This report was jointly produced with High Dividend Opportunities co-author Jussi Askola.

If we had to summarize the investment thesis for Realty Income (NYSE:O) in one short sentence, it would be along the lines of: “Solid income in good, and bad times”.

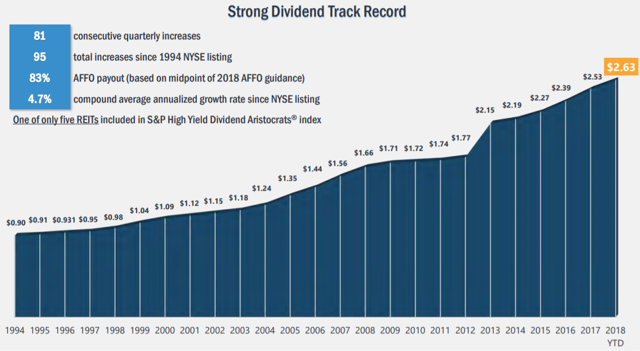

This is a company that has never missed a dividend payment and increased its dividend every year since going public in 1994. Not even the latest great financial crisis could stop the growth machine. If you are a conservative dividend-seeking investor who needs safe income, this is a very significant achievement not to be taken lightly.

The reason why the company has managed to fare so well through different recessions and crises is because, by nature, it is designed to deliver highly consistent and resilient income. This is why we like to say that Realty Income rarely disappoints. In fact, it is the type of firm that tends to function like clockwork!

Income Resiliency in Bad Times

The main issue of most businesses is that when the economic cycle starts going south, their fundamentals take a hit almost immediately. Take the example of the average manufacturing company. As we enter a recession, the demand for its goods suddenly decreases, leading to a drop in revenue and profitability. There is no mechanism to protect the company, as long-term purchase agreements are uncommon. The consequence is high volatility and low income resiliency throughout the economic cycles.

Unlike most other companies, Realty Income has never reported a year of substantial negative cash flow growth. Only once did the cash flow decrease, and this was in 2009, when the AFFO dropped by just 2%. Apart from that exception, it has been growth every single year for the past 20+ years.

This is really what extreme income resiliency looks like. So how is this made possible?

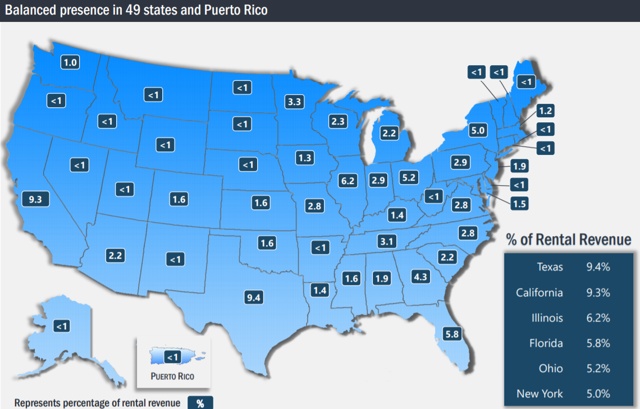

Realty Income owns a very diverse portfolio of over 5000 properties spread across USA with strong tenant-level and sector-level diversification.

The wide diversification makes the company practically immune to any single tenant or property failures. Moreover, the leases tend to be long, often in excess of 10 years, and as such, Realty Income is warranted a pre-defined income even during changing market conditions. This is perhaps the main reason why it was able to do so well during the financial crisis. These long leases have provided Realty Income with “bond-like” earnings that remained unaffected for the most part.

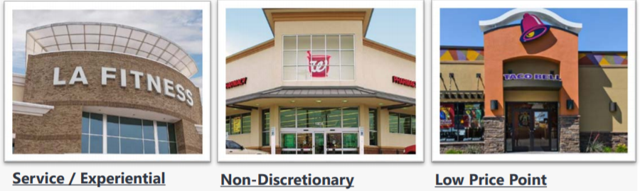

To reduce risk even further, Realty Income strategically invests in more defensive sectors which are expected to suffer little bankruptcies during recessions. This includes pharmacies, low price point fast food and fitness properties, for instance. The idea behind this allocation is simple: even in a bad recession, people will keep buying drugs at Walgreens (NASDAQ:WBA), go to get tacos from Taco Bell (NYSE:YUM), shop groceries at Dollar General (NYSE:DG), and keep working out at Plant Fitness (NYSE:PLNT), etc.

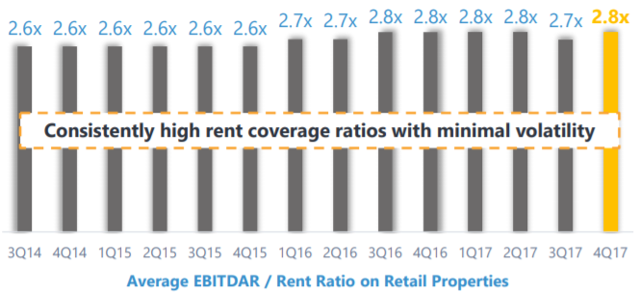

Finally, the selected properties benefit from very strong rent coverage ratios with minimal volatility. The profitability of the tenants is what makes or breaks a landlord in the long run. In the case of Realty Income, the risk of tenant bankruptcies appears minimal given that the company operates in defensive industries and generates plenty of cash flow to cover its rent payments.

Banking on Economic Cycles and Real Estate Cycles

Realty Income is a Property REIT and invests in real estate. It is interesting to note here that real estate cycles tend to last much longer than economic cycles. In fact, the real estate cycles tend to last 18 years on average, while economic cycles last only 5.5 years on average. This creates an opportunity for a successful real estate management team to adjust. The management of Realty Income has done exactly this. Of course, the long leases also provide a good protection against recession risks.

Summarizing the case for Realty Income

This company combines:

- Very wide diversification at the portfolio level.

- Long lease terms with good landlord protections.

- Defensive sectors with lower volatility during times of economic distress.

- Strong property-level profitability.

- Highly successful management team.

And this is the secret sauce to Realty Income’s extreme income resiliency. If the financial crisis couldn’t affect the company, what will?

Future Growth Prospects: Predictable and Sustainable

Growth is sustainable if it can be produced in a repeatable manner. In this sense, Realty Income follows a very simple approach to generate growth on two fronts:

- Internal growth - Automatic rent increases

- External growth - New acquisitions

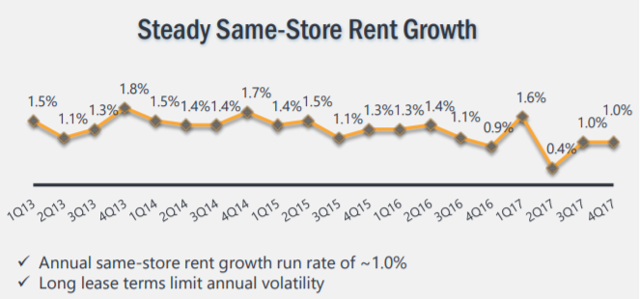

The rent increases are already agreed upon when signing the lease, and therefore, we can expect “automatic” growth on a yearly basis. The same-store rent growth accounts to about 1% currently. After accounting for leverage, we expect it to result in 1.5-2% FFO growth.

To complement the growth coming from rent increases, Realty Income keeps acquiring new properties to start new income streams. To finance the new investments, the REIT uses a combination of retained cash flow, debt and equity issuances.

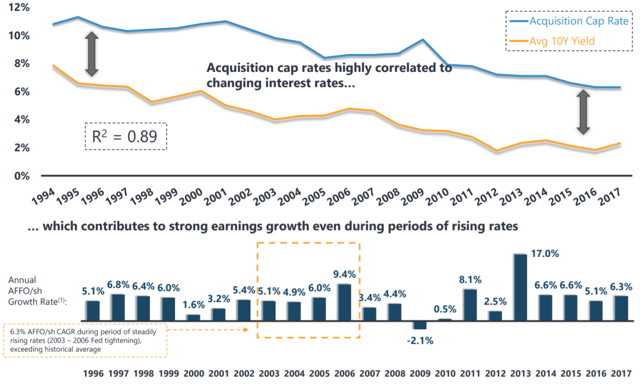

Therefore, it is important for the company to maintain a low cost of capital relative to the expected returns of its new investments. Going through the investor presentation, we find the following slide which is very interesting:

It shows how the firm has managed to achieve substantial external growth through acquisitions even in times of rising interest rates as we are experiencing today.

For instance, from July 2004 until June 2006, the Federal Reserve hiked interest rates from 1.25% to 5.25%. Anyone would agree that this was a very material increase that is unlikely to recur anytime soon. And yet, Realty Income managed to grow its AFFO per share by ~6% per year even then.

As we move forward, we believe that the company has a great shot at continuing to grow by approximately 5% per year, with about 1.5% coming from rent increases and 3.5% from new acquisitions.

5% + 5% = 10% Returns

Realty Income is no “bargain”. In fact, some analysts argue that it is overvalued compared to peers. We agree that the company is far from being a “deep value” stock when it is trading at 16.5 times expected 2018 FFO; but when put into perspective, we find that the current share price has room for further long-term upside.

Investors need to consider that Realty Income is one of the least risky REITs out there, and therefore, it deserves to trade at a premium to peers:

- The company has never cut its dividend, not even during the great financial crisis. Its cash flow has never suffered a yearly drop in excess of 2%.

- The collection of properties is of the highest quality - providing sustainable and defensive income for years to come.

- Rents are locked-in long term agreements and insensitive to economic cycles.

As long as the company manages to grow at 5% a year and continues to pay a ~5% dividend yield, we remain optimistic for strong long-term total returns. In other words, 5% yield + 5% growth = 10% expected total return per annum.

The growth rate will be less than 5% in certain years and more than 5% in others. As long-term investors in income producing stocks, this does not matter much to us. What interests us is that we expect Realty Income to keep growing its profits at approximately 5% per year on average.

Final Thoughts

Income resiliency and commitment to dividend payments are crucial to income investors and retirees. Realty Income excels at both. The cash flow of this company appears to be highly secure, and its commitment to paying dividends is very strong.

It is no wonder why this company refers to itself as “The Monthly Dividend Company”. It has now paid 573 consecutive dividend payments to shareholders and has increased its dividend for 82 consecutive quarters. How many companies can say as much about their dividend payment commitment?

This is why we consider this stock to be perfectly suitable for conservative income investors and retirees. Just like any other common stock, the share price of Realty Income will fluctuate on a daily basis, sometimes even sharply, but the income is expected to remain highly consistent. Long-term investors are set to be very well rewarded.

If you enjoyed this article and wish to receive updates on our latest research, click "Follow" next to my name at the top of this article.

All images taken from the Company"s website unless otherwise stated.

About "High Dividend Opportunities"

High Dividend Opportunities is a leading and comprehensive dividend service ranked #1 on Seeking Alpha, dedicated to high-yield securities trading at attractive valuations. It includes a managed portfolio currently yielding 10.3%, through high-yield MLPs, BDCs, REITs, Preferred Shares, and Closed-End Funds.

We follow a "value approach" by searching for high-yield stocks trading at low valuations to achieve both high income and long-term capital gains.

We invite income seekers for a 2-week free trial to help you identify the future outperformers in the high yield space. For more info, click here.

Disclosure: I am/we are long O.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment