Contrasting Fortunes Between P&G And Unilever

In recent weeks, Procter & Gamble (PG) has received a couple of downgrades following its Q3 FY2018 results announcement. In contrast, its peer in the consumer products space, Unilever (UL)(UN)(OTCPK:UNLNF)(OTCPK:UNLYF)(OTCPK:UNLVF), was upgraded by UBS in late March. Investors also cheered the announcement of a fresh €6 billion ($7.4 billion) stock buyback program and the raising of its quarterly dividend by 8% to €0.3872/share from €0.3585. In 2017, Unilever has already completed a €5 billion share buyback programme.

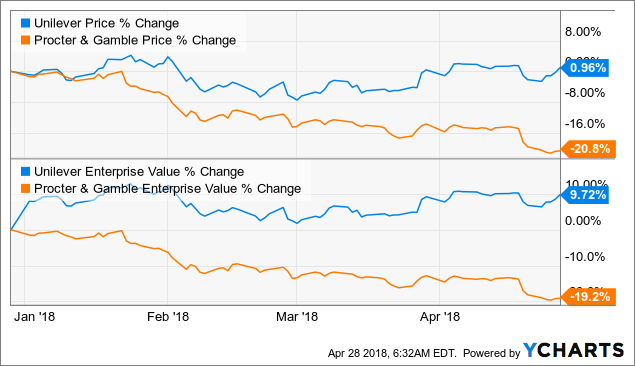

Year-to-date ("YTD"), the share price of P&G has fallen 20.8% while Unilever was relatively more stable. In terms of enterprise value ("EV"), the contrast is even more stark, with Unilever"s EV higher by 9.7% YTD as compared to P&G"s EV decrease of 19.2%. Given that the two leading names in the consumer products sector are facing the same competitive pressures from house brands, rising commodity costs, and challenges from e-commerce disruptions, the divergence appears to suggest that P&G is overly punished by the market. I explore deeper to find out if the sell-down in P&G was unjustified or that Unilever is overvalued.

UL data by YCharts

Tailwind From The Weakness In The US Dollar Discounted By P&G Investors

Readers familiar with the two consumer products giants would be able to quickly point out the difference in their reporting currencies. Unilever reports its results in euros while P&G does so in US dollars. The persistent weakness in the US dollar since early 2017 has been a huge tailwind for US-based P&G. For instance, in the last calendar quarter of 2017, P&G reported a core EPS growth of 10% but adjusted for currency effect, the growth shrunk to 6%. YTD, the US dollar sustained another 2% loss against the euro. In the first calendar quarter of 2018, the currency-neutral core EPS growth at P&G was just 1%, against the reported 4% before adjustments. In contrast, Unilever attributed a negative 9.8% in revenue impact to foreign exchange in its Q1 2018 results. Unfortunately, given the share price underperformance of P&G, it is obvious that investors have already discounted the tailwind from the weaker US dollar.

US Dollar to Euro Exchange Rate data by YCharts

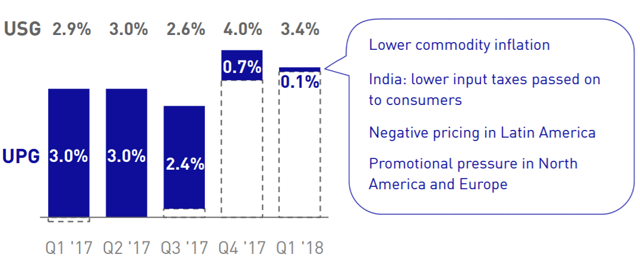

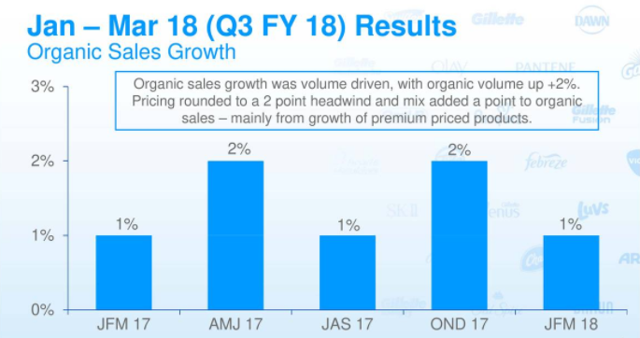

P&G To Continue Its Sales Growth Underperformance Against Unilever

Looking at the past five quarters, it is clear that Unilever has delivered superior underlying sales growth ("USG") ranging 2.6-4.0% from a combination of pricing and volume growth as compared to P&G"s 1-2% (P&G uses the term "organic" which is essentially the same as "underlying"). One worrying trend for Unilever is the drastically deteriorating ability to improve its USG through price increases. In Q2 2017, Unilever could raise prices by 3.0% to compensate for a flat sales volume growth, but it could only do so by a paltry 0.1% in the most recent reported quarter (Q1 2018).

(Source: Unilever Q1 2018 Results Presentation)

(Source: P&G Q3 2018 Results Presentation)

While a more restrained price increase strategy has enabled a favorable volume growth, it is possible that consumers have brought forward their purchases in a promotional environment. If that is indeed the case, I suspected that Unilever might find the subsequent months more challenging to continue pushing more inventory onto consumers" hands. Interestingly, the management does not agree. It is guiding for a USG of 3-5% in 2018 which at the midpoint would exceed its USG in 2017. The management of P&G is similarly bullish. It is guiding for an organic sales growth of 2-3% in 2018 and an "all in" sales growth of "about 3%," higher than that achieved in 2017. Given the share price weakness despite such positivity, it"s no surprise that the P&G guidance has fallen short of consensus expectations. To me, the bias against P&G seems rather unfair.

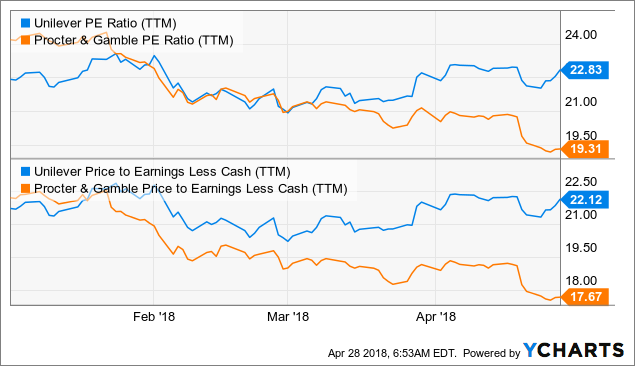

P&G"s P/E Has Fallen Below That Of Unilever

Despite the lower sales growth at P&G, its shares had at times traded at a price-to-earnings (P/E) ratio similar or even above that of Unilever. However, the recent divergence in their share price movements has resulted in Unilever"s P/E rising to 22.83x, higher than P&G"s 19.31x. The distinction is more stark when we look at the P/E ratio less their cash holdings, where P&G P/E less cash is 17.67x compared to Unilever"s 22.12x. This is another indication that suggests that P&G might be oversold.

UL P/E Ratio (TTM) data by YCharts

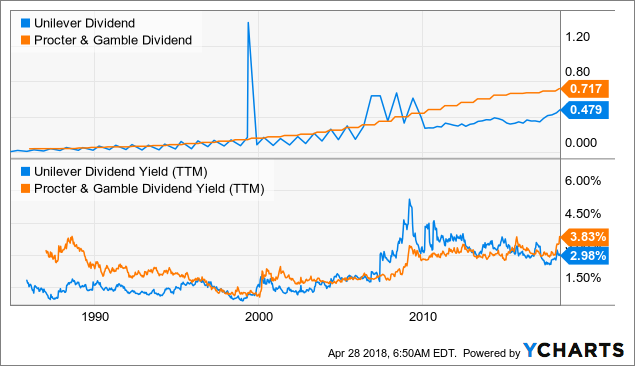

P&G"s Dividend Yield Has Risen Above That Of Unilever

Both P&G and Unilever have a solid history of dividend growth (adjusting for currency effect and one-offs). Nevertheless, despite hiking its quarterly dividend by 8% to €0.3872/share from €0.3585, Unilever"s dividend yield has still fallen to below that of P&G. Based on the last closing price, Unilever has a dividend yield of 2.98% against P&G"s 3.83%. At 3.83%, P&G"s dividend yield is at a record high and it is one of the rare periods when its dividend yield is above that of Unilever. If you are a fan of the "reversion-to-the-mean" strategy, then perhaps this is an opportune time to bet on P&G"s recovery.

UL Dividend data by YCharts

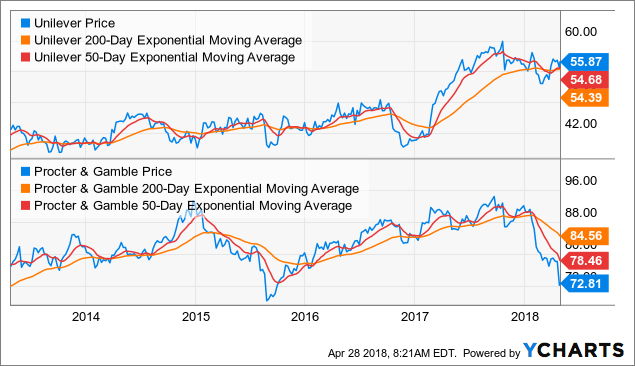

P&G Has Fallen Far Below Its 200-Day EMA

With the steep YTD plunge, the share price of P&G has fallen way below its 200-day exponential moving average ("EMA"). The last time a similar deviation occurred was in 2015 and the shares rebounded to above the 200-day EMA less than half a year later. History might not repeat but for a Dividend Aristocrat (and a King at that) to experience such steep share price plunge relative to its sector peer is perhaps a sign that market players might have been too bearish on P&G.

UL data by YCharts

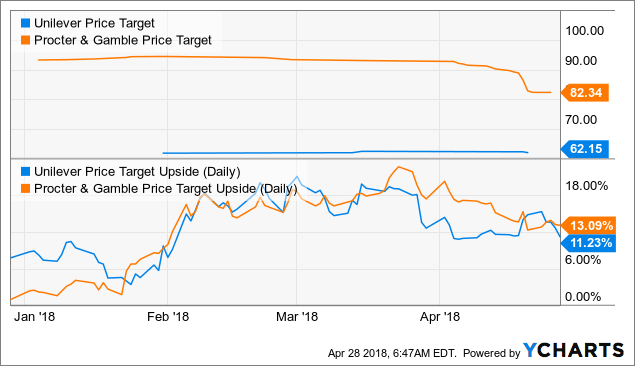

Analysts Have Been Revising P&G"s Price Target Downwards

While the most recent quarterly results were a beat on both the EPS and the revenue, analysts pointed to the weak pricing and the loss of market share as reasons for downgrading P&G. Despite the share price of P&G having already fallen 20.8% YTD, the upside to the consensus price target is only 13.09%, just slightly above that for Unilever at 11.23%. I found it unfathomable that analysts are overwhelmingly bearish towards P&G while staying positive on Unilever, despite the duo experiencing similar competitive markets in the world.

UL Price Target data by YCharts

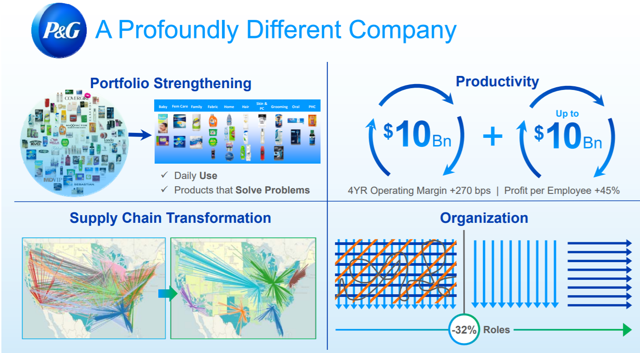

Both P&G And Unilever Have Delivered On Operational Improvements

The management at both P&G and Unilever deserve to be complimented for having achieved significant improvements on the operational front. Notably, Unilever managed to turn its cash conversion cycle of 10 days to a negative 12 days by the end of 2017, effectively meaning that the company could pay its suppliers 12 days after it receives the cash from its customers, a commendable feat. For P&G, it has streamlined its supply chain while reducing 32% of roles across the organization. From FY2012 to FY2016, P&G has achieved a productivity gain of around $10 billion and it is targeting another $10 billion over the following four years.

(Source: P&G 2018 Consumer Analyst of New York Conference Presentation)

Conclusion

I wrote a bearish article on Unilever in September last year noting the diminishing returns from the various initiatives to improve its margins. However, I am not always pessimistic about the company. In late January 2017, my initiation article on Unilever highlighted the tremendous growth in its e-commerce business, among other positives. The issue is that the market sentiment has switched from underappreciating Unilever to buoyant, thanks to the management"s successful drive in operational improvements.

On the other hand, P&G appears undervalued when we consider the relative underperformance of its share price against that of Unilever. Similar to Unilever, P&G has in place a plan to achieve growth amid the challenging consumer products environment. Hence, I believe that P&G has been oversold and nimble traders might be able to profit from a near-term rebound while longer-term investors might find the current pricing to be an opportune time to add to their positions in the Dividend King of the consumer products space.

(Source: TipRanks - ALT Perspective Ratings on Unilever)

What"s your take? Readers who make a comment will have access to the comment thread indefinitely. Hence, please freely share your thoughts, let me know if you found this article useful or provide your feedback in the comments section.

Author"s Note: Thank you for reading. If you would like a refreshing take on stocks that you own or are interested in, try looking here. Besides US companies, I cover a number of Asian stocks as well. If you wish to be informed of my new ideas via email so that you have time to read them before the articles get locked behind a paywall 10 days from publication, please select "Receive email alerts" when accessing on a desktop computer.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PG over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor"s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment