This article was first available to subscribers of the Gold Bull Portfolio, a premium service offered by Gold Mining Bull. Subscribers also received more detailed analysis.

IAMGOLD Post-Earnings Update

IAG data by YCharts

This is an update on mid-tier gold miner IAMGOLD (IAG), which I last covered back in August. For some background, I"ve been bullish on shares this year; I previously stated that this could be a turnaround year for the once struggling gold miner. I was bullish again in early June and in the last article in August.

Also note that IAMGOLD made a big sale earlier this year when it sold 30% of its massive Cote gold project to a Japanese company called Sumitomo, for $195 million; the company got $100 million at closing and will also get $95 million in cash within 18 months of closing or when a feasibility study is released. I covered this transaction back in June.

Here"s a breakdown of its recent news.

Strong Q3 Results

IAMGOLD impressed yet again as the company reported an increase in gross profit for the third straight quarter on the back of rising production and lower costs. The Westwood mine in particular continues to perform very well, especially when compared to its previous struggles.

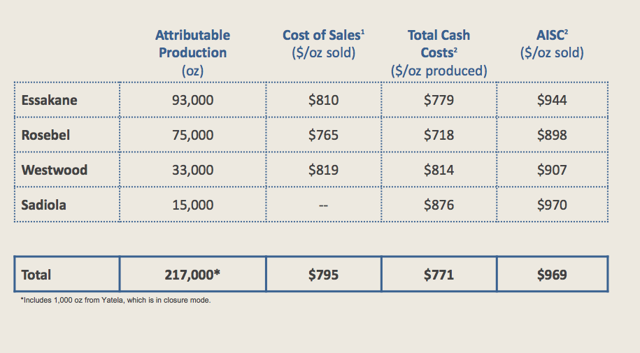

(Credit: IAMGOLD presentation)

The company produced 217,000 ounces of gold, up 3% from Q3 2016, with its all-in sustaining costs falling to $969 per ounce, down 7%. It has lowered the top end of its 2017 AISC guidance by $40 per ounce, so the range has now narrowed to $1,000 - $1,040 per ounce.

Westwood contributed 33,000 ounces of gold this past quarter, and more importantly, saw its AISC plummet from $1,391 per ounce in Q3 2016 to $907 per ounce this past quarter. The continued ramp up of Westwood is expected to result in lower cash costs in the coming quarters.

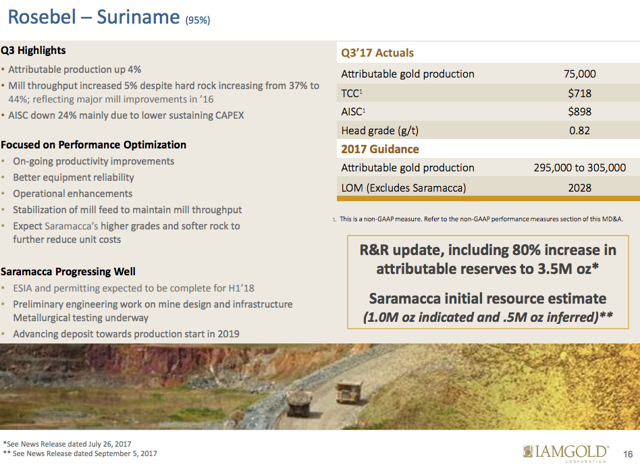

Rosebel is still its key producing mine, however. The mine produced 75,000 ounces of gold at $898 AISC in Q3, compared to $1,183 AISC last year. Back in June, IAMGOLD announced that total estimated attributable proven and probable gold reserves at Rosebel increased by 80% to 3.5 million ounces grading 1.0 g/t Au as at June 30, 2017 from 2.0 million ounces of gold at the end of 2016.

And its important to note that its life-of-mine to 2028 does not include any potential production from Saramacca (discussed more below).

(Credit: IAMGOLD presentation)

Gross profit rose 14% from last quarter to $40.9 million; net earnings was $30.8 million, or $.07 per share, up from $21.8 million, or $.05 per share in Q3 2016.

For the 9 months ended Sept. 30, 2017, the company has produced $230 million in net cash from operations, which is a slight decrease from $247 million in 2016, although this can mainly be attributed to lower gold prices in 2017 (the company"s gold margins were $27 per ounce higher in 2016).

Strong Balance Sheet

The company ended the quarter with $835.7 million in cash, cash equivalents, short-term investments (money market funds) and restricted cash. The company successfully extended its debt by five years when it issued $393.6 million worth of 7% senior secured notes, which mature in 2025, and also repaid over $100 worth of its previous senior unsecured notes. The company also received $96.5 million from the sale of its 30% interest in Cote.

IAMGOLD"s balance sheet was already strong last year but has improved quite a bit since then, which is saying a lot. The company has $583.6 million in cash and cash equivalents with $227 million in short-term investments (money market instruments) and only $24.7 million in restricted cash. Its long term debt position is $388.7 million, down from $485.1 million last year, and it has $247 million in available credit.

This gives the company plenty of funds to continue investing in its numerous development projects, and still provides firepower should IAMGOLD seek an acquisition or two. The company has one of the strongest balance sheets in the sector.

Saramacca Drill Results: I"m Impressed

IAMGOLD released results from its ongoing phase II drilling program at Saramacca, which is located nearby its Rosebel Gold Mine in Suriname. This is a combination of infill drilling ("proving" up resources to reserves) and expansion drilling (locate new resources).

Saramacca is arguably IAMGOLD"s most important exploration project as it will likely extend the mine life at Rosebel and won"t require too much money to get to production given its close proximity to the Rosebel milling facility. An initial resource estimate was released in September and pegged the resource at 1.022 million ounces indicated (2.2 g/t) and 518,000 ounces inferred (1.18 g/t).

New drilling results from IAMGOLD include infill drilling results of 39 meters grading 3.47 g/t and 57 meters grading 2.56 g/t; expansion drilling results included 6 meters grading 67.39 g/t and 34.5 meters grading 4.5 g/t.

These results are likely to lead to a proving up of inferred resources as well as a possible resource expansion at Saramacca. The company is targeting a reserve estimate by next year, with the potential for production by 2019.

Overall, IAMGOLD has spent $40 million on exploration in 2017, up from $26.5 million last year, and the company will likely continue to invest heavily in Saramacca and its other projects, including Boto in Senegal (1.56 million ounces at 1.8 g/t indicated), and the Pitangui project in Brazil (679,000 ounes inferred at 5.0 g/t).

Is the Stock a Buy?

Shares peaked in September, eclipsing $7 per share and now sit in the mid-$5s. The company carries an enterprise value of approximately $2.3 billion, and is producing $300 million in operating cash flow on an annual basis (my own rough estimate based on YTD cash flow), giving it an EV/CF of 7.6. The company is selling below its book value per share of $6.11 (total assets minus total liabilities, divided by shares outstanding).

With total available liquidity topping $1 billion, falling costs and exploration success at key development projects, and its current valuation, it"s hard not to like IAMGOLD"s stock here. The key risk, of course, is if gold prices fall far enough, the company"s profits will turn to losses as its AISC are still a bit high at approximately $950-$1,000 (but the progress it has made here is definitely impressive, and should continue into 2018).

If you want deeper coverage into the gold sector, as well as coverage of oil and gas stocks, please consider signing up for the Gold Bull Portfolio. A free two-week trial is now available for new subscribers (for a limited time only).

A subscription gets you updates and access to my real-life gold portfolio holdings (breakdown by stock symbol and weighting), research on junior miners/explorers, and early access to insider buying reports, earnings releases and coverage of oil producers and MLPs.

Disclosure: I am/we are long IAG.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment