Nobody can predict the future, so these are really planning premises or “what if” these predictions occur and what happens to the stock market as a result. Will we be prepared to act or will we be completely blindsided? Now is the time to think about what we will do if these predictions come true.

If there are no negative surprises, then 2018 is shaping up as another good year in the stock market. It will be tough for the portfolio managers to beat the Index, but the small investor should easily beat the Index because it is relatively easy to pick 10 good stocks out of 500 in the Index. (Pity the poor portfolio manager who has to pick 100 good stocks. They could easily pick 10 as an individual and trounce the Index, but managing billions is a lot more difficult than managing a million. That is why the small investor can beat the Index and the portfolio managers with billions finds it so difficult to do so.)

2018 Predictions

The pros will be prepared to act if any of the following happens:

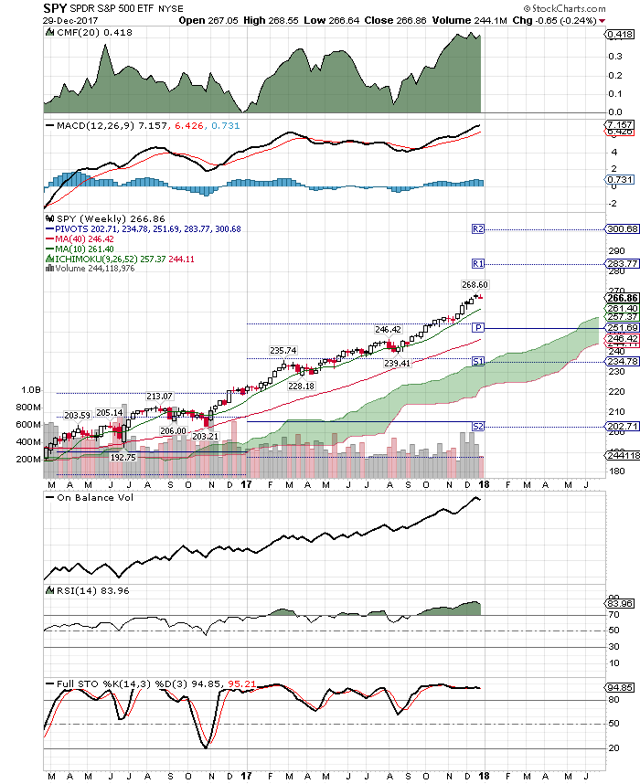

- War with North Korea: The market is not expecting this, but if it happens, I would expect the market (SPY) to drop to 200.0 on the first day. (See our chart below.) If the market changes its mind about the threat and sees the possibility of war, it will turn down targeting such lower support levels. I think there is a much higher possibility of war than the market is currently discounting. Trump has undercut diplomacy with Tillerson and given every indication of his preference for a military solution.

- Fed increases rates four times: The market is expecting higher rates from the Fed. Four rate increases have not been fully discounted yet. Increasing rates will probably be more of a problem for 2019 rather than 2018, because the market responds to higher interest rates slowly. This is a Fed bull market and it will be a Fed bear market at some point in the future.

- Mueller is fired: Again it is the exogenous, political and global factor that will provide the negative surprise and take the market down. I would see this as a pullback to test the 50 and 200 day moving averages on the SPY chart below.

- Republicans and Democrats call for Trump’s impeachment: This is highly unlikely in 2018 and the market does not expect this. It would be a big surprise for 2018, but it may be possible in 2019. Any smell of possible impeachment and the market will probably take back at least 50% of the Trump rally.

- Democrats win the House and Senate: Unlikely but possible. If the Democrats win the House and not the Senate, the market will probably pullback to test the 50 or 200 day uptrend. It will be the first strike to dismantle the Trump rally. The market looks ahead, but not as far as 2020. As we approach 2020 we could see a perfect storm of high interest rates, Democratic control and a rollback of most of the Trump deregulation and tax cuts. Add in market overvaluation from a booming market in 2017 and 2018 and you have the perfect storm for a market top and pullback. But I doubt the market won’t discount that as early as 2018.

- Bitcoin bubble bursts: As with all bubbles that burst, there will be some big losers. It is unlikely that the contagion will hit the stock market. But the rule of unintended consequences could hit the market. Namely funds could be pulled out of the market because of Bitcoin losses. The blockchain stocks, part of the bubble burst, would be hit. And it may trigger a flight to value, as other bubble like stocks with enormous PEs take a hit. Other bubble stocks could burst.

- Sector rotation hits Tech stocks: There was a little taste of this at the end of the year as the drop in the Technology ETF took good, value stocks down with the overvalued ones. The rotation was out of Technology (XLK) into Financials (XLF). The tax cuts will create rotation into stocks with the most to benefit from the tax cuts. The Apple X is already baked into Apple’s price. Now Apple (AAPL) has to deliver the projected revenue growth. With the mundane industrials attracting attention because of the tax cut, the nifty FANG stocks may see some outflows to safer pastures. Increasing interest rates make the financial sector attractive. There will be rotation out of the 2017 big winners into the new 2018 winners.

- Tillerson, Sessions and Kelly resign: I don’t expect this to affect the market initially, but unintended consequences could result. Tillerson and Kelly resignations may increase the probability of war. Sessions leaving may increase the probability of Mueller being fired and the President being impeached. War and impeachment would certainly take the market down.

- Tax cuts fail to grow GDP or increase jobs: The Democrats have probably underestimated the benefits of the tax cut. The tax cuts may fail in GDP and jobs, but many employees will have more money to spend. This could see a rotation into Retail with Amazon (AMZN) continuing to do well. Health care problems and the tax cut "for the rich" banners will probably win the House for the Democrats. Firing of Mueller and impeachment might win the Senate for them. All bets are off in the case of a war.

- 2018 is like 2017: The market is looking at 300.0 for the Index (SPY) as a reasonable bet and sees no war, no Democratic sweep in the elections, no change in the Trump rally and great benefits from the tax cut. That is probably the most likely case. The market does not see war, impeachment, nor any big announcements from Mueller. The market looks very positive for the short term as the best six months, according to the Stock Trader"s Almanac, play out. Come the summer and the fall it gets tacky. The Democrats start pounding away to win the House. North Korea and Mueller will have come to a decision point. Those decisions could take the market down.

Conclusion

Small investors can go with the market flow until it turns against them, and then they have to be prepared to pull the trigger. The only way to be prepared and to act quickly is to see the signals and warnings as they develop. By outlining some of the possibilities above, you are ready to act quickly and decisively, instead of hoping that the news is not as bad as it appears and that the market will bounce right back. Yes, buy on weakness and market bad news, but know when the bad news is fatal and you have to wait for a confirmed bottom to buy. Predictions are all about being proactive instead of reactive.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Each day we come up with a "Daily Index Beaters" stock pick and each week we take a look at the market to see if our predictions are a near term risk. Our computerized fundamental and technical signals tell us when to get out of the market or any stock in the Index. Our sell discipline is just as strong as our buy discipline. Sign up for a free trial of our daily report of stocks with confirmed buy and sell signals.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Daily Index Beaters is my paid subscriptions service.on SA. This was not previously published to paid subscribers.

No comments:

Post a Comment