We"re another quarter deeper into the cash flow generation era of Micron (MU) and the memory train is full steam ahead. The just reported quarter saw records in revenue, gross profit, earnings and cash flow. So what"s not to like?

Not much to be honest.

With a trailing 12-month cash flow of $6.7B and annualized future cash flows of over $8B, it appears Micron is in a position to be the strongest it ever has at the end of this fiscal year. The question is will the memory market cooperate and usher Micron into balance sheet glory? Thankfully, Micron is somewhat lengthy on its narrative of the industry environment as well as its own memory expectations.

(Source: durangoherald.com)

Coal In The Micron Locomotive

The industry-wide narrative includes a more firm 20% DRAM bit output for the calendar year. CEO Sanjay Mehrotra says demand remains strong due to "secular technology" drivers. NAND output is seen closer to 45% rather than 50% - as of last quarter - and this may calm fears of a drastic oversupply of NAND in 2018. Micron expects this bit output to bring the NAND market into balance - contrary to some analysts predicting an oversupply scenario.

Company-specific narrative revolves around capital expenditures, as it begins to pay dividends in terms of market share gains and technology node transitions. The company updated its bit output guidance for DRAM to go from below industry bit output to inline with industry bit output for the year - more on this shortly. Additionally, the company"s SSD (solid state drive) segment was up 80% overall year-over-year with "sales of cloud and enterprise drives more than tripling for that same period." Mehrotra appears to be correct in his previous assertions of NAND being highly elastic - as pricing softens, demands increases and drives the feedback loop onward.

Lost The Battle, But Winning The War

I couldn"t think of a good way to keep the train analogy chugging along for this section because there"s not a better way to describe the situation Micron has presented for this quarter and for the rest of the year.

I"m of course referring to the news Micron had a nitrogen supply disruption last week at one of its fabs in Taiwan. Management expects a return to full production by this week. The company expects an impact to DRAM output of 2-3% for the quarter due to this.

My subscribers knew I had an expectation for $3.00 in EPS for Q3"s guidance so when I saw $2.83 +/- $0.07 I knew something was amiss. I decided to do some math on this nitrogen supply impact to gather what guidance would have been had the fab been running at full capacity.

Using the insight from Mehrotra for a 2-3% DRAM output disruption and CFO David Zinsner"s expectation of a 2% overall revenue impact, I have a starting point to work back from. At a guidance midpoint of $7.4B we can calculate the DRAM revenue using a conservative 70% - as this past quarter it accounted for 71% of revenues. This gives us a breakdown of $5.18B in revenue. If we reverse engineer the math, DRAM should have been $5.29B-$5.34B without this nitrogen disruption. At 66% gross margins and 84% operating margins the math works out where operating income is negatively affected by $61-$89M. Drilling down with a non-GAAP net margin we get a net income of $58.7M-$85.4M or $0.06-$0.07 in EPS. This would bring guidance to a midpoint of ~$2.89-2.90 - meaning a high end guidance of $2.97.

This is a closer expectation to my original estimate and while still just a little soft from my aggressive expectations, was still leaps and bounds above analysts" expectations for sequential negative growth.

Now while a small battle lost for the quarter, the war is being won on the R&D and technology ramp front. Here I"m referring to the positive news of the company exceeding its own expectations for its 1X nm DRAM node ramp. Due to this transition to 1X faster than prior nodes, Micron has gone from expecting to be under the industry bit output to in-line with the industry, with the payoff coming toward the end of the year.

(Q1 Conference Call Slide)

(Q2 Conference Call Slide)

This means Micron may be looking at additional DRAM revenue for the calendar year it was not expecting just a quarter ago, as it now sees 1X nm bit crossover as it exits calendar year 2018.

What"s the impact to revenues you ask? I decided to make an assumption and give the numbers a shot. If Micron was expecting 18% bit growth (my assumption) and now expects 20% bit growth, my model says an additional $500M is possible for the fiscal year. If I use the same formulas above this equals out to an additional $0.22 in EPS for the year.

So while Micron may have had a slip up in the current quarter, it appears the execution it does have control over is bringing it in-line with the industry while overcoming the hiccup. Every quarter that goes by, Micron chips away at the lead of Samsung in terms of technology transitions. This is a Micron ready to win the war through sheer execution and technology excellence.

How About The Stock?

How about the stock, huh? If you"ve been around the Micron block once or twice with us you know the current share price action is nothing out of the ordinary. Those serious about the long-term don"t expect Micron to go up after earnings - you should always take the other side of that bullish bet if a friend offers.

But that doesn"t mean we haven"t come a long way in this battle. Remember, Micron shares were $38 just six and a half weeks ago. Today, while we are well off the fresh highs of $63 and change, we"re still in the $50"s - 34% higher than those disgusting (and very profitable) lows.

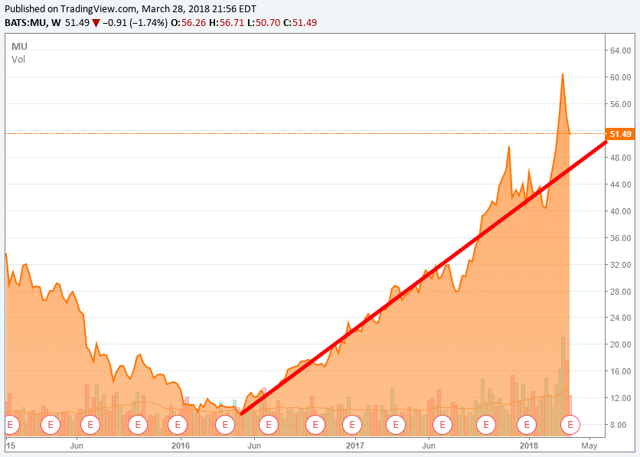

That being said, let me break out the chart for you and show you what I am seeing and what I expect. First lesson - the trend is your friend.

The red line is roughly the trend since the cycle moved out of the trough and started heading higher in mid-2016. As you can see the stock has gotten ahead of itself a little in the last run-up to $63. But, Micron is good about reverting to the trend, whether it overshoots or undershoots. Patience is key here as well as setting yourself up for a profitable strategy through medium-term options.

Next, Micron tends to want to test its previous highs, and it has yet to do so. The last high where it stalled out but then broke through just recently was $50.

Since the stock has broken through the previous high, it has yet to test it and confirm support. It"s possible Micron in an intra-day move also tests the 50-DMA while it"s at it. Another tidbit is the stock likes to be in the bounds of the Bollinger Bands and any move outside the top band usually gets smacked back in.

In other words, be patient with the stock as it finds its way back to the trend line as well as finishes testing the prior resistance. From there I expect Micron to churn for a bit before heading back higher and through the recent 52-week highs. Hint, hint: pick up near-the-money calls as it finishes its bottoming out period.

Fundamentally, the company is solid and hasn"t diverted course since my last statement on the fundamentals. In fact, the accelerated node transition positions it even better than prior estimates. The chart is doing its typical thing and we must be patient until it settles out and it, too, does the thing it has been doing for the past nearly two years.

Please tip your waitress as you relax on the Micron train.

If you"d like to be made aware of my opinion and analysis in the future on Micron and other tech companies, then I encourage you to follow me by clicking the "Follow" link at the top of this page next to my name.

Subscribers Got A First Look

I told my subscribers about this opportunity in Micron through my service"s chat room as well as my podcast before this article published. Not only were they aware but they also were given the strategy to capitalize on it, something I don"t share with my public readers in articles like the one you just read. To be made aware of opportunities like this, along with the strategy to profit from it, you need to join me in my service, Tech Cache. My service discusses tech and tech related companies and the opportunities therein because the growth your portfolio needs is in tech. Right now you can try it risk-free with a 2-week free trial!

Disclosure: I am/we are long MU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment