Investment Thesis

With Apple Inc. (AAPL) trading near all-time highs, the current slowdown in the stock could provide investors an opportunity to buy prior to the next earnings release on February 1st. The company is poised to continue its growth on the heels of its latest and greatest iPhone, but it is other areas of the business that are not getting enough attention that will propel the stock higher. In addition, the company reported that it will repatriate much of their overseas cash, which will provide numerous opportunities for management, which will have a sizable impact on the company.

What Have You Done For Me Lately

After publishing my recent AAPL article, “Is Apple A Buy At These Levels?”, in mid-November, the stock has been in a slowdown, trading between $170 and $175 for much of the time. After writing that article, and listening to those that commented, I decided to recently jump aboard the Apple ship.

I will discuss the reasons in further detail as to the fact why I have missed the boat too often and really like where the company is headed, as it lessens its reliance on the iPhone. In addition, I believe the repatriation of most of their overseas cash will pay huge dividends (not those types of dividends, but you know what I mean), which are not baked into the price in my opinion.

Since the announcement of their new iPhone products in mid-September, the stock has gained about 9.6%. So far in 2018, the stock is up 1.7%, while the S&P 500 continues its upward trend, up 5.1% during the year. Concerns around the sales of the new iPhone 8 and iPhone X, battery issues with the iPhone 8, LTE connectivity issues with the new iWatch Series 3, and delay of the iPhone X, have all added increased pressure to the stock as of late.

Battery issues and the connectivity with the iWatch have all been resolved, but recent reports released from analysts are predicting that demand for the new iPhones are slow and forecasts will be slashed during the next earnings release on February 1st. If I had a dollar for every time I saw a report like this, I would be rich! To be fair, some have been correct in the past, but most of the time, they are overblown. The first report, which has been called into question, came from a Sinolink Securities Co. analyst Zhang Bin stating:

Product shipments are 10 million less than previously estimated. The drop reflects weak demand because of the iPhone X’s high price point and a lack of interesting innovations”

In addition to this report, JL Warren Capital LLC reported shipments would drop from 30 million units to 25 million units in Q1 2018. During Q1, AAPL typically ships between 74-78 million units on average, meaning if the 25 million estimates were correct, iPhone X would account for about 30% of the sales mix. Having the higher than normal price point for the iPhone X, I think a break from normal is to be expected with the higher price point making up the difference in addition to a better margin.

Some analysts have already responded to the report saying the analysts are confusing cuts in the iPhone 8 with that of the iPhone X. The iPhone 8 has been out about a month and a half longer than the X, and it also does not include all the upgraded features that came with the X. This merely seems like a “buy the fake news” situation more than anything.

As of this week, JP Morgan analyst Narci Chang wrote in a research note that “high-end smartphones are clearly hitting a plateau this year, with the iPhone X orders being down 50% quarter over quarter.”

Other analysts are more optimistic reporting that the iPhone X was the world’s best shipping smartphone during the holidays with an expected 29 million units shipped in the most recent quarter. We will get our answer in about a week.

The company’s most recent earnings release related to their Q4 and 2017 annual results as of September 30, in which they had a tremendous final quarter. Apple reported Q4 adjusted earnings per share of $2.07 vs. $1.87 expected by analysts. Revenue for the quarter topped $52.6 billion with analysts expecting $50.7 billion. Lastly, analysts expected iPhone unit sales to be at 46 million units, which Apple surpassed by selling 46.7 million units. As you can see, the company blew away expectations on every major item above.

Looking at the year-to date results, Apple reported an increase in revenue, net income, and EPS of 6.3%, 5.8%, and 10.8%, respectively. Gross margins for the period were 38.5%, which is the second annual decrease in margin. Gross margins decreased 60 basis points from 2016 and 160 basis points from 2015. These are modest growth numbers compared to what investors got during the company’s best year of 2015.

When comparing to 2015, revenue was down 1.9%, net income was down 9.4%, and EPS was flat. Though the 2017 results compare positively to prior year results, it’s the lack of growth since 2015 that causes some concern. Overall units were down as well when comparing to 2015 by about 14 million iPhone units and 4 million iPad units. Mac unit sales were flat while real growth came from the services department.

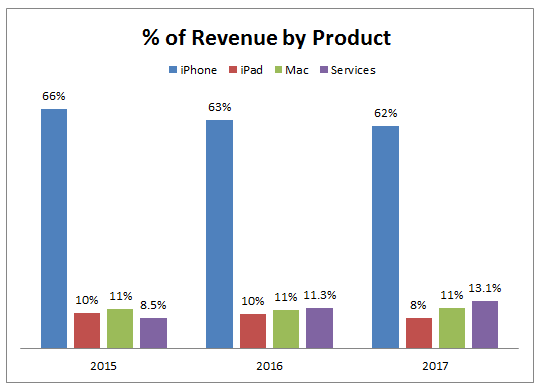

As I mentioned in my thesis, one of the areas that excite me the most about the company is its lessening reliance on the iPhone. Though the iPhone is still the main driver and continues to perform well, growth in other areas, particularly services revenue, has changed the sales mix. As you can see in the chart below, iPhone sales continue to be the main source of revenue, with over 60% of revenue related to its flagship product.

Source: Chart created by author

As mentioned, the growth in services revenue has been a major focus of the company moving forward as the segment has grown over 450 basis points, in terms of sales mix since the end of 2015 and is now the second largest reportable segment for the company. Apple Music continues to be a solid growth driver for the company with revenues up 75% year over year during the quarter. The company is seeing their highest conversion rates yet, based on users who try the Apple Music system for free and convert to a paid subscription.

In terms of subscriptions, the company now has over 210 million paid subscriptions, a 25 million subscription net increase since June 30, 2017. Sales and units sold reached all-time highs in China during the most recent quarter based on the new offerings from the company. Q4 was the second consecutive quarter in which the company saw double-digit growth in terms of iPad unit sales. Apple Watch continues to be the best selling smartwatch available to consumers today, as they saw 50% growth for the third consecutive quarter.

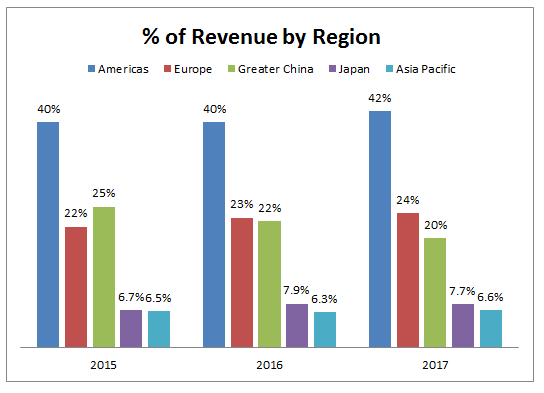

In terms of region, Americas continue to lead the charge with over 42% of total revenues coming from this region, followed by Europe and China, which account for 24% and 20% respectively of total revenues. Looking at the chart below, you can see the regions have been pretty consistent for the most part with the exception of China, which is a cause for concern.

However, the company did see a return to strong growth during the most recent quarter. China sales for the quarter were up 12% year over year, which should continue with the release of the new iPhones. Emerging markets outside of China saw revenue increase 40% during the quarter with sales doubling in India as the company continues to enlarge their footprint in that country as wireless availability strengthens.

Source: Chart created by author

Looking Ahead

Innovation has always been the key to Apple’s success since the release of the iPhone 1 back in 2007. Releasing innovative products with top of the line new technology has been what keeps Apple ticking. However, the question always arises from numerous bears on SA or elsewhere: can the company continue to innovate. Based on the track record, and the current products recently released, I would say the company is doing just fine. As you can see, Apple has breathed new life into not only their bestselling product, the iPhone, with the iPhone X, but also their fastest growing product, the Apple Watch.

Source: Apple.com

Just this past week, Apple announced plans to repatriate much of their $270 billion in overseas cash and contribute $350 billion to the US economy over the next five years, due to the recent tax cut bill that was signed. The new tax bill cuts corporate tax rates from 35% to 21% starting in 2018. The company’s 2017 effective tax rate was 24.6%, so the new bill will have a positive impact here.

The potential impact of the cash being repatriated could go in various routes, as management could use the cash to increase buybacks, increase dividends, pursue larger acquisitions, or even pay down debt. Obviously, all potential routes will serve the company very well, thus providing returns to shareholders one way or another.

In terms of which route I prefer, I would lean towards stock buybacks. I know this may not be a popular answer, as Nicholas Ward alluded to in his article “Investors Complaining About Apple"s Buyback Potential Baffles Me,” but taking a long-term approach will be extremely beneficial, not that the other routes would not, but just a preference.

As we alluded to earlier, growth in the service segment is something we should watch closely going forward. The service segment includes Apple Music, Apple Care, Apple Pay, and the main driver, the App Store. The company reported segment revenue of $30 billion during 2017 and they have a goal to reach $48 billion by 2020.

This week, CNBC Trading Nation had BK Asset Management Managing Director of FX Strategy Boris Schlossberg on the show where he practically announced the demise of Apple. He took issue with the high dollar amount Apple is selling many of their recent products, such as the iPhone X at $999 and the new HomePod that fetches a $349 price tag. He stated that the HomePod will be as big of a “failure” as the iPhone X, and that “nobody is going to buy it at such high price points.”

Now that seems a little extreme to me. It as if he needed some airtime and what better time to be an “Apple Bear” than when JPMorgan reports “slowing iPhone X orders” on the same day. I, however, do not have the same view as Mr. Schlossberg. Is Apple late to the game with the HomePod, absolutely, but the fact that they did not want to release the product until it was perfected in their minds, is a sound business decision.

Mr. Schlossberg also downplayed the cash being repatriated as a “one-time event and bad business decision.” I am not sure how this is a one-time event where the company can now buy back shares (long-term effect when dividends increase), or make a solid acquisition (long-term effect). It is not like they obtained a massive one-time sales contract that will never be repeated. Overall, I thought the interview was bogus and someone looking for airtime.

One interesting note I did read, as it related to the Verizon Communications (VZ) earnings release, was their recent upgrade rate during their most recent quarter. VZ released earnings this week and during the conference call, they alluded to a lower than normal upgrade rate of 7.2%, which is well below previous upgrade rates during prior iPhone launches. How much weight can we put into this? Not really sure myself, but it was interesting to say the least.

Valuation

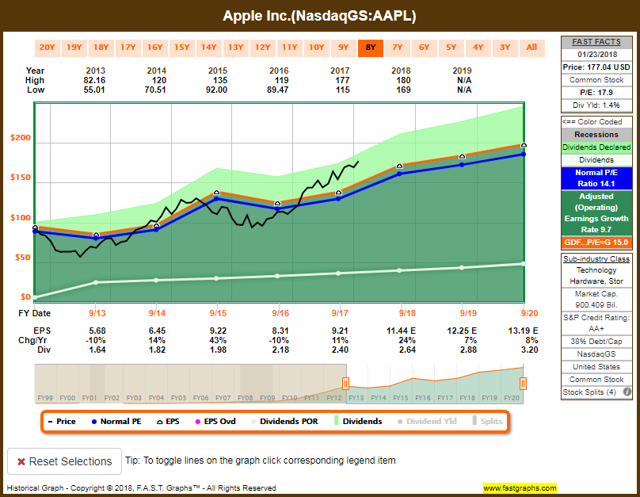

Based on the recent slowdown in the stock since November 2017, partly due to various reports speculating on iPhone 8 and iPhone X orders, the stock appears to be forming a new base that may be a solid entry point for those looking to ride the next wave up. Looking at the F.A.S.T. Graph chart below, the stock appears to be increasing at a faster rate than earnings.

Source: F.A.S.T. Graphs

AAPL stock has been on a tear for the last five years, gaining over 160% in value. The company has continued to launch new innovative products that have resonated with consumers fueling higher growth, yet some bearish investors still wonder whether the pipeline is reaching its tipping point. I feel as if we have heard this story from bears for years, but the company continues to prove them wrong. Now if a bear has a view based on valuation, I can see that, but when they question one of the most, if not the most, innovative company of all time, it tends to get a little old and not have much relevance.

Currently, the stock trades at a blended P/E of 17.9x (according to FAST Graphs) compared to its five-year average of 13.5x. This indicates that at current levels, the stock appears to be overvalued. However, AAPL does trade at a premium as it has continued to grow at a solid clip, but someone stating the stock is overvalued would not be a baseless comment.

Due to the super cycle that is taking place with the release of three new iPhones, I do feel that the premium above the recent norm is warranted. In terms of free cash flow, the company currently trades at a P/FCF of 17.9x compared to their five-year average of 10.5x, again indicating the stock is overvalued. In terms of Price to Sales, the stock currently trades at a P/S of 4.0x compared to a five-year average of 2.7x.

Conclusion

As you know, AAPL is a cash cow, with nearly $270 billion in cash and marketable securities as of their latest annual filing. The company currently pays a dividend yielding 1.42% and has a payout ratio of only 27%. The combination of positive cash flows combined with a low payout ratio excites me as a DGI investor, as it indicates the company has tons of room to grow the dividend over time.

Each of the last four years, the company has increased the dividend an average of 10% per year, which makes for a solid selection for any DGI portfolio with a long-term horizon. The prospect of double-digit dividend growth combined with aggressive stock appreciation bodes well for most investors.

Based on the metrics above, the stock currently appears to be overvalued; however, rarely do you get an opportunity to pick up a blue chip stock on sale. One must look at these metrics as a start but they cannot be the sole decision makers. As an investor, one must analyze the true fundamentals of the company combined with their moat and potential growth moving forward to determine if the premium today presents value in the years ahead.

Though AAPL appears to be overvalued, I believe the product innovation will continue in the future, which will propel this stock on an upward trend for years to come. Many bears are negative on the price of the new iPhones being too high, but I believe consumers will still upgrade, the increase in ASP should bode well for not only top line growth but bottom line growth as well. I am a mid-30s investor myself looking to secure my family’s financial future in our later years, as such, my view point is based on a long term horizon, God willing.

I hope everyone enjoyed the article and I look forward to hearing your viewpoints in the comment section above.

Note: I hope you all enjoyed the article and found it informative. If you do not currently follow me and would like to be notified of future articles, please hit the "Follow" button above. As always, I look forward to reading your comments below and feel free to leave any feedback. Happy Investing!

Disclosure: I am/we are long AAPL.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment