With it being Easter weekend, I thought it was the perfect time to write about one of my favorite sayings that holds true especially when investing. And investing in REITs even more so.

“Don’t put all your eggs in one basket.”

I often tell this to my kids before we kick off our annual Easter egg hunt in our backyard. They’re eager to fill a container with as many plastic eggs as they can find scattered across the yard. In some of the eggs, I’ve hidden a couple dollars. Others might have pieces of candy inside. Anyway, I’ll warn them: “Don’t put all your eggs in one basket.”

It never fails that, as they sprint around our backyard, their baskets get so full that eggs go flying everywhere. By piling the containers so high, my kids risk losing what might be some of the most prized eggs inside. A more strategic approach could be to carry the eggs in different ways - stuff them in pockets or in a separate pouch. But I digress.

So, how does the same concept hold true for investing in REITs?

Well, if you’re just now beginning to familiarize yourself with the sector, you’ll find a multitude of options. And I cover many of the sub industries. You’ll see industrial REITs, healthcare, retail, office, lodging, residential, self-storage, data center and infrastructure, to name some of the most well-covered classes.

Every year, as a REIT analyst and an investor myself, I’ll see certain sectors outperform others, but it’s always changing. Retail might not be so hot, but industrial could be on fire. The next year, health-care REITs could dominate with their growth. A lot of the fluctuations hinge upon what we read about in the papers every day: public policy changes, new tax reform, demographic evolutions.

That said, one can easily see why it’s smart to - over the long term - pick a number of these sectors, and some of the top-performing players within each. Alas, the biggest lesson of all, and a widely utilized risk management technique, is called DIVERSIFICATION.

Simply put, diversification strives to smooth out risk in a portfolio so the positive performance of some investments neutralizes the negative performance of others. Therefore, the benefits of diversification hold only if the securities in the portfolio are not perfectly correlated.

It’s true that many non-institutional investors have a limited investment budget and may find it difficult to create an adequately diversified portfolio. This fact alone is why many mutual funds and ETFs have been increasingly popular. In case you missed it, check out my article on Vanguard Real Estate ETF (NYSEARCA:VNQ).

Of course, many of you following me here on Seeking Alpha (I’m closing in on 50,000 followers - thank you!) read my articles because they want to outperform. After all, the name of the website you are reading is Seeking Alpha.

So, as a special Easter weekend treat I am going to provide you with 3 of my favorite “SWANs”, and while you should always attempt to accomplish diversification, remember that no matter how diversified your portfolio is, risk can never be completely eliminated.

You can reduce risk associated with individual stocks, but general market risks affect nearly every stock, and so it is important to diversify among different asset classes. The key is to find a happy medium between risk and return; this ensures that you can achieve your financial goals and SLEEP WELL AT NIGHT!

On Monday, I plan to publish the April edition of the Forbes Real Estate Investor (newsletter) and included is an article on the “Sweet 16 REITs”. I hand-picked 3 of my favorite REITs for this article, and you will have to read the newsletter on Monday to find out which REIT is laying the golden eggs.

W.P. Carey (WPC) is an easy pick for the basket. The company has never cut its dividend, and in fact, it has paid and increased its dividend for over 20 years in a row. The company recently increased the dividend (Q4-17) by over 7.4% (over the previous quarter).

These results demonstrate WPC’s commitment to maximizing long-term shareholder value as the company increased earnings while improving both the quality of the portfolio and the composition of the revenue stream. WPC also maintains a conservative payout ratio of 76%.

With close to 70% of ABR coming from leases linked to CPI, WPC has a built-in hedge against inflation, a differentiating factor among net lease REITs that is underappreciated by investors (approximately 95% of leases have either fixed or CPI-based contractual rent increases, with virtually no exposure to operating expenses).

WPC’s properties are located primarily in the U.S. and Europe. The company has subscribed to the view that U.S. retail real estate is overbuilt; it has had little such exposure for years. Instead, the company has been investing internationally for 19 years, primarily in western and northern Europe.

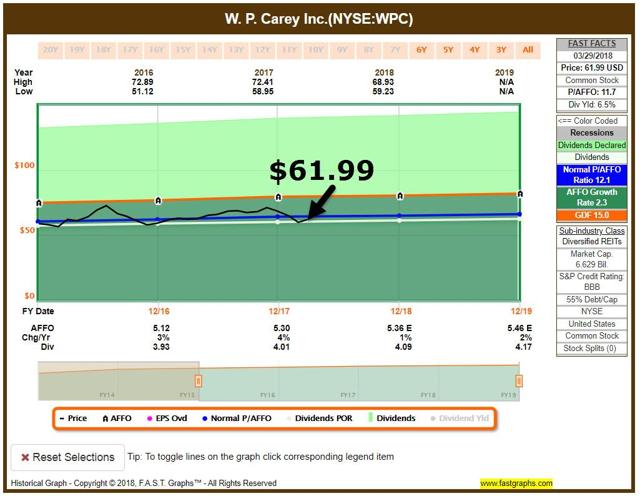

WPC has returned -8.6% YTD and shares are now priced at $61.99. The company’s P/FFO multiple is 11.7x (below the 2-year average of 12.1x). As noted above, the dividend is well-covered and the dividend yield is 6.5%.

Tanger Factory Outlets (SKT) is the only “pure play” outlet center REIT, with a portfolio of 44 outlet centers in the U.S. (22 states) and Canada.

Comparing Tanger to Simon Property (SPG) or CBL & Associates Properties (CBL) is not an apples to apples comparison. On a relative basis, high-quality mall REITs currently have easier sales comps than Tanger, since their prior period sales were down due to the negative impact of reduced international tourism due to the strong dollar.

Tanger continues to have the lowest cost of occupancy among all public Mall REITs and most of the company"s tenants report that outlet stores remain one of their most profitable and important retail distribution channels.

To maintain the strong and flexible leverage profile, Tanger prefers to use internally generated cash to fund any further purchases under the share repurchase program. The redemption make-whole premium and the completion of the two projects that will open later this year will consume the remaining cash flow for the balance of the year.

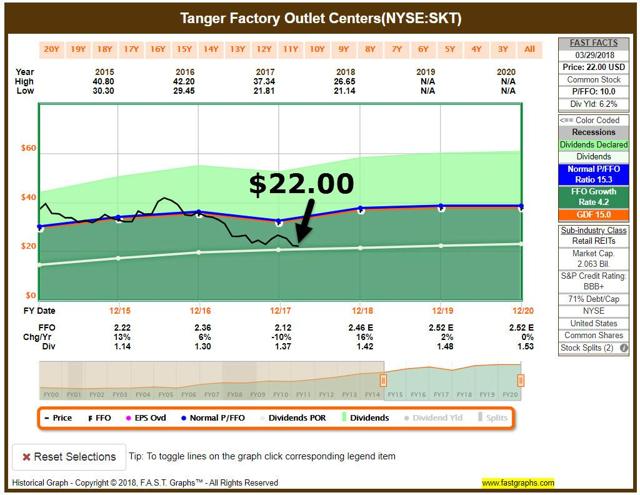

I am maintaining Tanger as a STRONG BUY as shares have returned -15.7% YTD. SKT now trades at $22.00 with a P/FFO multiple of 10.0x (3-year average P/FFO is 15.3x). The dividend yield is 6.2%.

STAG Industrial (STAG) is one of my favorite industrial REITs. To mitigate secondary market risks, the company has built an impressive portfolio that provides well-balanced tenant diversification. The company owns 356 buildings in 37 states, with approximately 70.2 million rentable square feet, its largest tenant represents just 2.6% of ABR, and the top 10 tenants represent just 14.1% overall.

STAG has found that primary and secondary markets have similar occupancy and rent growth experiences, and secondary industrial property markets generally provide less rent volatility and equivalent occupancy compared to primary industrial property markets.

Because of STAG"s Class B (secondary markets) industrial investment rationale, the company enjoys low capital expenditures and lower tenant improvement costs (relative to other property types). Also, its Class B tenants tend to stay longer, since moving costs and business interruption costs are expensive relative to relocating a "critical function" facility.

STAG shares have returned -11.8% YTD and shares are now trading at $23.92 (with a P/FFO multiple of 13.9x). STAG’s dividend yield is 5.9% and I maintain a BUY.

In closing, John Templeton once said, “Diversify. In stocks and bonds, as in much else, there is safety in numbers.”

REITs now have their own GICS category (“Real Estate”) that offers access to the real estate market typically with low correlation with other stocks and bonds. Investors who diversify their portfolios have historically had a better chance of ending up with higher returns because diversification reduces portfolio volatility and mitigates losses from any one security or asset class.

REITs help to diversify a portfolio because, as real estate, they are a distinct asset class that has demonstrated low to moderate correlation with other sectors of the stock market, as well as bonds and other assets.

In other words, REIT returns have tended to zig while returns of other assets have zagged, smoothing a diversified portfolio’s overall volatility. This diversification may help an investor increase long-term portfolio returns without taking on additional risk, and that helps intelligent investors SLEEP WELL AT NIGHT.

Note: Brad Thomas is a Wall Street writer, and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos, and be assured that he will do his best to correct any errors, if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking. If you have not followed him, please take five seconds and click his name above (top of the page).

Source: F.A.S.T. Graphs

Disclosure: I am/we are long ACC, AHP, AVB, BRX, BXMT, CCI, CHCT, CIO, CLDT, CONE, CORR, CUBE, DDR, DEA, DLR, DOC, EPR, EXR, FRT, GEO, GMRE, GPT, HASI, HTA, INN, IRET, IRM, JCAP, KIM, LADR, LAND, LMRK, LTC, MNR, NXRT, O, OFC, OHI, OUT, PEB, PEI, PK, PSB, QTS, REG, RHP, ROIC, SBRA, SKT, SPG, STAG, STOR, TCO, TXRT UBA, UMH, UNIT, VER, VNQ, VTR, WPC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment