Before I get started, let me be clear, I’m not recommending a self-storage REIT today.

I’m not even recommending a Data Storage REIT (although there’s an excellent article on CyrusOne (NASDAQ:CONE) in the upcoming newsletter).

My favorite storage REIT is unique and, accordingly, I am making the case that Iron Mountain (IRM) is a clear winner, because the company is distinguished because of the relative insensitivity to higher interest rates.

Simply put, IRM customers" storage needs are largely unaffected by interest rate movements, and the company"s core storage NOI doesn"t change with the value of the underlying real estate.

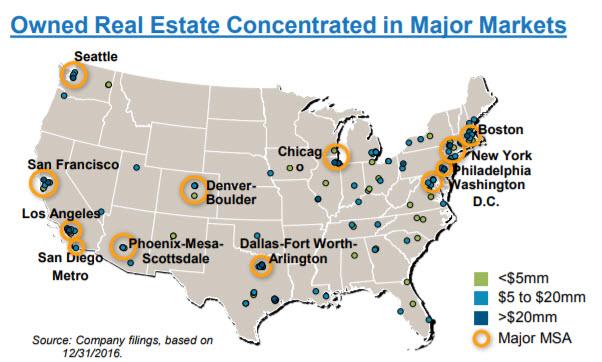

The company has an operating business, and that means it effectively controls real estate through long-term leases with multiple lease extension options and direct ownership in strategic locations of about one-third of its properties. IRM controls ~86 million square feet (27 million owned and 59 million leased), and the average building size is ~60K square feet.

In a rising rate environment, this structure reduces Iron Mountain"s exposure to real estate value fluctuations compared with REITs that own their entire portfolios. Additionally, it should be noted that the company enjoys higher levels of real price increases during periods of more inflation.

Since the company owns less real estate (owns 27 million sq. ft. and leases 59 million sq. ft.), the operations drive the value for the company. Because IRM has hundreds of customers, it can pass through increases, and this means the REIT is less impacted by rising rates.

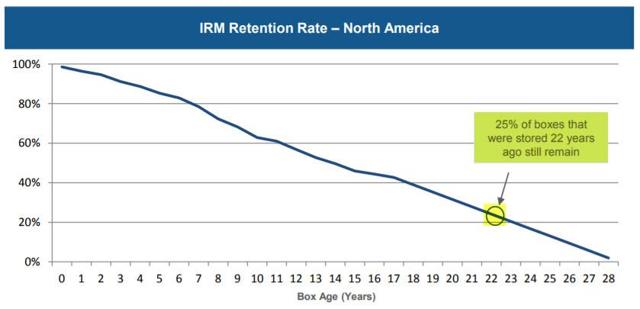

Also, IRM has only 2% customer turnover in a given year... this means 50% of the boxes that were stored 15 years ago still remain. Now you know what I mean when I say, "This REIT has exceptional shelf life."

Iron Mountain REIT

In February 1996, Iron Mountain became a public company, raising capital in part to initiate this consolidation. In December 2014, the company said the registration statement of Iron Mountain REIT, Inc. was declared effective. As a result, a special meeting of the company"s stockholders was held on January 20, 2015, at which time stockholders voted on a proposal to adopt the plan of merger between the company and Iron Mountain REIT, among other proposals, according to a Form 8-K.

That was just a "rubber stamp," though, since Iron Mountain was already a REIT in many ways.

The biggest hurdle for the Boston-based company was receiving a Private Letter Ruling (or PLR) from the IRS, and specifically, a ruling regarding the characterization of the company"s steel-racking structures as real estate. Earlier in 2014, Iron Mountain achieved IRS approval for REIT status retroactively as of January 1, completing the process that began in 2012.

By converting to a REIT, the company must now pay out at least 90% of taxable income to investors, resulting in a substantially higher dividend than it previously paid. Also, in addition to the clarity with regard to the definition of steel racking as real estate, Iron Mountain is now deemed somewhat of a hybrid as it relates to its peer classification.

Today, Iron Mountain is an industry leader in storage and information management services, serving 230,000 customers in 45 countries on six continents (with over 24,000 employees worldwide).

According to the company"s website, it serves organizations in every major industry and of all sizes, including more than 95% of the Fortune 1000, which rely on Iron Mountain as their information management partner.

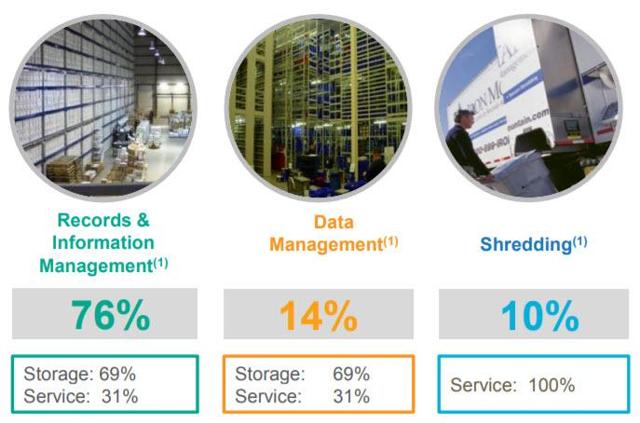

The company"s business model is to provide integrated solutions to unify the management of both physical and electronic documents. It stores and manages the following information assets:

Records & Information Management remains IRM"s core business (76% of revenue), and Data Management (14% of rev.) and Shredding (10% of rev.) are complementary pillars for the company"s mode of repeatability. Iron Mountain has a well-balanced platform that consists of over 85 million square feet of real estate and over 1,400 facilities in 53 countries.

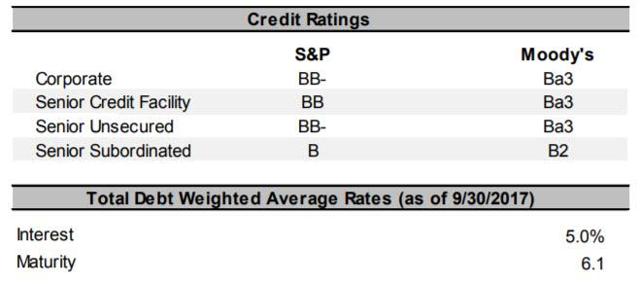

Balance Sheet Looking Better

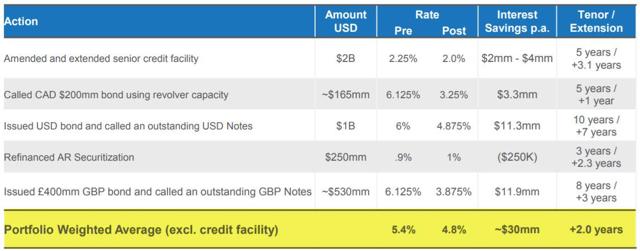

In Q3-17, IRM opportunistically executed several meaningful debt transactions which together provide increased capital flexibility and term out borrowings that you see below:

IRM amended the credit facility with improved covenants which increased flexibility and better recognized the value of the company’s real estate holdings, thereby reducing the lease adjusted leverage ratio.

Second, IRM redeemed 200 million Canadian dollar senior notes due 2021, utilizing revolving credit capacity.

Additionally, IRM redeemed $1 billion of senior notes due 2020 at a 6% rate and issued new senior notes at 4.875% due 2027. Lastly, IRM extended and increased the AR securitization program.

In total, these actions extended the average maturity to 6.5 years, reduced the average cost of debt by about 30 basis points, resulting in approximately $18 million in annualized interest expense savings. IRM incurred a charge for debt extinguishment cost of $48 million in the quarter.

The attractive pricing reflects bondholders understanding the health of IRM’s business and durability of cash flows. As of the end of the quarter, IRM had reduced the lease adjusted leverage ratio to 5.5 times from 5.8 times in Q2 and increased the capacity available on the capital structure remaining on track with the plan to reduce lease adjusted leverage.

IRM’s guidance for 2017 is summarized below. The core guidance remains unchanged and the company has increased the outlook for storage internal revenue growth to be between 3% and 3.5% from 2.5% to 3%. As a result of this better growth, considering a modest benefit from exchange rate, 2017 total revenues are expected to be near the high end of the guidance range.

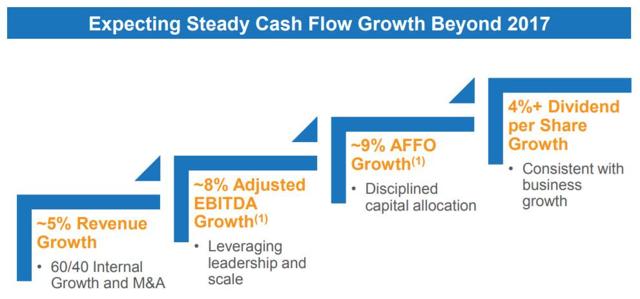

On adjusted EBITDA, IRM is maintaining its guidance range despite the delayed timing of acquisitions, though still incurring integration costs, the impact of the Russia Ukraine dispositions as well as charges related to natural disasters, which were partly offset by favorable exchange rates and one-time items highlighted in the second quarter.

IRM expects to be closer to the upper end of the range of $760 million AFFO range, as the company expects total maintenance and non-real estate investment to be roughly $150 million for the year, benefitting from better efficiencies and discipline following the acquisition of Recall.

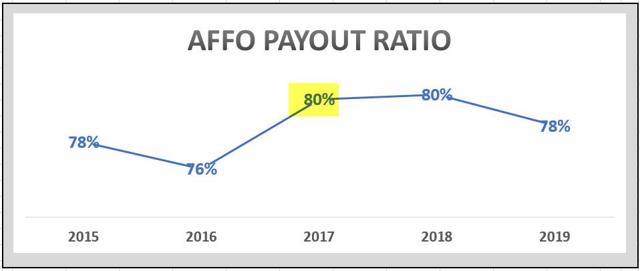

IRM expects an improved dividend payout ratio relative to AFFO considering also the dividend increase announced, as per my previous article:

“IRM announced a 6.8% increase in the quarterly dividend per share. Strong AFFO growth continues to drive dividend growth and this will provide meaningful significance to the narrowing of Iron Mountain’s valuation gap.”

The Future Looks Bright

IRM is well positioned to deliver on its financial projections for 2017 and the performance continues to be underscored by the durability of the storage rental business which builds cash flow growth.

Compared to a year ago, IRM’s adjusted EBITDA in the third quarter grew about 10% to $323 million. That’s growth of over 8% on a C$ basis and the adjusted EBITDA margin increased 230 basis points to 33.5%.

AFFO was $210 million in the third quarter, an increase of $32 million or about 19% from last year. The strong growth resulted from the almost 10% increase or $29 million of growth in adjusted EBITDA and more than funds the 7% dividend increase.

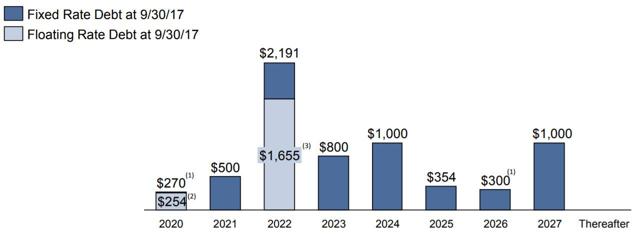

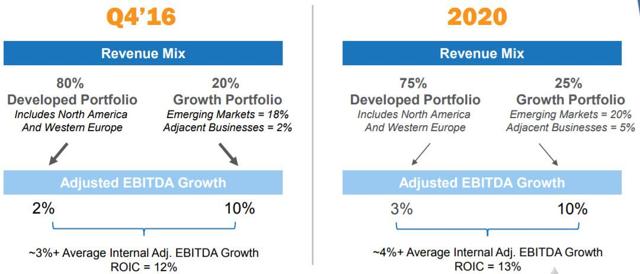

IRM’s shift in product mix underpins the company’s long-term dividend growth:

IRM’s 2020 plan forecasts profitable and sustainable growth:

This Is Why I Love This REIT

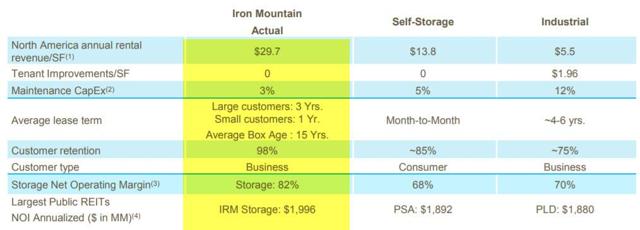

Iron Mountain is truly an outlier, this storage REIT has no “direct” peers and the market does not recognize the value of the very reliable and predictable cash flows…

IRM compares favorably to the broader REIT universe…

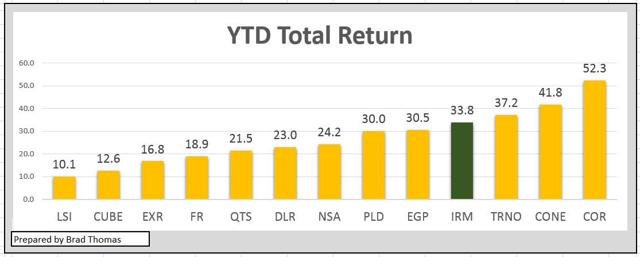

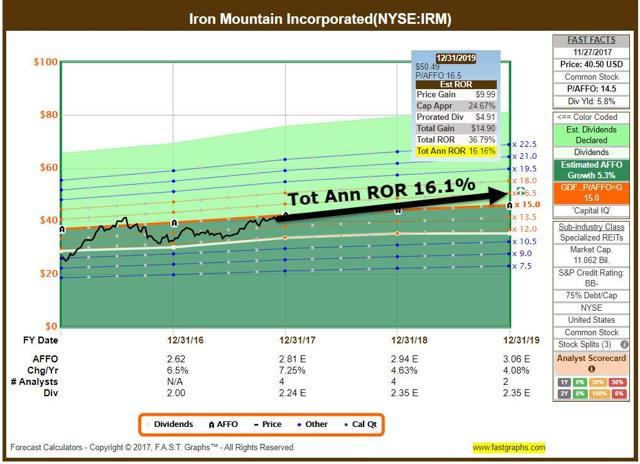

I’m glad I got on the train early…

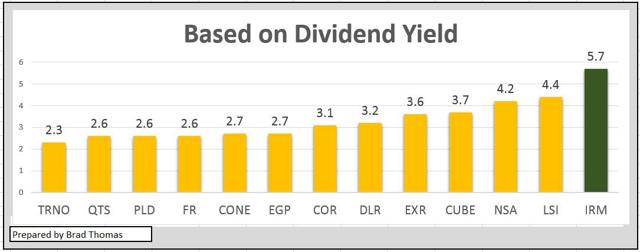

The dividend yield is still appealing….

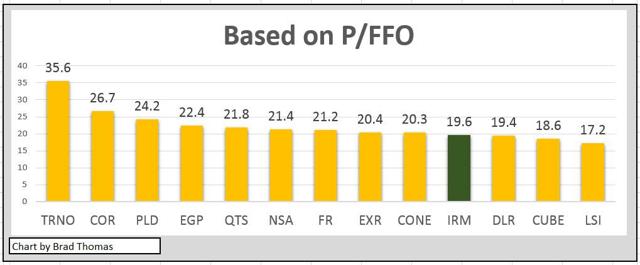

The P/FFO multiple remains attractive…

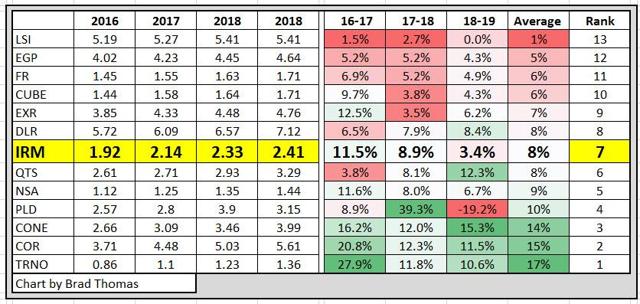

The future earnings (FFO per share) growth is above avarege…

…and the Payout Ratio is solid…

The Bottom Line: I am maintaining a BUY on Iron Mountain. The share price has begun to move in line with expectations, and I am still a BUYER given the Q3-17 performance and forecasted performance in 2018 and beyond. As I stated earlier, IRM customers" storage needs are largely unaffected by interest rate movements, and the company"s core storage NOI doesn"t change with the value of the underlying real estate.

This REIT is definitely uniquely positioned and I see more potential as the Iron Mountain brand continues to widen its moat and provide investors with more than just the security of boxes, but also security that the dividend is protected… the true mark of a sleep well at night investment.

From The Intelligent REIT Investor:

As any portfolio manager recognizes, the key to building a successful portfolio is to maintain adequate diversification across property types. REITs have consistently outperformed many more widely known investments. Over the past 15-year-period, for example, REITs returned an average of 11% per year, better than all other asset classes.

By maintaining a tactical exposure in the brick-and-mortar asset class, investors should benefit from my REIT research.

I will soon be launching a weekly podcast called "Show Me The Money," in which I will be providing sector updates and valuable REIT retirement investing strategies. I encourage all of my followers to post comments, as I try extremely hard to maintain an informative presence within the Seeking Alpha community.

Note: Brad Thomas is a Wall Street writer, and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos, and be assured that he will do his best to correct any errors if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking. If you have not followed him, please take five seconds and click his name above (top of the page).

Sources: FAST Graphs and IRM Supplemental.

Disclosure: I am/we are long APTS, ARI, BRX, BXMT, CCI, CHCT, CIO, CLDT, CONE, CORR, CUBE, DDR, DLR, DOC, EPR, EXR, FPI, FRT, GMRE, GPT, HASI, HTA, IRM, JCAP, KIM, LADR, LAND, LMRK, LTC, MNR, NXRT, O, OHI, OUT, PEB, PEI, PK, QTS, REG, RHP, ROIC, SKT, SPG, STAG, STOR, STWD, TCO, UBA, UNIT, VER, VTR, WPC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment