Micron (MU) posted its latest earnings report last week; the chipmaker managed to beat the street"s revenue and EPS forecasts yet again in Q2 and came out with a rather strong guidance for the third quarter. But those are just the highlights of its Q2 earnings report. Evaluating Micron"s latest results on a granular level reveals a particularly encouraging picture, one that suggests that the chipmaker"s growth momentum could stay intact and that its shares could rally further from the current levels over the next few months at least. Let"s take a closer look to have a better understanding of it all.

The Rockstar Segment

Let me start by saying that Micron"s Q2 earnings report was particularly encouraging for long-side investors. Its basic financial figures have already been reviewed by fellow contributors here on Seeking Alpha so we won"t be covering the same points again in this article. But just to rehash a bit here, for the sake of establishing talking points for our following discussion, the chipmaker"s revenue and EPS figures for the second quarter surged to $7.35 billion (up 58.1% YoY) and $2.67 (up 246% YoY) respectively.

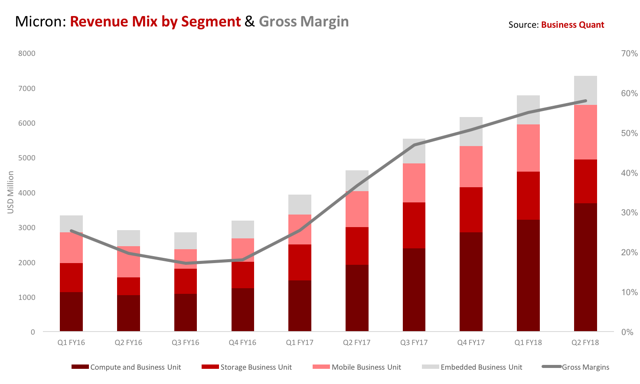

I"d like to point to readers that this growth isn"t attributable to just one or two operating divisions. Fact of the matter is that all of Micron"s operating divisions were up on a year-on-year basis in its second quarter. I"ve attached a chart below for your reference. Its Storage Business Unit was up on a YoY basis, and down sequentially, but we have to remember that Micron operates in a highly cyclical industry so it"s only fair if we compare its financials with comparable quarters from the past.

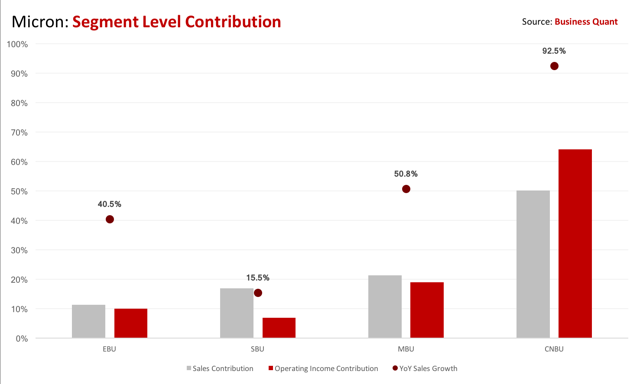

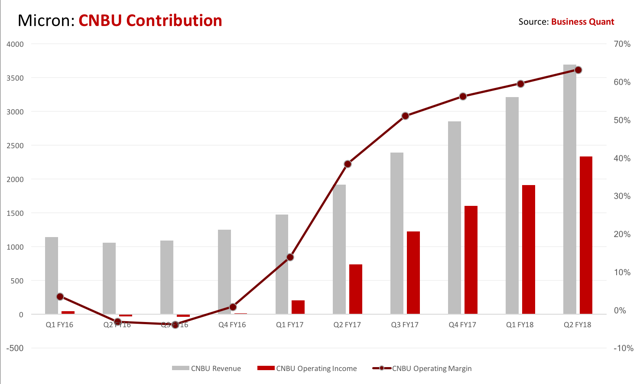

The robustness of Micron"s sales growth is perhaps best highlighted when we drill deeper into its Compute and Business Unit (CNBU). As the chart attached below would indicate, the segment already accounts for a major share of the company"s overall sales and operating income generation. Apparently, the same segment also grew at the fastest pace amongst all other business divisions during the second quarter.

Its CNBU segment posted an impressive YoY sales growth of 92.5% during Q2 FY18. But here"s the interesting part. The segment had posted an equally stellar year-on-year sales growth of 82% during Q2 FY17. So, instead of its growth slowing down due to cyclicality or law of large numbers working against it, the chipmaker actually accelerated its sales growth in Q2 FY18. Not only that, but the segment"s operating margins surged to its highest levels in two years.

CNBU"s recent growth was driven by a combination of elevated average selling prices and strong demand for memory products. Moving forward, as we"ll see in the next section of the article, DRAM prices are forecasted to further head north over the course of 2018. So, the recent growth in Micron"s CNBU segment isn"t necessarily a one-time thing.

ASP Evolution

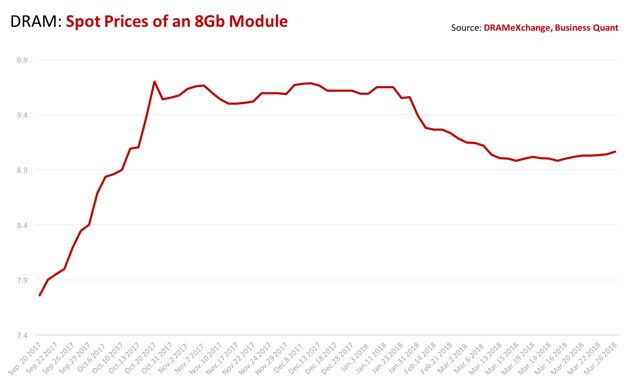

Micron makes different kinds of semiconductor solutions but sales of its DRAM and trade NAND memory products accounted for 71% and 25% of its overall sales in the second quarter. Anyone following the memory space closely would know that DRAM module prices have risen quite a bit over the recent months.

Now, analysts appear to have split opinions on where NAND and DRAM spot prices could be headed next. But IC Insights came out with a note last week, forecasting that DRAM and NAND ASPs could rise by as much as 36% and 10% respectively in 2018, after evaluating recent supply-demand trends of the same. As a result, the research firm ended up raising their overall sales growth forecasts for both NAND and DRAM for the year.

"The average selling price (ASP) of DRAM is now expected to be much stronger this year than originally forecast, IC Insights said. The firm expects DRAM ASPs to increase by 36 percent this year after growing by a whopping 81 percent last year...NAND ASPs are now expected to increase by 10 percent this year, following a 45 percent increase last year, IC Insights said." - Source.

Speaking on their bit growth, management noted the following in their second quarter conference call:

"We now expect Micron"s calendar 2018 DRAM bit output growth to be in line with the industry"s 20% range... For the NAND market, we believe the ongoing transition to 64-layer 3D NAND creates the opportunity for a more balanced industry dynamic in calendar 2018 versus the constrained conditions we saw in 2017. We expect industry bit output growth to be somewhat higher than 45% in calendar 2018...We believe we will be somewhat above industry bit output growth in calendar 2018 for NAND."

What this basically means is that Micron is positioning itself to increase its bit output over the course of 2018, at even higher ASPs for both NAND and DRAM products. So, unless something unexpected comes up, it"s highly likely that the chipmaker will post stellar sales and profit growth rates in FY18 as well.

The Sell-Off

Shortly after Micron announced its Q2 earnings, its shares dropped on concerns regarding the company getting caught amid trade wars between China and the U.S. The former came out with a list of potential retaliatory tariffs on food items ranging from litchis to walnuts, but nothing for semiconductors.

Here"s a link to the translated list. Chances are that this might not be the final list and China might come out with another list that imposes tariffs on U.S-based semiconductor firms at a later date to promote domestic firms. While I"m not an expert on international tariffs, I think we should consider that:

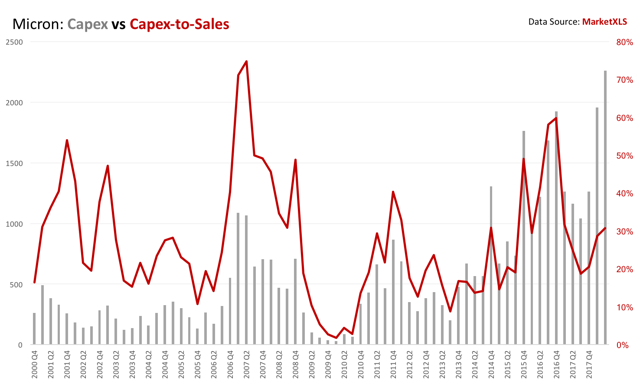

- Micron isn"t merely competing on price. It owns genuine IP and Chinese firms would have to significantly invest in R&D and capital expenditure before they can even think of closing in on the performance gap. The chart attached below should highlight Micron"s capex spending routine;

2. China would be risking its technological advances in the field of computing by imposing tariffs on standard memory products. This isn"t something that China would want to fiddle with, at least not until its domestic memory manufacturers can compete globally in terms of performance;

3. Trump Administration won"t necessarily sit idle while the country"s semiconductor industry withers away;

Also, if there was any material risk to Micron"s growth story due to the evolving tariffs-related situation between U.S and China, at least a few analysts would have sounded the alarm bells. But instead, the broad swath of analysts covering the memory manufacturer have only raised their price targets for the name.

Old Target | New Target | Room for Stock Appreciation | |

Citi | $55 | $65 | 20% |

Stifel | $85 | $95 | 75% |

Mizuho Securities | $66 | $70 | 29% |

Cowen | $55 | $65 | 20% |

Baird | $60 | $100 | 84% |

Mizuho | $55 | $66 | 22% |

Credit Suisse | $60 | $70 | 29% |

Evercore ISI | $60 | $80 | 48% |

Keybanc | $53 | $65 | 20% |

Nomura Instinet | $55 | $100 | 84% |

Investor Takeaway

Micron just posted fantastic quarterly results yet again. The chipmaker is showing signs of its growth momentum continuing well over the course of 2018 as well, so much so that analyst price targets for Micron across the board are substantially higher than its current stock price. Hence, I believe this is a good time to be bullish on Micron, and any potential weakness in its shares should be considered as a buying opportunity.

Author"s Note: I"ll be writing another report on Micron over the next week. Make sure to click that "Follow" button at the top of this page to get a notification as soon as the report goes live. Thanks!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment