(Source: imgflip)

The goal of my dividend growth retirement portfolio is to own companies that are poised to grow their profits, cash flow and dividends for not just years, but decades to come.

This is what has me so excited about Microsoft (MSFT) which under current CEO Satya Nadella has staged one of the most impressive pivots in the tech industry. That"s because Microsoft has not just talked the talk about breaking into the leading edge tech of the future, but with its massive success in cloud computing and subscription services, is walking the walk as well.

MSFT Total Return Price data by

YChartsOf course that success hasn"t gone unnoticed by Wall Street, which has understandably fallen in love with the stock over the past year. However despite Microsoft being near 52-week highs a careful analysis reveals it to actually still be undervalued by about 23%. In fact there are actually four reasons that I think Microsoft is likely to beat the market (by as much as 86% annually) over the coming decade.

That makes this fast growing tech bluechip a must own for income investors looking to cash in on some of the most important business megatrends of the coming decades.

Reason 1: Strong Growth Powered By Cloud

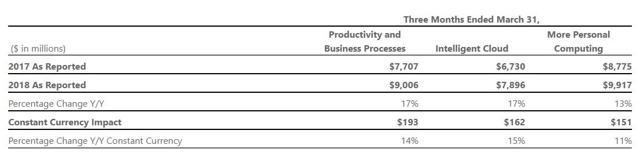

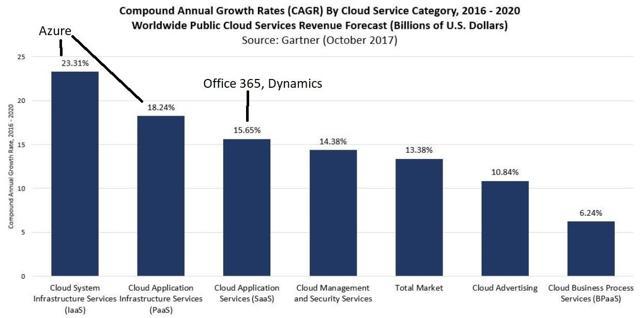

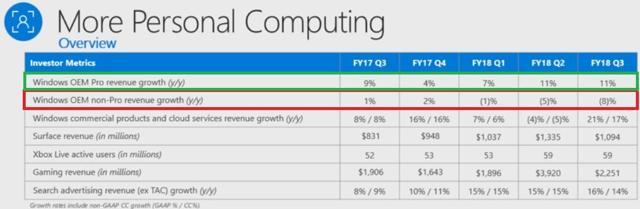

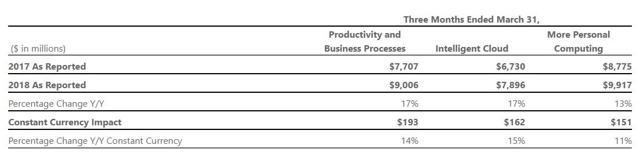

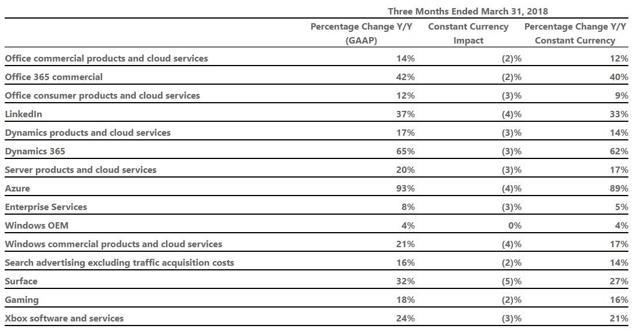

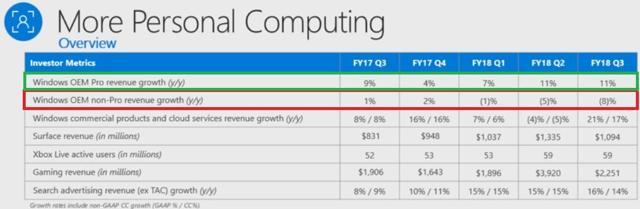

(Source: earnings release)

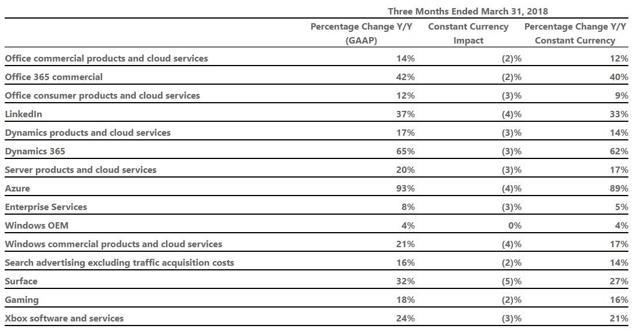

Microsoft"s top line grew at an impressive rate in Q1 2018 (its fiscal Q3) led by strong increases not just in cloud but also its productivity and business segment (subscription services for consumers and enterprises). However the main growth catalyst for Microsoft remains its cloud infrastructure as a services or IaaS business.

That"s because Microsoft"s strength in cloud isn"t just in offering businesses low cost solutions for outsourcing their IT needs but in a deeply integrated ecosystem and advanced AI driven data analytics that can make companies more productive over time.

This is why Azure, the company"s cloud platform (that hosts its applications like Office 365 and Dynamics 365) continues to grow like a weed; 93% in the last quarter. What"s more Azure premium notched its 15th consecutive quarter with 100+% revenue growth showing that Microsoft retains a wide moat in cloud that allows it to command premium pricing power.

In fact gross margins on cloud rose by 6% in the past year to 57%. Microsoft"s success in continuously improving its cloud ecosystem is a big reason for that because it helps to retain customers better via an increasingly sticky ecosystem. That in turn allows it to amortize fixed costs over a larger revenue base boosting the profitability of the cloud business and company as a whole.

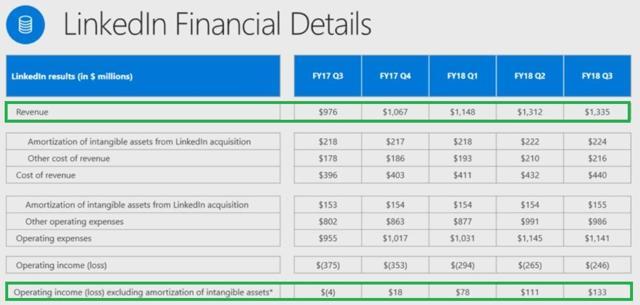

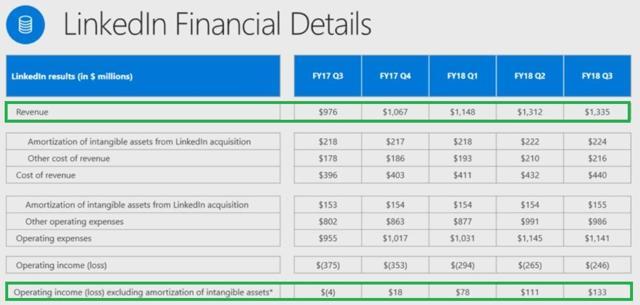

(Source:

earnings presentation)

A good example of how Microsoft improves its ecosystem is with the integration of acquisitions liked LinkedIn. That controversial $26.2 billion deal brought Microsoft the world"s premier HR social media network and has made Azure and Microsoft"s overall commercial and cloud ecosystem all the more valuable. Note that in the past quarter LinkedIn sales grew 37% and the company is now profitable on a cash flow basis. And on an earnings basis LinkedIn will be accretive to EPS in fiscal 2018, a year ahead of initial expectations.

The most recent good news is that Microsoft appears to be poised to win a major part of a six year $10 billion Pentagon cloud contract that provides cloud based enterprise services to 17 government agencies including the CIA and NSA. This is on top of a $1 billion contract that Microsoft, Dell, and General Dynamics (GD) won with the Air Force back in September of 2017.

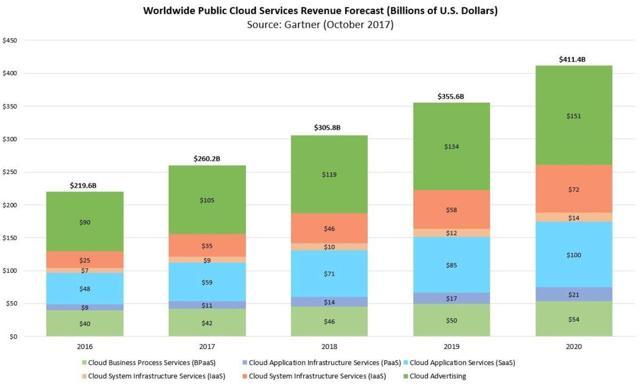

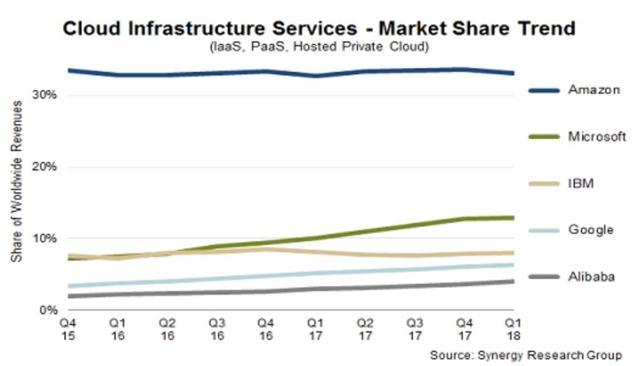

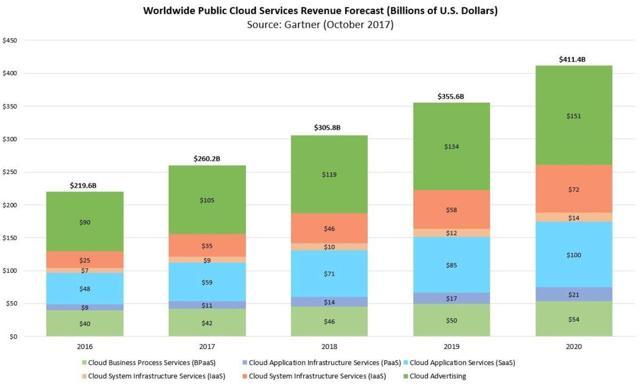

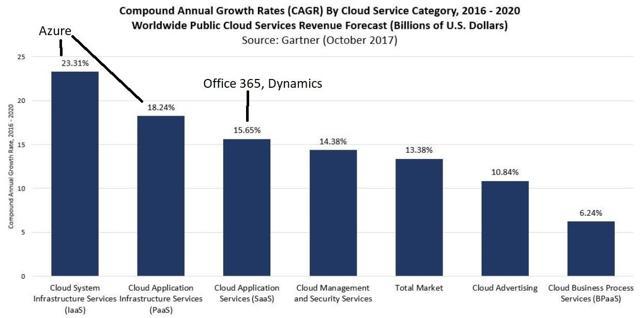

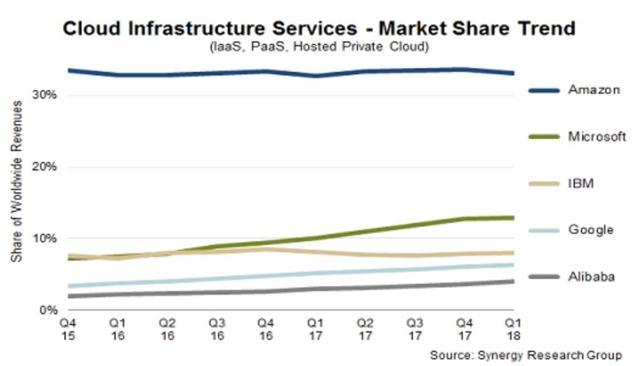

And as impressive as Microsoft"s cloud growth has been it"s just the tip of the iceberg. That"s because the future of enterprise IT solutions is firmly in the cloud. In fact by 2020 analyst firm Gartner expects that the cloud computing market will total $411 billion in size and will be growing at 16% to 23% per year (in the parts Microsoft operates in).

(Source: Gartner)

What"s more according to Gartner Microsoft and Amazon are poised to command 90% of the IaaS market by 2019 thanks to their strong first mover advantages and increasingly sticky ecosystems that create high switching costs. IT directors are notoriously conservative folks and once they find a good solution that works they are loath to switch providers and risk disrupting their business operations. All of which means Microsoft"s future growth prospects, both in sales and earnings, appear very bright indeed. How bright?

Morningstar analyst Rodney Nelson is projecting that over the next decade Azure will be able to grow at 31% per year, eventually representing 40% of the company"s revenue by 2028. In addition the higher margins on cloud are expected to boost the company"s operating margin from 31% to 40%.

But wait it gets better. Because while cloud is indeed a large and fast growing cash cow for Microsoft, it"s far from the only growth driver.

(Source: earnings release)

Microsoft has leveraged its cloud platform to run its various enterprise and productivity apps like Office 365 and Dynamics 365, which last quarter put up 42% and 65% revenue growth respectively.

Metric

|

Fiscal Q3 2018 Results

|

Revenue Growth

|

15.5%

|

Operating Income Growth

|

23.3%

|

Net Income Growth

|

35.3%

|

Free Cash Flow Growth

|

2.8%

|

Shares Outstanding Growth

|

-0.2%

|

EPS

|

35.7%

|

FCF/Share

|

3.1%

|

Dividend Growth

|

7.7%

|

Dividend Payout Ratio

|

35.5%

|

(Source: earnings release, Gurufocus, Morningstar)

That helped fuel very impressive top line growth for a company of this size. More importantly earnings boomed even more. And while true that 34% of the impressive net income growth was due to tax reform lowering the company"s effective tax rate from 23% to 14%, note that operating income (not affected by tax cuts) rose far faster than revenue indicating margin expansion.

Now it should be noted that Microsoft"s free cash flow or FCF (what"s left over after running the business and investing in growth) increased a far smaller amount. However remember that FCF is operating cash flow minus capex, and investment is volatile from quarter to quarter. In the last quarter Microsoft boosted its capex investment into further expanding the cloud business to the tune of $1.25 billion or 73% compared to Q3 2017. Much of that was to expand its data centers, which are now in over 50 countries around the globe.

However note that in 2017 the company"s FCF grew by 26% indicating that Microsoft is indeed converting its impressive revenue growth into even stronger bottom line growth that is needed to accelerate dividend growth. And lets not forget that Microsoft continues to enjoy one of the richest FCF margins in the world; 34.7% in the most recent quarter. This creates a river of free cash ($33.5 billion in the last 12 months) that explains why it"s sitting on a $132.3 billion mountain of cash.

Metric

|

Fiscal Q4 2018 Guidance

|

Revenue Growth

|

25.0%

|

Operating Earnings Growth

|

71.4%

|

(Source: management guidance)

That river of FCF is only set to grow larger as management"s guidance for the next quarter indicates even faster growth in both the top and bottom line. In fact if Microsoft can hit those numbers it will mean its growing at similar rates as back in its glory days of the late 1990"s. To help maximize the chances of that the company is also doubling down on expanding its competitive advantages.

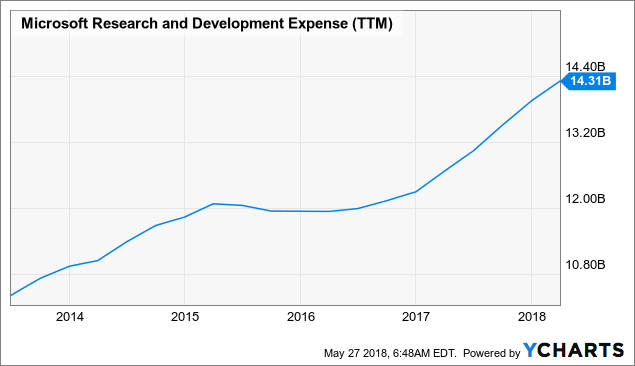

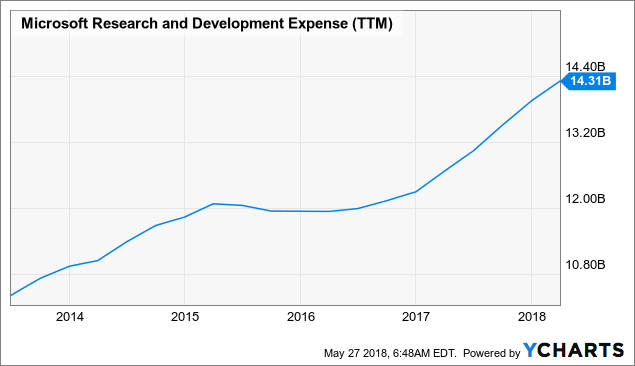

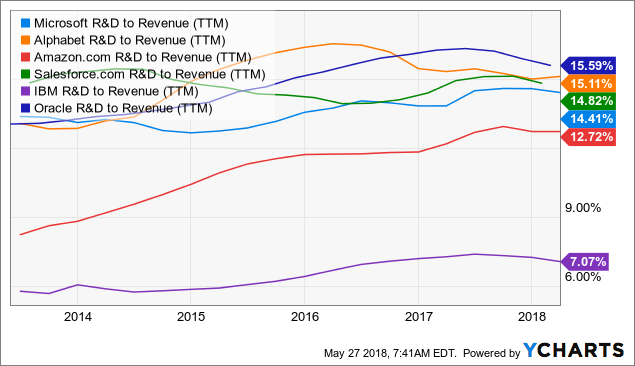

Reason 2: Company Is Investing Heavily To Widen Its Moat

One of the big risks for any big company is that management becomes complacent and decides to coast on FCF rich cash cows. This is certainly what Steve Ballmer did, but Satya Nadella is taking a totally different approach.

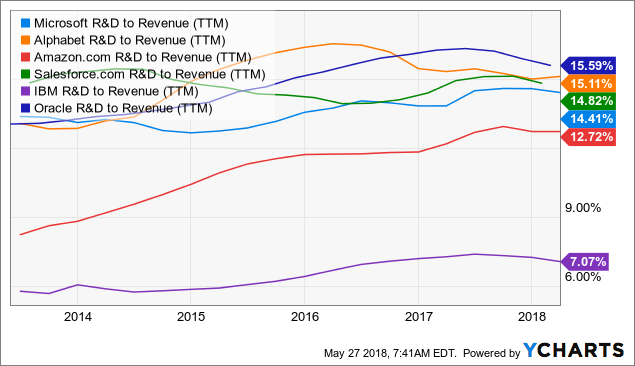

MSFT Research and Development Expense (NYSE:TTM) data by YCharts

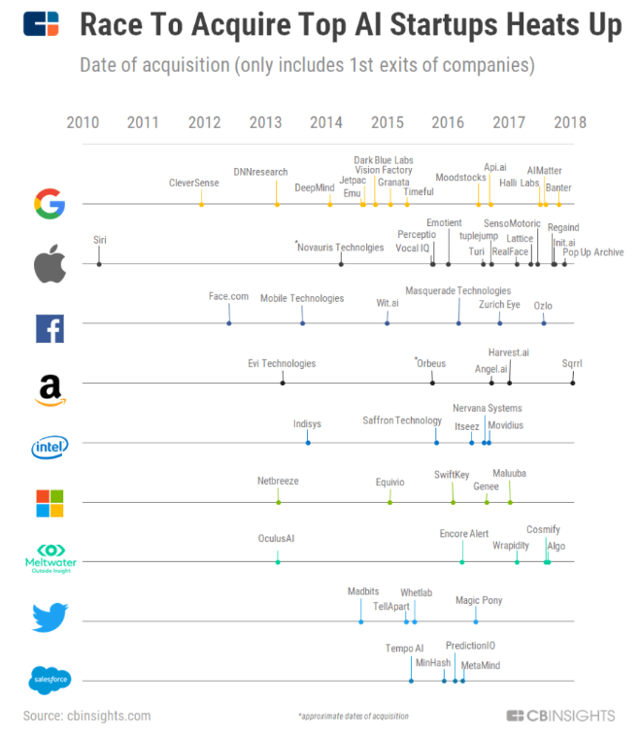

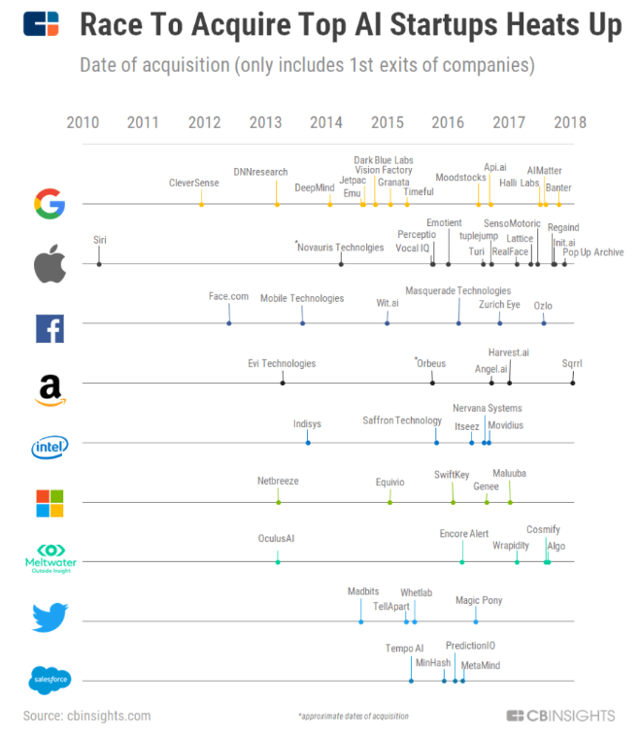

Recently Microsoft has greatly beefed up its already sizeable R&D budget. That"s because it understands that the future of its business isn"t just in hosting IT cloud solutions for companies but in offering a one stop shop for business optimization. That includes for fast growing new industries like the internet of things ((IoT)) for industrial customers such as Toyota which is always eager to improve the productivity of its factories and manufacturing capabilities.

The company is incorporating advanced AI driven data analysis into its platform which 300,000 (a figure that"s growing at 150% per year) app developers are currently using. Basically Microsoft knows that the future of enterprise IT business is in the cloud and the industry leaders will be those that have the best AI integration. That includes advances in cyber security which have become a major concern for both consumers and businesses alike. Microsoft has recently upped its AI driven cyber security offerings including with: Microsoft Secure Score, Attack Simulator, and Windows Defender ATP automatic detection and remediation.

That"s why it"s constantly making small bolt on acquisitions like Semantic Machines, a startup specializing in conversational AI. This small deal will not just strengthen Cortana (the consumer facing side of Microsoft"s AI business) but also comes with top talent like Larry Gillick, formerly the head of Apple"s AI efforts. Semantic is the sixth AI startup Microsoft has purchased since Nadella took the wheel and brought in the new cloud first strategy.

Another smart strategic move Microsoft is pursuing is partially integrating (allowing cross usage) between its cloud platform and that of Amazon (AMZN), and Apple (AAPL).

This is because Microsoft realizes that its biggest competitive advantages are scale and network effects. The larger its cloud and services user base grows the more developers it can attract to its ecosystem and the more feature rich, useful, and valuable it becomes.

Why is Microsoft doing all this? Because it has a major problem in that its legacy (but wildly profitable) Windows OEM business is continuing to decline. Remember that originally Microsoft"s main business was licensing Windows for PCs.

(Source: earnings presentation)

However as you can see the consumer windows OEM business has been seeing accelerating declines in the past three quarters as global PC sales decline due to consumers shifting more to mobile platforms. But there is some good news, and I"m not talking about the strong growth in Windows Pro OEM that is partially offsetting the decline in the retail side. Nor am I referring to the surprising strength of the company"s hardware division (Xbox and Surface) or advertising revenue from Bing.

(Source: earnings presentation)

Rather I"m talking about the great success that Microsoft has had in switching over its legacy Windows users to subscription services especially on the enterprise (commercial) side. Currently Windows remains the dominant PC OS with over 1 billion global users and over 350 million of those are running Windows 10. However ultimately PC OEM licensing is going the way of the dodo while recurring subscriptions are the wave of the future.

Microsoft"s Office 365 is the most feature rich application suite for word processing, spreadsheets, and presentations, and the company continues to grow its subscriber base at a rapid clip (28% in commercial and 17% consumer). In fact according to Nadella Office 365 commercial now has 135 million global subscribers.

That means that Microsoft"s commercial revenues are now 89% from subscription services including Office 365 and Dynamics, both of which are hosted on its cloud platform and integrated into Azure. This will allow Microsoft to continue improving its feature set at an accelerating pace. That"s thanks to its investments in AI whose data analysis can provide real time feedback on what its customers are utilizing and thus what features might be more useful in the future.

The bottom line is that Microsoft"s pivot to cloud, subscription services, and an AI driven future set it up for potentially decades of strong FCF growth. Which in turn translates into exceptional dividend growth and total return potential.

Reason 3: Dividend Profile Shows Long-Term Market Crushing Return Potential

Company

|

Forward Yield

|

TTM FCF Payout Ratio

|

Projected 10 Year Dividend Growth

|

10 Year Potential Annual Total Return

|

Microsoft

|

1.7%

|

37.2%

|

13% to 14%

|

14.7% to 15.7%

|

S&P 500

|

1.8%

|

50.0%

|

6.2%

|

8.0%

|

(Sources: Morningstar, Gurufocus, FastGraphs, Multpl, CSImarketing)

Ultimately the most important factor for me when looking at a dividend stock is the dividend profile which consists of three things: yield, dividend safety, and long-term growth potential.

Now Microsoft"s yield is certainly nothing to write home about as it basically matches the S&P 500"s paltry payout. However it"s also one of the safest payouts in corporate America. That"s because the current dividend makes up just 37% of the company"s trailing 12 month free cash flow, which is growing very quickly.

The other part of dividend safety is the strength of the balance sheet. After all a company"s dividend isn"t supposed to put its ability to invest in growth at risk and dangerously high debt levels would certainly do that.

Company

|

Debt/EBITDA

|

EBITDA/Interest

|

S&P Credit Rating

|

Interest Rate

|

Microsoft

|

1.7

|

16.3

|

AAA

|

3.50%

|

Industry Average

|

1.3

|

26.5

|

NA

|

NA

|

(Sources: Gurufocus, Morningstar, FastGraphs)

At first glance one might think Microsoft has too much debt, given that its leverage ratio and interest coverage ratios are so much worse than its peers. However you need to realize that Microsoft has an enormous foreign cash position that until recently it couldn"t repatriate except at 35% tax rates. Thus it, like Apple and numerous other tech companies, borrowed against that cash at the lowest interest rates in history to fund capital returns. In reality Microsoft"s $132.2 billion in cash more than covers its $77.2 billion in debt and its $55.1 billion net cash position means that the dividend is bank vault safe. That"s why Microsoft is one of only two companies (the other being Johnson & Johnson) with a AAA credit rating, literally higher than that of the US Treasury.

Finally let"s talk about dividend growth potential which historically is the key determinant of a dividend growth stock"s long-term total returns. In fact historically total return approximates yield + long-term dividend growth. However it"s important to realize that this formula (called the Gordon Dividend Growth Model) assumes a stable payout ratio over time.

Thus dividend growth is actually a proxy for earnings and FCF/share growth over time. This makes intuitive sense since there are just three parts of total returns: dividends, dividend/earnings/FCF growth, and changes in valuation multiples.

Over time valuation multiples tend to be mean reverting and thus cancel out, leaving just current yield (or yield on cost) and dividend/earnings/cash flow growth. However this means that when modeling long-term dividend growth one should not anticipate payout ratio inflation (dividend grows faster than FCF for a time) but merely use the long-term expected growth in FCF/share.

In the case of Microsoft analysts are expecting 13.2% EPS growth over the next decade. While such long-term forecasts must always be taken with a grain of salt in this case I consider those to be realistic expectations given the numerous large growth catalysts the company enjoys.

This means that at current valuations investors could enjoy about 15% annualized total returns from Microsoft over the next decade. Note that means that in 2028 your Microsoft investment, inclusive of dividends, would be worth about 4X what you invest today. It"s also about double the 8% annualized total return the S&P 500 is likely to generate from its current valuations.

Reason 4: Valuation Is Actually Better Than You Think

MSFT Total Return Price data by YCharts

Thanks to Nadella"s cloud/subscription pivot, Microsoft has been on fire over the last few years, crushing both the Nasdaq and S&P 500. So naturally many investors are worried that its shares are overvalued today. Now don"t get me wrong, I"m a diehard value investor and a core principle is to NEVER chase performance and overpay for a stock no matter how great it might be.

But here"s the thing. There is no 100% objectively correct way to value any stock. All we can do is use a combination of several metrics that appear reasonable based on a company"s business model to estimate a rough approximation of fair value and pay no more than that, or preferably a lot less.

I generally use at least three valuation metrics when deciding whether or not to buy or recommend a dividend stock. The first is the dividend profile, specifically whether or not a stock has the long-term potential to generate the 10+% total return that I use as my personal hurdle rate. Why 10%? Because since 1871 a low cost S&P 500 ETF would have generated 9.1% total returns net of expense ratio. Since owning any individual stock is always riskier than owning a diversified index fund I want to know that every investment I make at least has the potential to beat the market (otherwise just buy and index fund to get a strong and easier return). Microsoft"s approximate 15% total return potential easily passes that test.

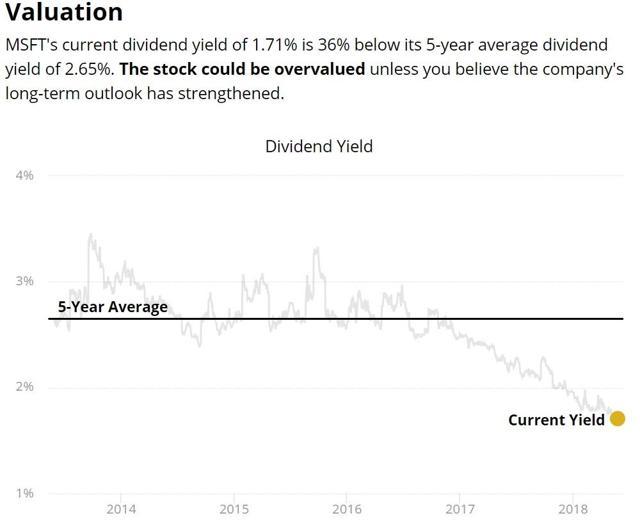

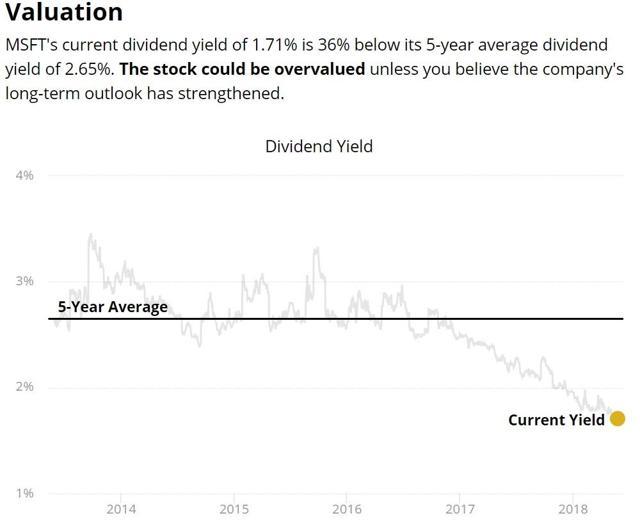

Another valuation method I usually use is comparing the yield to the five year average yield. This is because yield is one of those mean reverting multiples that usually fluctuates around a fixed point over time. Thus the five year average yield can be thought of as a good proxy for fair value.

(Source: Simply Safe Dividends)

This is where Microsoft looks to fail big time and appears about 36% overvalued. However what I"ve recently realized is that the fast changing nature of the tech sector means that this method isn"t necessarily that appropriate. At the very least it shouldn"t serve as an automatic disqualification. That"s because major business model pivots can greatly change the growth outlook for a stock and thus make the fair value yield lower than it was in a company"s slower growing past.

Which is why I use a third valuation model as well, developed by Benjamin Graham, the father of modern value investing (and Buffett"s mentor).

Forward PE

|

Implied Growth Rate

|

Historical PE

|

Benjamin Graham Fair Value PE

|

Estimated Fair Value

|

Discount To Fair Value

|

24.2

|

7.90%

|

26.1

|

31.7

|

$121.41

|

23%

|

(Sources: Gurufocus, Benjamin Graham, FastGraphs)

Graham came up with a formula for estimating a fair multiple based on the long-term (seven to 10 year) projected earnings or cash flow growth rate. This formula is: (8.5 + (2X earnings/cash flow per share growth rate)) divided by the discount rate (decimal form).

For example if a stock has zero growth and you require a 10% total return (discount rate) then Graham estimated that a fair PE would be 7.7. Why? Because assuming that a company with zero growth (but a stable business model) pays out 100% of earnings as dividends then you would receiving a 13% annual return from this investment.

In the case of Microsoft if we use the 13.2% consensus EPS/FCF per share growth forecast that implies a fair PE multiple of 31.7 and a fair value for the stock of about $121. This means that under Graham"s method Microsoft is actually 23% undervalued. That"s also in line with Morningstar"s estimated fair value of $122 which is based on an advanced two stage discounted cash flow analysis. How can this be? Because Microsoft"s current forward PE is indicating that the market is pricing in about 8% EPS growth over the next decade. That"s a very low bar to clear for a company that has such a massive and long growth runway ahead of it.

Basically this means that even though Microsoft has soared 43% in the past year and is near its all time highs, its strong fundamentals and excellent long-term growth catalysts still make it a strong buy today. Assuming of course you"re comfortable with the risk profile.

Risks To Consider

While I"m highly bullish on Microsoft and plan to add it to my own portfolio, there are nonetheless several risks to consider.

First in the short-term be aware that Microsoft"s large volume of international sales creates relatively larger currency risk. That is only going to get bigger thanks to booming sales in emerging markets like India where Microsoft saw 49% sales growth in 2016, and 30% growth in 2017.

In the most recent quarter Microsoft"s results were hurt between 2% and 5% (depending on business unit) from a rising US dollar.

^DXY data by YCharts

That"s a reversal of the weakening dollar in 2017 that helped boost all multinational profits. When the US dollar appreciates against other currencies then sales in those currencies become worth less in dollars that Microsoft reports results in (and uses to pay dividends).

A main reason the dollar weakened in 2017 was due to investor confidence that stronger economic growth in the UK, EU, and Japan would allow interest rates in those countries to rise. Instead US economic growth has continued to outpace weaker than expected growth in other major economies and our interest rates have continued to rise while theirs haven"t. This creates increased demand for dollars which means a larger currency growth headwind that Microsoft and all major US corporations could face over the next year or two. Note that over time currency fluctuations tend to cancel out, meaning this is purely a short to medium-term risk.

The larger risk for Microsoft is strong competition from large and well capitalized rivals that are also gunning for market share in the cloud. This includes:

The immense opportunity of the cloud, which will one day likely be a multi-trillion industry, means that everyone and their mother is racing to win market share in the backbone of future tech.

MSFT R&D to Revenue (TTM) data by YCharts

With the exception of IBM, who has long been far behind in R&D funding (as a % of revenue), all of its major cloud rivals are spending significant and growing amounts money developing their cloud offerings. Much of that is focused on improving AI integration into platform applications which means that Microsoft is going to have to remain nimble and avoid the kind of complacency it experienced in the past.

(Source: CNBC)

Luckily with Microsoft still behind Amazon in overall cloud market share (13% vs 33%) it"s unlikely Nadella is going to pull a Ballmer and rest on his laurels. Just be aware that there is a risk that smaller rivals might end up getting desperate and try to start a price war that could result in future cloud margins not being as high as we hope. This means that continued investment into AI and application improvements becomes all the more important, to build a wide moat around the company"s biggest cash cow.

Finally as we"ve seen in the company"s past investors must always consider the risk of poor capital allocation which can come in two forms. First big acquisitions are common in the tech world, and frequently companies overpay and then write bad deals off with huge losses. Microsoft"s $7.6 billion loss on Nokia is just the most recent example in a long history of lighting shareholder cash on fire.

Now Nadella has so far avoided huge deals other than LinkedIn, which has thus far proven a wise strategic purchase. So in terms of idiotic acquisitions I"m far less worried with Nadella behind the wheel than I was with Ballmer in the top spot. However no one is perfect and even business geniuses can be wrong so poorly conceived and money losing acquisitions are certainly a risk to keep in mind.

Finally I"m a tad worried that Microsoft might end up using its tax windfall (ability to repatriate tons of foreign cash at much cheaper rates) to do something stupid. That would include paying an enormous special dividend as some have speculated it will.

Now I should clarify that Microsoft has not yet revealed how its capital return plans will change post tax reform so this fear may be overblown. In addition many investors like special dividends, because they consider them a windfall that can be either reinvested back into more Microsoft shares or some other stock (or used to pay the bills).

However ultimately all I care about is that Microsoft use its capital return programs to boost long-term value. A growing dividend, as well as buying back undervalued shares (company has $30 billion remaining on its current repurchase authorization) creates long-term value. A special dividend doesn"t because once it"s paid the cash is gone and the share price falls by the amount of the special dividend on the ex-dividend date. Basically a special dividend has no benefit and reduces a company"s financial flexibility for things like investment, acquisitions, buybacks, and faster growing regular dividends.

Fortunately such worries should be low on one"s list of risks since it"s still a relatively speculative concern. One which management has shown no indication it is seriously considering.

Bottom Line: Microsoft"s Market Outperformance Is Not A Flash In The Pan But Likely To Continue For The Foreseeable Future

Don"t get me wrong, I"m NOT predicting that Microsoft is going to crush the market every single year like it has recently. Rather what I"m saying is that the company"s current business strategy has created a self perpetuating virtuous cycle in which the company can continue to grow quickly thanks to the immense scalability of its cloud platform. A platform which is deeply integrated into its ever improving subscription services and early stage (but promising AI) offerings.

That could translate into an ever stickier ecosystem that results in continued margin expansion resulting in an exponentially growing river of free cash flow to fuel impressive dividend growth. Which in turn should allow Microsoft to be a long-term market beater and a must own dividend growth stock for the next few decades at least.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment