By Bob Ciura

Valero Energy Corporation (VLO) is on a tear—including dividends, it has returned nearly 50% in the past one year. With oil prices trending higher, Valero’s margins are improving, and it is rewarding shareholders with huge cash returns. On January 23rd, Valero increased its dividend by 14%, and also announced a $2.5 billion share buyback.

With the dividend increase, Valero now has a 3.3% dividend yield. This is significantly above the S&P 500 Index dividend yield of 2%. Valero is one of 294 dividend stocks in the energy sector. You can see all 294 energy dividend stocks here.

Valero’s fundamentals are improving, and the stock has an appealing mix of dividend yield and dividend growth. After such an impressive rally in the share price over the past year, today might not be the best time to buy, but Valero remains a high-quality holding for dividend growth investors.

Business Overview

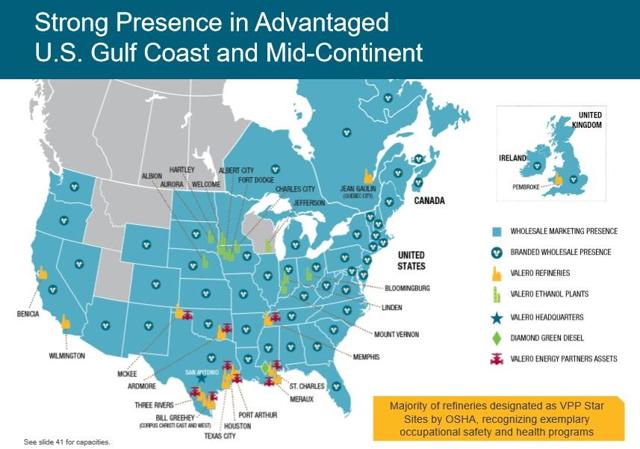

Valero Energy is an oil refiner. It manufactures and markets transportation fuels and other petrochemical products. It an independent petroleum refiner and ethanol producer. The company’s assets include 15 petroleum refineries, with total capacity of approximately 3.1 million barrels per day, along with 11 ethanol plants, with production capacity of 1.4 billion gallons per year. Valero’s petroleum refineries are spread across the U.S., Canada, and the U.K., while the ethanol plants are located in the Mid-Continent region of the U.S.

In addition, Valero owns the 2% General Partner interest, and a majority limited partner interest, in Valero Energy Partners LP (VLP) a midstream MLP. Refining represents about 90% of Valero’s operating income. The company has an impressive network of assets.

Source: January 2018 Investor Presentation, page 4

Valero had an impressive performance to start 2017. The company beat analyst earnings expectations, for both revenue and earnings-per-share, in each of the first three quarters. In the third quarter, revenue of $23.6 billion increased 20% year-over-year, and beat expectations by $4.57 billion. Earnings-per-share of $1.91 beat by $0.08 per share.

Throughput volumes and yields both increased 2% over the first three quarters of 2017. Valero’s adjusted refining operating margin increased 21% in that time, to $3.86 per barrel. The U.S. Mid-Continent region performed exceptionally well, with 92% operating income growth in the first three quarters. Meanwhile, the U.S. Gulf region grew operating income by 5.8% in that period. Valero’s adjusted earnings-per-share increased 31% over the first three quarters of 2017. Going forward, Valero has multiple catalysts for continued growth.

Growth Prospects

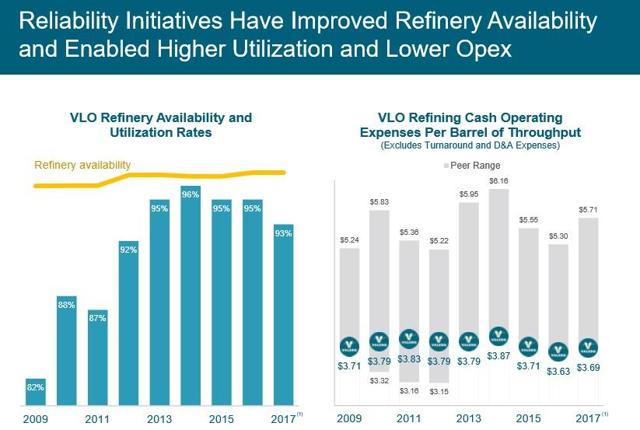

The fundamental backdrop remains positive for Valero. Supplies of domestic crude oil and natural gas are abundant, with production growth across several premier U.S. fields, such as the Permian Basin. At the same time, there is limited spare global refining capacity, which helps keep margins high. Global economic growth continues to support demand, which according to Valero, continues to outpace capacity additions. Valero is seeing improved refining availability, combined with lower operating expenses over the past five years.

Source: January 2018 Investor Presentation, page 8

New projects will fuel growth for the company. Valero maintains a strict 25% internal rate of return hurdle rate, in order to move forward with new refining projects. Valero expects to spend $2.7 billion on capital expenditures in 2018, $1 billion of which will be reserved for growth expenditures. It also expects to continue utilizing $1 billion annually for growth investments, through 2021. Approximately half of growth capital expenditures will be spent on refining projects, with the remaining half on logistics.

Recent project completions include the Diamond Pipeline and Wilmington cogeneration unit, which was completed in November 2017. Other near-term projects currently in development, include the Diamond Green Diesel expansion project, set for completion in the third quarter of 2018. Projects set for completion next year include the Houston alkylation unit, and the Central Texas pipelines and terminals project.

Exports are an additional catalyst for Valero, particularly to Mexico, where the company has had a presence for over 10 years.

Source: January 2018 Investor Presentation, page 10

In the third quarter, Valero announced it had signed long-term agreements with IEnova to use terminals to be constructed at the Port of Veracruz, near Puebla and Mexico City. This will import refined products into Mexico beginning in late 2018.

Dividend Analysis

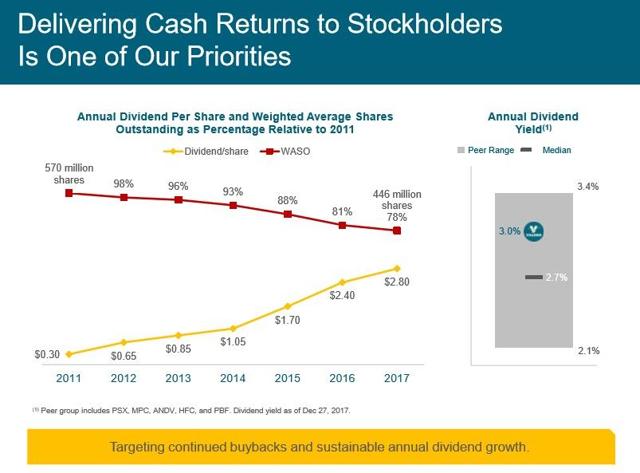

After the recent 14% dividend increase, Valero’s new quarterly dividend rate is $0.80 per share, or $3.20 per share annualized. The stock has a forward dividend yield of 3.3%. It also added $2.5 billion to its existing share repurchase program, resulting in a total of $3.7 billion left in its repurchase authorization. This which represents approximately 9% of the current market cap.

The company has reduced its share count by over 20% since 2011. In that time, it has also increased its annual dividend from $0.30 per share, to $3.20 per share.

Source: January 2018 Investor Presentation, page 13

Valero’s disciplined capital structure allows the company to continue returning cash to shareholders, in good operating climates and bad. Valero has a target payout ratio in a range of 40% to 50% of cash provided by operating activities for 2018. It also maintains a strong balance sheet, with an investment-grade credit rating, and a target debt-to-capital ratio of 20% to 30%. A healthy balance sheet helps Valero keep its cost of capital down, which leaves more cash flow available for dividends and share repurchases.

The only potential problem with buying Valero stock today, is the valuation. On a trailing basis, Valero stock trades for a price-to-earnings ratio of 21.3. This does not seem alarmingly high, since the broader S&P 500 Index trades for an average price-to-earnings ratio of 26.8. However, Valero typically does not trade for a price-to-earnings ratio above 20. According to ValueLine, Valero held an average price-to-earnings ratio of just 8.4, in the past 10 years.

Valero’s earnings growth soared last year, and its stock price followed suit. Investors interested in buying the stock now, have to pay a relatively high price for the company’s strong growth and improved outlook. As a result, this may not be a good time to initiate a new position, or add to an existing position.

Final Thoughts

Refining can be a volatile business. This is certainly a good time to be in the industry. Valero is coming off a great year, and new projects and exports should help continue growth. However, investors should wait for a better buying opportunity. For existing investors however, the stock remains a hold, due to its solid 3.3% dividend yield, and strong dividend growth.

Research has shown that dividend growth stocks, such as the Dividend Aristocrats, have significantly outperformed the S&P 500 in the past 10 years. This is why we developed our exclusive service Undervalued Aristocrats, which provides actionable buy and sell recommendations on some of the most undervalued dividend growth stocks around. Click here to learn more.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment