Background

It all started with a Seeking Alpha user"s comment on my blog "The Importance Of ROIC And My Strategy," which brought to my attention the wisdom of Fundsmith and its founder Terry Smith. Based in London, Fundsmith mainly manages two equity funds (i.e., one focused on the total global market and one on the emerging market), both of which are concentrated in the small number of stocks selected based on fundamental qualities for extremely long-term investors. Terry Smith (pictured below) has been referred to as "the English Warren Buffett" for his investment approach, philosophy and track record, which intrigued me to dig more into his stock-picking strategy.

Source: Fundsmith Website.

Surprisingly, I found my strategy and stock picks overlap with Fundsmith a lot.

The Strategy

Fundsmith"s stock-picking strategy is often spelled out as "ODD" as follows:

- Only invest in good companies;

- Don"t overpay;

- Do nothing.

The O (only invest in good companies) echoes Warren Buffett"s approach of buying wonderful businesses at fair prices. Terry Smith laid down the following aspects of evaluating a good company:

Source: Youtube.

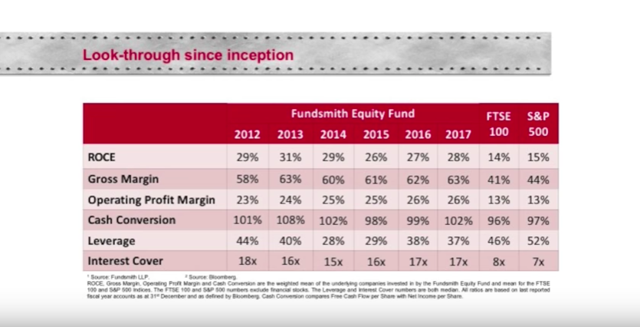

If you read my previous Seeking Alpha articles, it would not be difficult for you to find the similarity between Terry Smith"s "good company" metrics and the factors used in my quality-focused investing approach:

- Returns on capital - look for efficient capital allocation (the ultimate moat and great management);

- Margins - look for high pricing power and/or low-cost production;

- Cash conversion - favor cash-rich businesses;

- Leverage & interest cover - favor companies with a strong balance sheet and financial health.

Metrics, like ROIC/ROA/ROE, operating margin, free cash flow conversion rate, debt-to-equity, current ratio, cash return on (tangible) capital, are all heavily weighted as the factors when I rank stock qualities.

Based on my observation (of articles and comments), I feel that most readers here in the Seeking Alpha community should have done a good job on the first D (don"t overpay) with much focus on valuations. Terry Smith"s reasoning regarding the second D (do nothing) is that it would be much easier to harvest alpha in the long term than the short term. Therefore, patience is the key and selling overvalued but quality stocks too soon can cost you. Trading too frequently is the mistake that I see many SA readers may be making, again per my observation, while "doing nothing" is truly the most difficult thing to do according to Terry Smith.

Fund Performance

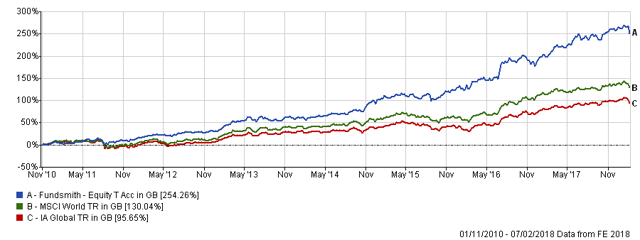

Apparently, Fundsmith"s approach worked out well, according to the chart below.

Source: trustnet.com.

From November 2010 until the end of 2017, Fundsmith delivers a 254% total return (even with a 1% fee deducted). You can compare this to the 130% return achieved by the MSCI World Index (with no fee obviously).

While many of you may find this track record of returns astonishing, I also would like to point out that it is not impossible for some individual investors with a certainly smaller amount of funding to beat Fundsmith using the same strategy. Again, as I always point out, the scale is not an advantage in the investment world. In many cases like this one, less is more (or more is less).

Fund Portfolio

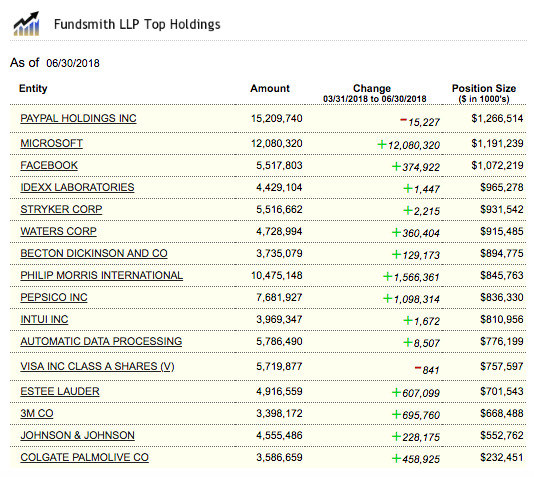

Checking the portfolio of Fundsmith Equity Fund, I am not surprised to see many of Terry Smith"s picks that are also invested in my investment fund or on my watch list, such as Microsoft (MSFT), Waters (WAT), Philip Morris (PM), Johnson & Johnson (JNJ), Intuit (INTU), Automatic Data Processing (ADP), Facebook (FB). Same case with his previous high-stake holdings, such as McDonald"s (MCD), Domino"s Pizza (DPZ), Novo Nordisk (NVO), Swedish Match (OTCPK:SWMAY) (OTCPK:SWMAF). The team at Fundsmith maintains a list of the so-called "investable universe" containing only around 60 stocks, waiting patiently for the right entry or exit points.

Source: www.holdingschannel.com.

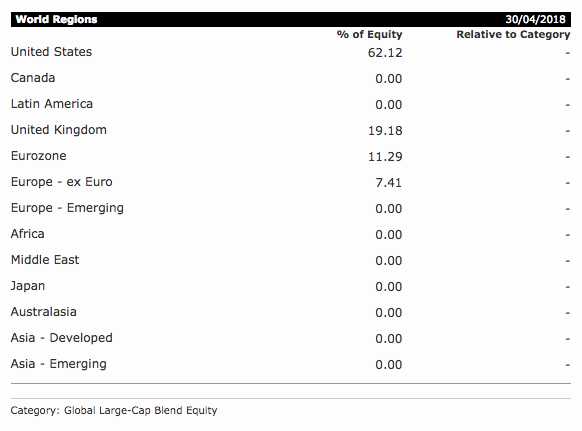

Although based in the UK, Fundsmith Equity fund has a concentrated holding (over 60% of the portfolio) in the US stocks (see below). The US is also my favorite region to deploy investments in equities, thanks to its mature legal system as well as prevailing shareholder friendliness and high returns on capital in Corporate America.

Source: www.morningstarfunds.ie; data as of 8/22/2018.

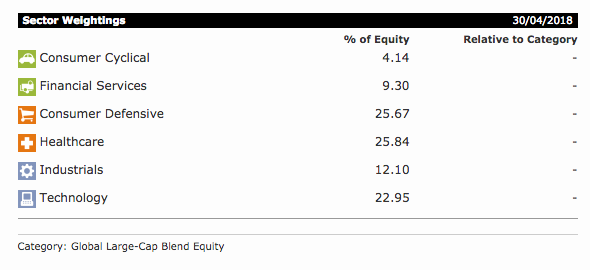

It is also worth noting that Fundsmith does not invest in any banking stocks (Terry Smith cited the concern of high leverage and low returns on assets) with most holdings in the consumer staples, healthcare and technology sectors. These are also my favorite sectors to search for high ROIC, cash-rich businesses with durable competitive advantages, such as Clorox (CLX), Novo Nordisk, Microsoft. I happen to hold no banking stocks as I always find myself not the expert in analyzing them.

Source: www.morningstarfunds.ie; data as of 8/22/2018.

In addition to the strategy and stock picks, I also found many pieces of advice from Terry Smith that are quite valuable but underrated among individual investors. I have been advocating a lot of these in the Seeking Alpha community but I would like to reiterate here.

Lesson #1: Quality above valuation

Charlie Munger (also Terry Smith"s role model) once said, if you are a long-term investor, the rate of return that the company generates on capital and its ability to reinvest at that rate in the future is the thing that will drive your returns, not the valuation you buy or sell the company. I personally regard high quality as the ability to consistently generate high returns on capital employed in great excess of the cost of that capital.

Unfortunately, here at Seeking Alpha, I am seeing way more discussions regarding valuations than business qualities, which is also a phenomenon among the wider investment community.

Lesson #2: Doing nothing is hard but important

I fully agree with Terry Smith"s thought that there are only two types of people when it comes to market timing:

- People who cannot do it;

- People who have not realized that they cannot do it.

Frequent information and decision is your enemy. This reflects another case that in investment more is less (or less is more). Think about those hedge funds.

Lesson #3: Old techs work better than new ones

Most technological innovations destroy values instead of creating ones. Think about airline and internet stocks. Quite often, new technologies are not even well understood by most people, preventing themselves from being a good investment target in the first place, such as BlockChain, Artificial Intelligence.

Elevator sector has been the old technology that Fundsmith favors as an investment. Companies typically charge high margins on maintains service of their products that are frequently being used by consumers in a very predictable way with extremely little competition. I do not own any elevator stock but has been following KONE Oyj (OTCPK:KNYJF) (OTCPK:KNYJY) and Schindler Holding (OTC:SHNDY) (OTCPK:SHLAF) for quite awhile.

Lesson #4: Cash flow is the king

The focus on cash flow brings in the benefits of getting high quality earning and avoiding some accounting manipulation traps. I would greatly prefer businesses that are able to convert 100% or more of their earning to free cash flow along with a high and stable margin.

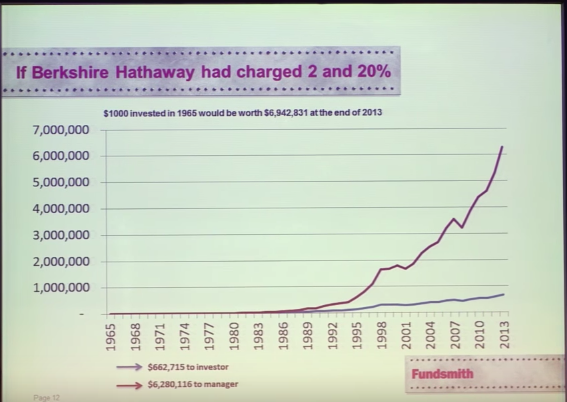

Lesson #5: Performance fee

Compounding interest is the 8th wonder of the world, but what if investment return is compounded in an adverse way. Here is Terry Smith"s favorite example: what if Berkshire Hathaway (BRK.A) (BRK.B) is a hedge fund or private equity fund charging 2% annual fee and 20% performance fee and Warren Buffett is the GP (General Partner) of the fund. As described below, between 1965 and 2013, the majority of the returns (90%) would have gone to Warren Buffett"s own pocket, leaving only 10% on the table for his hypothetical LPs (Limited Partner). Fortunately, this is only hypothetical. Like many other investors, I have been a so happy shareholder of Berkshire for years.

Source: Youtube.

Terry Smith recommends investors should never pay a performance fee. To me, any investment fund charging client 2/20 (think about PE/VC and hedge funds) should be considered a marketing-driven business as their real business model would be to persuade rich "fools" to sacrifice their own interests in a compounded way (quite often in a large portion).

Lesson #6: Consumer staples rock

In Terry Smith"s definition, consumer staples businesses conduct small-ticket non-durable everyday B2C transactions, which are repeating, predictable, and with bargain powers (think about this vs. B2B transactions, where you would need to deal with the whole purchasing department at your counterparty). I would add another advantage to being an investor in this sector: their businesses and products are easy to understand and boring so that they are neglected by Mr. Market quite often.

Many statistics show that consumer staples companies outperform the overall market in the long run and do so even by a wider margin in terms of risk-adjusted returns. For many of those who are worried about the upcoming recession considering we have been in this probably the longest bull market in history, consumers staples are the top place to be in along with other options describe in my previous article.

Lesson #7: It is never wrong to buy low-cost index funds

Both Terry Smith and Warren Buffett have admitted that for the majority of us, the most sensible way to invest to consistently buy into a low-cost index fund, although ironically both of them are active investment managers. Similiar to market timers, there are three types of people with regards to investment returns:

- Those who can consistently beat the market;

- Those who cannot beat the market in the long run;

- Those who just have not figured out yet that they cannot beat the market in the long run.

In my view, Group 3 is the majority while Group 1 is the extreme minority. Considering the difficulties of Group 2 and 3 to accurately spot the very few long-term winners, such as Warren and Terry, among all fund managers including those marketing champions charging 2/20 (i.e., most PE/VC and hedge funds), I think that the advocate for low-cost index funds to almost everyone is fair and objective.

Summary

Again, I have been enjoying learning the wisdom from Fundsmith and its founder recently. I believe that the fundamental quality focus is the key to investment success for alpha seekers, and you would sweeten the returns if you have the intellectual and psychological ability to avoid overpaying and stay patient. Certainly, as some may have already realized, this article (including the strategy/approach described) is probably not appropriate for short-term investors (or speculators as I usually call them).

In case you are a long-term investor, do follow me by clicking the button below.

Disclosure: I am/we are long MOST OF THE STOCKS MENTIONED.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor"s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment