This research report was jointly produced with High Dividend Opportunities co-author Jussi Askola.

Investors are wrong in selling CBL & Associates (CBL), and the more the price goes down, the more we buy.

We have decided to invest in Class B malls back in 2017, and today despite sitting on some (unrealized) losses, we remain confident in our thesis. It may take some time to play out, but we are patient contrarian investors – willing to take on additional volatility for the potential of higher returns in the long run.

In fact, as the market kept on selling off CBL, Washington Prime Group (WPG) and Pennsylvania Real Estate Inv Trust (PEI), we kept on buying. Looking at the charts, we realize that these are big contrarian bets, but we take comfort in Ben Graham’s saying:

You are neither right nor wrong because the crowd disagrees with you. You are right because the data and reasoning are right.”

3-Year Chart of CBL (Yield 14.1%)

3-Year Chart of WPG (Yield 14.1%)

3-Year Chart of PEI (Yield 7.2%)

We believe that all three names are more opportunistic today than ever before and remain strongly bullish assuming the investor is patient, emotionally-disciplined and not scared of volatility.

The share price performance continues to indicate deep fundamental decline in business economies; yet we see resiliency even after the recent disappointing quarter of CBL. (See full buy thesis here)

According to our latest scenario analysis, even in a case of permanently declining cash flow (which we do not expect), there is still plenty of returns to be made due to the extremely low valuations. On the other hand, if CBL/WPG/PEI eventually returns to positive growth (which we expect), the upside could be massive.

This may take a long time to play out, but we believe there is a good chance to see the share prices double or even triple as a result of FFO multiple expansion.

The following scenario case study will focus on CBL, but applies to numerous other retail REITs selling at opportunistic prices after sharp drops in share prices.

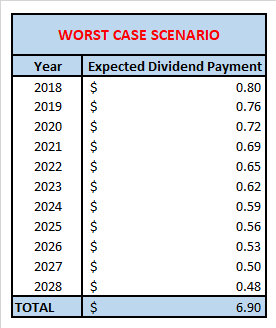

Our Worst-Case Scenario - a 5% decline per year in the dividend

Our worst-case scenario assumes that CBL is unable to manage to stabilize its cash flow. We assume that the company keeps its current portfolio as is and does not undertake any new acquisitions or dispositions. Due to continued operational difficulties, the cash flow will be reduced at a rate of 5% per year following occupancy and rent reductions. This 5% decline is directly passed to investors in the form of a 5% annual cut to the dividend.

Here are the expected dividend payments over the next 10 years:

Source: author’s model

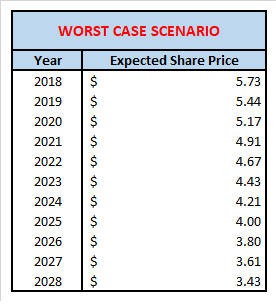

As can be seen in the above table, the total cumulative expected dividend payments account to $6.90 per share over the next 10 years, despite the consistent decreases in payments. By year 10, the cash flow has declined by 40% - and assuming its current FFO multiple of 2.7 times FFO holds over the years, the share price would change the following way:

Source: author’s model

Taking the forecasted share price of year 10 and adding to the cumulative dividend payments, we get a total of $10.33 per share. This compares favorably to the current share price of $5.73 and shows that there could be upside potential even in a pessimistic scenario with ever deteriorating results.

This is obviously a very simplistic scenario analysis as it does not even take into consideration the time-value of money. Moreover, we consider this outcome to be excessively pessimistic as it ignores the value creation that CBL can produce by redeveloping space and replacing struggling tenants.

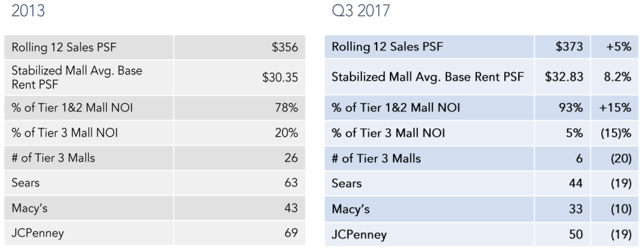

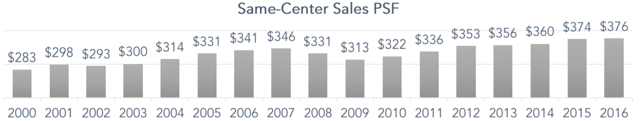

See the difference between 2013, and today. NOI coming from Tier 3 malls (lower quality) has come down from 20% to 5%, the number of Sears (SHLD), Macy’s (M) J.C. Penney (JCP) stores has also decreased significantly, the average sales per square foot and rents have actually increased:

Source: CBL Presentation

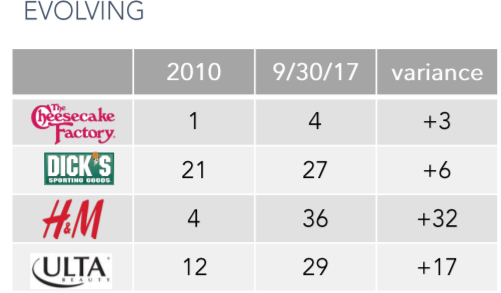

So very clearly, the redevelopment projects are creating value by reducing risk and increasing sales. To this day, CBL has undertaken lots of such projects resulting in an average 9% return on investment and helping to stabilize malls with superior tenants. For instance, in the last 7 years, CBL added 32 new H&M stores (OTCPK:HNNMY), 6 Dick’s Sporting Goods (DKS), 17 Ulta Beauty (ULTA), 3 Cheesecake Factory (CAKE), and many other higher quality tenants to its portfolio:

Source: CBL Presentation

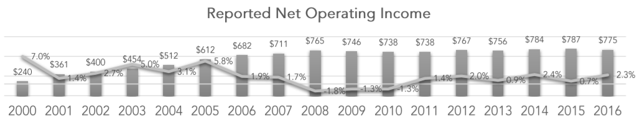

The REIT has over the last 10 years shown consistent performance with NOI, sales per square foot, and occupancy about flat.

NOI shows resiliency even during the greatest financial crisis, and is certainly not falling off a cliff:

Source: CBL Presentation

Sales per square foot have been increasing almost every year, and we expect this to continue as a result of continued investments in its properties.

Source: CBL Presentation

Finally, the very stable occupancy is proof that there is demand for leasing space in Class B malls. Even during the financial crisis, the occupancy did not fall below 92%.

Therefore, it is difficult for us to suddenly see the stock on a permanent decline after showing such resiliency in the past. In fact, CBL even reported positive cash flow growth in 2016. Sure, the more recent performance was disappointing in 2017, but one year means close to nothing in the long run.

Finally, it could also be argued that in a case of continued permanent decline in cash flow, the expected returns on redevelopments would go down making it unprofitable to put cash into capex. Instead, the management would seek to pay out as much in dividends as it can and return capital to shareholders to minimize value destruction. As such, a 5% decline in FFO would not necessarily mean a 5% decline in dividend. Given the current FFO yield of over 30%, if the management had to go that route, the initial investment would be quickly paid back.

The takeaway is that even in a case of permanent decline in cash flow and dividend, CBL shareholders have a chance of earning a nice return on their investment. According to our simple calculations, despite the dividend and share price dropping by 40% over the next 10 years, CBL shareholders would be expected to earn a ~6% compounded annual average return.

Our Base-Case Scenario

In our base-case scenario, we expect the cash flow and dividend to stabilize and remain about flat over the long run. It allows the REIT to keep paying the massive dividends (14% yield), and reinvest the remaining of its cash flow (about 50% of FFO) into improving its portfolio.

The asset improvements do not result in rent increases, but allow the REIT to reduce its exposure to struggling tenants Macy’s, Sears, and J.C. Penney – reducing its risk profile and improving its resiliency to the growth of Amazon-type (AMZN) companies.

Eventually, the market realizes that CBL has made valuable portfolio improvements and reprices it at about 5 times FFO.

Five times FFO remains extremely low but results in 83% gain from today’s share price, in addition to the continued dividend payments which account for $8 per share over the next 10 years.

Our Best-Case Scenario

In our best-case scenario, the difference to our base case is that the portfolio redevelopment eventually results in a higher quality asset base that generates higher rents.

We think that this is possible when considering that department store type tenants occupy a significant amount of space, but earn little sales per square foot and pay little rent today. By gradually redeveloping large Sears properties into many smaller specialty stores, we expect the overall traffic of malls to go up – benefiting all mall tenants and allowing CBL to increase rents and FFO to its shareholders. To illustrate this, consider the example of Coolspring Galleria, a CBL mall that underwent anchor transformation and resulted in +18% sales per square foot growth:

As noted earlier, the current yield on redevelopment projects is 9%, which is significant and proving that value creation is not just an “unlikely best case scenario,” but a reality that is already happening.

It may take a few years to really see FFO growing again, but this remains a very possible scenario. If CBL can stabilize its FFO -which is our base-case scenario - the stock should trade at 5 times FFO valuation, but if CBL is able to grow FFO, CBL may very well trade at 8 times FFO – close to 200% increase from the current price.

Near-Term catalysts

This holiday season was the best one in recorded history and retailers have done very well. Despite positive announcement from many retailers, retail and mall REITs have not yet reacted positively. We believe that once Q4 earnings results are out, the views of many investors are likely to change, and we could see a significant rally in CBL, WPG and other retail REITs. It is no surprise that retail malls have done pretty well over the past months given the general weakness in Property REITs. For example, CBL and WPG have both strongly outperformed the Vanguard REIT Index ETF (VNQ) since mid-December 2017.

Final Thoughts

There is above-average risk in buying into the CBL story and it should be clear to investors by now. That said, the current valuation is so ridiculously low that even a poor performance could result in gains for the patient contrarian investors. This does, however, require high emotional discipline to avoid selling off at the first negative news and it could take significant time for the thesis to play out. Investors are today overly focused on short-term results which may greatly vary. Focusing on the long run and ignoring the noise, we see tremendous upside in the CBL redevelopment story.

We do think that the high risk is very well compensated, given the current very generous yield of 14.1%, in addition to the potential price appreciation in our "base case" and "best case" scenarios. This same thesis applies to many other retail REITs trading at bargain valuations. At the current valuation, we rate CBL as a Strong Buy.

If you enjoyed this article and wish to receive updates on our latest research, click "Follow" next to my name at the top of this article.

About "High Dividend Opportunities"

Looking for High-Yield stocks trading at cheap prices?… This is why many subscribe to our service.

High Dividend Opportunities is a leading and comprehensive dividend service ranked #1 on SeekingAlpha, dedicated to high-yield securities trading at attractive valuations. It includes a managed portfolio targeting 8-9% yield, with the best high-yield MLPs, BDCs, REITs, Preferred Shares, and Closed-End-Funds.

Many high-yield sectors have not participated in the recent big-rally and offer a unique opportunity. We invite readers for a 2-week free trial to have a closer look at our strategy and our best picks for 2018. Get prepared for a powerful year ahead! For more info. click HERE.

Disclosure: I am/we are long CLB, WPG, PEI.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment