Investment Thesis

Whenever I talk to an Amazon (AMZN) shareholder they always highlight for me the same "story" - which is, Amazon is investing for growth. However, if after more than a decade of investing for growth, the business is still only just marginally profitable, it makes you wonder if some of that cash has been squandered? And also begs the question, and the vastly more dangerous question of, when Amazon finally stops investing for growth and operating at just-above-break even, just how profitable will it actually be?

Recent Results: Q1 2018

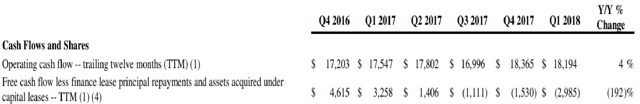

Last week, Amazon released its Q1 2018 results and it showed that its top line had once again grown strongly by 39% YoY (currency adjusted). Also, that its operating cash flow was up just 4%.

(source) - Q1 2018 press release (click table to maximize)

Highlighted in the above table, on the top line is a trend, where the amount of cash from operating activities which Amazon generates trickles up quarter over quarter, at a slow and steady pace. Then, on the bottom line, it shows the amount of "owner earnings" or free cash flow that the owner of the business can walk away with each quarter. And there, it shows a trend, and how Amazon has gone from steadily generating cash to using cash at quite a steady pace. In fact, in its latest quarter, Amazon had an outflow of cash of $3 billion for its trailing twelve months compared with an inflow of $3.3 billion for the trailing twelve months ended Q1 2017.

Is Warren Buffett Right?

Anyone who says that size does not hurt investment performance is selling.

- Warren Buffett

For a long time, value-investors disciples have listened to the Oracle of Omaha say that size hurts performance, but these rules appear to have been ignored by Amazon shareholders. Accordingly, whenever I discuss Amazon with an Amazon shareholder, they go on to highlight to me a brand new avenue that Amazon is embarking on. When I question them on Amazon"s ability to generate free cash flow, their face boils red and the conversation turns slightly sour: "how dare I ask such blasphemous questions?’

Valuation

From the point of view of revenue, Amazon has two main segments: its retail operations and AWS. However, for all the gains in market-share which Amazon makes in its retail operations, and although this quarter showed a strong improvement compared with the same period a year ago, its consolidated operating income stood at just $520 million.

Although Amazon"s second segment, AWS, is the only segment that is highly profitable, with operating income margins of roughly 25%; at the end of the day, this quarter just brought in $1.4 billion. These two segments together certainly do not support its present +$700 billion market cap.

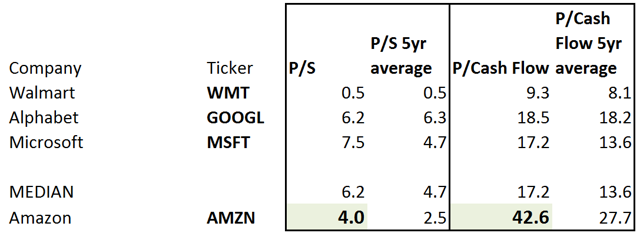

For now, in an effort to best confuse Wall Street, Amazon runs these two very different business lines, its retail business and the cloud, under the same corporate structure. This obviously confuses many investors as they don’t know how with what to compare a company such as Amazon. Is it a retail business which should be compared to Walmart (WMT)? Or is a cloud business, with strong margins that should be awarded a higher, tech-like, multiple, such as Alphabet?

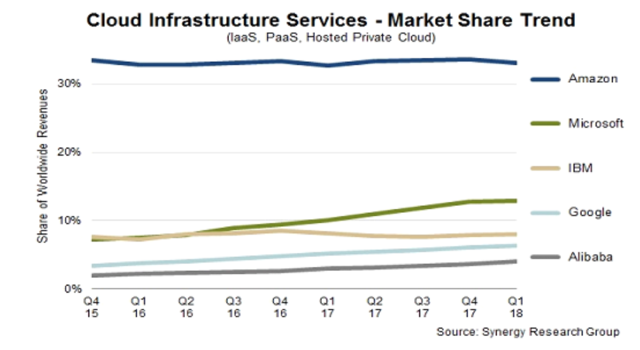

Incidentally, I should note, that Amazon"s AWS is no longer growing unrivalled. Now that Microsoft (MSFT) has woken up to the profitability of the cloud, AWS is no longer able to price its offering regardless of the competition. AWS must price its offering to gain market share and scale. Furthermore, Microsoft"s Azure is now growing at above 90% YoY, for several quarters and it currently holds a solid second place in terms of market-share.

(source): Top cloud providers

On the other hand, although AWS still holds the number one position for cloud market-share, its growth was "only" 49% YoY and significantly less than Microsoft’s Azure’s growth.

Finally, it is important to highlight that Amazon"s current valuation is actually more expensive than it has been during the past 5-years on average. Said another way, as Amazon has grown to the size it has, and it has fewer and fewer opportunities for future growth it is actually being priced more expensively than in its past - which is ironic. Whenever one analyzes a publicly traded investment, one should think, what kind of "edge" do I have that others have not thought about. It is not sufficient to say that "I have a longer-term horizon than others" because when something is being traded more expensively than in the past, I could argue that opportunity has already been accounted for.

Takeaway

Too many investors confuse knowing a business or liking its products with thinking that this or that company makes for a worthwhile investment. For example, whilst I utterly enjoy the benefits associated with being a Prime member and have a nearly daily use of Amazon, this does not mean that I think that its stock makes for a safe investment.

Disclaimer: Please do your own due diligence to reach your own conclusions.

Note: The only favor I ask is that you click the "Follow" button, so I can grow my Seeking Alpha friendships and our Deep Value network. Please excuse any grammatical errors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment