By Bob Ciura

There is no shortage of dividend-paying energy stocks to choose from. We have compiled a list of 294 dividend stocks in the energy sector. You can see all 294 energy dividend stocks here.

While there is an abundance of energy stocks that pay dividends to shareholders, there are just two energy stocks on the list of Dividend Aristocrats, a group of 53 stocks in the S&P 500 Index, with 25+ years of consecutive dividend increases. You can see all 53 Dividend Aristocrats here.

Integrated oil and gas giants Exxon Mobil (XOM) and Chevron Corporation (CVX) are the two Dividend Aristocrats from the energy sector. Despite operating in a cyclical, and often highly volatile industry, Exxon and Chevron have increased their dividends for over 30 years. They also offer secure 3.7% dividend yields.

Both companies reported quarterly earnings on Friday, February 2, and the market reacted negatively in both cases. Exxon and Chevron declined 6% and 3%, respectively. This article will compare and contrast their earnings, and why both companies remain high-quality dividend growth stocks.

Earnings Overview

Exxon and Chevron are both integrated majors, meaning they operate balanced business models across all corners of the oil and gas industry. The Upstream segment includes oil and gas exploration and production. Downstream activities include refining and marketing. They also have chemicals businesses.

For the fourth quarter, Exxon had adjusted earnings per share of $0.88 on revenue of $66.52 billion.

Source: Earnings Presentation, page 7

Both figures represented strong growth from the prior-year fourth quarter. For example, revenue jumped 18% year-over-year. But both figures missed analyst expectations. Analysts had expected Exxon to earn $1.03 per share while revenue missed estimates by $7.79 billion. As a result, earnings came in 14% below consensus.

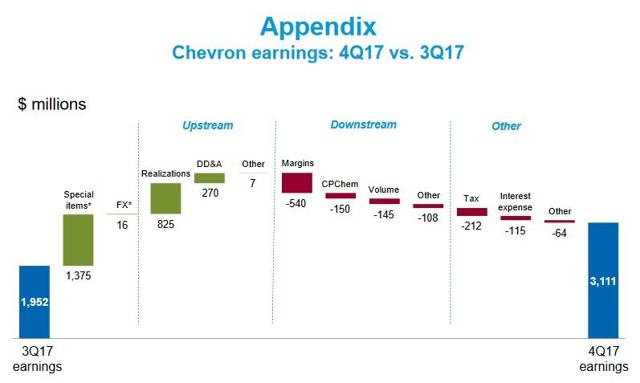

Chevron posted profits of $3.4 billion, or $1.64 per share, for the final quarter of 2017. However, earnings included a $2 billion tax benefit. Excluding the tax benefit, Chevron had earnings per share of $0.72. Analysts had expected earnings of $1.22 a share. Chevron"s earnings were 41% below consensus.

Source: Earnings Presentation, page 22

Tax reform was a major benefit to both companies. Operationally, upstream activities, primarily exploration and production, performed very well for both Exxon and Chevron. Not surprisingly, this was due to rising oil and gas prices. Exxon"s fourth-quarter earnings excluding U.S. tax reform and impairments increased $1 billion to $2.5 billion, driven by higher prices, as realizations increased more than $10 per barrel.

Profits in Chevron"s upstream business rose to $5.3 billion in the fourth quarter from $930 million a year ago. However, the results were helped by a benefit from U.S. tax reform totaling $3.3 billion.

The major culprit for both companies" disappointing earnings was international refining. For Exxon, refining outside the U.S. generated earnings of $646 million, 33% lower than the same quarter a year ago. For Chevron, profits in the international downstream segment fell 75%. Since Chevron"s international refining unit performed much worse than Exxon"s, which led to a much bigger earnings miss for the quarter, it seems Exxon had the better quarter.

Growth Prospects

Going forward, 2018 will likely be another year of growth for Exxon Mobil and Chevron. Growth will be fueled by new projects set to come online or ramp up. With a more favorable pricing environment, this could accelerate upstream earnings growth in 2018.

Exxon Mobil"s most significant new project could be offshore Guyana.

Source: Earnings Presentation, page 20

In the third quarter of 2017, Exxon Mobil completed the Turbot-1 exploration well in offshore Guyana, its fifth discovery in Guyana at the time. In the fourth quarter, the company announced the sixth oil discovery offshore Guyana with the completion of the Ranger-1 exploration well.

Discoveries offshore Guyana are now estimated to total more than 3.2 billion recoverable oil-equivalent barrels. Guyana will be a major driver of Exxon"s future production growth. At its 2017 Analyst Meeting presentation, Exxon gave guidance for annual production to rise to 4.0-4.4 million barrels per day by 2020.

Meanwhile, Chevron"s most important projects are its liquefied natural gas (or LNG) facilities in Australia, Gorgon, and Wheatstone.

Source: Earnings Presentation, page 12

These are enormous undertakings. Put together, Gorgon and Wheatstone have annual production capacity of more than 24 million tonnes of natural gas. And, because they are in Australia, they are perfectly situated geographically to serve the booming energy demand in Asia.

After many years in development, the projects are finally ramping up. The Gorgon project started up last year, and shipped over 80 LNG cargos in 2017. On October 8th, Chevron announced it had reached first production at Wheatstone. At full capacity, Wheatstone will supply 8.9 million metric tons per year of LNG. The two projects are positioned well to serve booming energy demand in Asia.

These projects will have a huge positive impact on Chevron"s cash flow in two ways. First, now that they have been placed into service, they will account for significant production growth. In the fourth quarter, the projects averaged nearly 400,000 barrels of oil equivalents per day. By January, combined production from Gorgon and Wheatstone exceeded 500,000 barrels of oil equivalents per day. Plus, Chevron will also no longer have to spend billions of dollars developing the projects.

Chevron"s growth prospects appear stronger, particularly on production. Chevron increased production by 5% in 2017, and expects 4% to 8% production growth in 2018. Exxon"s production fell 3% in the fourth quarter, and it has a more modest production growth outlook over the next several years. As a result, Chevron has stronger growth prospects.

Valuation & Dividend Analysis

Chevron had earnings per share of $4.85 in 2017. The stock has a price to earnings ratio of 24.8. Exxon had earnings per share of $4.63 in 2017. Based on this, the stock trades for a price to earnings ratio of 18.1. Exxon appears to be significantly cheaper than Chevron on a valuation basis.

In terms of dividends, both stocks have secure payouts. Earnings per share easily covered both companies" dividends in 2017. Chevron actually increased its dividend by 3.7% along with quarterly earnings to $1.12 per share on a quarterly basis. Exxon"s most recent dividend increase was a 2.7% increase in April 2017. Both stocks have 3.7% dividend yields, although Chevron"s future dividend growth could be higher than Exxon"s, based on its stronger growth potential.

Final Thoughts

The past few years have been highly challenging for Big Oil. Now that oil prices are finally back above $65 per barrel, things are finally looking up for the oil and gas industry. Exxon and Chevron are both profitable companies with strong balance sheets, although Exxon"s production drop is a cause for concern. As a result, Chevron could be the better oil Dividend Aristocrat for 2018.

High-quality dividend growth stocks, such as the Dividend Aristocrats, have outperformed the S&P 500 Index in the past 10 years. In addition to Chevron and Exxon Mobil, there are many other high-quality Dividend Aristocrats, with attractive valuations and high dividend yields. Find them with our service Undervalued Aristocrats provides actionable buy and sell recommendations on some of the most undervalued dividend growth stocks around. Click here to learn more.

Disclosure: I am/we are long XOM.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment