, built on commoditized Intel (NASDAQ: INTC) x86 servers, a cheap staple and modern workhorse for enterprise DCs. But the appliances are powered by Nutanix software - the "secret sauce" that controls the servers and binds together compute, storage, and networking resources into a single, cluster-computing unit - hence the term "hyperconverged." So which is it - software or hardware?

The market treats it as both. Its revenue multiple - at times trading in the low 3s, now in the low 4s - is both higher than that of a typical hardware company but lower than a typical software company, where a 46% grower like Nutanix might traditionally be awarded with a 7x revenue multiple. In recent months, however, Nutanix has announced its intention of pivoting more toward software, jumpstarting the recovery in shares, as software businesses find more favor with investors and carry much higher multiples.

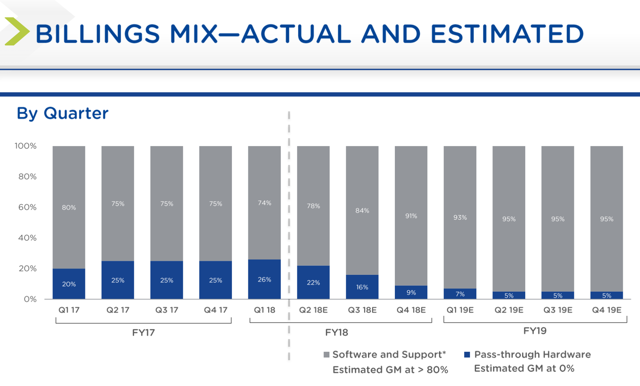

And it has much higher margins as well - so it"s no wonder that investors value software revenue streams much more than hardware. Nutanix estimates that its software and support revenues will carry 80%-plus gross margins (representing nearly pure profit for each incremental sale), versus hardware appliances which are basically sold at cost.

Going forward, as Nutanix includes its base OS as part of its software sales, the company expects hardware sales to be less than ~10% of total billings. As shown in the chart below, taken from Nutanix"s Q1 earnings deck, its hardware mix was 26% this quarter, eventually dropping down to 9% by year end and 5% the year after that.

With software eventually moving to become the dominant part of the company"s revenue base, it"s almost guaranteed that Wall Street and large institutional investors will shift their view on Nutanix and consider it more of a software play, attaching higher multiples to its revenue streams.

60-second summary

Investors are finally paying attention to the fact that the winds are blowing in the right direction for Nutanix - across the board. Recall that even though the stock has rallied this year, it has still yet to recover past the $37 high mark it saw immediately post IPO. With enthusiasm rekindling on the back of massive growth and a fresh software narrative, Nutanix is well-positioned to outperform in 2018.

I"m still waiting on a price target of $40 (4.85x EV/FTM revenues) to consider letting go of a portion of my holdings. With the software story becoming more prevalent, however, there"s a good chance of the company entering into a sustained phase of multiple expansion as it eases into a more software-normal revenue multiple of ~6x. Either way, with a strong Q1 under its belt and with Wall Street"s newfound confidence in the company, it seems the only way for Nutanix is up.

Disclosure: I am/we are long NTNX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment