It"s easy to see how blockchain technology could destroy bank profits. After all, it allows people and businesses to conduct business peer-to-peer, thereby cutting out the middleman. Imagine what happens when financial transactions happen without a 3rd party intermediary, such as Wells Fargo (WFC).

As a shareholder, the first reaction to blockchain might be horror because banks depend on being the source of truth and trust between parties. That"s how they seemingly add value, in effect, by selling trust via accountability, tracking, auditing and so on.

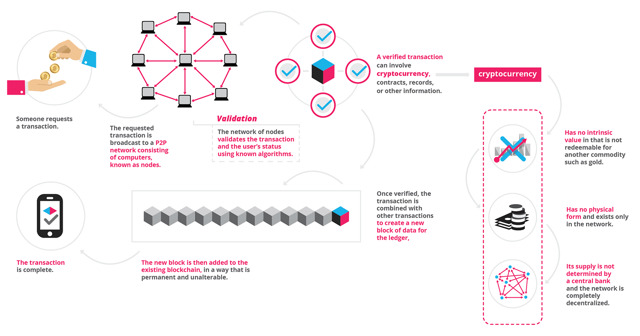

Here"s a simple visual that shows the flow of a simple transaction, along with some descriptions and definitions:

To emphasize, the key element is that no central authority, no bank, no Wells Fargo is in the middle or anywhere in this chain of events. If you"re an investor and you"re not at least a little bit curious, or downright worried, then it"s time to look at this because it"s happening right now. Banks might feel threatened.

To emphasize, the key element is that no central authority, no bank, no Wells Fargo is in the middle or anywhere in this chain of events. If you"re an investor and you"re not at least a little bit curious, or downright worried, then it"s time to look at this because it"s happening right now. Banks might feel threatened.

With blockchain, we can imagine a world in which contracts are embedded in digital code and stored in transparent, shared databases, where they are protected from deletion, tampering, and revision. In this world every agreement, every process, every task, and every payment would have a digital record and signature that could be identified, validated, stored, and shared. Intermediaries like lawyers, brokers, and bankers might no longer be necessary. Individuals, organizations, machines, and algorithms would freely transact and interact with one another with little friction.

Despite the potential for fear as a Wells Fargo investor, I tend to look at blockchain as an opportunity more than a threat. Let"s look at what WFC has been doing to ensure their survival, and perhaps even grow their competitive advantage.

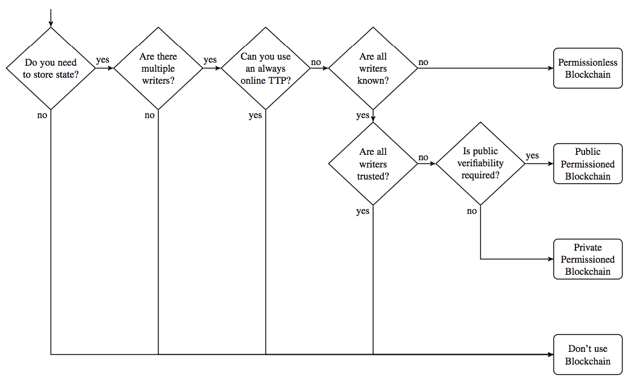

Before we do that, remember that blockchain isn"t right for everything. We need to ask the question: Do you even need blockchain? It"s not a one size fits all technology, and it"s still new. And, perhaps WFC can exploit blockchain? We"ll return to this idea shortly.

You can easily flow the blockchain adoption decision this way:

The essential point is that blockchain might be pretty much useless in many situations, and may not pose any threat whatever in some areas of banking.

The essential point is that blockchain might be pretty much useless in many situations, and may not pose any threat whatever in some areas of banking.

Furthermore, blockchain can provide cost reductions, time reductions, and increase competitive advantages for banks in some ways. Blockchain can therefore improve profits for banks when properly installed, in the right places.

Let"s look at an interesting use case. If you want move money around the globe there"s a good chance you"ll need to use the SWIFT system, which is:

...a vast messaging network used by banks and other financial institutions to quickly, accurately, and securely send and receive information such as money transfer instructions. Every day, nearly 10,000 SWIFT member institutions send approximately 24 million messages on the network.

Obviously there are various fees and costs associated with using SWIFT, and banking institutions depends on it for moving transaction information in bulk. Plus, it"s not perfect and can be quite messy. As Jeff Bezos says, those margins (and information issues) are blockchain"s opportunity. The opportunity is that Wells Fargo could get better. That"s where Ripple comes in:

International wire transfers between banks cost from $5 to more than $50, plus foreign-exchange charges of 0.25% to 3% and "landing fees" of as much as $20. And the error rate for wire transfers is between 3% and 5%, Thomas said.

Where Swift, the Society for Worldwide Interbank Financial Telecommunication, provides a one-way messaging service, Ripple provides a two-way protocol. This allows for greater transparency: Banks can exchange information and find out ahead of time what the fees and foreign-exchange rates will be, along with the expected date of delivery for the funds. If any of the information is wrong or missing, both banks will find out before the payment is sent, which should keep transfers from getting stuck in the pipes.

Ripple provides speed and accuracy, at a lower cost. And Wells Fargo is coming on board. For example, in late 2016:

The Commonwealth Bank of Australia, Wells Fargo, and Brighann Cotton have claimed the first interbank trade transaction combining blockchain technology, smart contracts, and the Internet of Things (IoT). The transaction, which took place between Brighann Cotton US and Brighann Cotton Marketing Australia, and their respective banks Wells Fargo and Commonwealth Bank, involved a shipment of 88 bales of cotton from Texas, USA to Qingdao, China.

The message here is that Wells Fargo isn"t sitting and waiting for blockchain to steamroll their business. Instead they are using blockchain, including various experiments with Ripple, to innovate and improve. Most of this will happen behind the scenes and out of sight of average customers. And, most of the initial advantages will come from bank-to-bank or institutional transactions behind the scenes. In other words we"re not talking about better usability or new customer tools but instead this is about accuracy, efficiencies, and other operations related advantages.

Put another way, the real disruption with blockchain and banking is to the tools and services that support the industry, such as SWIFT. Indeed, Wells Fargo can exploit blockchain technology while simultaneously pressuring providers to use it to drive down costs. This is something like how Wal-Mart (WMT) puts pressure on suppliers to drive down costs, and improve logistics efficiencies. Technologies like barcodes, RFID and IoT can cause some disruption but mostly they are enablers.

By analogy, blockchain isn"t so much of a threat as it is an unknown. You still need businesses and banks like Wells Fargo to provide software, tools, services, interfaces and more. You also will probably need banks to handle contracts and various negotiations for many, many years. There"s far less of a replacement threat than there is a pace-of-adoption threat. If other banks, such as Bank of America (BAC) or JPMorgan (JPM) adopt blockchain faster and better, that"s the problem, not blockchain inherently.

I also want to bring up another idea about adoption. Stick with me on this. When people talk about artificial intelligence, they tend to think about computer and robots, and how they will take over or replace humans. This is extremely black and white, us vs. them thinking. It"s far more likely that in the short and medium term, computer technology will augment our bodies and our thinking. Still with me? Well, consider the same type of transformation happening with blockchain and Wells Fargo. Blockchain isn"t going to suddenly overthrow banking. Bitcoin can"t instantly replace Wells Fargo. Instead, we"re seeing how banks cautiously experiment and slowly embrace blockchain.

There won"t be a revolution but instead there will be an evolution. Blockchain will augment banking, not replace it. Wells Fargo might experience some bumps along the way but ultimately what was meant to replace banking will instead augment it. Investors are safe as long as bank leadership incorporates blockchain intelligently.

Let"s wrap it up.

- On the surface, blockchain threatens banks like Wells Fargo because people and businesses can carry out transactions peer-to-peer. This is far more imaginary and ideal than true. This is the dream, the ideal, but not the raw truth in the market.

- Blockchain isn"t relevant or necessary in many banking situations. Banks are unlikely to embrace blockchain in many situations simply because it isn"t as efficient or effective, and will likely never be the right fit for many types of transactions.

- In cases where person-to-person or business-to-business transactions are a good fit for blockchain, it"s quite possible that banks will provide other tools and services to facilitate the activity (e.g., software or mobile apps). The threat isn"t blockchain, it"s that banks like Wells Fargo don"t adapt. This is a business threat, not a technology threat.

- There are plenty of situations where blockchain is a strong enabling technology, such that banks can increase speed and efficiency, while driving down costs. Wells Fargo, for example, could also drive 3rd parties to use blockchain technology to better trace and track transactions. This again is not at all a technology threat but more of a business re-engineering opportunity in their ecosystem.

Taken as a whole, as long as Wells Fargo continues to move forward with blockchain adoption, they aren"t threatened. The biggest threat isn"t the technology itself but instead lack of adoption if competitors move faster, with better solutions, and internal efficiencies. Blockchain won"t eat Wells Fargo.

I certainly wouldn"t short WFC because of any type of existential threat fueled by blockchain or the Bitcoin phenomenon. It"s way more of a "wait and see" situation. I can"t see blockchain directly destroying Wells Fargo, but I do see how it could cause pain if they don"t adapt and adopt. Giddy up!

Disclosure: I am/we are long WFC,WMT,BAC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment