This Tuesday in Chicago, Apple (AAPL) unveiled its new, most inexpensive iPad model geared primarily towards K-12 students. In this article, I explore the impact that the new device might have on the Cupertino company"s future financial results. I conclude (spoiler alert) that, while not a game-changer for the investment thesis, the new tablet model can only be beneficial to Apple as the device maker tries to regain relevance in a market that it has long lost.

Source: Recode

The return of the iPad

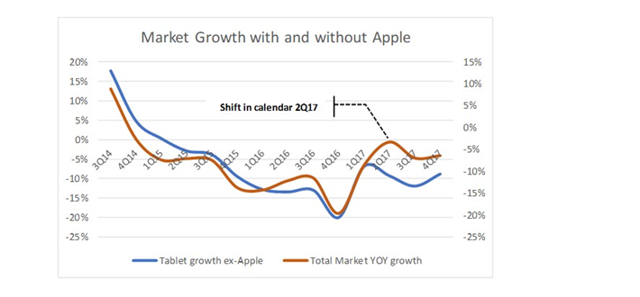

Contrary to the more pessimistic projections, including my own that predicted Apple"s tablet sales fizzling out over time as the iPods have, the iPad is in the early stages of an unexpected comeback. The graph below illustrates how, even though tablets in general have not experienced positive growth in units shipped since 3Q14, Apple"s device has separated itself from the crowd and now controls nearly 30% of the market (vs. only 22% in calendar 3Q16).

Source: DM Martins Research, using data from IDC

Also notice in the graph above that Apple"s fortune began to change in calendar 2Q17. Not coincidentally, that was exactly when the company introduced its low-end, $329 iPad that allowed Apple for the first time to compete in the mid-tier space and fight for pocket share of budget-conscious consumers.

So what?

I would characterize the spike in iPad sales early in 2017 as an expansion in Apple"s total addressable market. Instead of the high-end tablet that only the more affluent users could afford, the Cupertino company finally had something compelling to offer to a larger chunk of the tech gadget consumer base.

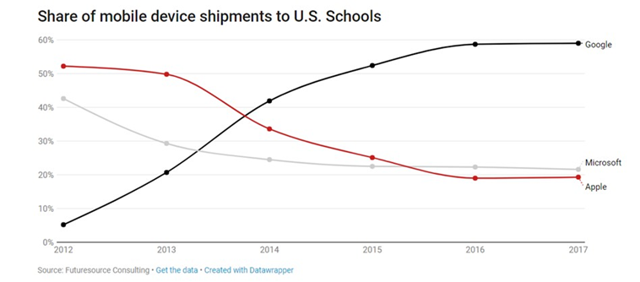

Yesterday"s launch of the new iPad, which retails at an even lower $299, sounds to me like a similar move. This is not to say that the iPad has not already penetrated the K-12 space. At one point not too far in the past, it actually led this market. But as the graph below illustrates, Apple has become nearly irrelevant at U.S. schools, trailing Alphabet (GOOG) (GOOGL) domestically and Microsoft (MSFT) internationally by a very wide margin.

One might argue that Apple has already lost the education market, rendering the company"s new product introduction all but useless. The recent trends seem to point at this logical conclusion, at first glance. But I believe the exact opposite is true: because Apple has become the underdog in the K-12 space, it has quite a bit of room to go until it recaptures at least part of this market. Let"s look at the following numbers, provided by FutureSource Consulting:

Global sales of Mobile PCs into the K-12 market increased in 2017, with annual shipments growing 11% year-on-year, reaching 29.2 million units, up from 26.3 million in 2016. The outlook for 2018 is positive, with volumes forecast to grow 20.3% to reach 18.7 million globally

Although the figures above speak to sales of mobile computers in general, I think the education market for tablets will perform much better than the overall average -- I believe tablet sales in general could very well continue to contract in 2018. Some of the same drivers of increased mobile device demand at schools, including the expected roll out of large scale national projects outside the U.S., are likely to support tablet sales as well.

If I assume that Loup Ventures is correct in its estimate that up to 15% of iPad sales are education-related (i.e., about 6.5 million of the total 43.8 million devices sold in fiscal 2017), then I calculate that each 1% gain in global market share at an ASP of $300 would represent nearly $100 million in additional annual iPad sales. Recouping market leadership and capturing the same 50% from 2013, certainly not an easy feat, would mean an extra $3 billion in tablet-related revenues for the Cupertino company each year.

Parting words

I doubt that Apple"s launch of its new iPad will do much to increase revenues or earnings substantially in the foreseeable future. But at the same time, I believe that the new product can only be a positive catalyst, even if a nearly immaterial one to some. For one, selling into the education market is unlikely to be cannibalistic of Apple"s other product offerings (think of iPhone X vs. iPhone 8 as an example of strong adoption of the former usually meaning weak demand for the latter). And aside from short-term benefits, introducing the iOS ecosystem to a wider young audience can have very positive consequences much farther down the road.

In the end, I do not think that the new iPad changes or adds much to Apple"s investment thesis. But I remain at least as bullish about AAPL today as I have been prior to this most recent product refresh.

Note from the author: If you have enjoyed this article and would like to receive real-time alerts on future ones, please follow D.M. Martins Research. To do so, scroll up to the top of this screen and click on the orange "Follow" button next to the header, making sure that the "Get email alerts" box remains checked. Thanks for reading.

Disclosure: I am/we are long AAPL.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment