There are serious downside risks to the Australian dollar. Generally, I believe that you should sell AUDUSD (or trade the bearish thesis through related ETFs: FXA, CROC, DAUD, UAUD), but I want you to be aware of the risks.

First, let"s discuss why you should sell the Aussie. Then, I will explain why you should be cautious.

Technicals

Consider the weekly chart.

Source: Trading View

Since 2016, the AUDUSD has been moving in a strict Fibonacci channel, with remarkable discipline. Every single level that was previously a resistance later became a support and vice versa. The general trend was up, but it was not until 2018 that the currency finally managed to break above 200-SMA and hold above it. Now, however, it is at risk of sliding below that critical level and possibly setting a new monthly low. Indeed, this week"s candle (see the chart below) nearly engulfs the previous candle, which is a sign of a strong bearish pressure. Indeed, last week, AUDUSD failed to hold above 0.382 Fibo trend-channel line and history shows that over the past two years, every time the currency failed to hold above that level, it then retreated towards 0.236 level and sometimes fell below it.

On a daily chart, the exchange rate has dropped below its weekly pivot level (0.7890) as well as below all key short-term moving averages (5, 10 and 21). Furthermore, relative strength index is weakening.

Fundamentals

I believe two themes will be weighing on the Aussie on the fundamental side of things: divergent monetary policy between the Fed and the RBA and structural weaknesses in the domestic economy.

The Fed minutes from the meeting, held Jan. 30-31, were released on Wednesday. They indicated the Fed sees increased economic growth and an uptick in inflation as justification to continue to raise interest rates. Some analysts actually believe that the Fed is even more hawkish today than it was three weeks ago, when it held that meeting. David Kelly of JPMorgan predicts "unless there is some shock" there will be four rate hikes this year.

By contrast, the Reserve Bank of Australia (the RBA) is likely to follow a more gradual rate rise path, due to low wage growth and high household debt. Thus, divergent monetary policy will ensure that any rallies in AUDUSD will be hard to sustain. Indeed, the average monthly spread between two-year bond yields dropped below zero in February. In other words, the spread is now negative because the yield on U.S. Treasuries is higher compared to Australian bonds. This has not happened since July 2000. Yes, you read it correctly. The monthly average two-year yield spread between the U.S. and Australia has not dropped below zero for almost 18 years. But now it is below zero, which makes long positions on AUDUSD even costlier.

Source: Federal Reserve, Reserve Bank of Australia, personal calculations

Now to Australia"s domestic issues.

As already said, the combination of low wage growth and high debt means the RBA will stand pat on rates for a while yet. The problem, however, is that the debt is not only high, but that it is also getting higher. RBA data shows that the average household mortgage debt-to-income has risen to around 140% at the end of 2017 from nearly 120% in 2012.

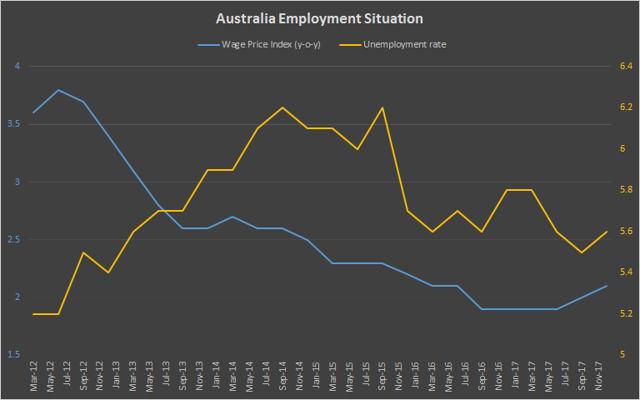

Simultaneously, employment situation is just not getting better fast enough. Wage growth remains stubbornly low (too close to inflation level), while unemployment rate remains persistently high (it has been above 5.0% since 2012).

Source: Australian Bureau of Statistics

On balance, divergent monetary policy between the Fed and the RBA and structural weaknesses in the Australian economy (notably, debt-income situation) compels me to look for opportunities to short AUDUSD. However, there is one issue that dents my confidence - commodities.

Commodities

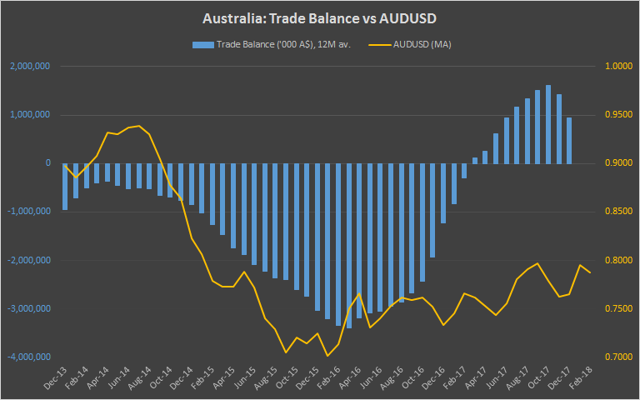

Australia is a resource-rich country, which is exporting a lot of commodities - specifically, iron ore, coal, wheat and liquefied natural gas. The price of commodities has been going up lately as global demand improved. As a result, Australia"s trade balance went into surplus (see the chart below). Although that surplus already started to shrink in November last year, it was probably only a temporary adjustment. Indeed, oil price is up 4% year-to-date, and because energy is a major component of Australia"s exports mix, I expect to see further improvements in its trade balance in January and February.

Source: Australian Bureau of Statistics

Stronger exports will improve current-account balance and will drive the demand for the Australian dollar. This factor is making me a bit more cautious in my trading strategy.

Overall, I will be looking for opportunities to short AUDUSD - especially if I see any rallies, but my targets will be relatively modest. I doubt we will see 0.7000 in the nearest future, but 0.7500 is possible.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment