Source: imgflip

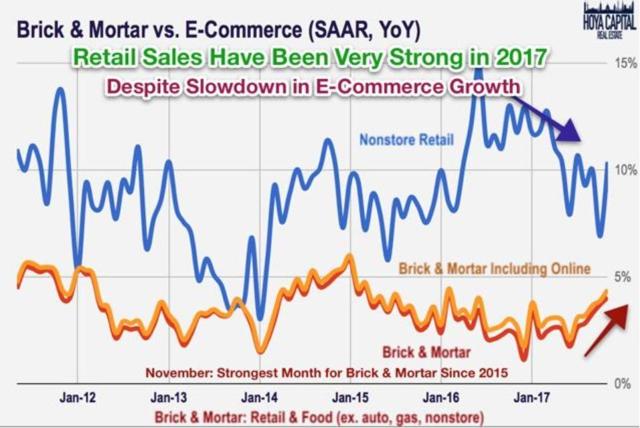

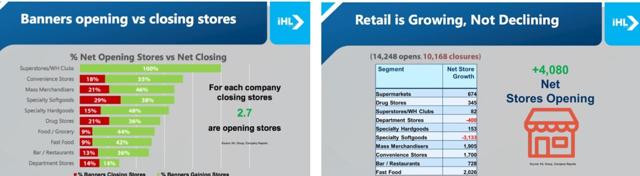

2017 saw the largest number of US retail store closings in history, which the media has dubbed the "retail apocalypse". However, in reality, rumors of traditional retail"s demise are greatly exaggerated.

Source: Hoya Capital Real Estate

In fact, traditional retail sales have been growing around 2% a year since 2005, right alongside the overall US economy. Better yet? In 2017, a strengthening economy meant that brick & mortar retail growth actually accelerated. This is why, despite over 10,000 total store closings, the number of US retail stores actually increased by over 4,000.

Source: Hoya Capital Real Estate

In addition, shopping center REITs as a whole have continued to post slow but steady same-store net operating income or NOI growth throughout this so called "apocalypse".

Source: Hoya Capital Real Estate

The bottom line is that shopping center REITs, like all real estate, are made up of both high, medium, and low quality names. This means that there continue to be Grade A industry leaders with world class management, strong balance sheets, and strong growth prospects.

Let"s take a look at Federal Realty Investment Trust (FRT), which is not just the gold standard in its industry, but arguably one of the best REITs you can own period.

More importantly, thanks to the recent sell-off in REITs, Federal Realty is now trading at some of the most attractive valuations in years. That means that this is likely a great time to add the only REIT dividend king to your diversified high-yield dividend portfolio.

The Undisputed King Of Shopping Center REITs

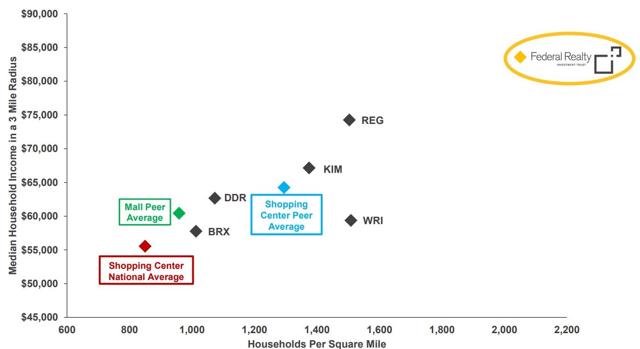

Source: FRT Investor Presentation

Federal Realty Investment Trust may not be a massive REIT, but since its founding in 1962 (making it one of the oldest REITs in the world), it has proven an exceptional ability to make investors rich. It"s done so thanks to its exemplary management team, led by CEO Donald Wood, who took over the top spot in 2002 after serving for four years as COO and CFO.

Specifically, FRT has focused on quality over quantity, being highly selective about only purchasing or developing shopping centers in the nation"s premier property markets. Today, it owns 104 centers making up 24.1 million feet of leasable square footage leased to over 2,800 tenants.

Source: FRT Investor Presentation

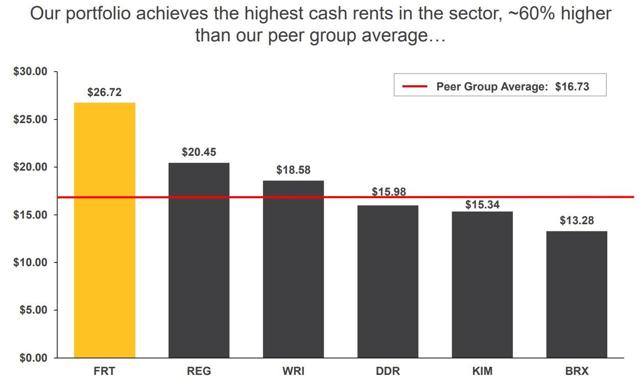

Federal Realty"s centers are located in very high density and very affluent areas, which is why it enjoys the industry"s best average rent per square foot by far.

Source: FRT Investor Presentation

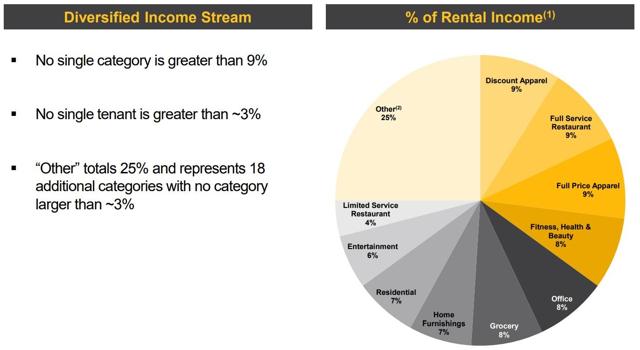

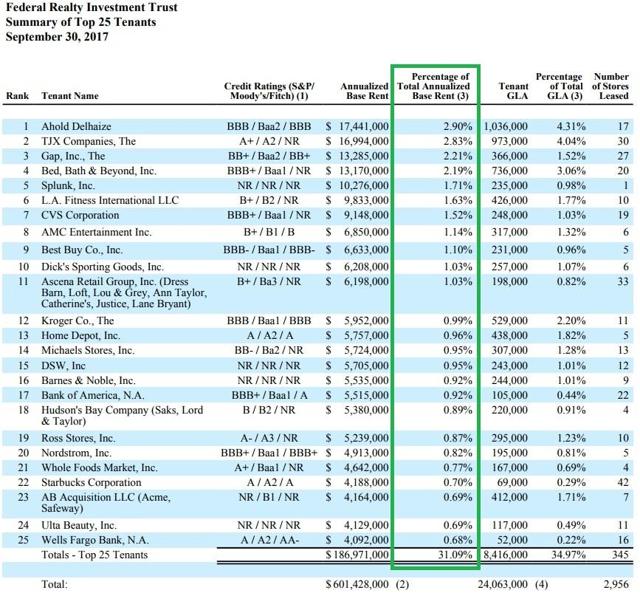

The REIT is also highly diversified by both industry subcategory, as well as tenants, with no customer making up more than 2.9% of annual rent.

Source: FRT Investor Presentation, Earning Supplement

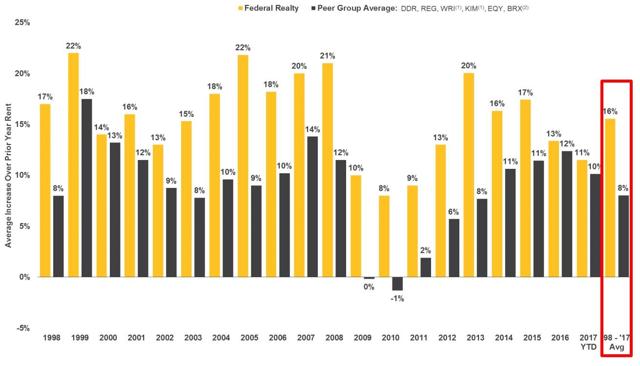

Federal Realty"s focus on top-tier shopping centers located in prime locations also means it has consistently enjoyed the industry"s top lease spreads. This means that FRT is able to obtain higher rents anytime it signs a new lease, whether with a new tenant (if an old one has failed or left) or when renegotiating expiring leases.

Source: FRT Investor Presentation

In the most recent quarter, Federal Realty"s lease spread came in at a very healthy 14%, with 400,000 square feet of space leased at an average rental rate of $38.24 per square foot.

This helped it to achieve same-store YOY operating income growth of 2.6%, 4.4% when including redeveloped properties. And speaking of redeveloped properties, this is the key to the REIT"s strong growth prospects going forward.

That"s because in recent years FRT has been investing into non retail properties, such as offices, hotels, and apartments (it owns over 2,052 rental units).

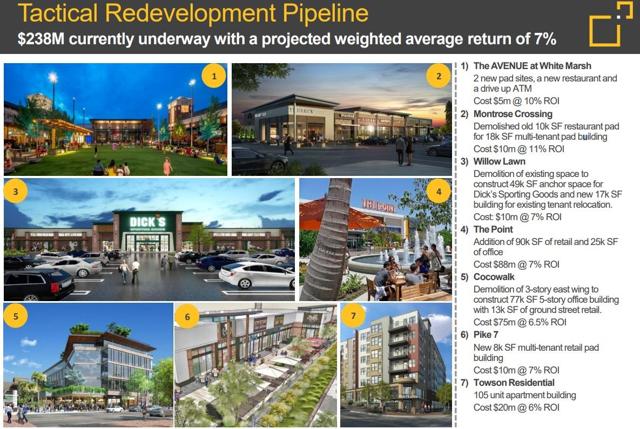

Source: FRT Investor Presentation

In the coming years, management says it wants 20% of rent to come from non retail properties. Not only will this provide greater diversification but because the hotels, offices, and apartments are located on top or near its shopping centers, they help to further drive higher traffic that benefits its tenants. That, in turn, means continued strong leasing spreads.

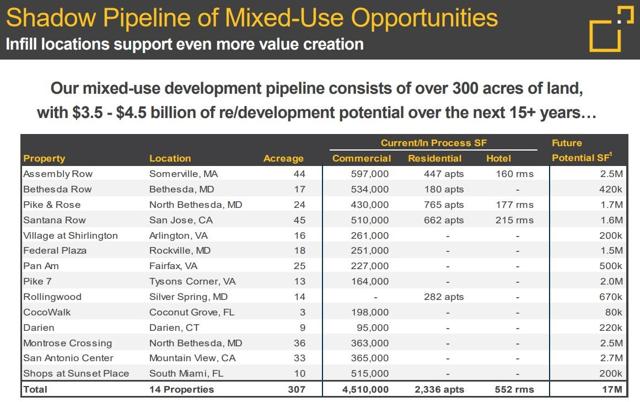

But wait it gets better. Federal Realty"s plans to invest more heavily into non retail means it has a much larger growth market to target in the future, about $4 billion over the next 15 years. The cash yields on these investments are usually about 7% to 8% which is much higher than traditional shopping centers (6.3% cash yield historically).

This brings us to another major competitive advantage, FRT"s industry-leading low cost of capital. This ensures strong AFFO yield spreads (cash yield minus cost of capital) on all its investments.

| Approximate AFFO Weighted Average Cost Of Capital | 2.9% |

| Historical AFFO Cash Yield On Invested Capital | 6.3% |

| Approximate AFFO Yield Spread | 3.4% |

Sources: management guidance, FastGraphs, Morningstar

The low cost of capital is thanks largely to two things. First, the REIT has been very conservative with debt, which is why it has one of the highest investment grade credit ratings in all of REITdom (more on this later).

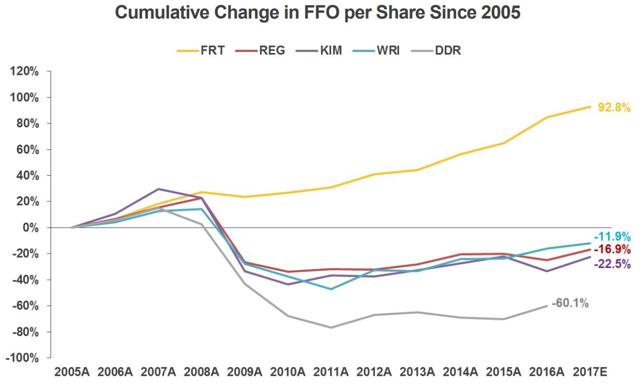

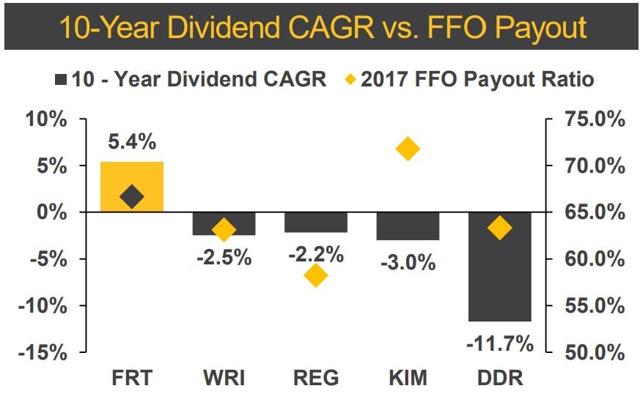

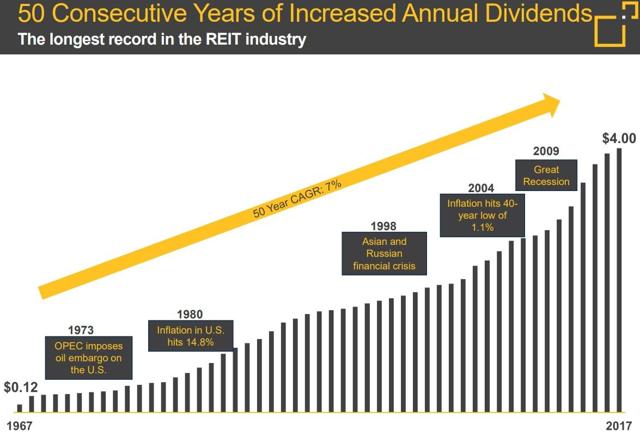

Second, Federal Realty"s track record of successfully adapting to challenging and constantly shifting industry conditions is literally the best in the business. That"s both in terms of growing its funds from operation or FFO (operating cash flow) per share far faster than lower quality rivals, as well as being the only dividend king REIT in the world.

Source: FRT Investor Presentation

Basically, Federal Realty Investment Trust is the bluest of REIT blue chips and the ultimate sleep well at night (SWAN) stock. The disciplined and very shareholder friendly corporate culture has proven to be incredibly resilient which is why the REIT rightfully trades at a substantial premium to its lower quality rivals (more on this in a moment).

However, that premium helps to ensure low costs of equity which allows management to, in concert with retained cash flow and modest amounts of low cost debt, ensure it has ample low cost liquidity with which to grow.

In fact, today FRT"s liquidity (remaining borrowing power + cash) stands at $781 million, which is enough to fund about three years worth of its planned investments.

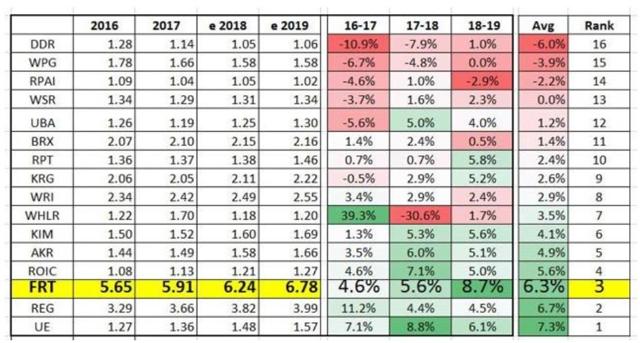

Combined with its existing redevelopment pipeline, as well as its ongoing opportunistic acquisitions, Federal Realty is likely to remain one of the fastest growing shopping center REITs in America.

Shopping Center REIT FFO Growth Projections

Source: Brad Thomas

Or to put another way, Federal Realty is perfectly positioned to take advantage of America"s accelerating economy and rising consumer spending which bodes well for its long-term dividend growth prospects.

Dividend Profile: Excellent Income Growth And Risk-Adjusted Return Potential

| REIT | Yield | 2017 FFO Payout Ratio | 10 Year Projected Dividend Growth | 10 Year Potential Annual Total Return | 5 Year Beta | Risk Adjusted Potential Total Returns |

| Federal Realty Investment Trust | 3.2% | 67% | 5% to 7% | 8.2% to 10.2% | 0.337 | 24.3% to 30.3% |

| S&P 500 | 1.7% | 50% | 6.2% | 7.9% | 1.0 | 7.9% |

Sources: management guidance, GuruFocus, FastGraphs, yCharts, CSImarketing, multpl.com

Ultimately, REIT investing is all about the dividend. That means that investors need to pay particular attention to the dividend profile which is composed of three parts: yield, dividend safety, and long-term growth prospects.

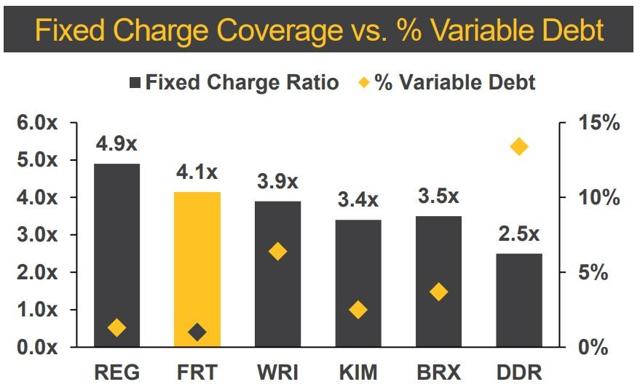

As one might expect from a dividend king, Federal Realty offers a very safe payout courtesy of one of the industry"s lowest FFO payout ratios. But of course, there"s more to dividend safety than just a low payout ratio. One also needs to make sure that a REIT isn"t drowning in debt.

| REIT | Forward Net Debt/EBITDA | EBITDA/Interest | Fixed Charge Coverage Ratio | Debt/Capital | S&P Credit Rating |

| Federal Realty Investment Trust | 5.4 | 5.5 | 4.1 | 56% | A- |

| Industry Average | 5.8 | 3.4 | NA | 62% | NA |

Sources: FRT Investor presentation, earnings supplement, Morningstar, CSImarketing, FastGraphs

Fortunately, Federal Realty always takes a long-term approach to business, which means a highly conservative balance sheet. That includes below average leverage ratio, a very strong fixed charge coverage ratio, and an interest coverage ratio that"s much greater than its peers. The REIT also has the lowest amount of variable rate debt (1%) in the industry.

That leads to one of the strongest investment grade credit ratings of any REIT in America, which is what helps to ensure: very low cost of capital, a high cash yield spread on new investments, and strong long-term growth.

Better yet? Like most REITs, Federal Realty is a low volatility stock. In fact, over the past five years, it"s been 66.3% less volatile than the S&P 500. This makes it an excellent choice for low risk investors, such as retirees.

All told, Federal Realty"s long-term dividend growth potential of 5% to 7% means that it should be capable of about 9.2% annual total returns. That may not seem very exciting, but you need to keep two things in mind. First, given the overheated valuations of the S&P 500 today, FRT should be able to beat the market over the next decade. And given its status as one of the highest quality REITs in the world, as well as its low volatility, this means it offers far superior risk-adjusted total return potential.

In addition, this Grade A industry leader, which is rarely on sale, is now trading at the most appealing valuation in about four years.

Valuation: Still Not Cheap But Worth Buying At Fair Value

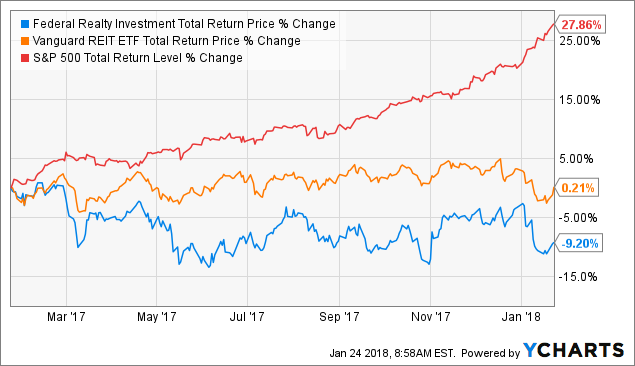

REITs have had a rough year, basically returning nothing while the red hot S&P 500 has gone parabolic. Federal Realty meanwhile has done far worse. However, while some might see that as a sign to stay away, I view it as a potentially good buying opportunity.

| REIT | P/AFFO | Historical P/AFFO | Yield | Historical Yield |

| Federal Realty Investment Trust | 21.1 | 19.2 | 3.2% | 3.0% |

| Industry Median | 11.0 | NA | 5.3% | NA |

Sources: Hoya Capital Real Estate, FastGraphs, GuruFocus

Now it"s important to keep in mind that on a price/FFO basis, FRT is nowhere near "cheap". After all, it is still trading at a huge premium to its peers, as well as higher than its historical norm.

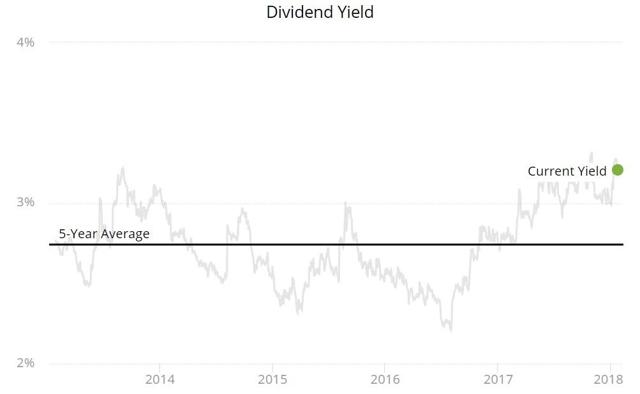

However, as a dividend focused investor, I generally like to compare a stock"s yield to its historical norm, and here things look a lot better. Specifically, Federal Realty"s yield is now slightly above its 13-year median and compared to its five-year average yield, it looks like a potentially good buying opportunity.

Source: Simply Safe Dividends

Of course, backwards looking valuation metrics can only tell us so much. After all, profits and dividends come from the future. This is why I like to use a long-term discounted dividend model to estimate a stock"s fair value based on the net present value of its future payouts.

| Forward Dividend | 10 Year Projected Dividend Growth | Terminal Growth Rate | Fair Value Estimate | Dividend Growth Baked Into Current Share Price | Discount To Fair Value |

| $4.00 | 5% (conservative case) | 3% | $106.74 | 4.5% | -17% |

| 6% (likely case) | 4% | $123.11 | -1% | ||

| 7% (bullish case) | 5% | $146.69 | 15% |

Sources: FastGraphs, GuruFocus

I use a 9.1% discount rate because since 1871 this is what a low cost S&P 500 ETF would have generated, net of expenses. Thus I consider this the opportunity cost of money.

However, because any discounted cash flow model requires estimating the smoothed out future growth rates, there is a large amount of inherent uncertainty associated with this approach. This is why I use a variety of what I consider to be realistic growth models, preferably based on long-term management guidance. In this case, FRT expects to grow FFO/share at 5% to 7.25% a year over the long-term.

When we run the figures, we find that indeed Federal Realty doesn"t appear undervalued. Based on my best estimate of its most likely growth scenario. In fact, I estimate that the stock is pretty much at fair value right now.

However, under the Warren Buffett principle of "better to buy a wonderful company at a fair price than a fair company at a wonderful price", purchasing FRT is still potentially a good idea. That is assuming you understand the risks associated with the stock, especially the realities of its interest rate sensitivity.

Risks To Consider

There are three risks I think are worth considering before buying Federal Realty Investment Trust.

First, while the REIT does have excellent diversification of its rent in terms of tenants, it is worth noting that some of its largest customers are indeed struggling.

For example, The Gap (GPS), and Ascena Retail Group (ASNA) have been struggling in recent years not just with declining sales in weak stores but with an overall decline in their brands. Similarly, LA Fitness, while e-Commerce proof, is facing increased competition from smaller boutique gyms.

Now keep in mind that none of these tenants represent a substantial amount of rent, so FRT"s dividend safety isn"t likely to be put at risk even if they were to fail entirely. However, in the event of continued decline, it could take some time for management to find new tenants to replace them which could result in short-term FFO/share growth weakness that could hurt the short-term dividend growth rate and share price.

Another potential risk to keep in mind is that Federal Realty isn"t a large enough REIT to fully fund its various growth endeavors. For example, its redevelopment pipeline largely represents joint ventures and partnerships with other developers that means that there is a risk that some of its projects might end up being delayed or even canceled if some of its partners fall upon hard financial times.

Finally, we can"t forget that diversifying into non retail properties can be a double-edged sword. That"s because FRT has the most experience in traditional retail, and developing office, hotel, and apartment real estate is not exactly in management"s wheelhouse.

And since real estate development is a highly complex and localized endeavor, there is no guarantee that FRT will be able to finish its projects on time or on budget. That might mean it fails to hit its 7% to 8% cash yield targets on its redevelopment pipeline which could result in FFO/share growth missing its long-term targets.

What about interest rates? That"s certainly one of the biggest things that REIT investors worry about which is understandable given that REITs can, at times, be highly interest rate sensitive.

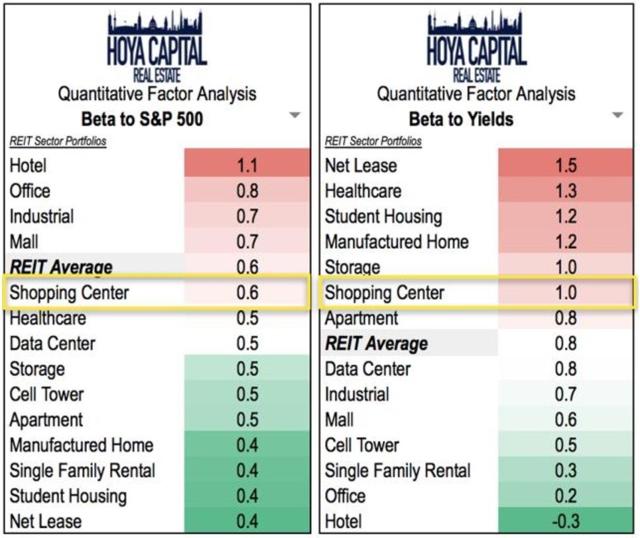

Source: Hoya Capital Real Estate

Usually, there is an inverse relationship between a REIT"s beta to the S&P 500 (volatility relative to the market) and beta to a REITs" yield compared to 10-year Treasury yields.

This is because a REIT"s beta (to the stock market) generally is lower the longer the leases are. This makes intuitive sense since the longer the leases the more stable the cash flow that funds the dividends.

However, longer leases also mean slightly higher inflation risk. That"s because, while rental escalators generally have inflation baked into their formulas, the exact formula is fixed until a new lease is signed or an existing one renegotiated.

The good news is that FRT"s 8.2-year weighted average remaining lease duration is not that large, which explains why its beta to yield is slightly below the industry average.

Source: Hoya Capital Real Estate

Keep in mind that beta to yield (interest rate sensitivity) is cyclical. This means that short-term price sensitive investors, such as those that retiring soon and plan to use the 4% rule, need to understand that there is a real risk of potentially losing money in any REIT if long-term rates spike and you are forced to sell at the bottom.

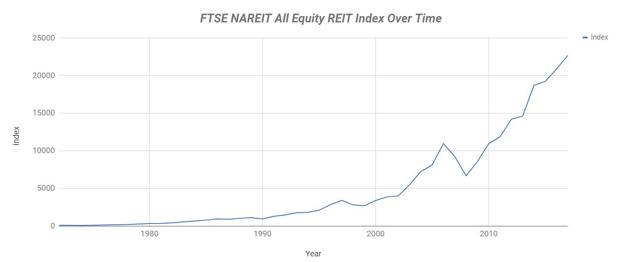

But don"t let that scare you away from REITs entirely because historically, commercial real estate has been an excellent long-term income and wealth compounder.

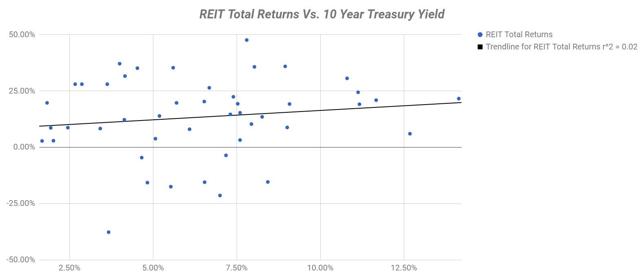

That"s because REIT interest rate sensitivity is both cyclical and mean reverting. That means that over the past 45 years, the actual correlation between REIT total returns and 10-Year yields (proxy for long-term rates) is effectively zero (actually slightly positive).

Sources: NAREIT, St. Louis Fed

Note that the R Squared of 0.02, which indicates that since 1972, 10-Year Treasury yields have explained just 2% of REIT total returns. Basically, this means that, over a long enough period of time, REIT investors should not worry about rates at all. That"s because they are largely irrelevant to long-term total returns.

For example, since 1972, equity REITs have increased in value 85% of the time only suffering 7 down years in the past 45 years.

This includes times where interest rates hit all-time highs (10-year Treasury Yield 16% in September 1981). In fact, here"s how equity REITs did as a sector between 1972 and 1990. This was during the fastest period of interest rates in US history as well as a period of steadily declining Treasury yields.

| Year | 10-Year Yield (Start Of The Year) | Equity REIT Total Return |

| 1972 | 6.09% | 8.0% |

| 1973 | 6.54% | -15.5% |

| 1974 | 7.0% | -21.4% |

| 1975 | 7.53% | 19.3% |

| 1976 | 7.80% | 47.6% |

| 1977 | 7.4% | 22.4% |

| 1978 | 7.94% | 10.3% |

| 1979 | 8.95% | 35.9% |

| 1980 | 11.13% | 24.4% |

| 1981 | 12.68% | 6.0% |

| 1982 | 14.14% | 21.6% |

| 1983 | 10.8% | 30.6% |

| 1984 | 11.67% | 20.9% |

| 1985 | 11.17% | 19.1% |

| 1986 | 9.08% | 19.2% |

| 1987 | 7.18% | -3.6% |

| 1988 | 8.26% | 13.5% |

| 1989 | 9.01% | 8.8% |

| 1990 | 8.43% | -15.4% |

Source: NAREIT, St. Louis Federal Reserve

In fact, since 1972, equity REITs have handily beaten the S&P 500, on both an absolute and inflation-adjusted basis.

| Asset Type | 45 Year Annual Total Return | 45 Year Inflation Adjusted Annual Total Return | Growth Of $10,000 In Inflation Adjusted Dollars |

| Equity REITs | 12.8% | 6.4% | $409,583 |

| S&P 500 | 10.6% | 8.6% | $163,070 |

Sources: NAREIT, Moneychimp.com

How is that possible? Because the current narrative that "REITs are bond alternatives" is incorrect. Bonds are fixed coupon assets, whose value is purely derived from: remaining duration, the coupon payment, and current interest rates (usually inflation expectation driven).

Equity REITs, on the other hand, are growing organizations whose management adapts over time to varying industry and economic challenges to keep its property base, cash flow, and dividends growing.

But what about costs of capital? If rates are high, then debt is expensive, and so REITs can"t grow profitably, right? Actually not true, because if rates are very high then cap rates are low and so cash yields on new acquisitions are also higher.

In addition, REITs match their debt duration to their lease duration, thus minimizing cash flow (and profit) sensitivity to interest rates.

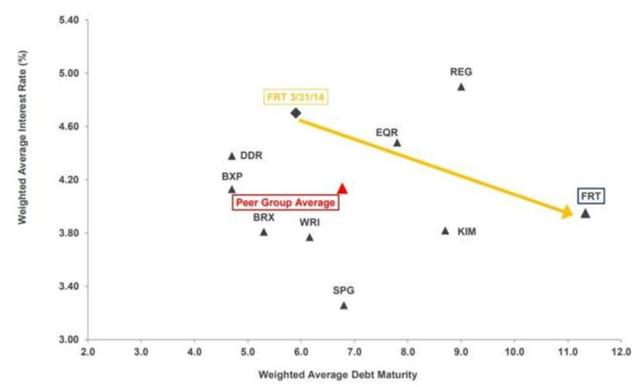

Source: FRT Investor Presentation

For example, 99% of Federal Realty"s debt is fixed, and over the past three years, it"s managed to both refinance at lower rates. More importantly, the REIT has refinanced for longer bond duration than its weighted average remaining lease duration of 8.2 years.

Or to put it another way, FRT makes sure that the spread between cash yield on invested capital and its cost of capital is fixed. This ensures that its profitability on new investments is constant, no matter what rates are doing.

What happens after the bonds mature though and interest rates are much higher? Well, that"s where people fail to appreciate the beauty of REITs; specifically that REITs are good inflation hedges.

This is because interest rates are usually high when the economy is strong and thus, inflation is usually higher. REITs are able to thus offset rising inflation via higher rents.

Basically, when FRT"s bonds do mature if interest rates are significantly higher than they were when the bond was sold, the new rental rate it can obtain on the property it purchased with the debt will rise as well. Thus, the cash yield spread on invested capital remains highly stable over time.

This explains both how REITs in general, and Federal Realty in particular, have been able to so consistently compound investor wealth over time; in all manner of economic and interest rate conditions.

Source: NAREIT, Index = 100 in 1972

Bottom Line: Federal Realty Investment Trust Is The Ultimate SWAN REIT And Potentially Worth Buying Today

Please don"t get me wrong, I"m not saying the Federal Realty Investment Trust is necessarily a screaming bargain right now. Nor am I predicting that this is the bottom for this REIT or any other. After all, no one can predict short-term stock prices and it"s certainly possible that FRT and REITs, in general, might have a bad year if interest rates rise sharply.

However, knowing that interest rates are NOT a threat to REITs in the long-term, what I ultimately care about is buying the top quality and time-tested names in a growing industry. That means dividend stocks with: strong balance sheets, growing cash flows and dividends, and a proven ability to adapt over time to grow in any economic, interest rate and political environment.

Federal Realty Investment Trust is unquestionably a Grade A SWAN stock that offers all of these features. And with the price now at fair value (something that"s rare for a stock of its caliber in an overheated market), I have no qualms about recommending it to anyone looking for a highly safe and steadily growing income stream.

In fact, should FRT remain at current prices (or fall) in the coming weeks, I plan to add it to my own high-yield retirement portfolio.

-----------------------------------------------------------------------------------

Studies show that most investors have underperformed the stock market by about 80% over the past 20 years due to a large number of mistakes, including market timing, improper portfolio structure, and poor stock selection.

Investor In the Family And Seeking Alpha are proud to bring you the 2018 Do It Yourself Investing Summit from Jan. 22nd to Jan. 26th. This summit brings together 21 of Seeking Alpha"s top investing minds (including yours truly) to highlight numerous priceless: investing principles, as well as ideas and tips about the market, economy and individual stocks for 2018.

I hope you"ll join us for this can"t-miss event and gain access to this treasure trove of knowledge that can ultimately save you a lot of: time, money, and can help you to achieve your financial dreams.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment