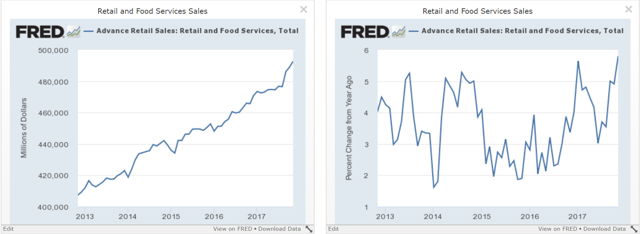

Retail is a very difficult business. Margins are razor thin, competition is intense and there’s an 800-pound gorilla in the room named Amazon that allows consumers to price goods in real time, which prevents companies from aggressively raising prices. Yet retail is a huge market. Consumer spending accounts for 70% of U.S. economic growth. And according to several government statistics, consumers are spending at solid rates:

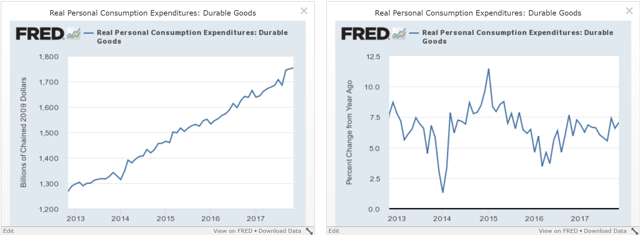

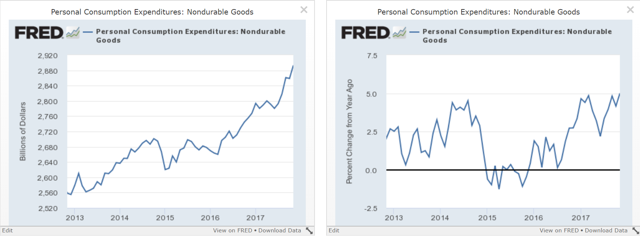

Retail sales (top chart, from the Census Bureau) have increased consistently for the last five years (top left). According to the latest release, the Y/Y growth rate is near its highest level in five years (top right). According to the Bureau of Economic Analysis, consumer spending on durable goods (middle charts) and non-durable goods (bottom charts) is also growing at strong rates.

Retail sales (top chart, from the Census Bureau) have increased consistently for the last five years (top left). According to the latest release, the Y/Y growth rate is near its highest level in five years (top right). According to the Bureau of Economic Analysis, consumer spending on durable goods (middle charts) and non-durable goods (bottom charts) is also growing at strong rates.

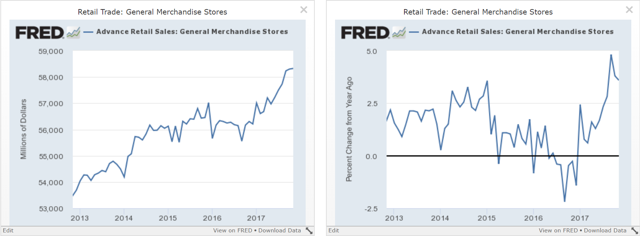

General merchandise stores – where Target (NYSE:TGT) competes - are the third largest subset of overall retail sales, accounting for 12% of total in-store U.S. spending.

The pace of growth in this sector of the retail sales market decreased from mid-2014 through mid-2016 but has since resumed its expansion. It is now increasing near its highest level in five years.

The pace of growth in this sector of the retail sales market decreased from mid-2014 through mid-2016 but has since resumed its expansion. It is now increasing near its highest level in five years.

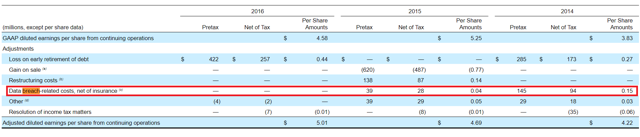

Target is the third largest discount retailer in the U.S., based on market capitalization. Wal-Mart (NYSE:WMT) is by far the largest (market cap: $292 billion) with Costco (NASDAQ:COST) a fairly distant second (market cap: $81 billion). Target has a market cap of $35 billion. The company has had a difficult few years. First off was the massive computer hack of 2013. Last year was the first year when they had no expenses related to this issue:

And then there’s the failed Canadian expansion, which they ended in early 2015:

And then there’s the failed Canadian expansion, which they ended in early 2015:

Target is abandoning its $4.4 billion expansion into Canada after less than two years, the company announced Thursday.

The retailer is pulling out of the country after racking up more than $2 billion in losses.

Target had promised investors that the Canadian business would be profitable by the end of 2013.

The retailer hired a new CEO and replaced the president of its Canadian operation to try to execute a turnaround. But its efforts failed.

As a result, Target sold its pharmacy business to CVS in mid-2015, which provided much-needed cash. But, a transaction of this magnitude would also sap a company’s strength and focus as it made the transition.

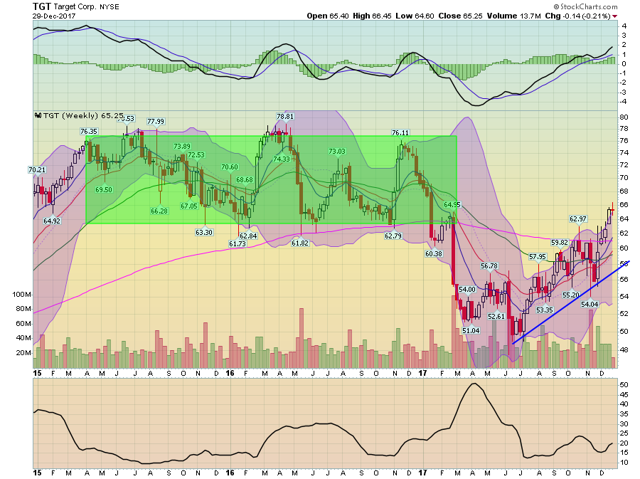

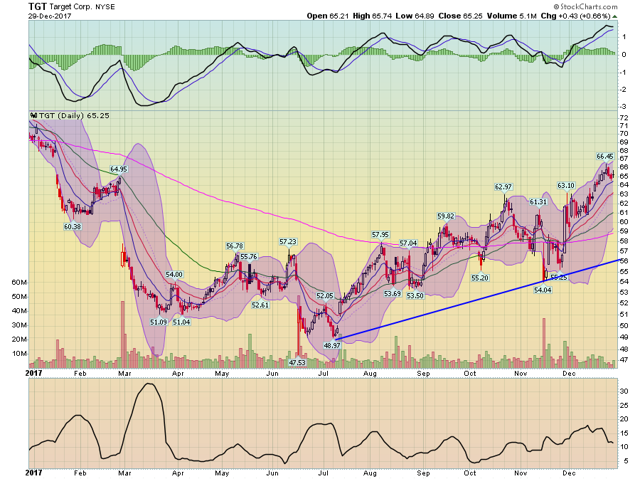

The combination of these events would be enough to hurt any company’s growth, which is reflected in the stock price:

The weekly chart (top chart) shows that prices moved sideways between 2015-2017- trading between the lower 60s and mid-70s. Overall momentum was declining. Prices dropped sharply in the first half of 2017. But the daily chart (bottom chart) shows that prices have since rallied from the upper-40s to the mid-60s. Despite this movement, Target is the second cheapest dividend aristocrat with a PE of 13.7. This is the kind of valuation level that gets my attention. However, there are usually reasons why stocks are this cheap - and none of them are good. What we need to see is a reason for the stock price to turn around. Thankfully, Target"s earnings are starting to improve.

Target’s annual income statement explains why the stock price has been less than stellar for the last five years. Top line revenue growth declined from $73.3 billion in 2013 to $69.4 billion in 2017 (over the same period, both Wal-Mart and Costco increased sales). COGS and operating expenses remained more or less constant. However, the net margin did increase from 2.72% - 4.56% and EBITDA was also up 157 basis points, increasing from 8.89% to 10.46%.

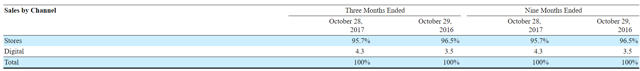

However, it’s their latest quarterly numbers that are exciting investors. According to the last 10-Q, Q/Q sales increased 1.21% while 9-month sales are up .61%. Comparable store sales also rose .9% QQ and .3% on a 9-month basis. Most importantly, digital sales are rising:

While their current level of online sales is disappointing, it also means the company has ample room for growth. And topline growth is growing (finally).

While Target"s revenue numbers are less-than-stellar, their cash flow is very impressive. It has increased from $2.4 billion in 2013 to $4.6 billion on a TTM basis. This has allowed the company to buy back stock and continue to increase their dividend. Their current dividend payout ratio is 50%, meaning they have ample room to continue their status as a dividend aristocrat.

Is there enough here to warrant a speculative buy? Yes. First off, the company hasn’t experienced any significant bad news for a few years. The financial impact of the computer breach is over, the sale to CVS is complete and the cost of writing down the Canadian debacle is finished. As a result, we’re starting to see marginal improvement in sales along with very strong cash flow. The stock is currently yielding 3.8% - nearly 130 basis points higher than the 10-year treasury and that’s before we consider the possibility of additional capital appreciation.

But also remember, retail is a very tough environment. Margin compression will remain an industry-wide problem thanks to Amazon and it’s also possible that since we’re closer to the end of this expansion than the beginning, the U.S. consumer could slow his spending habits. Although Wal-Mart’s gross revenue increased 5.54% over the last five years, they have considerable international exposure. And Costco, which has grown a far stronger 27% over the same time period, has the membership advantage. If Target does continue growth, it will be based on a slow grind of 1%-4%/year. But, that should be enough to keep its stock price rising for the next 6-12 months.

This post is not an offer to buy or sell this security. It is also not specific investment advice for a recommendation for any specific person. Please see our disclaimer for additional information.

Disclosure: I am/we are long TGT.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment