I like monitoring dividend increases for stocks on my watch list of dividend growth stocks because I consider such stocks to be candidates for further analysis. Companies can only increase their dividends sustainably if earnings grow sufficiently.

I use the CCC List as a starting point and apply the following screens:

- Market cap ? $500 million

- No stocks that are being acquired

- No Over-The-Counter or Pink Sheet stocks

- Dividend Yield ? 1.5% for Challengers

- Dividend Yield ? 1.0% for Contenders and Champions

In the past week, four companies announcing dividend increases passed these screens, including one of the stocks I own. The table below presents a summary of these increases.

The table is sorted by the percentage increase, %Incr. Dividends are annualized and in US$, unless otherwise indicated. Yield is the new dividend yield for the market close Price on the date listed. Yrs are years of consecutive dividend increases, while 5-yr DGR is the compound annual growth rate of the dividend over a 5-year period. 1-yr %Incr is the percentage increase from the year-ago dividend. (Some companies increase their dividends more than once a year, so this puts the most recent dividend increase in context).

BancFirst (BANF)

BANF is a financial holding company that conducts all of its operating activities through its principal wholly-owned subsidiary, BancFirst, a state-chartered bank in Oklahoma City, Oklahoma. BANF operates through 4 principal business units: metropolitan banks, community banks, other financial services and executive operations and support.

On Friday, August 24, the company increased its quarterly dividend by 42.86% to 30¢ per share. The dividend is payable on October 15 to shareholders of record on September 28. BANF will trade ex-dividend on September 27.

Altria Group (MO)

MO was founded in 1919 and is headquartered in Richmond, Virginia. The company manufactures and sells cigarettes, smokeless products, and wine in the United States. In March 2008, MO spun off the subsidiary Philip Morris (NYSE:PM) to protect it from litigation in the United States.

Recently, MO increased its quarterly dividend to 80¢ per share, an increase of 14.29% over the prior dividend of 70¢ per share. The dividend is payable October 10, with an ex-dividend date of September 13.

Stock Yards Bancorp (SYBT)

SYBT operates as a bank holding company for Stock Yards Bank & Trust Company, a state chartered bank with operations in Louisville, Indianapolis, and Cincinnati. The company operates in two segments, Commercial Banking and Wealth Management and Trust. SYBT was founded in 1904 and is headquartered in Louisville, Kentucky.

Recently, the board of directors of SYBT declared a quarterly dividend of 25¢ per share. The new dividend represents an increase of 8.70%. SYBT will trade ex-dividend on September 14. The dividend is payable on October 1, to shareholders of record on September 17.

Weyerhaeuser (WY)

WY is a real estate investment trust that invests in timber, land, and forest products, primarily in the United States. The company owns timberlands in the USA and has long-term licenses in Canada. It manufactures wood and specialty cellulose fibers products. WY was founded in 1900 and is based in Seattle, Washington.

On Friday, August 24, WY increased its quarterly dividend to 34¢ per share, an increase of 6.25%. The first payment will be on September 28 to shareholders of record on September 14. The ex-dividend date is September 13.

Please note that I"m not recommending any of these stocks. Readers should do their own research on these companies before buying shares.

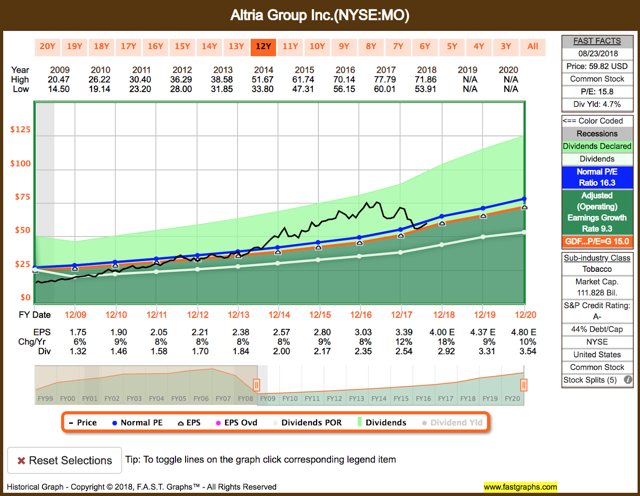

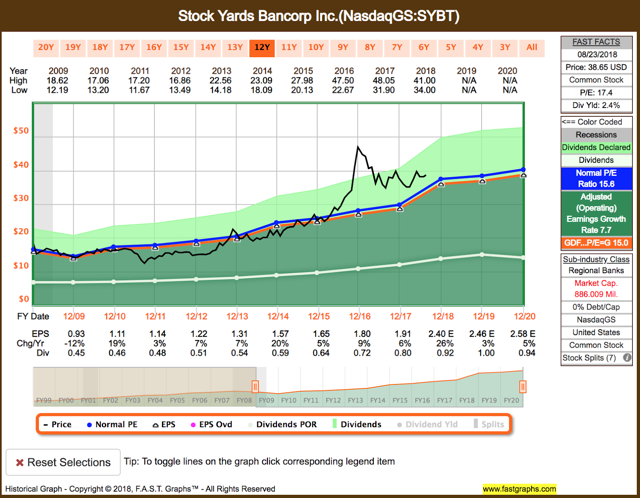

Below, I"m including charts from F.A.S.T. Graphs for three of this week"s dividend raisers, BANF, MO, and SYBT.

In these charts, the black line represents the share price, and the blue line represents the calculated P/E multiple at which the market has tended to value the stock over time. The orange line is the primary valuation reference line. It is based on one of three valuation formulas depending on the earnings growth rate achieved over the time frame in question. (The Adjusted Earnings Growth Rate represents the slope of the orange line in the chart).

BANF"s price line (black) is above the primary valuation line (orange) and above the stock"s normal P/E ratio (blue). The stock is trading at a premium to fair value. An investment in BANF in January 2009 would have returned 10.6% on an annualized basis (with dividends included).

MO"s price line is below the stock"s normal P/E ratio and above the primary valuation line. The stock is trading at about fair value. An investment in MO in January 2009 would have returned 18.5% on an annualized basis (with dividends included).

SYBT"s price line is above the primary valuation line and above the stock"s normal P/E ratio. The stock is trading at a premium to fair value. An investment in SYBT in July 2010 would have returned 9.5% on an annualized basis (with dividends included).

Upcoming Ex-Dividend Dates

As a bonus, here is a summary of available ex-dividend dates for the next two weeks. You must own a stock before its ex-dividend date to be eligible to receive the next dividend.

The table is sorted by Ticker, and as before, Next Div is annualized. Please note that Next Div links to the latest dividend declaration announcement.

Summary of Upcoming Ex-Dividend Dates: Dividend Increases: August 28-September 10, 2018

Company | Ticker | Yield | Recent Price | Yrs | 5-Yr DGR | Next Div. | Ex-Div Date | Pay- able Date |

Analog Devices | 1.94% | $98.78 | 16 | 8.40% | 08/30 | 09/12 | ||

Arthur J. Gallagher & Co. | 2.27% | $72.15 | 8 | 2.80% | 09/06 | 09/21 | ||

Allstate | 1.85% | $99.53 | 8 | 10.40% | 08/30 | 10/01 | ||

Arrow Financial | 2.63% | $39.55 | 25 | 2.30% | 08/30 | 09/14 | ||

Associated Banc-Corp | 2.20% | $27.30 | 7 | 16.80% | 08/31 | 09/17 | ||

Avista | 2.89% | $51.53 | 16 | 4.30% | 08/30 | 09/14 | ||

Avery Dennison | 1.97% | $105.79 | 8 | 10.30% | 09/04 | 09/19 | ||

Aircastle Limited | 5.30% | $21.14 | 7 | 11.50% | 08/30 | 09/14 | ||

Bank America Corp. | 1.94% | $30.89 | 5 | 57.70% | 09/06 | 09/28 | ||

Becton Dickinson & Co. | 1.17% | $255.40 | 46 | 9.80% | 09/06 | 09/28 | ||

BlackRock | 2.62% | $477.51 | 9 | 10.80% | 09/06 | 09/24 | ||

Badger Meter | 1.10% | $54.70 | 25 | 8.20% | 08/30 | 09/14 | ||

BorgWarner | 1.53% | $44.41 | 5 | N/A | 08/31 | 09/17 | ||

Cass Information Systems | 1.41% | $73.85 | 17 | 8.20% | 08/31 | 09/14 | ||

Cathay General Bancorp | 2.26% | $42.52 | 5 | 85.10% | 08/31 | 09/14 | ||

Commerce Bancshares | 1.32% | $71.05 | 50 | 5.30% | 09/06 | 09/24 | ||

Cabot | 2.02% | $65.48 | 7 | 9.80% | 08/30 | 09/14 | ||

Cullen/Frost Bankers | 2.38% | $112.73 | 25 | 3.40% | 08/30 | 09/14 | ||

Chemical Financial | 2.36% | $57.66 | 7 | 6.10% | 09/06 | 09/21 | ||

C.H. Robinson Worldwide | 1.91% | $96.50 | 20 | 6.20% | 09/06 | 09/28 | ||

Chatham Lodging Trust | 6.13% | $21.52 | 8 | 12.00% | 08/30 | 09/28 | ||

CME Group | 1.65% | $169.32 | 8 | 8.10% | 09/07 | 09/25 | ||

Compass Minerals International | 4.52% | $63.70 | 14 | 7.80% | 08/30 | 09/17 | ||

Canadian National Railway | 2.07% | $87.92 | 21 | 11.20% | 09/06 | 09/28 | ||

CNO Financial Group | 1.84% | $21.77 | 7 | 42.30% | 09/07 | 09/24 | ||

Costco Wholesale | 0.99% | $231.28 | 15 | 12.90% | 08/30 | 09/14 | ||

Central Pacific Financial | 2.90% | $28.92 | 6 | N/A | 08/30 | 09/17 | ||

CSX | 1.18% | $74.65 | 14 | 7.60% | 08/30 | 09/14 | ||

Connecticut Water Service | 1.81% | $68.90 | 49 | 4.10% | 08/31 | 09/18 | ||

Dominion Energy | 4.66% | $71.64 | 15 | 9.60% | 09/06 | 09/20 | ||

Dover | 2.28% | $84.26 | 62 | 10.40% | 08/30 | 09/17 | ||

Brinker International | 3.46% | $43.89 | 13 | 14.90% | 09/06 | 09/27 | ||

EMC Insurance Group | 3.39% | $25.95 | 8 | 9.50% | 08/31 | 09/11 | ||

EPR Properties | 6.22% | $69.45 | 8 | 6.70% | 08/30 | 09/17 | ||

Evercore Partners | 1.84% | $108.60 | 12 | 11.60% | 08/30 | 09/14 | ||

First American Financial | 2.97% | $56.57 | 8 | 36.90% | 09/07 | 09/17 | ||

FactSet Research Systems | 1.14% | $224.31 | 20 | 12.70% | 08/30 | 09/18 | ||

FedEx | 1.06% | $245.02 | 17 | 27.20% | 09/07 | 10/01 | ||

First Horizon National | 2.58% | $18.60 | 7 | 53.40% | 09/06 | 10/01 | ||

Flowers Foods | 3.52% | $20.47 | 17 | 9.80% | 08/30 | 09/14 | ||

First Merchants | 1.81% | $48.54 | 7 | 47.20% | 09/06 | 09/21 | ||

Corning | 2.18% | $33.00 | 8 | 14.50% | 08/30 | 09/28 | ||

Genuine Parts | 2.91% | $99.13 | 62 | 6.80% | 09/06 | 10/01 | ||

Home Depot | 2.05% | $201.30 | 9 | 25.10% | 08/29 | 09/13 | ||

Hartford Financial Services Group | 2.40% | $50.00 | 8 | 18.10% | 08/31 | 10/01 | ||

Hubbell | 2.47% | $124.89 | 10 | 11.30% | 08/30 | 09/14 | ||

Hyster-Yale Materials Handling | 2.00% | $61.87 | 7 | 36.90% | 08/30 | 09/14 | ||

Interpublic Group | 3.67% | $22.88 | 6 | 24.60% | 08/31 | 09/18 | ||

Ingersoll-Rand plc | 2.13% | $99.59 | 8 | 27.20% | 09/06 | 09/28 | ||

Kellogg | 3.09% | $72.45 | 15 | 4.00% | 08/31 | 09/17 | ||

Kimberly-Clark | 3.44% | $116.34 | 46 | 6.50% | 09/06 | 10/02 | ||

Lancaster Colony | 1.56% | $153.67 | 55 | 9.00% | 09/06 | 09/28 | ||

Lear | 1.71% | $164.22 | 8 | 29.00% | 08/29 | 09/18 | ||

Lockheed Martin | 2.49% | $321.29 | 15 | 12.40% | 08/31 | 09/28 | ||

LyondellBasell Industries NV | 3.47% | $115.12 | 8 | 19.60% | 09/04 | 09/12 | ||

Mercantile Bank | 2.68% | $35.82 | 7 | 52.40% | 09/06 | 09/19 | ||

McDonald"s | 2.53% | $159.38 | 42 | 5.90% | 08/31 | 09/18 | ||

McKesson | 1.20% | $129.67 | 11 | 8.10% | 08/31 | 10/01 | ||

Meredith | 4.12% | $52.90 | 25 | 6.30% | 08/30 | 09/14 | ||

Magna International | 2.51% | $52.66 | 8 | 14.90% | 08/30 | 09/14 | ||

MGE Energy | 2.05% | $65.85 | 42 | 4.00% | 08/30 | 09/15 | ||

Herman Miller | 2.06% | $38.40 | 7 | 34.60% | 08/30 | 10/15 | ||

Maxim Integrated Products | 2.98% | $61.75 | 17 | 8.40% | 08/29 | 09/13 | ||

NBT Bancorp | 2.43% | $41.14 | 6 | 2.80% | 08/30 | 09/14 | ||

NextEra Energy | 2.57% | $172.70 | 24 | 10.40% | 08/29 | 09/17 | ||

Nu Skin Enterprises | 1.84% | $79.44 | 18 | 12.50% | 08/30 | 09/12 | ||

NRG Yield | 6.27% | $20.40 | 6 | N/A | 08/31 | 09/18 | ||

Realty Income | 4.51% | $58.60 | 25 | 7.40% | 08/31 | 09/14 | ||

Old Republic International | 3.50% | $22.31 | 37 | 1.40% | 08/31 | 09/14 | ||

Open Text | 1.56% | $38.94 | 6 | N/A | 08/30 | 09/21 | ||

Occidental Petroleum | 3.93% | $79.34 | 15 | 8.70% | 09/07 | 10/15 | ||

Public Service Enterprise Group | 3.41% | $52.75 | 7 | 3.90% | 09/06 | 09/28 | ||

PepsiCo | 3.31% | $112.15 | 46 | 8.50% | 09/06 | 09/28 | ||

Pinnacle Foods | 1.95% | $66.81 | 5 | N/A | 08/31 | 10/15 | ||

Principal Financial Group | 3.82% | $55.51 | 10 | 19.70% | 09/05 | 09/28 | ||

Polaris Industries | 2.22% | $108.13 | 23 | 9.40% | 08/30 | 09/17 | ||

PPL | 5.52% | $29.70 | 17 | 3.10% | 09/07 | 10/01 | ||

Perrigo plc | 1.02% | $74.29 | 16 | 14.20% | 08/30 | 09/18 | ||

Qualcomm | 3.69% | $67.15 | 16 | 18.30% | 09/04 | 09/26 | ||

Ritchie Brothers Auctioneers | 1.88% | $38.22 | 15 | 7.70% | 08/28 | 09/19 | ||

Everest Re Group | 2.35% | $220.85 | 5 | 21.30% | 09/04 | 09/19 | ||

Regions Financial | 2.91% | $19.26 | 6 | 51.10% | 09/06 | 10/01 | ||

RLI | 1.13% | $77.59 | 43 | 5.70% | 08/30 | 09/20 | ||

Sinclair Broadcast Group | 2.46% | $29.25 | 7 | 5.90% | 08/30 | 09/17 | ||

Stepan | 1.01% | $88.83 | 50 | 7.70% | 08/30 | 09/14 | ||

Six Flags Entertainment | 4.69% | $66.48 | 9 | 15.70% | 08/29 | 09/10 | ||

South Jersey Industries | 3.39% | $33.07 | 19 | 5.90% | 09/07 | 10/02 | ||

Silgan Holdings | 1.46% | $27.36 | 15 | 8.40% | 08/31 | 09/18 | ||

Spire | 2.97% | $75.65 | 15 | 4.80% | 09/10 | 10/02 | ||

Steris Corp. | 1.18% | $114.95 | 13 | 10.40% | 08/28 | 09/27 | ||

SunTrust Banks | 2.71% | $73.75 | 7 | 45.90% | 08/30 | 09/17 | ||

Stanley Black & Decker | 1.87% | $140.97 | 51 | 6.10% | 09/06 | 09/18 | ||

Tennant | 1.12% | $75.00 | 46 | 4.00% | 08/30 | 09/14 | ||

Travelers | 2.36% | $130.51 | 14 | 9.60% | 09/07 | 09/28 | ||

Tyson Foods | 1.90% | $63.12 | 6 | 41.80% | 08/30 | 09/14 | ||

United Fire Group | 2.44% | $50.92 | 6 | 12.70% | 08/30 | 09/14 | ||

UMB Financial | 1.54% | $75.56 | 26 | 4.50% | 09/07 | 10/01 | ||

Union Pacific | 2.13% | $150.13 | 12 | 14.80% | 08/30 | 09/28 | ||

V.F. | 2.01% | $91.77 | 45 | 17.80% | 09/07 | 09/20 | ||

Wendy"s | 1.91% | $17.80 | 9 | 22.90% | 08/31 | 09/18 | ||

Westwood Holdings Group | 4.66% | $58.41 | 16 | 10.90% | 09/06 | 10/01 | ||

Whirlpool | 3.62% | $127.12 | 8 | 16.50% | 08/30 | 09/15 | ||

Waste Management | 2.05% | $90.70 | 15 | 5.50% | 09/06 | 09/21 | ||

Weingarten Realty Investors | 5.10% | $30.98 | 8 | 5.80% | 09/06 | 09/14 | ||

WesBanco | 2.31% | $50.13 | 8 | 8.40% | 09/06 | 10/01 |

Thanks for reading! If you like this article and would like to read similar ones in future, please click the Follow link at the top of this article. And, if you"re already following me, I sure would appreciate it if you click on the Like button below!

Disclosure: I am/we are long D, LMT, MCD, MO, NEE, O, QCOM, SWK, TRV.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment