There"s always a story. There"s always at least two sides to every story, depending upon whom you ask. Here"s mine.

My 2017 Story And What I Learned

While others fretted in the beginning of 2017 that the market had peaked and was ripe for a deeper correction, I maintained my focus. Leaving the market in the beginning of 2017 would have cost an investor 20% of gains in that year and about 8 percent in the New Year before the recent correction.

Corrections market-wide and company specific continued to bring opportunities for income investors to enhance their income with higher dividend yields.

Since I"m an income investor, I"m always on the look-out for these types of opportunities. Though I strongly adhere to the notion that time in the market is crucial and necessary to see the fruits of a compounding dividend investment strategy blossom, I also adhere to the large benefits that can accrue to the income investor if a dollop of timing the market is layered on top.

Developing And Refining An Income Investing Strategy

My laser-focused strategy of buying temporarily depressed stock prices on investor panic has served me and my subscribers to "Retire 1 Dividend At A Time" well the past two years. Since the bottom of the financial crisis, which occurred on March 9, 2009, I have honed and refined the strategies I use to build, grow and protect income for retirement.

An important refinement to the strategy has been to rinse and repeat it as often as possible and as often as accumulated dividends become available for reinvestment. Though I think employing a DRIP strategy can be quite effective for less active investors, or those that don"t want to monitor their portfolios on an ongoing basis, I believe that accumulating dividends as they hit the brokerage account lets us take advantage, in a much more effective manner. This is especially true when panicked investors wish to dump perfectly good stock and sell it to us at undervalued prices, which happened two weeks ago when the market experienced a 10% correction.

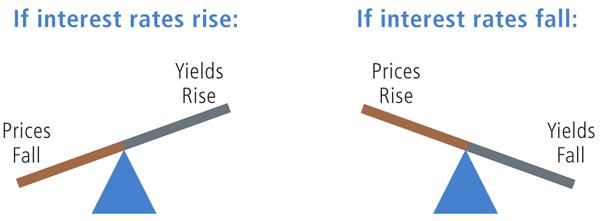

Whenever this occurs, prices fall and yields will rise. It works the same way in the bond market. It is this simple mathematical relationship that gives rise to the extraordinarily higher yield and dividend dollar totals we are able to put up on the board.

Accumulation Of Dry Powder

Some detractors would criticize this approach to dividend accumulation. It is their contention that money should be put to work at all times so it can always generate income for us. They"ll throw all sheets to the wind and reinvest dividends no matter how high a price they pay.

It is my considered belief that holding some amount of accumulated dividends in cash allows us the choice to decide when to invest it, when it can get us the biggest bang for the buck. In this sense, we have often experienced that patience pays.

Staying 10% to 20% in cash most times allows for the deployment of cash when it can get us that biggest bang for the buck.

Dealing With Risk In The Market

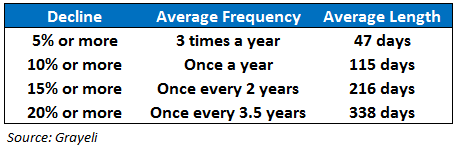

In an effort to assuage the fears of readers, followers and subscribers, I counsel them to keep approximately three years of cash or cash equivalents in reserve. This allows the investor to realize that even if a large correction or crash occurs, just at the time they might want to begin drawing down funds for retirement spending, no stocks need to be sold to accomplish this goal. At such times, the cash hoard can be relied upon to pay the bills. This strategy will allow plenty of time for stock prices on high quality companies to rebound and reinvigorate the investor"s courage. The average large correction lasts about eighteen months.

Average length of Corrections

So, keeping a cash cushion that will last twice as long can only bring more comfort and keep the investor from selling in a panic, depriving themselves of the income that that stock created in the first place.

A decent cash pile can go a long way towards holding the investor"s hand and walk them calmly through any correction, even one as big as the one we experienced as recently as the Great Recession and financial crisis of 2008-2009.

Preparing For 2018

Preparation for 2018 revolves around the theme that interest rates are most certain to continue to rise in an increasingly strong economy, one that is gathering steam and will get an extra boost from a large tax cut for corporations. Buying those companies bound to benefit more from a huge tax cut will give greater certainty to the overall outcome of an investment in the year to come.

Companies with large net operating loss carry forwards will benefit less than companies who don"t have them. Citigroup (C), for instance, currently has $16 to $20 billion of these NLCs. With the corporate tax rate reduced from 35% to just 21%, Citigroup will save that much less on their tax bill and operating income will suffer.

Here"s an example to help illustrate:

A $10,000.00 loss at a 35% tax rate can save $3500 on a company"s tax bill. But at 21%, a $10,000 loss will be worth just $2100 in tax savings. This will necessarily negatively impact a company"s bottom line.

Net Deferred Tax Assets

Companies with net deferred tax assets - those with significant net operating loss carry forwards (NOLs) or those with substantial deductions taken for tax before book (e.g., litigation expenses, loan loss accruals, etc.) - will see the value of those net deferred tax assets decline. Very simply, a $1,000 NOL is worth $350 under the current tax law"s 35% corporate rate, but would only be worth $210 with the new corporate rate cut to 21%.

As discussed earlier, Citigroup has said that such a change would cost it $16-17 billion. As a consequence, some corporations were exploring how they might accelerate earnings more quickly into 2017 so as to apply those NOLs under the current higher tax regime while they are worth more. Using these NOLs would lower a company"s taxable income for 2017 and, by reducing current tax due, increase its cash.

In contrast, firms with a net deferred tax liability stand to benefit from the new lower 21% rate.

The banking theme offers opportunity in two distinct areas. The first is represented by the hunt for financial firms that have low NOL carry forwards and stand to benefit more than their high NOL carry forward competitors.

Additional Opportunity in 2018

Additional opportunity comes with the realization that with a Fed rate rise already promulgated at the December, 2017 FOMC meeting, and two or three additional hikes coming down the pike in 2018, the financials stand to gain from a widening of the spread. They"ll be able to still borrow at competitively low rates if their balance sheets are strong while at the same time being able to charge more for the loans they make and the auto loans, home equity loans and credit card fees they charge to consumers.

The sweet spot will be finding those banks that stand to gain from both phenomenon. The regional banks, like Regions Financial (RF), or BB&T Corporation (BBT) doing all their business domestically, would appear to represent a good starting place to explore these possibilities.

Best Ideas For 2018: What"s The Story?

I recently wrote, "Shopping At Tanger Outlets Bought Us A Bargain" to emphasize the benefits of contrarian investing. Along with other REITs and mall REITs in particular, this company lost around 40% of its market value as millions of investors decided, wrongly I think, that brick and mortar was dying. I strongly believe that news of the death of brick and mortar has been greatly exaggerated, and Tanger Outlets (SKT) serves a high-end niche market that will do well.

It is well for investors to realize that, though online retailing continues to grow by leaps and bounds, it still accounts for only about 15% of all shopping. It"s also wise to remember that consumer spending accounts for 70% of U.S. GDP.

Just a few weeks ago, we recommended purchase of SKT to our subscribers at $22.67. As I write this, it is changing hands at $25.26. This 11.4% gain in so short a time illustrates the capital appreciation that can be captured by going against the grain and executing on a solid idea with a high-quality company.

We obtained a high yield of 6.04% for our subscribers. Today"s buyer must settle for a much lower 5.4%. Because there"s always a sale somewhere in the market, this type of market timing can be employed multiple times throughout the year in any number of names.

We took another contrarian position on AT&T (T) recently and continue to believe it will play out well for investors in 2018, regardless of the outcome of the planned merger with Time Warner (TWX).

After the suits are finished litigating the lawsuit with the Department of Justice, if AT&T prevails, they"ll be able to handle the additional debt to do the deal. If the DOJ prevails, AT&T will simply move on to another friendly target that will aid in its adaptation to the future. Investors worried about the debt load will breathe easier and have new justification to buy the stock again, pushing its price ever higher. Author Michael Wolff wrote a best-selling book about the goings-on at the White House. He contends that numerous high-level White House advisors and staffers have said, "No way, this deal is not going to be approved". Take that for what it"s worth.

In the meantime, we recommended AT&T to subscribers and followers in recent posts, at $32.60 per share. We guided readers and subscribers to a solid 6.01% yield on a stalwart that normally yields closer to 5.00%.

As I write this, AT&T is currently trading for $39.19, just weeks after our purchase. Today"s income investor will have to settle for a dividend yield of just 5.10% as it reverts to that 5% mean just discussed. Again, this compares to the hefty yield we received of 6.01%. Once T raised its annual dividend to $2.00 a few weeks later, our yield on cost rose to 6.13%.

For those capital gainers out there, we"ve also scored capital appreciation of 20.2% on this new position.

Time In The Market Vs. Timing The Market

Income investors often say that "time in the market is more beneficial than timing the market". Because I"m a long-term investor, I subscribe to the first part of that statement. Because I"m also an opportunistic investor, I can also enhance my dividend stream by adhering to the second part as well. There is always a sale in the stock market, somewhere. You just need to know where to look for it.

Got A Pension?

Today, only 24% of workers are covered by traditional, defined benefit pensions at work. The rest of us must fend for ourselves. Big corporations who used to provide pensions now save enormous sums by no longer offering them. Instead, the other 76% have been encouraged to find ways to fill the gap between the meager amounts we’ll receive from Social Security and the actual spending needs we’ll all have in retirement. This was the genesis of the Fill-The-Gap Portfolio.

The Fill-The-Gap Portfolio

The FTG Portfolio contains a good helping of dividend growth stocks, like AT&T. It was built with the express purpose of benefiting from this and other strategies.

Three years ago, I began writing a series of articles on December 24, 2014, to demonstrate the real-life construction and management of a portfolio dedicated to growing income to close a yawning gap that so many millions of seniors and near-retirees face today between their Social Security benefit and retirement expenses.

The beginning article was entitled, "This Is Not Your Father"s Retirement Plan." This project began with $411,600 in capital that was deployed in such a way that each of the portfolio constituents yielded approximately equal amounts of yearly income.

The FTG Portfolio Constituents

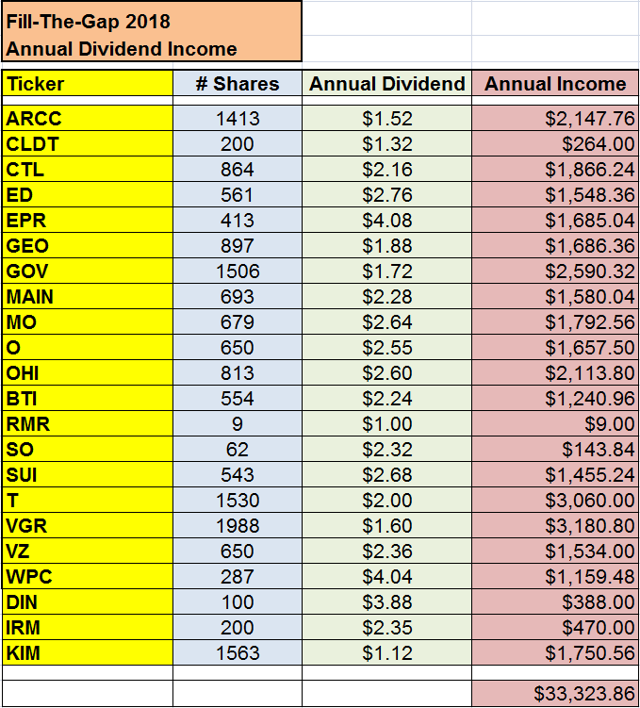

Constructed beginning on 12/24/14, this portfolio now consists of 22 companies, including AT&T Inc (T)., Altria Group, Inc. (MO), Consolidated Edison, Inc. (ED), Verizon Communications (NYSE:VZ), CenturyLink, Inc. (NYSE:CTL), Main Street Capital (MAIN), Ares Capital (ARCC), British American Tobacco (BTI), Vector Group Ltd. (VGR), EPR Properties (EPR), Realty Income Corporation (O), Sun Communities, Inc. (SUI), Omega Healthcare Investors (OHI), W.P. Carey, Inc. (WPC), Government Properties Income Trust (GOV), The GEO Group (GEO), The RMR Group (RMR), Southern Company (SO), Chatham Lodging Trust (CLDT), DineEquity (DIN), and Iron Mountain, Inc. (IRM) and Kimco Realty Corp (KIM).

Because we bought most of these equities at cheaper prices since the inception of the portfolio and because most of our stocks have increased their dividends regularly, the yield on cost that we have achieved is 7.67% since launch on December 24, 2014. Current portfolio income, including recent dividend raises by AT&T and Realty Income, and our newest addition of AT&T shares, now totals $33,323.86, which is $2142.00 more annual income than the previous month. This represents a 6.5% annual income increase for the portfolio.

When added to the average couple"s Social Security benefit of $32,848.08, this $33,323.86 of additional supplemental income brings this couple annual income of $66,171.94. We note that the dividend income on this portfolio has now surpassed the amount coming from the Social Security benefit. This far surpasses the original goal set to achieve a total of $50,000.00, which is accepted as a fairly comfortable retirement income in many parts of the country. That being said, this average couple now has the means to splurge now and then on vacation travel, dinners out, travel to see the kids and grandkids and whatever else they deem interesting.

Taken all together, this is how the FTG Portfolio generates its annual income.

FTG Annual Dividend Income

Insert FTG 2018 Annual Dividend Income pic, here:

Chart source: the author

Your Takeaway

As discussed in “Even A Cloudy Crystal Ball Comes Into Focus Twice A Year”, paying too much attention to the everyday price swings, even with stodgy stalwarts like AT&T can drive investors to drink. But for those investors willing to be more proactive in their investing, there is a lot to be said for putting favored stocks on a watch list and exercising the patience to wait, and then pounce when others have thrown the stock out with the bathwater.

My aim was to demonstrate that great capital gains and enormous growth of portfolio income can be accomplished if an investor is willing to spice up his portfolio with a dash of market timing, now and then. AT&T’s yield, shooting up from its usual 5% range to 6.01% was something we could not ignore. We could not stand by passively and look that gift horse in the mouth. We acted, for ourselves, our readers who follow me, and subscribers.

With the ten-year Treasury rate convincingly smashing through a 2.2%-2.5% range that has held for quite some time, now is a good time for investors to sharpen their pencils and get their orders set up. Rising yields, as evidenced by the ten year Treasury bond ticking up to 2.95% last week, are already bringing down the prices of favored REIT investments for retirees who seek income. With each tick down in price, yields rise. It"ll be time soon to enter limit orders to grab some accidentally high yield once again and buttress our portfolios with additional income.

We all have mistakes we’ve made that we can learn from. The key is having the courage to look back upon them, learn from them, and then act upon the information learned.

In regard to our recent successful AT&T trade, we have been reminded, once again, “If AT&T trades down to a point where it yields 6%, I will buy it, I can buy it, and I did buy it”.

I continue to learn lessons, have tried to apply them and I try to share them with you.

Your Engagement Is Appreciated

As always, I look forward to your comments, discussion, and questions. Do you use DRIP investing? Have you occasionally employed market timing? What has been your experience and have you found it worthwhile towards your ultimate goal of growing income for retirement? Please let me know in the comment section how you approach these situations in your own portfolio and how you arrive at your decisions.

Author"s note: Should you be interested in reading any of my other articles detailing various strategies to enhance your returns on a dividend growth portfolio, you will find them here.

If you"d like to receive immediate notification as soon as I write new content, simply click the orange "follow" button at the top of this article next to my picture or at the bottom of the article, then click "Real time alerts."

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

Thanks for reading. Interested in more dividend strategies and ideas?

I run Retire 1 Dividend At A Time to help investors stay focused on their portfolio income and long-term goals.

My promise to you: With every exclusive article, email, instant-text and chat, I"ll help guide you to:

- Increased income for retirement, one dividend at-a-time.

- Under-valued stocks for a greater margin of error and higher capital appreciation.

- Methods to safely diversify your portfolio.

- Strategies to build, grow and protect your income for retirement.

You"re invited to take a two-week free trial to get started on the next step of your investing journey!

Disclosure: I am/we are long ALL FILL-THE-GAP PORTFOLIO STOCKS.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment