Investment Thesis

The world is accelerating towards an energy crisis, primarily due to back-to-back-to-back years of underinvestment in new energy generation. I keep my finger on the pulse.

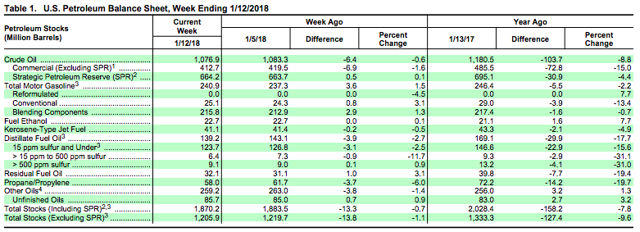

The EIA"s petroleum balance sheet for the week ending January 12, 2018 showed surprising total oil draw:

Although oil market participants focused, as usual, on the Crude Oil inventory draw of 6.4 mb, the Total Stocks (including SPR), my preferred measure, drew an eye-popping 13.3 mb.

Readers should note that this measure now shows a large draw of 158.2 mb from the year-ago period; but more importantly, the vast majority of this draw occurred in the second half of 2017, on top of the significant draws in floating storage throughout the year, as well as inventory draws in other parts of the world.

Second-Level Analysis

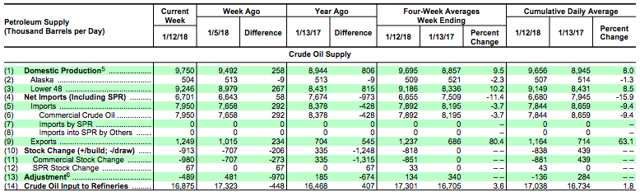

The following table presents the underlying drivers of the inventory draw:

- Lower 48 production strongly recovered from the previous week"s dip, as expected, for a week-over-week gain of more than 250 kb/d;

- crude oil imports jumped by nearly 300 kb/d;

- crude oil exports jumped by nearly 250 kb/d, but remained below what many estimate is needed to close the gap between WTI and Brent crude oil prices; and

- crude oil input to refineries dropped by 450 kb/d, in-line with seasonal trends, as refineries get ready to retool for summer-blend fuels during the time between peak heating oil season and peak summer drive season.

Counter to the above-presented changes, the Adjustment figure, which I discussed in Why The "Adjustment" Does Not Matter, swung by nearly 1 mb/d, proving once again that the data must be taken with a bucket of salt.

Bear Argument

It is important to, not only consider, but be able to articulate the opposing argument as well and ideally better than the opposing side. To that end, I keep an open mind and listen intently to oil bears, as I discussed in Rig Count Is Dead, Or Is It?

Although one part of the bear thesis that rig count would start rising significantly following higher prices has not yet started playing out, it is possible that the existing fleet of onshore rigs can become more productive with ever-lengthening laterals and more efficient use of proppants and completion crews. In order to measure this, I will keep an eye on the number of completed wells in the coming months.

If the U.S. shale industry can somehow more than offset the high depletion rate of shale wells by accelerating innovation, then surging U.S. production could save the world from an energy crisis. I do not, however, believe this is the likely scenario.

Bottom Line

The pace of draws on a global total oil basis, in both visible and less visible inventories, in the last six months has been alarming. It is difficult to see how this trend can normalize from the supply side, as the world accelerates into an energy crisis in the coming quarters.

Readers should consider a diversified portfolio of energy investments for the upcoming period, along with a membership to Value Portfolio, as part of which I discuss specific investments.

Follow For Free Articles

If you enjoyed this article, please click "Follow" next to my name. Your support will allow me to invest further time and resources into creating proprietary research for you.

Premium Research

If you"re interested in my investment methodology and other holdings, join Value Portfolio. I"m confident that you will find my fundamental research to be insightful, and I look forward to discussing ideas with you.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment