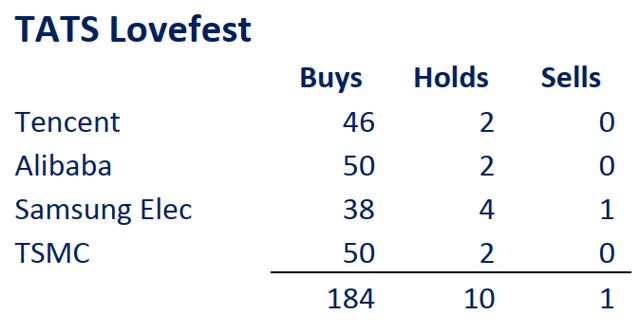

As far as consensus names go in Asia, Tencent (TCEHY) is right up there with Alibaba (BABA), Samsung (OTC:SSNLF), and TSMC (TSM) (henceforth, collectively known as the "TATS"). These four stocks were primarily responsible for driving the Asian stock market rally from 2016 to 2018 i.e. the Asian FAANG equivalent. Of the 46 analysts covering Tencent, a whopping 96% have a straight "buy" call. Zero sells.

*Consensus as of March "18

It"s usually hard to make a differentiated pitch for any of these stocks because of how well covered they are (try beating 50 analysts at their own game). But with herd mentality comes opportunity - the Chinese stocks, in particular, have suffered massive drawdowns in 2018 and are starting to look interesting.

Cue Tencent.

Tencent, like most Asian tech stocks, is especially reactive to EPS upgrades/downgrades. And because analysts tend to be more herd-like in Asia, price movements around earnings releases can be vicious.

The latest earnings miss led to a pretty sizeable dip indeed - the stock is now down ~16% in 2018. Consensus estimates may have gone down for 3Q but it hasn"t gone up for 2019 - and I think that"s opportunity.

Segment by Segment

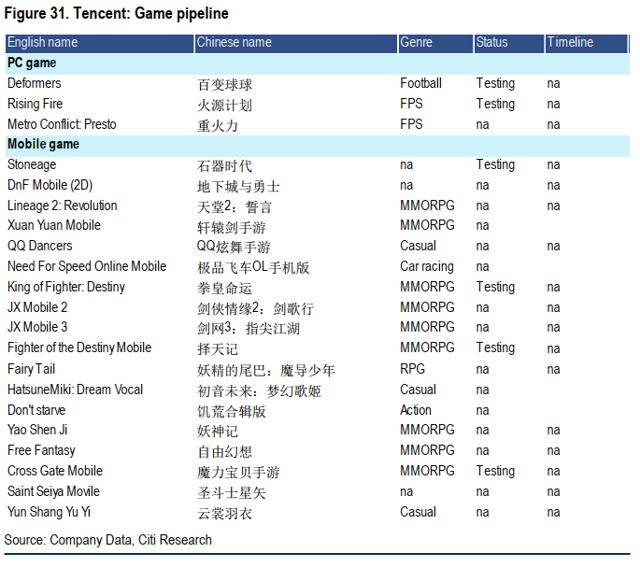

Tencent"s revenue contribution comes primarily from gaming revenue, so it seems logical to start here. Two segments within gaming - PC (-5% YoY; -9% QoQ) and mobile (+19% YoY; -19% QoQ). These two segments aren"t mutually exclusive - time shift to mobile games was called out as a reason for PC"s YoY decline. Seasonal effects were cited for the QoQ decline. The mobile shift isn"t as encouraging as one might think - mobile ARPU is half that of PCs but the runway is bigger. To get mobile ARPU to PC levels, Tencent is leaning toward category and demographic expansion.

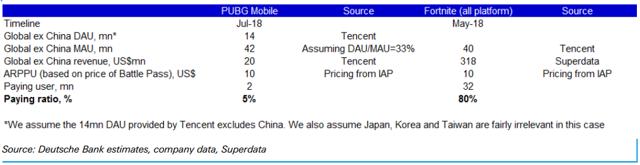

The sequential mobile downshift was caused by the "non-monetization" of popular tactical tournament games (PUBG) on delayed regulatory approval. I like that management isn"t aggressively managing the downshift - they stated no intention to aggressively release the approved games in the pipeline (they"ve got plenty) to offset the short-term hiccup. The prudence shows both confidence in the outlook as well as long-term thinking on the part of management.

Looking at the stats, the timing delay clearly played a key role - DAU in China grew at a double-digit rate YoY, but monetization per user declined as users shifted time to non-monetized tactical tournament games. Fortnight is awaiting green channel approval (temporary bridge while the government restructures) for one-month monetization, so the sooner we see that through, the faster the likely uplift. League of Legends (LOL) also saw Chinese DAU increase QoQ. In the meantime, analysts have taken down 3Q estimates to account for the regulatory delay. What I think they might be missing here is a subsequent acceleration in the 2019 numbers considering the delays are likely just a timing shift.

The other segments were strong - non-game social networks (+38% YoY) saw fee-based VAS subscribers grow 30% YoY to 154mn on strong video sub growth. The 74 million subs equate to 121% YoY growth (ARPU was flat).

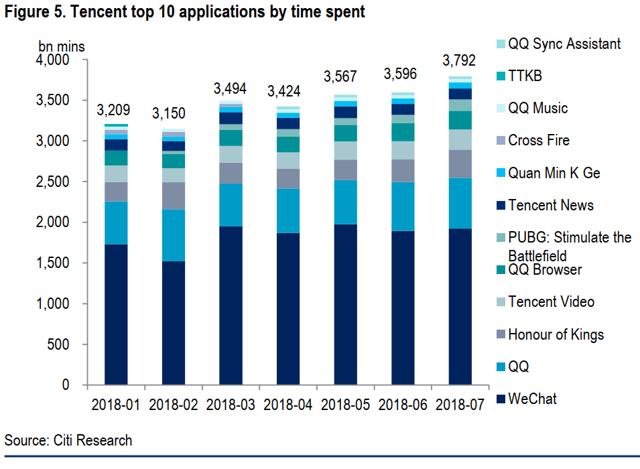

Media ad (+16% YoY) leveraged a strong content portfolio e.g. Produce 101 to offset a decline in news ad rev (-single-digit YoY) from reduced monetization. Tencent did achieve QoQ growth as the ad load was raised post-ad system revamp. Management stressed that competition fears from Douyin are unwarranted and Tencent"s time spend is not affected. With total time spend on Tencent"s top apps continuing to increase, no reason to doubt the runway in my view.

Social ad (+55% YoY) saw increasing advertising inventories in Weixin Moments along with new advertising inventories in Mini Programs, higher impressions, and eCPMs for the Mobile Ad Network. The Q also saw enhanced traffic and monetization for the QQ KanDian news feed - total daily page views of QQ Kan Dian and Mobile QQ browser were +55% YoY. Meanwhile, total daily short video views combined climbed over 3 times YoY.

Other rev (+81% YoY) saw MAU for the payment business reach 800mn+ at end-June with average daily transaction volume growing 40%+ YoY and offline commercial payment volume up 280% YoY. Reduction of interest income from restricted custodian deposits had a small impact - low tenth percentages of total other rev (max ~1%). The plan is to offset the regulatory impact with growing the wealth management (WMP) and loan business. There will be no raising of the headline commission rate (~0.6% listed) but merchant rebates may be given to drive promotions. Cloud revenue grew 100%+ YoY.

Party Like It"s 2009

Deutsche (NYSE:DB) was out post-2Q with a note reminding investors of 2009 when a similar government restructuring occurred. Drawing parallels from the 2009 precedent, the issue here is likely to be a lack of clear roles & responsibilities as regulators are still defining the roles and responsibilities of the different government (as opposed to the government imposing severe regulations on gaming).

Back in "09, a similar restructuring involved the GAPP (General Administration of Press and Publication) and MIC (Ministry of Culture). The GAPP exercised authority over game license approval while the MIC oversaw game content approval. There was a transition period over which the responsibility of governing online games moved from GAPP to MIC and concerns were resolved within a few months by early-2010.

Post-2010, the MIC has been responsible for approving the content of games, with the GAPP responsible for approving the license of new games. In 2013, this changed as the SAPPRFT (State Administration of Press, Publication, Radio, Film, and Television of the People"s Republic of China) succeeded GAPP in 2013.

In April or so, the SAPPRFT was restructured into SART (State Administration of Radio & Television) and the State News and Publication Bureau, which led to the recent dislocation in the approval process. This created a temporary drag as companies were unable to monetize their unapproved games.

To fill the void, a "Green Channel" soft approval process was created which allows Tencent some wiggle room to sustain monetization of its games. The Green Channel is positive on two counts - 1) the regulatory authority is supportive and 2) the normal approval process could resume in the near future.

Fortnite PC is in the process of applying for the Green Channel, so expect some monetization on this front, but PUBG Mobile will require higher regulatory authority approval due to its Korean roots. Per Tencent, the Monster Hunter recall is a one-off due to content violations - the content launched was different from that submitted. The content issue here will be interesting to watch as the rationale was that the submitted version was not interesting (read: violent) enough.

My understanding is that the Chinese government views gaming as a key export. Plus, gaming is the cheapest form of entertainment in China and it makes little sense to crack down on the industry. Censorship is, however, a key issue - regulation is targeted more toward teenagers. The key concern here in my view, is twofold - 1) how long will the delay last and 2) will geopolitics factor into decision making (recall PUBG mobile has Korean origins).

My base case is we see a speedy approval process - the gaming industry is far too important in China to be hindered by bureaucracy plus Tencent has been working closely with the government and their confidence ("when, not if") is likely not misplaced.

Short Term vs. Long Term

The Tencent dip in my view is the perfect case of time arbitrage - the short-term timing shift means very little in the long run. In the short run, the inability to monetize PUBG Mobile is a big deal. Some back of the envelope math sizes the opportunity cost at ~$800m/yr ($20m rev w/14m DAU overseas = $800m on >50m DAU in China).

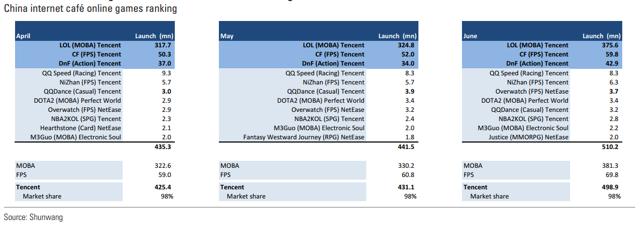

But in the long run, Tencent"s ability to produce hit game after hit game is unrivalled. Tencent dominates gaming on both PC and mobile. As of June, Tencent holds a 98% market share in PC game launches in China.

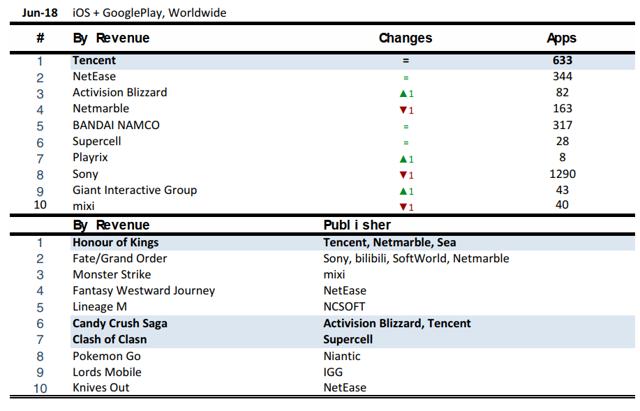

Meanwhile, its mobile game portfolio dominates gross rankings worldwide.

(Source: GS; App Annie)

The delay in PUBG mobile monetization (~$800m/ yr) should have seen analysts take up 2019 est in tandem with the 3Q downgrades, yet most analysts took down EPS numbers going out to 2020. Coupled with the option-like investment portfolio (worth ~HK$58.6/ share) which continues to appreciate as well as the widening Naspers" (OTCPK:NPSNY) discount, I like Tencent at these levels, particularly through Naspers.

Disclosure: I am/we are long NPSNY.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor"s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment