It didn"t even last three weeks. Earlier this month, Tesla (TSLA) CEO Elon Musk tweeted that he was planning on taking the company private at $420 per share and funding was secured. Whether this was a distraction to hide poor results, an effort to burn short sellers, or something else entirely, it clearly did not work out. On Friday night, the plan was abandoned, putting Tesla in a precarious situation that likely will not end well, even with shares falling considerably already.

Tesla issued this blog post to inform investors it would remain public. The post contained some questionable statements, like the fact that Elon Musk spent considerable time talking to investors about this transaction. How could he do that in just a couple of weeks, especially when he"s recently talked about working 120 hour weeks and being at the factory so much? Also, why didn"t he spend considerable time listening to investors two years ago when so many opposed the SolarCity deal? He also said that his belief that there was more than enough funding to take Tesla private suggests he didn"t have funding lined up originally.

Statements from the blog post are likely to be a key part of lawsuits from investors who bought shares thinking they were going to $420, only to see them drop since. Tesla"s board may also be in a little trouble, given they continue to give Elon Musk plenty of support despite all the issues he is dealing with. It"s really funny how the board agreed that the better path was to stay public, indicating that they didn"t agree with the go-private decision, yet they fully support Elon Musk as CEO:

The Board and the entire company remain focused on ensuring Tesla’s operational success, and we fully support Elon as he continues to lead the company moving forward.

Of course, Tesla issued the blog post after 11PM Eastern on Friday night. It was the latest example of the company dropping bad news over a weekend when investors are unable to trade. The blog post even said that a final decision was made on Thursday to remain a public entity, so why didn"t the company issue this news earlier? Unfortunately, unlike many of the bad delivery/production announcements that were dropped over weekends (sometimes even holiday weekends), this news will be front and center on the financial news outlets Monday morning. The attention here will shift to the SEC which will need to do something in order to protect investors from a similar situation happening again, and not just in regards to Tesla.

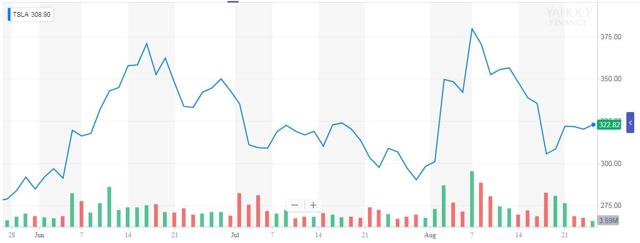

It"s amazing how Elon Musk could just tweet his plan out during the day, with the stock not being halted for quite some time, but after deciding to not go private anymore, it took more than 24 hours for a statement to be released. Tesla management and its board continues to show time and time again that it cannot be trusted, something I believe is critical when deciding whether or not to own shares. Tesla closed Friday down $65 from the August 7th high after the go private tweet, and the 2025 bonds were approaching new lows even before this decision was scrapped. How much will they fall on Monday, absent some other push to prop up the stock like opening up Model Y deposits or something else designed to distract.

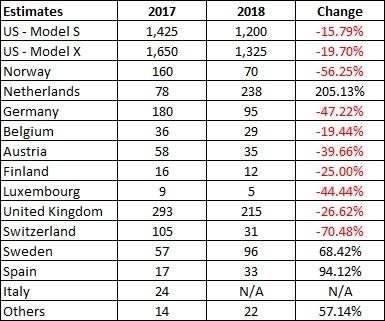

I had previously mentioned that I expected this go private plan to consume most of the Tesla news cycle for the next couple of months. However, now that it isn"t happening, investors will surely focus on Q3 results. Management needs to prove that it can be GAAP profitable and free cash flow positive, and that it can sustain these items to pay off the billions in debt coming due soon, along with billions more needed for new factories. July estimates showed the quarter off to a slow start for the S/X as seen below, down about 700 units from July 2017, even without China tariff troubles, and we"re only a week or so away from getting a swarm of August numbers.

(Source: teslastats.no, TMC Europe tracker, InsideEVs monthly scorecard.)

Tesla has said going back to the Q1 investor letter in May that it was evening out its delivery process as to not have such a large final month of the quarter, but so far that hasn"t seemed to be the case. Will Tesla need a huge September sales push to hit delivery and financial targets for the quarter? Recently, a few hundred inventory vehicles were posted to the EV site, containing their usual big discounts for vehicles with some mileage on them, adding to a previous statement of mine that Tesla is trying to dump as much inventory as possible to improve the balance sheet. Those efforts might come back to really hurt margins however.

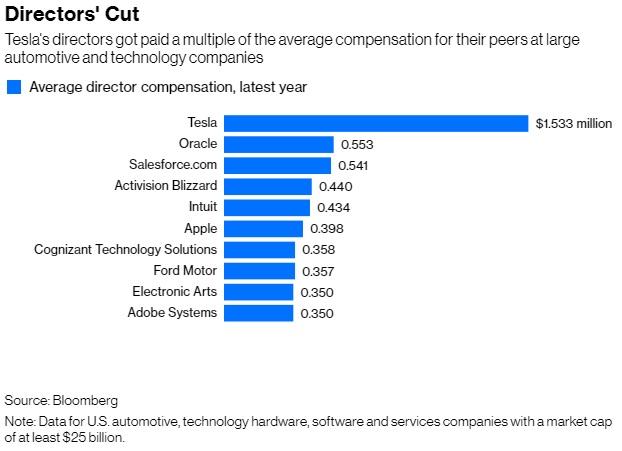

In the end, Elon Musk"s quick decision to scrap his go private plan is only going to lead to more trouble for Tesla. Now, the company will be reliant on quarter to quarter results, with even more scrutiny of every single number. There already have been a number of lawsuits filed from investors that have lost money, and even more are bound to crop up. Again, management credibility is a key issue, with a late Friday night bad news drop. Tesla"s board is also in a tricky situation. The board is very highly compensated as seen below, and really needs to find a new leader, as they don"t agree with his decisions yet they full support him. That shows that there is a major corporate governance problem. In the end, we got more fluff from Elon Musk, with him not delivering as usual, and that is likely to mean big trouble for shareholders.

(Source: Bloomberg article, seen here)

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

No comments:

Post a Comment