(Source: Flickr Creative Commons)

Apple has received a lot of negative attention over last month due to weak [expected] iPhone sales

Apple (AAPL) has been one of the most successful companies over the last few years, which led to the corporation being the most valuable public entity in the world. The success was driven by many factors, but it is clear iPhone played the main role here. Recently, many analysts have started to doubt the future of Apple Corporation due to their concerns related to Apple smartphone. For instance, on January 22 Apple received the second downgrade in just one week, this time from Atlantic Equities, on weakened expectations for Q2 iPhone sales. It is stated "Analyst James Cordwell cites weaker than expected sales for the March quarter with the firm"s revenue estimates now below consensus for Q2 to Q4," which is why the firm went from overweight to neutral on Apple. Previously, Longbow downgraded Apple on January 17, and Nomura lowered its rating to Neutral on December 19.

As a result, the stock continued to trade sideways over the period, raising concerns over its future movement. Hence, the range between $168 and $175 has been maintained over last three months, and the attempt to increase above the channel has not been successful so far.

AAPL data by YCharts

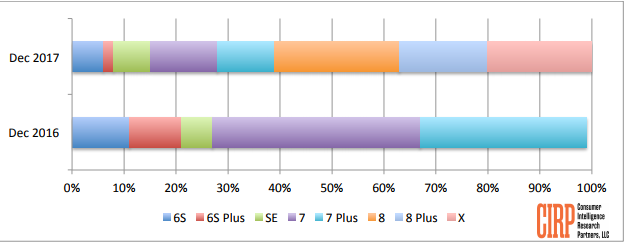

At the same time, when it comes to iPhones, I do not see any objective reason to be so skeptical. An article by Mark Hibben estimates that Apple was likely to sell about 100 million iPhones in December quarter (Apple"s Q1 FY 2018), which would represent 27% increase year on year. If the data regarding product mix provided by CIRP is correct and applicable to the global sales, we can expect about 20 million iPhones Xs sold in the quarter.

(Source: CIRP)

Even if the number itself does not seem impressive to analysts, pricing and currency changes should be taken into account. Let"s suppose Apple indeed sold between 20 million and 29 million (estimated by Canalys) iPhone Xs worldwide, reflecting about 20-29% of the total number. About 40% of phones are represented by the previous models (from 6S to 7 Plus), and their average price was about 10% lower than the average price of these phones a year ago. Therefore, the decrease in the average price of the previous models would lead to the total 4% decrease in smartphone revenue. The price of iPhone X is about 30-40% higher than the average price of the "basic" model (in this case 8 and 8 Plus), which means the total impact on revenue is about positive 7-12%. This very rough calculation alone shows that even if Apple sold the same amount of phones than a year ago, we could expect the revenue generated by iPhones to be 3-8% higher for the quarter year on year.

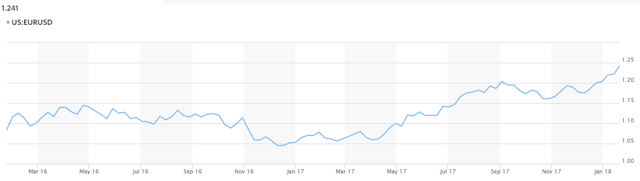

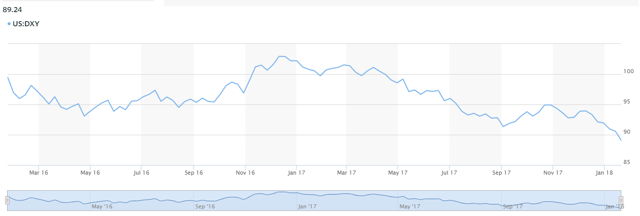

Then goes the currency impact. Statista suggests Apple sells 40% of its phones in Americas, while 60% is generated in the rest of the world. In light of this, a sharp decrease in the dollar index that we have seen over the last year should be very favorable for Apple. The positive currency impact on the total smartphone revenue is likely to be about 3-5%. Regarding European sales, the situation looks even more positive for Apple, as Euro has appreciated by about 14% over last year. For instance, in Germany, the average price of the latest phone models (7 and 7 Plus a year ago and 8, 8 Plus, and X this year) measured in dollars went from $913 (830 EUR multiplied by 1.1) to $1144 (953 EUR multiplied by 1.2). A conclusion seems to be clear here: even with the same level of sales, Apple was likely to generate much higher revenue for the quarter than a year ago.

(Source: MarketWatch)

Overall, although many analysts present the situation with iPhones as terrible, the facts provided above demonstrate that Apple can positively surprise with the upcoming Q1 FY 2018 numbers.

There are several other reasons to stay long AAPL: services and original content, HomePod, autonomous driving, and other

Moreover, iPhone is not the only source of revenue that Apple will rely on in the future.

First of all, services generate a solid amount of money for the corporation, and the growth in this segment is impressive. Hence, in Q4 FY 2017 the services category, which includes the App Store, iTunes Store, Apple Music, Apple Pay, AppleCare, iCloud, licensing, and other services, brought in about $8.5 billion, up 34% year over year.

I believe the growth will likely continue in the future, thus providing Apple with a hedge for its hardware sales. This is supported by the fact that Apple plans to heavily invest in its original content, thus attracting even more users to the platform. The "big jump into original content" is expected to start with Steven Spielberg"s Amazing Stories, a 10-episode series with a budget of $5 million per episode. The big names involved in the production should ensure the high quality of the upcoming content.

This past June, the company hired former Sony Pictures Television heads Jamie Erlicht and Zack Van Amburg to spearhead the effort. While at Sony, the duo oversaw shows like Breaking Bad, so bringing them into the fold can be seen as a sign that Apple understands the type of industry relationships and creative dynamics that are required to develop a robust and diverse slate of television.

Another point is related to HomePod. Apple"s first smart speaker is launching on February 9, and so far the prospects look solid. Even though I do not see the product selling hundreds of millions, it is likely the speaker will gain popularity, since high quality of sound combined with good ecosystem and simplicity should attract many customers.

It is clear smart speakers are quite popular among consumers, evident by Amazon (NASDAQ:AMZN) Echo"s example, which app was the top app for Android and iOS on Christmas day. Notably, more than 10 million Amazon speakers were expected to sell in 2017, although their average price is more than three times lower than $350 of HomePod. In turn, Canalys predicts 56.3 million smart speakers will ship in 2018, "shy of doubling from 2017 sales." If Apple gains at least 10% market share in 2018, revenue from HomePod could amount to about $2 billion, which would be a nice addition to the overall sales.

Finally, autonomous driving is the area which Apple can benefit from. Yes, the level of competition has been increasing rapidly in this segment. I wrote about the topic in detail a year ago, and since then the number of companies involved in the field has at least doubled. However, the market for the technology is huge, which is why many players can coexist there successfully. Significant market size and the increasing popularity of "passenger economy" and ride-hailing apps are the reasons for Apple to invest in the field.

Apple is more than strong financially. DCF analysis shows the stock has room to grow

When it comes to financials, Apple remains to be one of the most solid corporations on the market. The total level of cash of about $270 billion, low debt compared to the level of profitability, and growing net income are the facts that describe the state of things.

There are some concerns related to decreasing margins, but the metric is still better than this of peers or than this of Apple 8 years ago. Besides, the increase in services sales should positively impact Apple"s margins, and therefore, there is no reason to be too skeptical here at the moment.

AAPL Operating Margin (TTM) data by YCharts

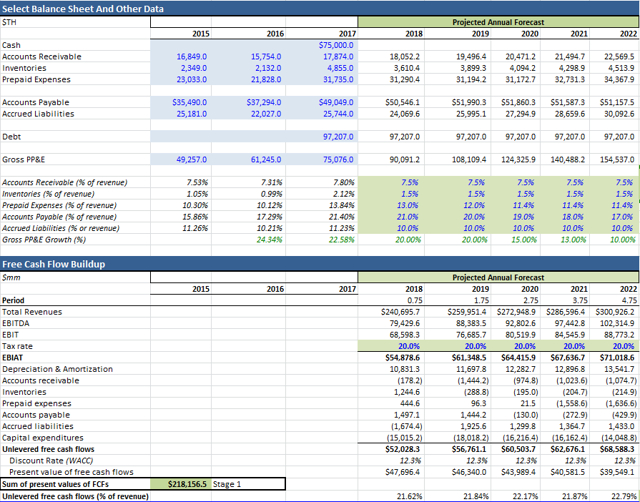

To strengthen the analysis, I use discount cash flow model to value the company.

My analysis is based on the following assumptions:

1. The average annual revenue growth over the horizon period of five years is estimated to be around 5.6%, with a 5% increase in FY 2018 and 8% growth in 2019. I believe the assumptions are relatively conservative, considering the revenue will be boosted by services and new products.

The growth from 2020 to 2022 is expected to be on the level of 5%.

2. EBITDA margin will remain on the level of 33-34%. This should provide a reasonable valuation for cautious investors, since AAPL"s average level of EBITDA margin has been more than 35% over last three years.

3. The average growth of gross PP&E of 18% will reflect a need to ramp up the facilities for developing the autonomous driving technology and other new products.

4. The effective tax rate is estimated to be at the level of 20%.

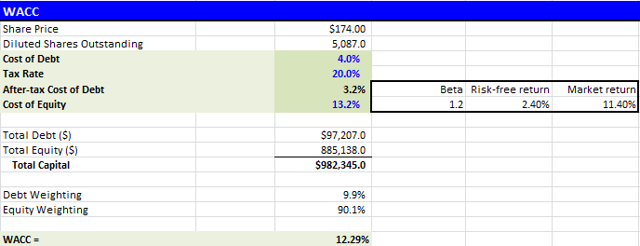

5. Then goes the WACC.

The after-tax cost of debt is 3.2%. The cost of equity capital (13.2%) is calculated using CAPM, with 1.2 beta, 2.4% risk-free rate, which is the current U.S. 10-year bond yield, and 9% market premium. The WACC is, therefore, estimated to be 12.3%.

(Source: the author"s model)

Here is the operating and balance sheet data used in the modeling:

(Source: the author"s model)

As a result, the model shows $925.1 billion equity value under the base scenario, which assumes EV/EBITDA multiple will be at the level of 12 by the end of the horizon period (FY 2022). This level of the multiple is conservative considering current market conditions. In this case, the fair value of the stock is $181.9.

The sensitivity analysis shows a range of possible outcomes that will be driven by actual results of the corporation. In light of this, the fair price range is $175.9-187.8, which represents 1-8% upside potential.

Note that this analysis only takes into account Apple"s most liquid cash ($75 billion). If we incorporated the full level of financial resources possessed by the corporation, the fair price would be even higher.

While some concerns are justified, the stock remains to be attractive for investment

Overall, despite the fact that iPhone will likely face increased competition in the coming years, there is no objective reason to be skeptical about Apple"s future. It was shown in the article that the analysts" concerns over December quarter are exaggerated, since iPhone sales are likely to be higher than expected due to favorable pricing and currency changes. Moreover, such sources of revenue as services and original content, HomePod, and autonomous driving will likely provide a solid hedge for hardware sales.

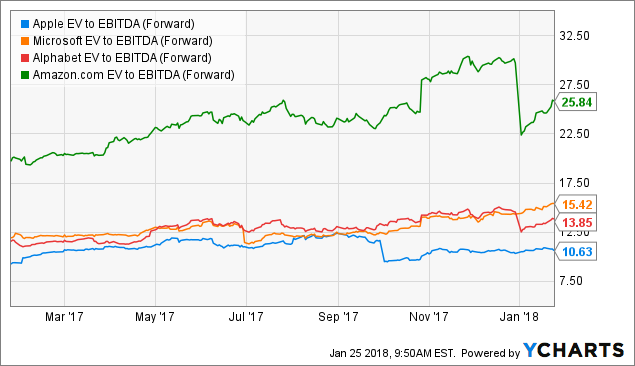

Apple"s valuation remains to be low compared to peers. For instance, its EV/EBITDA ratio is much lower than this of other tech giants, despite the fact that Apple"s cash pile allows the company to diversify operations to many promising segments. Low valuation is also supported by DCF analysis. The model shows the stock is currently undervalued, with 1-8% upside potential.

AAPL EV to EBITDA (Forward) data by YCharts

My detailed analyses of Apple, Microsoft, and other tech companies can be found on my profile page. If you like my article and would like to stay up to date on the next one, you can click the "Follow" button next to my profile.

Disclosure: I am/we are long AAPL.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment