Apple (AAPL) has not lived up to the high expectations of Wall Street in the 10-year anniversary of iPhone. All reports point to rapidly slowing sales in iPhones, which as a segment contributes 70% of the total revenue of Apple. It is highly possible that Apple could end this fiscal year with under 200 million unit shipments of iPhones. Last fiscal year, it stood at 216 million. Even the ASP bump due to a weaker dollar will not be sufficient to sustain Apple"s stock price at the current level. Investors should be ready for a bearish momentum in the stock as Apple declares its Q2 earnings.

Few fundamental bright spots

Apple has not been able to show good results in the fundamental metrics of the company. Most of the bullish thesis for Apple from different analysts talks about tax reform, buybacks, the benefit to EPS, and other non-company related issues. We know that Wall Street rarely rewards a stock that has only non-fundamental issues in its favor. IBM is a perfect example why investors should be wary about EPS growth based on buybacks.

Apple"s poor results are not limited to the iPhone segment. HomePod"s bad reception will become an even bigger issue as the duopoly of Amazon (NASDAQ:AMZN) and Google (NASDAQ:GOOG) increase their grip on the voice assistant and home entertainment segment. Tim Cook has been repeating himself about Apple"s product pipeline for the past five years. Five years back, he said it is "chock full" of "incredible stuff". This claim has been reiterated several times but the end result has not been successful. At the same time other competitors, including Chinese OEMs, have been closing their distance with Apple.

Apple still makes 70% of its total revenue from iPhones. This makes the company overwhelmingly dependent on the fluctuations in sales of a single product. Most of the bullish run of 2017 was in the expectation of a big "Supercycle" in the iPhone segment. This has certainly not happened. It is also turning out to be quite a negative performance. The recent news report about lower sales from Apple suppliers shows that we could easily see a mid-single digit decline in unit shipments of iPhones in this fiscal year.

In fiscal 2017, Apple delivered 216 million unit shipments of iPhones and a cautious projection for this fiscal would put the forecast in the sub-200 million range.

But why is this so important?

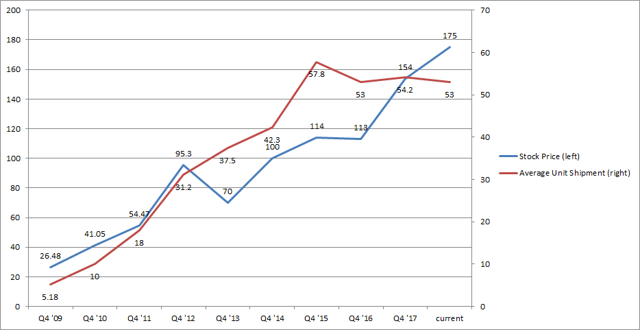

Apple"s stock has closely followed the performance of its iPhone segment. We can see this by comparing Apple"s stock price along with average quarterly unit shipments of iPhones for the past ten years.

Fig: Apple"s stock price and average quarterly unit shipments. Source: Apple Filings. Chart by Author

Apple was able to recover from a major dip in 2012 because of good growth in iPhone shipments. It can be clearly seen from the chart that during that period Apple"s stock was heavily undervalued. However, after the recent bull rally along with poor performance in this iPhone iteration, the stock has become overvalued according to this metric. It should be noted that for the current fiscal year, I have taken an average quarterly unit shipment projection of 53 million or 212 million for fiscal 2018.

If iPhones shipments end up falling below the 200 million mark, the gap between Apple"s current stock level and the performance of its most important segment will further widen.

Don"t put all eggs in the Services basket

The usual comments I have seen in every article on Apple is that the Services segment will make up the difference of performance in the iPhone segment. The numbers behind this show that it would be very difficult for the Services segment to make up for any slack in the iPhone segment, at least for the next few years.

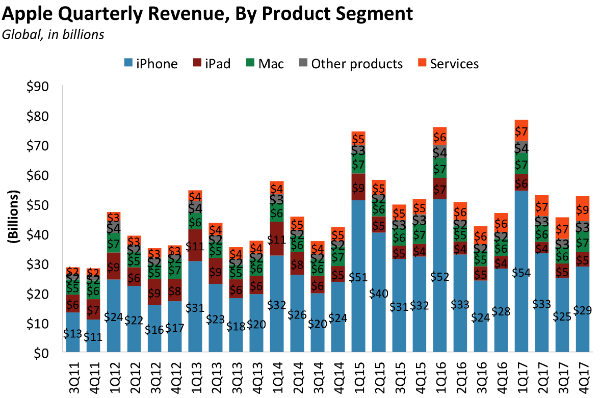

Fig: Apple quarterly revenue by segments. Source: Apple filings

In fiscal 2017, Apple made $141 billion from its iPhone segment, whereas the Services segment contributed $30 billion and Other Products contributed another $13 billion. Hence, cumulatively the Services and Other Products segments make up less than one-third the revenue base of iPhone. This means that even if we see a 7% decline in iPhone revenue, the Services and Other Products segments will need to grow by 23% just to make up for the revenue loss.

A fall in iPhone unit shipments also hurts the overall ecosystem, on which Services and Other Products are heavily dependent.

So when do we see a correction?

This is the million dollar question (Maybe more).

Fig: Trailing 12-month PE ratio of Apple

Just two years back, Apple was trading at under 10 times its ttm PE ratio. No one has a crystal ball but it is difficult to see Apple trading at the current all-time high considering the series of negative reports we have heard about Apple.

Apple"s average earnings estimate for the current year and next year are:

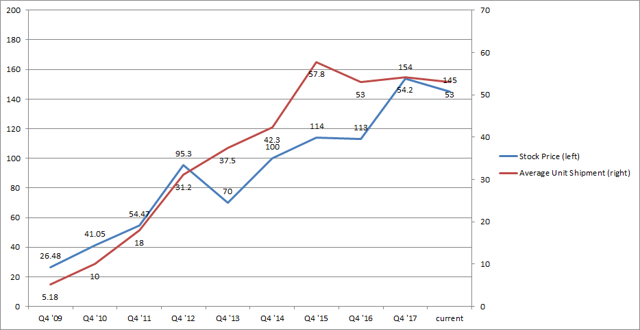

Average EPS estimate for fiscal 2019 is $13.2. Giving a valuation multiple of 11 would give Apple a price target of $145. This price level would give investors a decent margin of safety against future "iPhone shocks" and also give a better dividend yield, which has fallen to its lowest level. A $145 price target also eliminates the valuation gap according to the first figure shown above.

Fig: Apple"s stock price and average quarterly unit shipments with price target of $145. Source: Apple Filings. Chart by Author

Investor Takeaway

The continuous negative reports on Apple will end up leading to a correction in the stock price, sooner instead of later. The current price level is at least 20% overvalued, as iPhone sales continue to slide for the remaining quarters of this fiscal year. It would be naive to put too much faith in the Services and Other Products segments lifting Apple"s revenue, as they are still relatively at a very low level.

A fall in iPhone shipments also puts a question mark on Services growth rate. A mid-single digit fall in unit shipments in iPhone will end up giving sub-200 million iPhone shipments in fiscal 2018. Apple"s stock should see a correction once the unit shipment numbers of Q2 quarter are declared. This should allow analysts to recalibrate their projections for the current fiscal year. If Apple does not see tariff reductions in the trade negotiations started by the current administration, we should see a major correction in the stock.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment