By Bob Ciura

One of the most disappointing stocks in the entire S&P 500 Index last year, was General Electric (GE). GE shares have lost nearly half their value in the past one year. If that weren’t bad enough, the company also cut its dividend by half, due to its eroding fundamentals.

At the same time, GE remains an industrial powerhouse. It also has a long history of surviving difficult times such as this. GE has an operating history of over 100 years. At a share price of $16, the stock has a dividend yield of 3%. The combination of 100+ years in business and a 3%+ dividend yield places GE on our list of “blue-chip” stocks. There are only a few dozen stocks that qualify as blue chips. You can see the full list of all blue chip stocks here.

At a price under $16, not only does GE have a solid 3% dividend yield, but it also has an attractive valuation. This is certainly a challenging time for GE, but the company is not doomed. This article will discuss why GE is a buy under $16.

Business Overview

There is no sugarcoating it—GE performed very poorly in 2017. The fourth quarter was particularly weak; GE reported quarterly revenue of $31.4 billion, which was down 5% year over year, and missed analyst expectations by a whopping $2.66 billion. The huge miss was especially glaring, considering GE had solidly surpassed analyst expectations in each of the first three quarters of 2017.

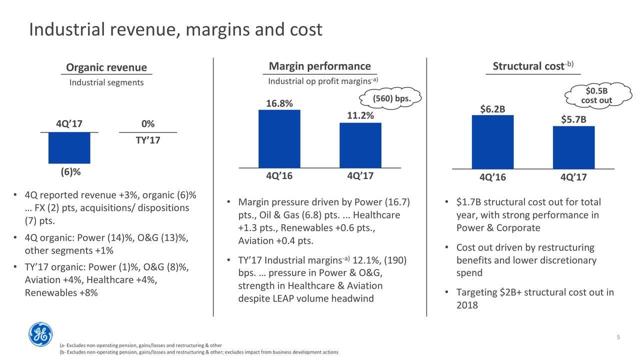

Source: Q4 Earnings Presentation, page 5

GE also disclosed an SEC investigation into the company’s insurance accounting practices. GE’s insurance unit reported a massive $6.2 billion after-tax charge against earnings in the fourth quarter.

The good news is, the company remained profitable, with adjusted earnings-per-share of $1.05. GE is a massive conglomerate, with a leadership position across multiple industries. Still, adjusted earnings declined 30% from 2016.

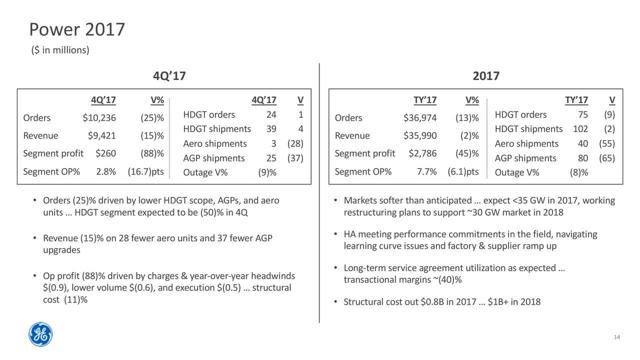

A big reason for GE’s deterioration is its power segment, which continues to struggle. Segment earnings declined 88% in the fourth quarter, and the power business will be a continued headwind in 2018.

Source: Q4 Earnings Presentation, page 14

Fortunately, GE is still doing some things right. In 2018 and beyond, GE will focus on accelerating growth in aviation and healthcare, two of its businesses that are still performing well. It will also focus on turning around its power business, by cutting costs and righting the ship.

Growth Prospects

GE’s fundamental deterioration last year, combined with the SEC investigation, do not inspire a great deal of confidence. However, GE’s chances of a successful turnaround are promising. The company is aggressively cutting costs, to slim down and become more efficient. GE cut structural costs by $1.7 billion in 2017, and expects $2 billion in additional cuts in 2018. Along with growth across its core businesses, these cost cuts will greatly help GE return to earnings growth.

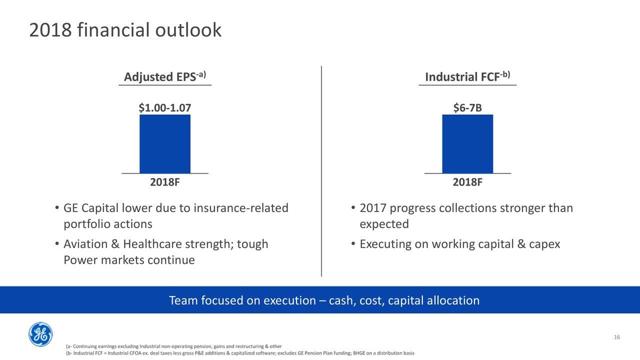

For fiscal 2018, GE expects adjusted earnings-per-share of $1.00-$1.07.

Source: Q4 Earnings Presentation, page 16

Returning to its operating segments, aviation and healthcare still have a long runway of growth up ahead. Both segments grew operating profit by 9% in 2017. In healthcare, GE saw mid-single digit growth in the U.S. and Europe last year, along with more than 10% growth in the emerging markets. In aviation, GE expects 7% to 10% growth in 2018. It remains on track to deliver 1,200 LEAP engines in 2018, and production of over 2,000 engines by 2020.

Renewable energy is another positive growth catalyst for GE. In 2017, renewable energy revenue increased 14%, and eclipsed $10 billion for the year. Overall, GE expects as much as 3% organic revenue growth in 2018.

GE could also be a beneficiary of the recent tax reform. GE expects a long-term benefit to earnings, as it is expecting a tax rate in the low-to-mid 20% range. In addition, the company is confident the SEC investigation will not have a material impact. On GE’s fourth-quarter earnings call, CFO Jamie Miller said the company is cooperating fully with the investigation, and is not “overly concerned”.

Valuation & Dividend Analysis

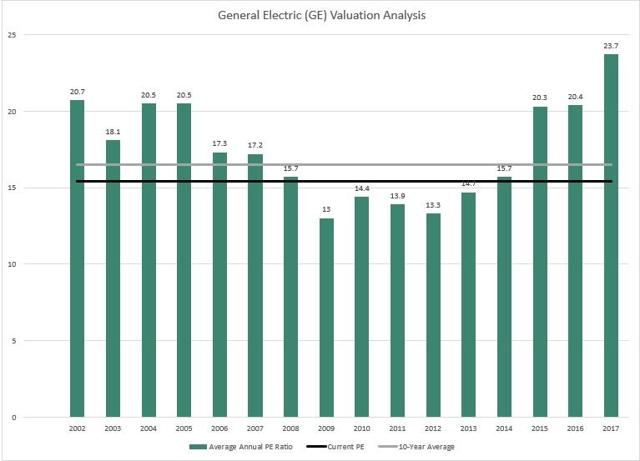

Based on the midpoint of fiscal 2018 earnings guidance, GE stock trades for a price-to-earnings ratio of 15.4. GE is valued 7% below its 10-year average price-to-earnings ratio, of 16.5.

Source: Value Line

GE is not a deep-value stock, but could be considered slightly undervalued. And, if earnings are near a bottom, the valuation multiple could expand moving forward, if the company returns to grow earnings. Even with relatively low future growth assumptions, GE could produce satisfactory returns, assuming at least a flat price-to-earnings ratio from here. A potential breakdown of total returns is as follows:

- 2% to 3% organic revenue growth

- 0.5% to 1% margin expansion

- 1% share repurchases

- 3% dividend yield

In this scenario, total returns would reach 6% to 8% per year, including dividends. Returns could be significantly higher, if earnings growth exceeds the 3.5% to 5% projected above. Expansion of the valuation multiple would only add to these annual returns, in the event GE accelerates earnings growth above projections.

GE is still a strong cash-flow generator. The company expects free cash flow of $6 billion to $7 billion in 2018. This should be more than enough to cover the dividend. With 8.68 billion diluted shares outstanding at the end of 2017, GE’s new dividend rate of $0.48 equals a dividend cost of roughly $4.2 billion. Using adjusted earnings-per-share, GE expects a dividend payout ratio less than 50% in 2018. On a free cash flow basis, GE expects to maintain a dividend payout ratio of 60% to 70%.

Reducing the dividend gave the company greater financial flexibility, which it can use to strengthen its financial position. GE is targeting a healthy net-debt-to-EBITDA ratio of 2.5 times going forward. The reset dividend appears to be secure, and at a price of $16 or below represents an attractive 3%+ dividend yield.

GE is one of 747 dividend-paying stocks in the industrial sector. You can see all 747 dividend-paying industrial stocks here.

Final Thoughts

In our last review of GE, when the stock was trading at $18, we suggested investors wait for $16. With GE now down to $16, the stock is nearing buy territory. Investors will need to be patient, as GE is a huge company, and it takes time to turn around a company of this size. GE is certainly a work-in-progress.

But at this price, GE could produce attractive returns moving forward, if the turnaround is successful. In the meantime, investors can buy the stock at a reasonable valuation, and a 3% dividend yield.

The Dividend Aristocrats have increased their dividends for 25+ consecutive years. Research has shown that dividend growth stocks, such as the Dividend Aristocrats, have significantly outperformed the S&P 500 in the past 10 years. This is why we developed our exclusive service Undervalued Aristocrats provides actionable buy and sell recommendations on some of the most undervalued dividend growth stocks around. Click here to learn more.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment