Investment Thesis

SQ data by YCharts

Square (NYSE:SQ) had a tough day on Monday. Analyst Mark Palmer downgraded the company from Neutral to Sell and put $30 price target on the stock, triggering a single-day 16% decline. Despite that decline, shares of the company have more than tripled in over the past year, based on positive growth and news that the company is piloting Bitcoin (Pending:COIN) sales.

I am bullish on Square"s brand name and business model and project double-digit growth for the next seven years. Despite that, I find shares of Square continue to be 35% overvalued and place their fair value at $27/share. I am excited to see Square"s launch of Bitcoin sales in Square Cash, but believe it will have relatively little impact on the company"s top and bottom line.

While I believe in Square as a company, shares have simply rallied too far, perhaps on the back of irrational exuberance over Bitcoin"s recent rally. Until shares of the company fall back to Earth, I will remain on the sidelines.

Square"s Business and Revenue Streams

Source: Square, Inc.

Square is primarily known for its Square Reader and Square Register products, which allow businesses to accept credit cards, debit cards, and other payment methods. These point-of-sale systems have allowed entrepreneurs and small businesses to accept credit cards where they may not have otherwise been able to offer this service. Square was founded by its CEO, Jack Dorsey, who is also the CEO and co-founder of Twitter (NYSE:TWTR).

Although Square charges for its hardware, Square"s revenue is primarily generated by transaction fees. For example, the Square Register accepts all major cards for a cost of 2.5% plus 10 cents per transaction. This transaction-based revenue accounts for 88% of Square"s total revenue over the past 12 months, while hardware sales make up 2% of the company"s revenue.

These terminals are Square"s best asset as a company. Square"s services are widely used and widely known. This enables Square to reach customers at a much higher rate than some of its lesser-known peers. Square also benefits from a simple payment system, although it can be more expensive than its peers. Further, consumers know and trust Square devices, whereas some consumers may be skeptical of lesser-used processing systems. Square"s branding thereby provides it with some level of enduring competitive advantage, although this is contingent on Square continuing to offer competitive products with its peers, including Clover Go and PayPal Here (NASDAQ:PYPL).

Three services make up the remaining 10 percent of Square"s revenue and are categorized by the company as subscription and services-based revenue. Square Instant Deposit offers Square users the ability to have funds instantly deposited into their account, for a 1% fee, instead of using free payments which take one to two business days. Caviar is a service which allows users to order food for either delivery or pickup which Square acquired in 2014 for about $100 million. Rounding out Square"s services, Square Capital offers small business loans and financing in order to allow them to grow. Together, these three businesses contribute 10% to Square"s revenues.

Square Cash: Entry Into Bitcoin Sales

^NYB data by YCharts

Bitcoin has been in the news quite a bit recently, with the cryptocurrency breaking through the $9,000 barrier, and nearing $10,000. As I write, Bitcoin is currently trading at $9,800 on a popular trading site. Bitcoin is a fascinating technology and is a tiny part of my portfolio (less than one bitcoin), although its current price is divisive, with plenty of bulls and bears alike.

Square has gotten into the Bitcoin spotlight as well, with word that the Square Cash app is letting some of its users use the app to purchase Bitcoin. This support is still being tested, according to Tech Crunch, but could potentially allow customers to buy and sell Bitcoin using the app.

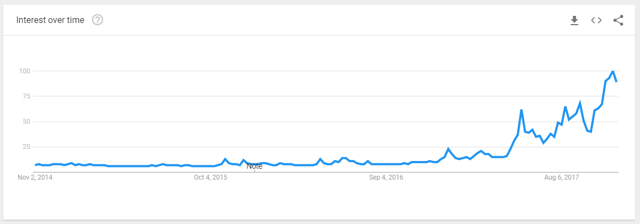

Source: Google Trends

Source: Google Trends

This could potentially be big news for both Square and for Bitcoin. Bitcoin"s popularity (and price) is at an all-time high, and Square could be one of the first major, publicly-traded companies to allow users to trade the currency, which could aid wider adoption of the currency.

Further, Square could potentially increase its revenue through Bitcoin sales. Daily Bitcoin volume is, according to Bitcoinity, approximately 150,000 bitcoins, or about $1.47 billion. Trading fees at major exchanges tend to be around 0.1% to 0.2% per side, while fees at less specialized sites tend to be around 1.5% plus credit card processing fees where applicable. Square"s pricing structure is likely to align with that of Coinbase.

"Given Square"s tendency to move judiciously into new technologies, we expect it will do the same with bitcoin purchases," Credit Suisse AG analyst Paul Condra wrote in a note to clients Wednesday. "The upside could be significant if cryptocurrencies become more mainstream."

- Bloomberg

Square"s revenue from this business is highly speculative. While the market is a billion-dollar market, Square"s portion of that market is likely to be smaller. For example, Square might attract 5 million Bitcoin customers by 2019, and each might purchase $500. With 1.5% commissions, this would represent slightly more than 1% of Square"s revenue in 2019. This relatively small contribution is part of what led Mark Palmer to downgrade the stock:

"We believe Square"s valuation already reflects emphatic and unimpeded growth while failing to factor in competitive, credit-related and macro risks that did not go away when some investors suddenly viewed its shares as a play on a trendy cryptocurrency," wrote Palmer on Monday. "We believe Bitcoin could provide a marginal contribution to Square"s revenues if the trial succeeds, it becomes a permanent feature for all Square Cash users, and the company starts to charge a fee for trades."

- CNBC

Square"s relationship with Bitcoin is also potentially dangerous due to the dramatic price fluctuations of the currency. Square could potentially be impacted by large price movements if Square holds a large float of the currency to buy and sell to customers rather than merely offering an exchange. Further, customers" trust in Square could be hurt if they purchase the currency through Square Cash and it subsequently declines in value.

For this reason, I view the offering as somewhat of a double-edged sword. While I am personally long a small amount of Bitcoin, it is a highly risky asset, and Square should balance the risks to its balance sheet and reputation with the potential gains from offering the currency.

Square Capital: Becoming A Bank Increases Complexity

Square has also been in the news recently for its application to become a bank. Square filed an application to become an industrial loan company (an industrial bank) with the Federal Deposit Insurance Corporation. Square"s bank would be headquartered in Salt Lake City and capitalized with $56 million.

In an interview, Square"s head of lending, Jacqueline Reses, described the bank as allowing Square Capital to offer small-business loans directly and to also offer deposit products to small businesses. Square Capital loans are currently available but are issued by Celtic Bank rather than Square.

In his downgrade of Square to a sell, Mark Palmer also expressed disapproval of this decision and contrasted the decision with PayPal selling its U.S. credit assets:

"Just as we suggested that PYPL"s move to reduce credit risk should be supportive of its stock multiple, we believe SQ"s expanding foray into credit likely will weigh on its multiple," Palmer says. He says increasing financial complexity reduces the likelihood that a potential buyer would view Square as a takeover target.

- U.S. News

I appreciate that Square is attempting to remove its dependence on Celtic Bank or other outside banks, but the move to become a bank is dangerous. As Mr. Palmer suggests, increasing the financial complexity of the company makes it much more difficult to value accurately. This is a problem that current General Electric (GE) shareholders are familiar with, as GE is a notoriously complex company, which may have masked its recent problems until it was too late.

"Simplification of metrics is going to be a huge focus going forward," General Electric Chief Executive John Flannery told investors, "Complexity has hurt us."

- Dealbreaker, citing GE Investor Update

Valuation of Square

SQ data by YCharts

Unlike my recent valuation of GameStop (GME), I am bullish on the future of Square. Square"s prospects in the future are strong despite competition from PayPal and others, due to its strong product offering, simple fee structure, and great brand recognition as a first-mover in the industry.

I have used a discounted cash flow (DCF) model to value Square. To do this, I have calculated its cash flows for the next 10 years. Using a DCF longer than five years is necessary because Square is growing so quickly: Square"s subscription and services-based revenue has risen 92% TTM, while Square"s transaction-based revenue (from point-of-sales systems) has risen 33% TTM. Accordingly, I believe it will take more than five years for Square to reach a terminal growth rate.

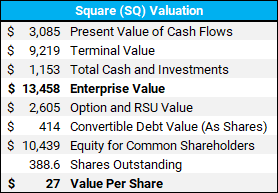

Figure 1: Valuation Results

Based on my valuation of Square, I value the company at $27 per share. While I am bullish on Square"s likelihood of continued success in the future, I believe that the company is overvalued by the market. Shares have climbed from $12 to over $40 in the past year. In my view, this ascent has far exceeded the underlying value of the cash flows of Square, and Square is due for further price corrections to return to its true value.

The terminal growth rate used here is the same as my risk-free rate, and all values are discounted back at the appropriate cost of capital (see Figure 4). Values of options, restricted stock units (RSUs), and convertible debt are all based on the current Square stock price of $41.

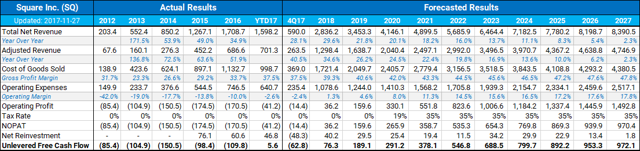

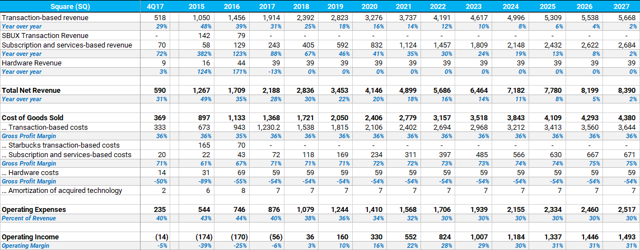

Figure 2: Fourth Quarter and Annual Projections

Above are my projections with for the fourth quarter, as well as for each year from 2018 to 2027. I expected revenue growth of 28.1% in 2017, based on Square"s fourth quarter projections. I expect this revenue growth to rise slightly in 2018 (due to continued strong growth in subscription and services-based revenue, see Figure 3), before ultimately declining to a terminal growth rate. In this projection, Square"s terminal revenue is $8.4 billion. This is approximately 5x Square"s 2016 revenue but is still lower than PayPal"s revenue.

Adjusted revenue is a non-GAAP measure that Square uses, which excludes past Starbucks-related (NASDAQ:SBUX) revenue and also excludes the cost of revenue for transaction-based revenue. This is intended to be a better measure of revenue, according to the company, since the transaction-based costs are largely processing fees paid to credit card companies. Because Square typically uses this figure, I have chosen to project it here as well.

The changes in gross profit margin are driven by changes in the makeup of Square"s revenue, as shown in Figure 3. I expect Square"s tax rate to be 0% until its loss carryforward burns off in the middle of 2020. After that, I project a 35% tax rate. Based on this projection, I expect Square to make an operating profit for the first time in 2018 and for that operating profit to grow steadily in the coming years as revenue also rises.

Figure 3: Growth and Gross Margins By Segment

By segment, I project transaction-based revenue and subscription and services-based revenue to decline to a terminal growth rate in 2027. However, I project Square to continue growing its revenue by double-digits until 2024. I expect Square to maintain its COGS margins on transactions and on hardware. For subscription and services-based costs, I expect the company to continue to make small gains, having moved from 61% gross margins in 2015 to 70% in 2017.

I also expect that Square will be able to lower its operating expenses as a percentage of revenue in the future. Because of economies of scale, Square"s R&D costs and SG&A costs are unlikely to continue to match revenue growth in the future, leading to increased margins.

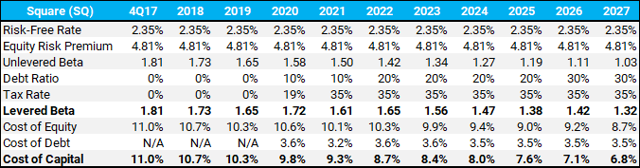

Figure 4: Cost of Capital

My valuation is based on Square maintaining an optimal debt ratio in the future. This debt ratio is optimized, to the nearest 10%, based on bond ratings by interest coverage ratio. Averaging to the nearest 10% results in a slightly "lumpy" cost of debt, but minimized the cost of capital to Square in any given year, based on their tax rate.

The beta I am using is an adjusted bottom-up beta. Square"s regression beta is not meaningful, due to the limited period of time Square has been trading. To get a beta, I have taken an unlevered beta from a collection of financial services firms and averaged those betas. I further adjusted that unlevered beta each year, so that as Square matures into a stable, low-risk company, its unlevered beta will decline to that of its larger peers. Accordingly, Square"s unlevered beta declines from 1.81 down to 1.03, which is the average of its larger peers" betas.

I have then levered the unlevered beta, and multiplied by the equity risk premium and added the risk free rate. The equity risk premium here reflects that Square"s business is almost exclusively conducted in the United States rather than in riskier overseas markets. The resulting cost of equity is then weighted averaged with the cost of debt (after tax) to form a cost of capital. Using this method, my cost of capital begins at 11.0% but declines to 6.8% as Square reaches maturity.

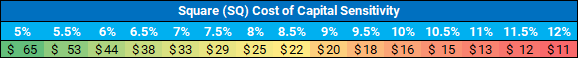

Figure 5: Cost of Capital Sensitivity

For those who prefer to use their own costs of capital, I have also provided a cost of capital sensitivity analysis. Each of these costs of capital is a constant cost of capital, rather than the varying cost of capital that I have used for my valuation.

Risks and Catalysts

As shown by movement on Monday, analyst ratings provide a potentially potent catalyst for movement in Square"s price. Further catalysts include:

- Square"s adoption of Bitcoin will continue to make waves and could provoke either upward or downward movement in share prices. This movement may be correlated with the movement of Bitcoin itself, which can be very volatile. Square"s release of its Bitcoin platform to the public is likely to cause major movement in shares of the company, and a cancellation of that platform (should that occur) would also produce movement.

- Square Capital"s attempts to become a bank could be blocked, which may hurt share prices. Similarly, news that Square has been approved as an industrial bank could provide upward momentum for the company.

- As a financial services company, Square must be vigilant to avoid a security breach, such as what happened to Equifax (NYSE:EFX). Equifax has not yet recovered from that breach, with shares prior to the breach trading at $141, compared to $110 today.

- Continued quarterly results will provide a lot of clarity on how the company is growing. Square"s segment growth rates of 92% and 33% are extremely high, and Square"s ability or lack of ability to maintain those growth rates will have billions of dollars of impact on the value of the company.

Conclusion

I am bullish on Square"s future as a company. Square has a strong brand name with good recognition from consumers and small business owners. Square offers great point-of-sales products with simple fee structures. Square combines this offering with a strong analytics package and useful features, including Instant Deposit. These factors will allow Square to continue its double-digit growth well into the future. Square may also be able to capitalize on becoming a source for Bitcoin in the future.

Despite that, I find Square overvalued. I place the value of shares of the company at $27/share, which is 35% less than their current price. For this reason, I would avoid shares of Square as an investor. Because of the high-growth nature of Square, short-selling shares of Square is quite risky. However, long-term puts may limit downside risk while still providing strong returns if Square"s price continues to falter.

(I typically invest in a retirement account that does not have access to margins or to options, so I will remain on the sidelines.)

Disclosure: I am/we are long GME.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment