Grocer Albertsons signed an agreement to buy all Rite Aid (RAD) stores not bought by Walgreens (WBA). The deal is unusual, to say the least. Rite-Aid shareholders will effectively get $2.50 a share, which is a far below amount Walgreens paid for the 1,932 stores it bought. Shareholders should demand more than the low-ball offer.

Walgreens bought 1,932 stores for $4.4 billion, which values the stores at $2.28 million a store. Conversely, Albertsons will get the approximately 2,670 Rite Aid stores for $1.83 of cash plus a share of Albertson’s, for every 10 shares of Albertson’s. The exact terms of the deals are as follows:

Under the terms of the agreement, in exchange for every 10 shares of Rite Aid common stock, Rite Aid shareholders will have the right to elect to receive either (I) one share of Albertsons Companies common stock plus approximately $1.83 in cash or (ii) 1.079 shares of Albertsons Companies stock. Depending upon the results of cash elections, upon closing of the merger, shareholders of Rite Aid will own a 28.0 percent to 29.6 percent stake in the combined company, and current Albertsons Companies shareholders will own a 70.4 percent to 72.0 percent stake in the combined company on a fully diluted basis.

Source: Rite Aid

The approximately $2.50 per RAD stock values the buyout at $2.6 billion, or just $970,000 for each store. Paying less than half what Walgreens paid is wholly inadequate for shareholders. If an activist investor like Elliot steps in, as contributor Seven Corners Capital Management suggests, it would have a strong case in forcing Cerberus to raise its offer.

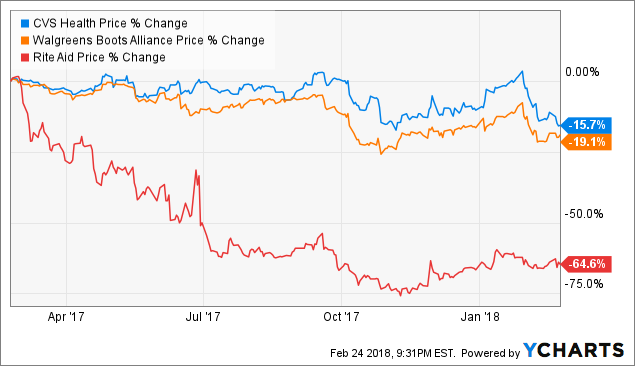

RAD Stock:

Take Cash and New Share or No Cash and More Shares

If no activist investor gets involved to get more for each RAD stock, then shareholders may either take the $1.83 in cash plus 1/10 Albertsons shares or take a bit more Albertsons shares only. As you will notice, the deal is structured to give very little money to shareholders. Investors need to consider how weak the combined company will be when it merges. Finding $375 million in synergies is hardly assured. As author Vince Martin calculated, assigning a 5x multiple to EBITDA and the combined Rite Aid/Albertsons would have a market cap of $7 billion. That would imply a share value of just $2 a share.

Speculating on Rite Aid

Author Daniel Jones believes the merger is good for shareholders. The bullishness is based on the combined firm achieving the cost synergies, $400 million in free cash flow from Rite Aid, and a P/FCF of just 4.2 times. The problem with this view is that Albertson’s stores are all dated and are in need of a major refresh. Prior to the merger, Rite Aid had walked through a more innovative business model that would embrace technology in its business. It would have focused more on delivering a better customer experience. This merger sets Rite Aid’s turnaround back.

Reader Sean Livingstone figures Amazon.com (AMZN) could swoop in to buy some of Rite Aid’s stores. The online retailer is working with Berkshire Hathaway and JPMorgan Chase to partner on health care. Yet the new company will focus only on the technology solutions. It will need a physical storefront to deliver easily accessible drugs.

Merger Sets Too Low a Value for Rite Aid Stock

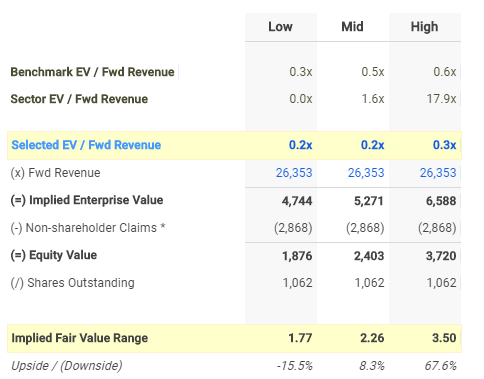

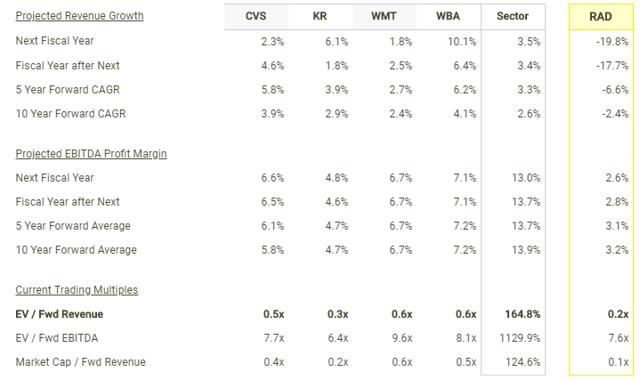

The merger values RAD stock at just 0.2x EV/Fwd Revenue. CVS Caremark (CVS) is worth 0.5x while Walgreens (WBA) is valued at 0.6 times.

Source: finbox.io

Rite Aid is worth north of $3.50 a share at a 0.3x EV/Fwd. Revenue and that excludes assuming management succeeds in fixing the business and generating higher revenue in the future:

Source: finbox.io

Final Word

Rite Aid shareholders should vote against the merger and, should the deal go through, sell the stock before the Albertsons shares are issued. Cerberus failed to take Albertsons public through an IPO for over three years. This backdoor entry into the stock market is a troubling deal that hurts the RAD shareholder. Rite Aid had a fundamentally better chance of turning around its business as a pure-play pharmacy chain. The merged firm has two bifurcating goals of growing in the supermarket business and in pharmacy. The synergies between the two businesses are limited. Post-merger, the firm will suffer from low p rofitability and extra costs needed to put the two operations together.

Please [+]Follow me for continued coverage on value stocks on sale. Click on my name next to my avatar at the top of the article to view DIY tips streamed through the ‘People’ tab.

If You are a Do-it Yourself Value Investor, please look at this marketplace subscription.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Rite Aid Survey guide so if you have any suggestions about the post or have any query about Customer Survey, you can share it with us in comments right below here. If you are interested in more you can also take a Rite Aid survey to win a coupon and enjoy free products and discounts too.

ReplyDeleteRite Aid Customer Survey

Rite Aid survey

storesurvey.riteaid.com win $1000 customer survey

Rite Aid survey

rxsurvey.riteaid.com win $1000

This Blog Is A very Great Albertsons Survey

ReplyDelete