(Source: imgflip)

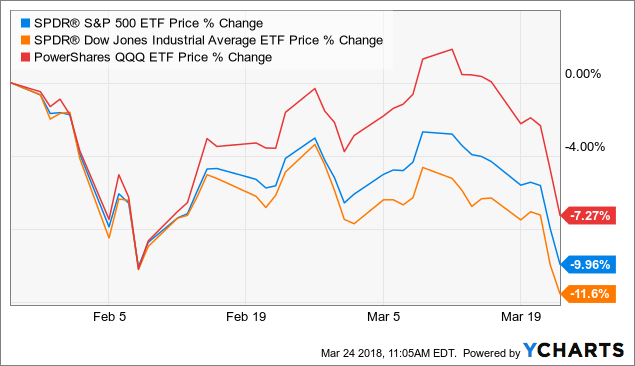

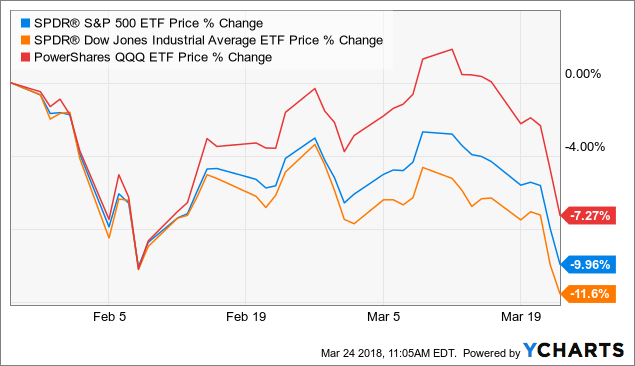

The stock market just had its worst week since the correction began, with the S&P 500 (SPY), Dow Jones Industrial Average (DIA), and Nasdaq (QQQ), falling 5.6%, 5.9%, and 7.3%, respectively.

SPY Price data by YCharts

This means that the market has now retraced to its previous low, something I warned was historically likely to happen.

SPY data by YCharts

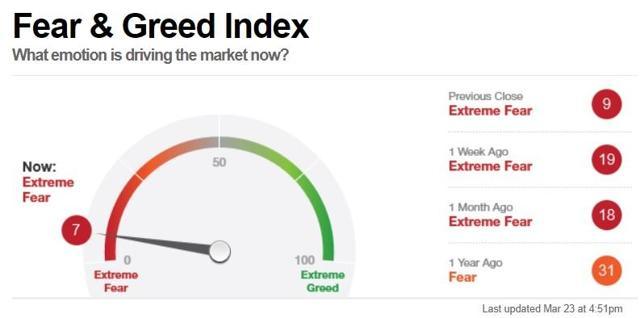

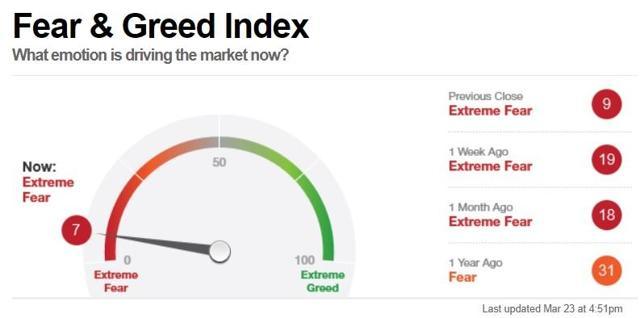

But still investors are understandably worried about the return of such volatility, after 2017"s freakishly calm and bullish year. In fact, according to CNN"s Fear & Greed Index, a meta analysis of seven different market indicators, investors are not just afraid but are petrified right now.

(Source: CNN)

But since the root cause of fear is uncertainty and doubt, let"s take a look at what caused the stock market"s latest freakout. More importantly discover why these fears are likely overblown, and why the you shouldn"t be racing for the exits.

What The Market Is Freaking Out Over Now

On Thursday, President Trump announced that he would be imposing 25% tariffs on $50 billion to $60 billion worth of Chinese imports covering 1,300 products including: aerospace, information and communication technology, and machinery. This was in retaliation for years of Chinese intellectual property theft against foreign companies, including US firms.

The Chinese responded with calls for America to "cease and desist" and the Chinese embassy said:

"If a trade war were initiated by the US, China would fight to the end to defend its own legitimate interests with all necessary measures." -Chinese Embassy

Thus far, Chinese retaliation has been modest, just $3 billion against 128 US imports including: pork, aluminum pipes, steel and wine. However, according to Gary Hufbauer, senior fellow at the Peterson Institute for International Economics, those $3 billion in tariffs appear to be in response to Trump"s earlier steel and aluminum tariffs.

Those only affected $29 billion in US imports, before Trump began exempting most US allies.

The Wall Street Journal is reporting that China will now ratchet up its own counter tariffs, specifically against, "U.S. agricultural exports from Farm Belt states." Specifically, this means tariffs on U.S. exports of soybeans, sorghum and live hogs, most of which come from states that voted for Trump.

Apparently, the Chinese began planning for a potential US trade dispute last month when the Chinese Commerce Ministry met with major Chinese food importers to discuss lining up alternatives sources of major US agricultural products. For example, China is considering switching its soy imports to Brazil, Argentina and Poland.

The concern that many people have is that during the announcement on the Chinese tariffs, which cover just 10% of all US imports from that country, Trump stated that this was just the first in a series of upcoming tariffs against China.

So many are worried that if the President truly believes that "trade wars are good and easy to win", then he could potentially escalate this trade tiff into a full blown trade war. Something that history shows is never a good thing, and sometimes has disastrous consequences.

How Bad Would A Full Blown US/China Trade War Be?

The White House has stated that it wants to reduce the US/China trade deficit by $100 billion a year, or about 20%. Theoretically, that could mean that Trump might impose tariffs on all Chinese goods, in order to make them more expensive and less competitive with either US goods or those from non-tariffed countries.

So what effects would this have on the US? Well, first of all prices will increase initially, since companies like Walmart (WMT) have complex supply chains with contracts for sourcing for its stores. So in the likely case a 25% tariff on $50 billion to $60 billion in Chinese imports represents a $12.5 billion to $15 billion increase in US input costs.

Or to put another way Trump"s China tariffs are likely to boost inflation by 0.08%, and drive core PCE from 1.5% to 1.6%. Now that isn"t the total negative affect to the US economy. After all, China has already retaliated in response to steel tariffs, and is likely to now ratchet up its own counter tariffs.

How bad could that be for American exporters? Well, China supplies just 2% of US steel, meaning that the steel tariffs represent a $580 million loss of export revenue. In response, they slapped tariffs on US goods (with apparent plans to completely replace them with foreign alternatives) of $3 billion. That"s a retaliation tariff ratio of 5.2, meaning for every $1 in export revenue threatened by US tariffs, China appears to be willing to cut its US imports by as much as $5.20.

However, in 2017, Chinese imports of US goods totaled $130 billion, so there is no way this retaliatory ratio could hold. However, theoretically, if the US and China were to get into a full blown trade war, China could cease importing up to $130 billion of US products.

That worst case scenario would likely require Trump imposing similar (25%) tariffs on all Chinese imports to the US, which totaled $506 billion last year. In the worst case scenario, that could temporarily raise US prices by $127 billion.

Worst Case US/China Trade War Costs

Impact

|

Cost To US Economy

|

% Decrease In Real GDP Growth

|

Increase In Inflation

|

Core PCE

|

Higher US Prices

|

$127 billion

|

0%

|

0.7%

|

|

Lost US Exports

|

$130 billion

|

0.7%

|

0%

|

|

Total

|

$257 billion

|

0.7%

|

0.7%

|

2.2%

|

Sources: thebalance.com, CNN, Marketplace, Bureau of Economic Analysis

Nominal US GDP would not fall due to rising prices; in fact, it would increase. However, GDP is reported as inflation adjusted, meaning that price increases would not have an measured affect on economic growth since they are by definition excluded.

However, they do represent a true cost to the economy, since it means consumer pay more and have less money to spend on other things. The effect on GDP would potentially be seen via China"s replacement of potentially $130 billion in US exports with those from other nations. That would knock off 0.7% from US economic growth. Currently, the Federal Reserve is projecting 2.7% growth in 2018, so in our worst case scenario that would fall to 2.0%.

Meanwhile, the higher US prices would represent about 0.7% increase in inflation, pushing the core, (ex-food & fuel), personal consumption expenditure index to 2.2%. Core PCE is the Fed"s preferred inflation metric because it"s a survey of what people actually buy, taking into account rising prices, (switching to cheaper alternatives).

The bottom line is that a full blown US/China trade war has the potential to do significant damage to America. It could potentially lower economic growth 25% over a year, and raise inflation by nearly 50%. But just above the Fed"s stated 2.0% target. Fortunately, this worst case scenario is unlikely to actually happen.

Trade Wars Are Terrible But This "Tariff" Isn"t Likely To Become One

First understand these tariffs are not immediate. US Trade Representative Robert Lighthizer’s office will have 15 days to publish a list of the goods, which will be followed by a 30-day comment period before they go into effect. Tariffs and retaliatory tariffs are not a light switch, but a slow moving regulatory process.

This means that it will likely be six weeks (early May) before any US tariffs on Chinese imports begin. Chinese retaliation in terms of decreased exports would likely start by late June/early July at the earliest. Or to put another way, half of the impact of the worst case scenario would be eliminated by timing.

And time is our friend here because most trade disputes, even threatened tariffs, are merely negotiating tactics. Most of the time tariffs get called off relatively quickly as both sides seek some kind of resolution.

After all, China potentially could take a 3.8% hit to GDP if it lost its US export market, cutting its economic growth in half. That"s something it has no interest in. Meanwhile, the sharp hit to Trump"s constituency (states that helped elect him), plus slower US economic growth, would certainly not help the President"s re-election efforts in 2020.

We"ve already seen that the President"s threatened tariffs can get walked back. For example, the steel and aluminum tariffs that freaked out the market a few weeks ago. Trump has since "temporarily" exempted: The European Union, Canada, Mexico, Brazil, Australia, New Zealand and South Korea. These countries actually are responsible for 2/3 of all US steel imports while China represents just 2%.

In early March, China"s Supreme Court vowed to strengthen China"s protection of intellectual property rights, something that Chinese tech firms have been calling for. This means that the trigger for these tariffs might already be fading. It also means that both China and the US have a relatively easy way out, in which no one loses face, because each side can claim some kind of victory.

What The Fed Did To Potentially Spook The Markets

The other potential partial factor for this week"s sharp drop is the Federal Reserve"s March meeting in which it hiked the Federal Funds rate by 25 basis points to 1.5% to 1.75%. This was already priced in by the bond market and was a surprise to no one. The Fed said that, "The economic outlook has strengthened in recent months" and boosted its economic growth forecasts:

- 2018: 2.7% (from 2.5%)

- 2019: 2.4% (from 2.1%)

- 2020: 2.0% (from 1.8%)

- Long-Term: 1.8% - unchanged

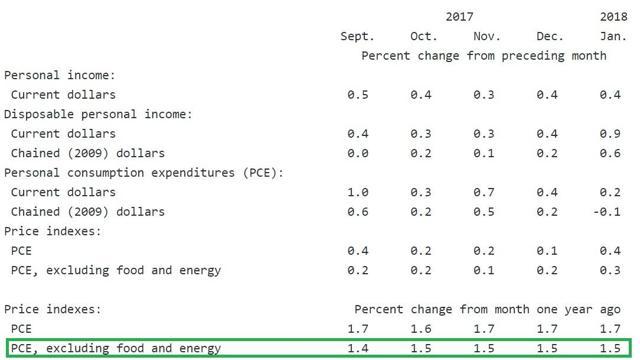

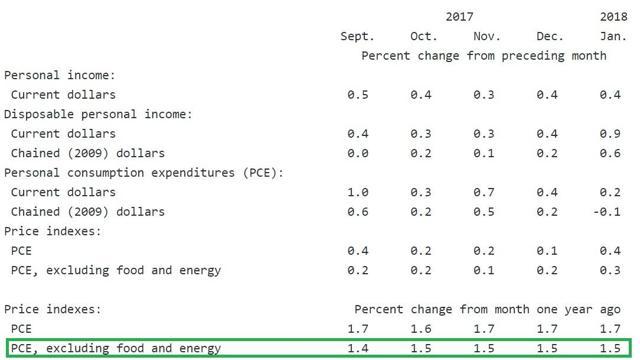

The Fed also updated its core PCE projections:

- 2018: 1.9%

- 2019: 2.1%

- 2020: 2.1%

Meanwhile the Fed"s new unemployment forecast is:

- 2018: 3.8%

- 2019: 3.6%

- 2020: 3.6%

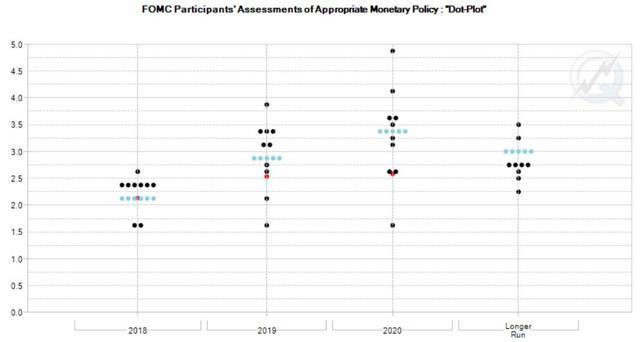

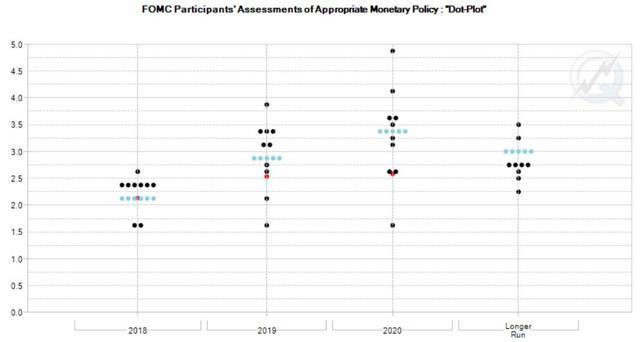

Now none of these upgraded projections are significant, since they basically mean the Fed is just more bullish on the economy. But what potentially concerned the market is the Fed"s slightly more hawkish stance on interest rates.

(Source: CME Group)

Basically, this revised plan from the Fed calls for:

- 2018: two more hikes (same as before)

- 2019: three hikes (same as before)

- 2020: two hikes (one more than before)

The Fed basically expects to raise its Fed Fund rate, which is the overnight interbank lending rate, to 3.5% by the end of 2020. Of course, that"s assuming the US economy keeps growing as quickly as predicted.

3.5% is still far below the historical norm (4% to 6%), so why should that have concerned investors? Simply put because it indicates that the Fed might end up triggering a recession.

Yes You Should Fear An Inverted Yield Curve...

While the Fed Funds rate has no direct link to the bond markets that actually control US corporate borrowing costs, most US banks do benchmark their prime rate off it. The prime rate is how much they charge their most creditworthy and favored clients.

The prime rate has now been raised to 4.75%. The prime lending rate is what most non mortgage consumer loans are benchmarked off. So this means that US consumer borrowing costs are rising, and could rise another 1.75% by the end of 2020. That could certainly slow the pace of consumer borrowing, and potentially increase the US savings rate. While a good thing in the long term, it would potentially cause consumer spending to slow. Since 65% to 70% of US GDP is driven by consumer spending that might in turn slow US economic growth and, more importantly to Wall Street, corporate profit growth.

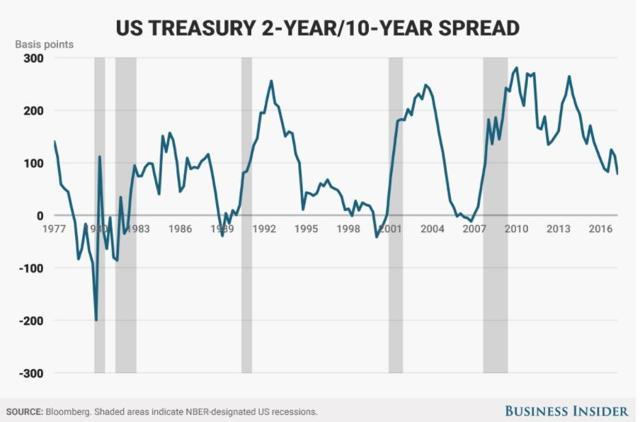

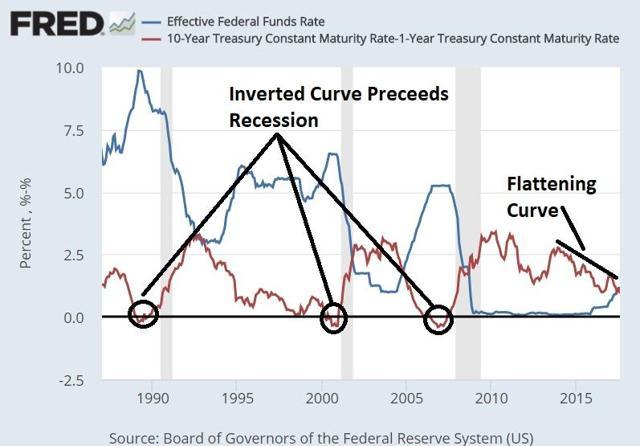

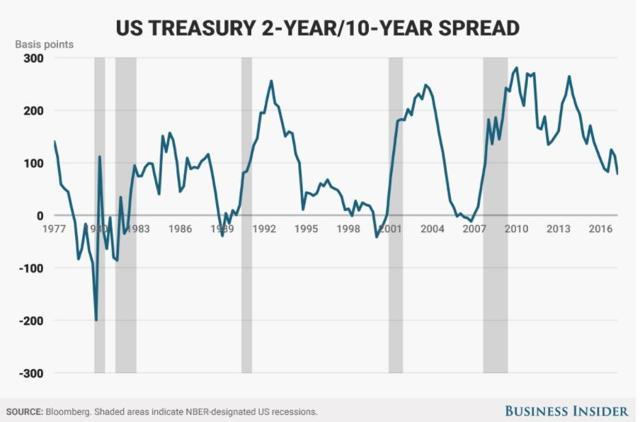

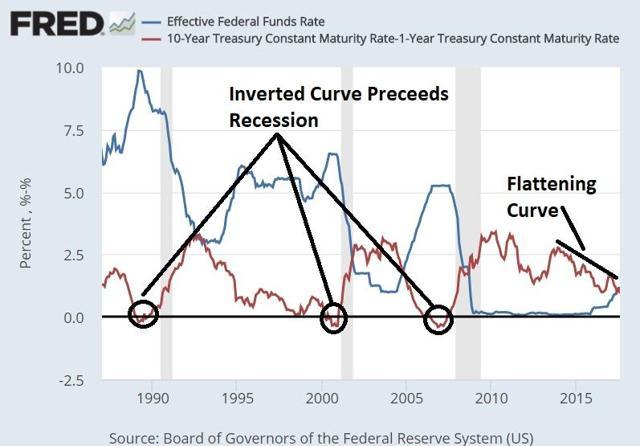

But here is the real reason that investors should worry about the Fed Funds rate potentially rising another 1.75%. Because under current economic conditions, it would almost certainly cause a recession. That"s based on the single best recession predictor we have, the yield curve. This is the difference between short-term and long-term treasury rates.

The yield curve is 5/5 in predicting the last five recessions. If the curve gets inverted, meaning short-term rates rise above long-term rates, a recession follows relatively soon (usually within one to two years).

Why is this? Two reasons. First, if short-term rates are equal to or above long-term rates, the bond market is signaling that it expects little economic growth and inflation ahead.

More fundamentally, it"s because financial institutions borrow short term to lend long term, at a higher interest. This net margin spread is what creates lending profits and is why loans get made in the first place. So if short-term borrowing rates rise higher than long-term rates, it can decrease the profitability of lending, and result in fewer loans. Thus, consumer spending can fall, businesses invest less, and the economy slides into a recession.

And while the Fed Funds Rate has no direct link to the interest rates that companies care about (long-term rates that benchmark corporate bond rates), studies show that the short-term treasury bonds track closely with the Fed Funds Rate. But long-term rates, such as the 10-year Treasury yield, do not, as they are set by the bond market based mostly on long-term inflation expectations.

This is why the market freaked out over January"s labor report that showed wages rising 2.9%. The fear is that if the labor market is too hot, then rising wages trigger faster inflation which forces the Fed to hike rates high enough to trigger a yield curve inversion. This is what occurred before the last three recessions.

Basically, this means that if the Fed were to proceed with its revised rate hike schedule, then short-term rates would likely rise by 1.75% or so. Long-term rates, on the other hand, are set by inflation expectations and the 10-year yield of 2.83% is currently pricing in 2.1% inflation.

(Source: Bureau Of Economic Analysis)

However, inflation has been stuck at 1.5% for the last four months, and so far shows no signs of rising to those long-term expectations. Which means that 10-year yields are not likely to rise 1.75% by 2020, in line with rising short-term rates.

That in effect indicates that seven rate hikes would almost certainly invert the yield curve, heralding the next recession. The good news? The Fed isn"t likely to keep hiking if inflation remains low and threatens to invert the yield curve.

...But The Fed Isn"t Likely To Invert The Curve

So if the Fed"s current forecast calls for low inflation, but enough rate hikes to likely trigger a yield curve inversion and possible recession, why am I not freaking out? Two main reasons. First, Jerome Powell, the new Fed Chairman, is not an economist, but a veteran of Wall Street. Over his career, he"s been:

- Managing director for Bankers Trust - a US bank

- Partner at The Carlyle Group - a private equity firm

- Founded Severn Capital - a private equity fund specializing in industrial investments

- Managing partner for the Global Environment Fund - a private equity fund specializing in renewable power

Here is why this matters. Economists are big fans of economic models, such as the Phillips Curve. This says that as unemployment falls below a certain, (full employment), wages and thus inflation, must rise.

Powell has indicated that he"s willing to go where the data takes him, and not just assume the models are correct. In other words, Powell doesn"t buy into the fears of the Fed"s more hawkish members.

In fact, take a look at what he said during the last Fed post meeting press conference:

“There is no sense in the data that we are on the cusp of an acceleration of inflation. We have seen moderate increases in wages and price inflation, and we seem to be seeing more of that... The theory would be if you get below the sustainable rate of unemployment for a sustained period, you would see an acceleration of inflation. We are very alert to it. But it’s not something we observe at the present... We will know that the labor market is getting tight when we see a more meaningful upward move in wages... Wages should reflect inflation plus productivity increases ... so these low wage increases do make sense in a certain sense... That is a sign of improvement (rising labor participation rate), given that the aging of our population is putting downward pressure on the participation rate... It"s true that yield curves have tended to predict recessions ... a lot of that was when inflation was allowed to get out of control." -Jerome Powell

What we see in these quotes is a man who understands finance and understands that the world is more complex than simplified models would indicate. He seems to realize that we are NOT at full employment. So until wages start rising there is no reason to assume we are and that inflation is about to accelerate to dangerous levels.

Powell has also indicated that he expects tax cuts to fuel more investment, boosting productivity, which would allow wages to rise without triggering higher inflation. This is something that I expect as well and the key reason that I"m personally so bullish on the economy, and expect the current expansion to continue for many years.

The bottom line is that Powell seems to be a man who will, for the sake of expectations, make a forecast. But he seems more than willing to ultimately alter monetary policy as the economic data indicates is necessary, not raising rates just because the Phillips Curve says to.

And as a former Wall Street banker who is well aware of the yield curve and its importance, I don"t consider it likely that he"ll blindly keep hiking rates based on a plan from a few years ago. When the facts change, Jerome Powell changes his mind.

Which brings me to the biggest reason to shake off and ignore this last terrible week in the stock market.

US Economic Fundamentals Remain Strong And That"s All That Matters

The stock market may be a forward looking instrument, but it"s also prone to fits of violent pessimism whenever anything bad happens. The market often takes a worst case scenario like "sell first, ask questions later" approach.

Trump announces tariffs? It MUST mean we"re headed for a full blown global trade war that will trigger massive inflation, a shrinking economy, and a bear market! Sell everything!

The truth is that while sometimes the worst case scenario happens (such as the Financial Crisis), 99% of the time negative effects of anything are not as bad as people fear. Or to put another way very seldom is it true that "this time is different."

So let"s take a page of out Jerome Powell"s playbook and look at the data. I"ve already covered why the last jobs report was darn near perfect.

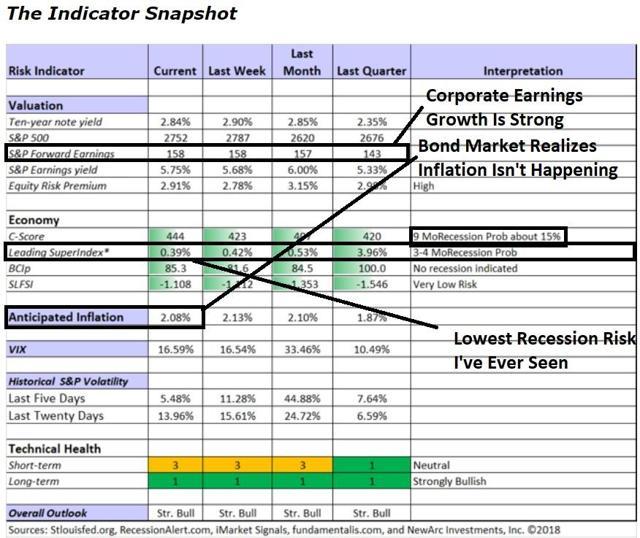

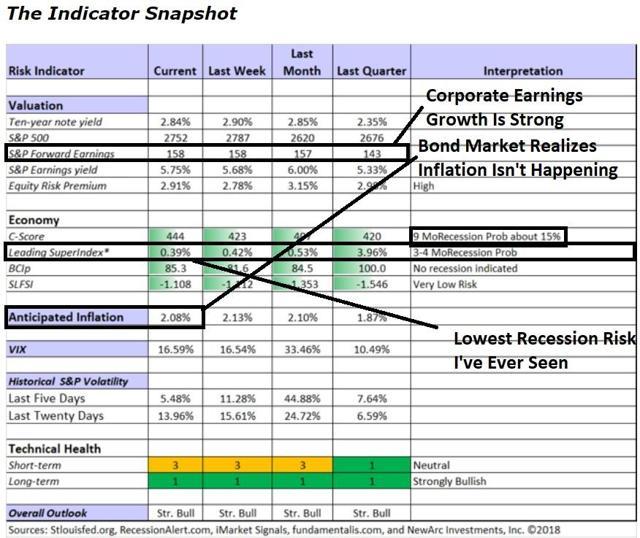

Meanwhile, the risk of a recession is the lowest I"ve seen since I discovered Jeff Miller"s excellent weekly economic report 18 months ago.

(Source: Jeff Miller)

Specifically, according to a collection of meta analyses of leading indicators and economic reports, the four- and nine-month recession risk is 0.39% and 15%, respectively. Of course, these can and do change over time as new data comes in. But the point is that based on the most recent evidence there is no reason to fear a recession.

Finally, the New York Fed"s Nowcast (real time GDP growth estimator) is saying that Q1 and Q2 GDP growth is likely to come in at 2.9%, and 3.0%, respectively.

Now that also changes with economic reports as they come in, but if true then this is how US economic growth is trending:

- 2016: 1.5%

- 2017: 2.3%

- Q1 2018: 2.9%

- Q2 2018: 3.0%

Does this portend doom and gloom for the economy, labor market, or corporate earnings growth? No it does not.

I"m not saying stick your head in the sand and ignore all risks. But rather than freak out over POTENTIAL worst case scenarios to the economy we focus on the facts as best we know them. Right now those facts are:

- low and stable inflation

- strong job market but not at full employment (otherwise wages would be rising)

- accelerating economic growth

- strong and accelerating corporate profits

- stock market trading sideways = valuation multiples falling = less risk of a bubble and crash

Bottom Line: Markets Are Driven By Short-Term Emotions, Your Portfolio Decisions Shouldn"t Be

Don"t get me wrong a full blown trade war with China would be a terrible thing. It would undoubtedly significantly increase inflation, slow the economy, and potentially force the Fed to raise rates to dangerous levels. These are things that could certainly trigger a bear market or even a recession.

However while all those risks are real, the probability of such a worst case scenario remains remote and speculative. What we do know for sure is what the economic data shows. Which is that the fundamentals underpinning the current economic expansion and bull market remain strong. More importantly, in an economy this large, it would take a large and protracted negative shock to derail those fundamentals and trigger the kind of market crash that many now fear is imminent.

That doesn"t mean that you shouldn"t protect yourself. I myself am continuing to de-risk my high-yield retirement portfolio with a strong focus on quality, undervalued, low volatility, and defensive stocks. But my point is that I"ve been doing that for several months now, back when the market was still roaring higher, and before fears of a trade war surfaced. That"s because I believe in building a bunker while the sun is shining so you never have to fear any market storm.

My recommendation to investors remains the same. Stay calm, focus on your long-term strategy, and don"t let the market"s knee-jerk reactions to likely overblown speculative fears cause you to make costly short-term mistakes.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment